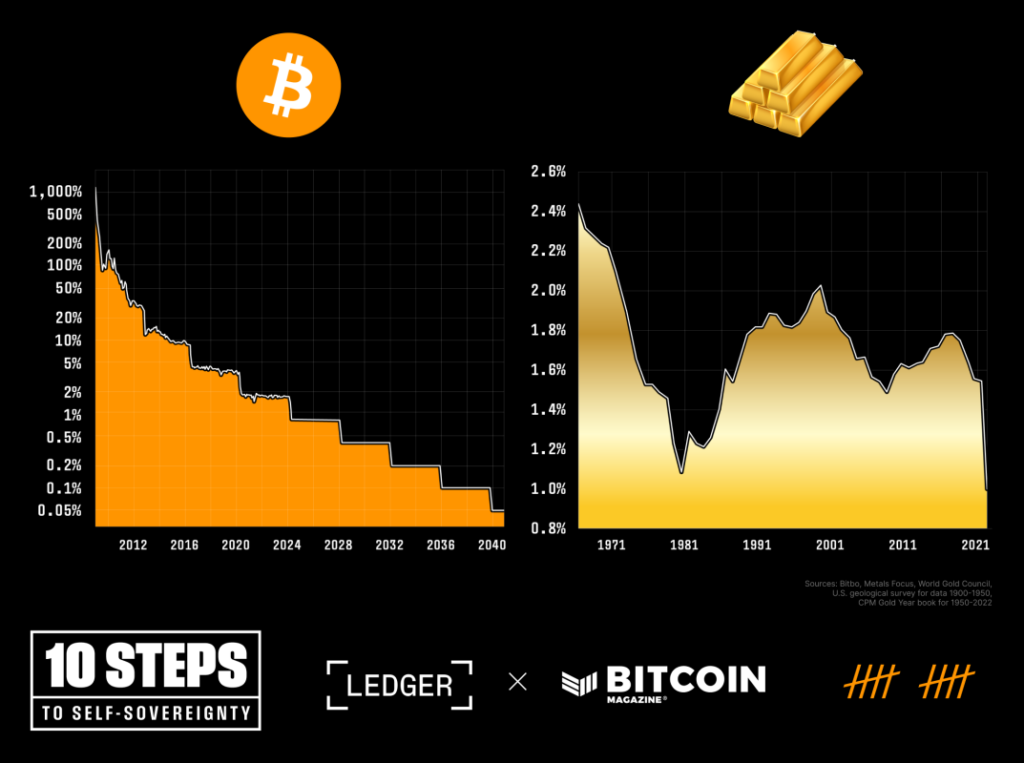

Bitcoin, the pioneering cryptocurrency, is set to undergo a significant transformation that will solidify its position as a scarce digital asset. With the upcoming Bitcoin halving event, the annual inflation rate of Bitcoin is poised to drop below that of gold, a traditional store of value. This pivotal moment marks a shift in the dynamics of scarcity in the digital realm.

Bitcoin Halving: A Game-Changer

At Bitcoin block height 840,000, the supply of Bitcoin will be halved, leading to a substantial reduction in its annual inflation rate from 1.7% to 0.85%. In contrast, the annual supply of gold typically increases by 1-2% per year, influenced by technological advancements and economic factors.

Bitcoin has previously undergone three halving events:

1. November 28, 2012: Bitcoin's block reward reduced from 50 BTC to 25 BTC per block.

2. July 9, 2016: The second halving cut the block reward to 12.5 BTC per block.

3. May 20, 2020: The most recent halving lowered the block reward to 6.25 BTC per block.

Future Outlook: Bitcoin's Scarcity Surpasses Gold

The upcoming fourth Bitcoin halving is anticipated to occur on April 20, 2024 EDT, further diminishing the block reward to 3.125 BTC. This milestone will bring the total Bitcoin supply to 20,671,875, inching closer to the maximum supply limit of 21 million. In comparison, the supply of gold continues to expand, highlighting Bitcoin's growing scarcity relative to the precious metal.

Evolving Perspectives on Gold as a Store of Value

Gold has long been revered as a reliable store of value, with historical references linking its value to that of a high-quality garment over centuries. However, the challenges associated with verifying, transporting, and storing physical gold have underscored the limitations of this traditional asset.

Bitcoin, on the other hand, presents a digital alternative that offers unparalleled advantages in terms of scarcity, durability, and immutability, redefining the concept of a store of value in the modern era.

Bitcoin's Monetary Attributes: A Digital Revolution

Bitcoin's finite supply of 21 million coins, coupled with its decentralized network and immutable blockchain, positions it as a robust monetary asset. Its resistance to inflation and tampering, along with its ease of transfer, have propelled Bitcoin into the spotlight as a superior store of value.

As Bitcoin continues to gain traction in the global economy, its market capitalization has surged, reflecting growing confidence in its monetary qualities. With the upcoming halving event, Bitcoin's scarcity will surpass that of gold, signaling a paradigm shift in the perception of digital assets.

Embracing the Digital Age

As we stand on the brink of a new era in finance, characterized by evolving digital landscapes, Bitcoin's rise as a scarce and reliable asset marks a significant milestone. The upcoming halving event serves as a testament to Bitcoin's resilience and long-term viability as a store of value.

In conclusion, Bitcoin's impending halving heralds a new chapter in the narrative of scarcity, positioning it as a frontrunner in the digital realm. While gold has had its time in the spotlight, Bitcoin's time to shine is on the horizon.

CFTC

bbb.org

How To

How to Buy Physical Gold in An IRA

An easy way to invest gold is to buy shares from gold-producing companies. But this investment method has many risks as there is no guarantee of survival. Even if the company survives, they still face the risk of losing their investment due to fluctuations in gold's price.

Another option is to purchase physical gold. You can either open an account with a bank, online bullion dealer, or buy gold directly from a seller you trust. The advantages of this option include the ease of access (you don't need to deal with stock exchanges) and the ability to make purchases when prices are low. It's also easier to see how much gold you've got stored. So you can see exactly what you have paid and if you missed any taxes, you will get a receipt. You have less risk of theft when investing in stocks.

However, there are some disadvantages too. For example, you won't benefit from banks' interest rates or investment funds. You won't have the ability to diversify your holdings; you will be stuck with what you purchased. Finally, the tax man might ask questions about where you've put your gold!

If you'd like to learn more about buying gold in an IRA, visit the website of BullionVault.com today!

—————————————————————————————————————————————————————————————-

By: Bitcoin Magazine

Title: Bitcoin Halving: Redefining Scarcity in the Digital Age

Sourced From: bitcoinmagazine.com/sponsored/quality-money-bitcoin-to-become-scarcer-than-gold-post-halving

Published Date: Thu, 11 Apr 2024 15:55:35 GMT