With the imminent launch of Hong Kong's Bitcoin ETF, a surprising development has emerged – some of the major traditional asset managers in Mainland China are stepping into the fray.

Interest in Hong Kong's New Bitcoin ETF

The creation of Hong Kong's new ETF has garnered significant attention in the digital asset space globally. Unlike the conventional Bitcoin spot ETF model popular in the United States, Hong Kong's ETF follows an in-kind generation approach. This unique model, combined with the region's substantial capital investment and strong international finance ties, positions Hong Kong as a promising testing ground for ETF acceptance in East Asia.

Mainland China's Entry into the Fray

Surprisingly, several major capital firms based in Hong Kong have shown interest in launching their ETFs. However, the landscape shifted dramatically when prominent players from Mainland China entered the scene. Harvest Fund and Southern Fund, with over $230 billion and $280 billion in total assets under management (AUM) respectively, submitted applications through their HK-based subsidiaries. China Asset Management, boasting $270 billion in AUM, also established a partnership with existing Bitcoin ETF providers in the city.

Regulatory Challenges and Market Dynamics

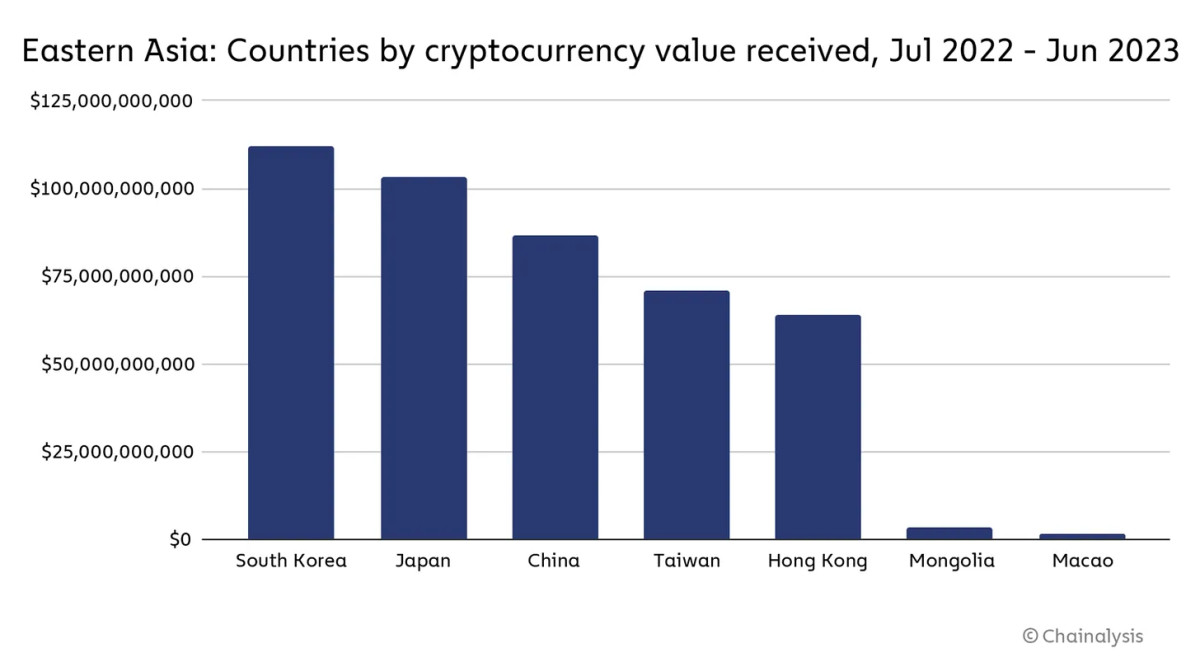

While the US ETF market is experiencing diminishing hype, the involvement of these multibillion-dollar Mainland firms signals a new chapter. The interaction between Mainland Chinese entities and Hong Kong's financial regulations poses intriguing questions. Despite China's purported Bitcoin ban, recent reports indicate significant transaction volumes. The evolving regulatory landscape in China aims to restrict access to the market while hinting at tacit warnings for investors.

Implications of Chinese Participation

The participation of top Chinese asset managers in Hong Kong's Bitcoin ETF venture underscores a shift in attitude towards digital assets. This move not only signifies a significant commitment but also holds the potential to reshape perceptions of Bitcoin among investors and regulators. The unique in-kind model adopted by Hong Kong's ETF fosters direct engagement between national businesses and the digital asset trade, potentially influencing policy decisions.

Hong Kong's Crypto Aspirations

Hong Kong is positioning itself as a regional crypto hub, with local banks embracing the digital asset space. Initiatives like HashKey Group's expansion into Bermuda underscore the city's ambitions. The goal to surpass US-based competitors in trading volume within five years reflects a bold vision for growth. Moreover, the favorable regulatory environment in Bermuda presents opportunities for HashKey to cater to a broader audience, including Chinese expatriates.

Anticipation and Potential Impact

The impending launch of the Bitcoin ETF in Hong Kong has garnered widespread anticipation. This innovative financial instrument has the potential to revolutionize the ETF landscape globally. Should China revise its stance on Bitcoin, it could have far-reaching implications. Observers are keenly watching for developments in this space, as the success of Hong Kong's Bitcoin ETF could reshape the narrative surrounding digital assets in China and beyond.

Frequently Asked Questions

How much of your portfolio should you hold in precious metals

To answer this question, we must first understand what precious metals are. Precious metals have elements with an extremely high worth relative to other commodity. This makes them very valuable in terms of trading and investment. The most traded precious metal is gold.

There are also many other precious metals such as platinum and silver. The price volatility of gold can be unpredictable, but it is generally stable during periods of economic turmoil. It also remains relatively unaffected by inflation and deflation.

As a general rule, the prices for all precious metals tend to increase with the overall market. However, they may not always move in synchrony with each other. For instance, gold's price will rise when the economy is weak, while precious metals prices will fall. Investors are more likely to expect lower interest rates making bonds less attractive investments.

However, when an economy is strong, the reverse effect occurs. Investors are more inclined to invest in safe assets, such as Treasury Bonds, and they will not demand precious metals. They are more rare, so they become more expensive and less valuable.

To maximize your profits when investing in precious metals, diversify across different precious metals. You should also diversify because precious metal prices can fluctuate and it is better to invest in multiple types of precious metals than in one.

What is the tax on gold in an IRA

The fair market value at the time of sale is what determines how much tax you pay on gold sales. Gold is not subject to tax when it's purchased. It's not considered income. If you decide to make a sale of it, you'll be entitled to a taxable loss if the value goes up.

For loans, gold can be used to collateral. Lenders seek to get the best return when you borrow against your assets. This often means selling gold. This is not always possible. They might keep it. They might decide that they want to resell it. You lose potential profits in either case.

If you plan on using your gold as collateral, then you shouldn't lend against it. You should leave it alone if you don't intend to lend against it.

What precious metal is best for investing?

This depends on what risk you are willing take and what kind of return you desire. Gold has been traditionally considered a haven investment, but it's not always the most profitable choice. If you are looking for quick profits, gold might not be the right investment. If you have the patience to wait, then you might consider investing in silver.

If you don't care about getting rich quickly, gold is probably the way to go. Silver might be a better investment option if steady returns are desired over a long period of time.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

finance.yahoo.com

irs.gov

bbb.org

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- How do you keep your IRA Gold at Home? It's Not Exactly Legal – WSJ

How To

3 Ways to Invest Gold for Retirement

It is crucial to understand how you can incorporate gold into your retirement plans. You can invest in gold through your 401(k), if you have one at work. You may also be interested in investing in gold beyond your workplace. A custodial account can be opened by a brokerage firm like Fidelity Investments if you already have an IRA. You might also consider purchasing precious metals directly from a trusted dealer if they are not already yours.

These are three easy rules to remember if you invest in gold.

- Buy Gold with Your Cash – Don't use credit cards or borrow money to fund your investments. Instead, deposit cash into your accounts. This will protect you from inflation and help keep your purchasing power high.

- Physical Gold Coins: You should own physical gold coins, not just a certificate. Physical gold coins can be sold much faster than paper certificates. You don't have to store physical gold coins.

- Diversify Your Portfolio. – Do not put all your eggs into one basket. In other words, spread your wealth around by investing in different assets. This helps to reduce risk and provides more flexibility when markets are volatile.

—————————————————————————————————————————————————————————————-

By: Landon Manning

Title: Chinese Financial Institutions Embrace Hong Kong’s Innovative Bitcoin ETF

Sourced From: bitcoinmagazine.com/markets/chinese-financial-institutions-turn-to-hong-kongs-new-bitcoin-etf-

Published Date: Thu, 11 Apr 2024 14:00:00 GMT