If you're a serious investor and looking for an investment option, the Gold IRA Fidelity Group is one company that you should consider using. This company is reputable and has a long track record for customer satisfaction. The company's representatives are always ready to assist you and help you reach your financial goals.

Investment options

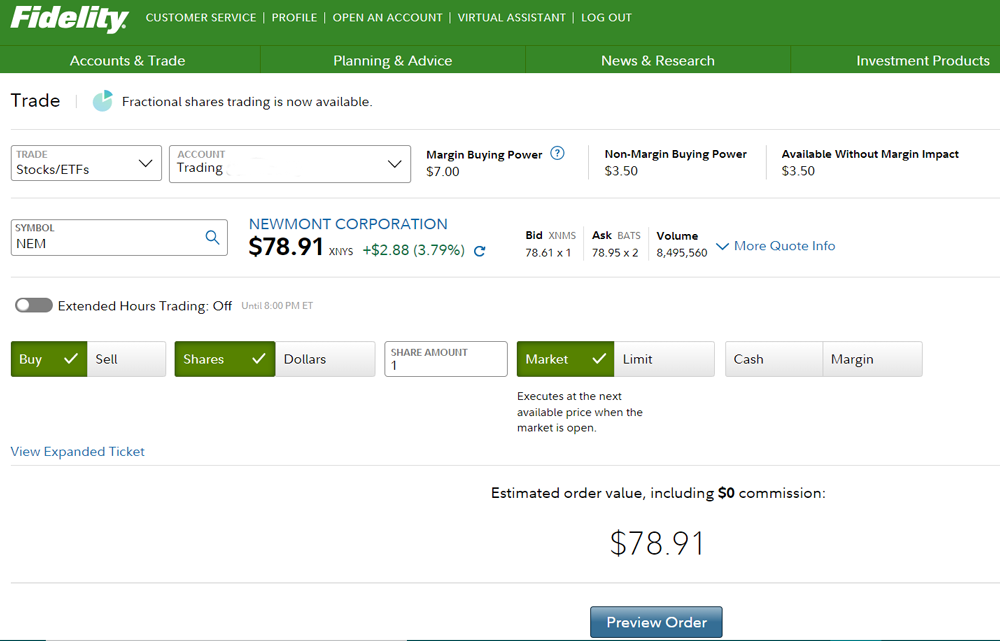

When it comes to investing in gold, Fidelity Investments offers several options. The company is larger than most competitors, so it is able to offer options not available elsewhere. It offers several gold ETFs, as well as a gold retirement account. ETFs are a good way to invest in gold since they are highly liquid and include many assets. You can trade ETFs commission-free, and there is typically no management fee to worry about.

Fidelity also offers several gold mutual funds. Its Select Gold Portfolio invests 80% of its capital in gold-related companies. Another gold-related fund, Fidelity Gold Select Portfolio, invests 25 percent of its capital directly in gold. This fund also features no transaction fees.

Stipulations

When it comes to investing in gold, Fidelity offers a gold IRA that is easy to get started with. The minimum investment amount is low and it is easy to understand what you are getting into. One of the benefits of this type of account is that the gold is insured. In addition, you can choose to have up to $1 million worth of gold in your account.

Gold is relatively free of correlation with other assets, so it's a safe bet for a retirement account. It also has a low correlation with stocks and bonds, so it can reduce overall portfolio risk. Gold IRAs do have a few disadvantages, though, and fees are often higher than traditional IRAs. You'll also find that gold is more expensive than real estate and cryptocurrency SDIRAs.

Costs

There are many factors that can influence the costs of a Gold Ira. First, there is the commission schedule. Fidelity charges 0.50% in annual fees on each trade, which is high compared to other funds that charge less than that. Fidelity also doesn't offer any commission-free trades, so you will likely have to pay a fee to buy or sell precious metals.

Fidelity is a large investment company with $4.9 trillion in assets under management. While this may give some investors a sense of comfort, it doesn't make them an ideal choice for precious metals IRAs. Fidelity is not a specialist company when it comes to precious metals, so you should avoid them unless you are absolutely sure that your money is in good hands. It's worth noting that Fidelity may have sold you a 401(k) plan through your employer, but that doesn't mean they know much about precious metals.

Reputation

Before you invest in a gold IRA, make sure you research its reputation. Positive reviews from past clients are the best indicator that a gold IRA company is reputable. You can also check for complaints against the company with the Better Business Bureau or the Business Consumer Alliance. You can also find out whether the complaints have been resolved or not.

In addition to positive reviews, gold IRA companies must also abide by strict regulations. As such, they are expected to deliver a high level of service, safety, and customer satisfaction. A good gold IRA company also provides its clients with account-lifetime support and educational resources.

Investing in gold IRAs with Fidelity

Investing in gold with Fidelity is a great way to diversify your portfolio and take advantage of the tax benefits. Fidelity is one of the largest financial institutions in the United States and offers a wide range of investment products and services, including retirement planning and gold investment services. Its dedicated wealth management team can create customized financial plans to help clients invest in precious metals. An Individual Retirement Account allows investors to save money for their retirement and for their family's financial future.

Many of the companies that offer gold IRAs offer expert advice and informational materials to help investors understand how they can maximize their retirement savings. Typically, the best companies offer a free beginners guide, articles, and videos to help people learn more about investing in precious metals. However, some companies may require a personal consultation before providing this information.

Frequently Asked Questions

Should You Open a Precious Metal IRA?

The answer depends on whether you have an investment goal and how much risk tolerance you are willing to take.

An account should be opened if you are planning to use the money in retirement.

Precious metals will appreciate over time. You can also diversify your portfolio with them.

Additionally, silver and Gold prices tends to move together. This makes them better choices when you want to invest in both assets.

If you're not planning on using your money for retirement or don't want to take any risks, you probably shouldn't invest in precious metal IRAs.

Can you make money from a gold IRA

To make money from an investment you must first understand how it works and secondly what products are available.

If you don't know, you shouldn't start trading until you are sure you have enough information to trade successfully.

You should also find a broker who offers the best service for your account type.

Many different accounts are available, including standard IRAs and Roth IRAs.

A rollover may be an option if you have other investments like stocks or bonds.

What are the fees for an IRA that holds gold?

The average annual fee to open an individual retirement account (IRA), is $1,000. There are many types to choose from, such as Roth, SEP, SIMPLE, traditional and Roth IRAs. Each type has its own set requirements and rules. If you don't have tax-deferred investments, then earnings may need to be taxed. Consider how long you will keep the money. If you are planning to hold onto your money for a longer time, you will likely save more money opening a Traditional IRA than a Roth IRA.

A traditional IRA allows for contributions up to $5500 ($6,500 if older than 50). A Roth IRA allows you to contribute unlimited amounts every year. The difference between the two is simple. A traditional IRA can be withdrawn after retirement without any taxes. With a Roth IRA, however, any withdrawals will be subject to taxes.

What Is a Precious Metal IRA?

Precious and precious metals are excellent investments for retirement accounts. They are a timeless investment that has held its value since the beginning of time. A great way to diversify and protect your portfolio is to invest in precious metals such silver, gold, and platinum.

In addition, some countries allow citizens to store their money in foreign currencies. You can buy Canadian gold bars and keep them at home. Then, you can buy gold bars in Canada and sell them for Canadian dollars when your family is home.

This is a simple way to make investments in precious metals. It's particularly helpful for people who don't reside in North America.

What are the three types of IRAs?

There are three types of IRAs. Each type of IRA has its pros and cons. Each of these types will be described below.

Traditional Individual Retirement Account (IRA).

A traditional IRA allows pre-tax money to be contributed to an account. This allows you to earn interest and defer taxes. The account can be withdrawn tax-free once you are retired.

Roth IRA

Roth IRAs allow after-tax dollars to go into an account. Earnings are exempt from tax. You can also withdraw money from the account to retire your funds tax-free.

SEP IRA

This is similar to a Roth IRA but requires additional contributions from employees. The additional contributions are subject to tax, but earnings accrue tax-deferred. You may choose to convert the entire amount to a Roth IRA when you leave the company.

Statistics

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

External Links

investopedia.com

regalassets.com

kitco.com

takemetothesite.com

How To

How to decide if a Gold IRA is right for you

Individual Retirement account (IRA), is the most widely used type of retirement plan. Individual Retirement Accounts (IRAs) are available through financial planners, banks, mutual funds and employers. Individuals are allowed to contribute up to $5,000 each year to IRAs without having to pay tax consequences. This amount can be contributed to any IRA, regardless of your age. However, there are limits on how much money you can put into certain IRAs. A Roth IRA is only available to those who are at least 59 1/2. Under 50-year-olds must wait until they reach 70 1/2 years of age before you can make contributions. Some people may also be eligible for matching contributions if they work for their employer.

There are two types of IRAs available: Roth and traditional. Traditional IRAs allow you to invest in stocks, bonds and other investments. A Roth IRA allows you to only invest in after-tax dollars. Contributions to a Roth IRA aren't taxed when they come out, but withdrawals taken from a Roth IRA are taxed once again. Some people combine both of these accounts. Each type of IRA has its pros and cons. What should you look at before deciding which type is best for you? Here are three things to keep in mind:

Traditional IRA Pros:

- Each company has its own contribution options

- Employer match possible

- More than $5,000 in savings per person

- Tax-deferred growth until withdrawal

- May have restrictions based on income level

- Maximum annual contribution is $5,500 ($6,500 for married couples filing jointly).

- The minimum investment required is $1,000

- You must start receiving mandatory distributions after age 70 1/2

- An IRA can only be opened by someone who is at least five years older than you.

- Transfer assets between IRAs is not possible

Roth IRA pros

- No taxes owed when contributing

- Earnings grow tax-free

- No minimum distributions

- The only options for investing are stocks, bonds, or mutual funds

- No maximum contribution limit

- Transfer assets between IRAs is possible without restrictions

- You must be at least 55 to open an IRA

If you are thinking about opening an IRA, it is important to be aware that not all companies offer exactly the same IRAs. For example, you might be able to choose between a Roth IRA (or a traditional one) from some companies. Others will give you the option to combine them. You should also note that different types of IRAs may have different requirements. Roth IRAs have no minimum investment requirements, while traditional IRAs require a minimum $1,000 investment.

The Bottom Line

When you are choosing an IRA, it is crucial to consider whether you will pay taxes now or in the future. If you're planning to retire in the next ten-years, a traditional IRA may be the best option. Otherwise, a Roth IRA may be better suited for you. In either case, it's a smart idea to speak with a professional about your retirement plans. You need someone who knows what's happening in the market and can recommend the best options for your situation.