If you own a gold IRA, you might be wondering how to store it safely. There are a couple of options. You can use a bank deposit box or a third party depository. However, keeping your precious metals at home is not recommended. This practice is considered a violation of the IRA rules, and you would likely be subject to a distribution penalty if the IRS finds out.

Investing in a self-directed gold IRA

If you're an investor looking for a way to diversify your investments, investing in gold is one option. You can also invest in a normal brokerage IRA, but you'll have to do a bit more work and incur extra costs. In addition, if you choose to store your gold coins and bullion at home, you should take steps to minimize your exposure to the IRS.

Before investing in a self-directed gold IRA, you should find a custodian that has been approved by the IRS. A custodian is responsible for the administration of your IRA and ensuring it maintains tax-deferred status. Many gold IRA companies have a list of recommended custodians they trust.

A home-based gold IRA is a popular way to store your precious metals. Many people prefer to store their precious metals at home, but this is not true for all situations. A self-directed gold IRA can hold gold and other precious metals, such as silver. It can protect other investments from inflation and help protect other investments. In addition, self-directed gold IRAs can offer a high level of flexibility, as they allow you to invest in a wide variety of different assets.

Investing in a third-party depository

If you're planning to store gold in your IRA at home, you should know that it's considered a distribution and may incur a 10% penalty if you're under age 59.5. It's also extremely volatile and doesn't perform well in comparison to other investments. You may also find yourself the target of a costly IRS audit and a hefty fine.

Investing in a third-party gold IRA depository can help protect your precious metal investments. While you're at home, your precious metals will be kept separate from the other assets in your IRA account. This separate storage allows you to avoid penalties that might be imposed for storage of other types of assets.

The advertising for home storage gold IRAs makes it seem like it's legit and simple to do, but the reality is more complicated than you might think. First, you'll have to deal with taxes and penalties for breaking the gold IRA laws. It's also a scam. The best way to avoid these pitfalls is to consult with a trusted partner before making a decision.

Investing in a bank deposit box

Investing in a bank deposit box is one way to protect your assets. Bankrupt banks do not necessarily lose all of their assets. However, they may restrict access to the box. In addition, banks may close for maintenance or for a holiday. If you decide to invest in a bank deposit box at home, you should understand the risks involved.

The best place to keep your valuables is a bank safe deposit box, but they aren't always the most convenient. They can only be accessed during bank hours, and you may have to wait for an employee to help you. Plus, it may be difficult to access the box during emergencies, such as a COVID-19 pandemic.

Frequently Asked Questions

How much do gold IRA fees cost?

$6 per month is the Individual Retirement Account Fee (IRA). This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

You may have to pay additional fees if you want to diversify your portfolio. These fees will vary depending upon the type of IRA chosen. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

Most providers also charge an annual management fee. These fees range from 0% to 1%. The average rate is.25% per year. However, these rates are typically waived if you use a broker like TD Ameritrade.

How do I open a Precious Metal IRA

First, decide if an Individual Retirement Account is right for you. Open the account by filling out Form 8606. For you to determine the type and eligibility for which IRA, you need Form 5204. This form must be submitted within 60 days of the account opening. Once this is done, you can start investing. You could also opt to make a contribution directly from your paycheck by using payroll deduction.

If you opt for a Roth IRA, you must complete Form 8903. Otherwise, the process will look identical to an existing IRA.

You'll need to meet specific requirements to qualify for a precious metals IRA. The IRS states that you must be at least 18 and have earned income. You can't earn more than $110,000 per annum ($220,000 in married filing jointly) for any given tax year. And, you have to make contributions regularly. These rules apply regardless of whether you are contributing directly to your paychecks or through your employer.

A precious metals IRA can be used to invest in palladium or platinum, gold, silver, palladium or rhodium. But, you'll only be able to purchase physical bullion. This means you won't be allowed to trade shares of stock or bonds.

You can also use your precious metals IRA to invest directly in companies that deal in precious metals. This option may be offered by some IRA providers.

However, there are two significant drawbacks to investing in precious metals via an IRA. First, they are not as liquid or as easy to sell as stocks and bonds. This makes it harder to sell them when needed. They don't yield dividends like bonds and stocks. Also, they don't generate dividends like stocks and bonds. You will eventually lose money rather than make it.

Should You Get Gold?

In the past, gold was considered a haven for investors during economic turmoil. Many people are shifting away from traditional investments like bonds or stocks to instead look toward precious metals such gold.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

This could be changing, according to some experts. They believe gold prices could increase dramatically if there is another global financial crises.

They also note that gold is increasingly popular because of its perceived intrinsic value and potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- Before you start saving money for retirement, think about whether you really need it. It is possible to save for retirement while still investing your gold savings. Gold does offer an extra layer of protection for those who reach retirement age.

- Second, you need to be clear about what you are buying before you decide to buy gold. Each one offers different levels security and flexibility.

- Don't forget that gold does not offer the same safety level as a bank accounts. Losing your gold coins could result in you never being able to retrieve them.

If you are thinking of buying gold, do your research. You should also ensure that you do everything you can to protect your gold.

How much tax is gold subject to in an IRA

The fair market value at the time of sale is what determines how much tax you pay on gold sales. Gold is not subject to tax when it's purchased. It is not considered income. If you decide to make a sale of it, you'll be entitled to a taxable loss if the value goes up.

Loans can be secured with gold. When you borrow against your assets, lenders try to find the highest return possible. This often means selling gold. It's not guaranteed that the lender will do it. They may just keep it. They may decide to resell it. The bottom line is that you could lose potential profit in any case.

To avoid losing money, only lend against gold if you intend to use it for collateral. If you don't plan to use it as collateral, it is better to let it be.

Is buying gold a good way to save money for retirement?

Buying gold as an investment may not seem very appealing at first glance, but when you consider how much people spend on average on gold per year worldwide, it becomes worth considering.

Physical bullion bars are the most popular way to invest in gold. However, there are many other ways to invest in gold. It is best to research all options and make informed decisions based on your goals.

For example, purchasing shares of companies that extract gold or mining equipment might be a better option if you aren't looking for a safe place to store your wealth. If you are looking for cash flow from your investment, buying gold stocks will work well.

You can also put your money in exchange traded funds (ETFs). These funds allow you to be exposed to the price and value of gold by holding gold related securities. These ETFs can include stocks of precious metals refiners and gold miners.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

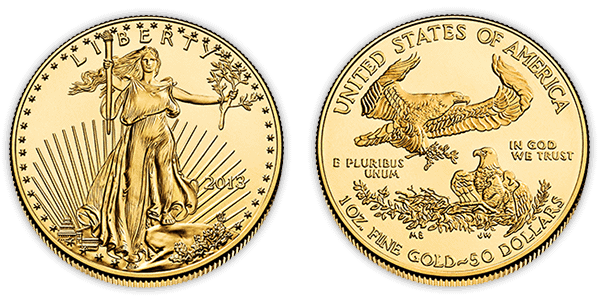

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

finance.yahoo.com

forbes.com

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement account

How To

How to hold physical gold in an IRA

The best way to invest in Gold is by purchasing shares of companies that produce it. But this investment method has many risks as there is no guarantee of survival. There is always the chance of them losing their money due to fluctuations of the gold price.

Another option is to purchase physical gold. This means that you will need to open an account at a bank, bullion seller online, or purchase gold from a trusted seller. This option is convenient because you can access your gold when it's low and doesn't require you to deal with stock brokers. It is easier to view how much gold has been stored. So you can see exactly what you have paid and if you missed any taxes, you will get a receipt. You have less risk of theft when investing in stocks.

However, there are some disadvantages too. For example, you won't benefit from banks' interest rates or investment funds. You can't diversify your holdings, and you are stuck with the items you have bought. Finally, the tax man might ask questions about where you've put your gold!

BullionVault.com offers more information on buying gold for an IRA.