We use an independent third party to help us pick the best product recommendations from thousands of available options. However, some of these links appear because we think certain services or tools are useful, so we may be compensated when you click them. Our content is independently produced by our editorial team and any views expressed are solely their own.

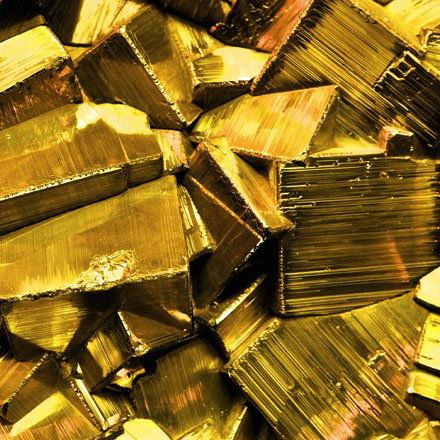

As the economy continues to improve, people are looking for ways to protect themselves from the potential effects of inflation. With that in mind, they're increasingly investing in precious metal IRAs. These IRAs allow them to buy physical bullion coins and bars without paying taxes on the gains.

A traditional IRA account, which can be easily set up and managed by a custodian, requires a few more moving parts than a Roth IRA account. Investors may need to find a custodian and an IRS-certified depository where they can purchase and transfer their gold into the depository. Gold needs to be bought and moved to the depository in order for the custodian to manage it.

After researching 18 legitimate gold IRA providers, we selected the top three in each category based on their overall performance. Best Overall: Patriot Gold GroupBest for Transparent Pricing: Augusta Precious MetalsFor customer support, goldco precious metals is best. For smaller investors, Noble Gold may be the best option. Best for IRA Rollovers: Regal AssetsIf you're new to buying insurance, consider purchasing Advantage Gold coverage.

Best overall: Patriot Gold Group

Patriot Gold Group

We combine an extensive track record of providing excellent consumer service with superior consumer ratings and low prices to make our list as one of the top overall gold IRA companies. Investor-direct pricing. Great scores from important consumers.A long history in the gold IRA industry. You need to fill out the form to get enough information from us.. Minimum investment required

Patriot Gold Group has been providing superior customer service for years, which has earned them high marks from consumer advocacy organizations. Their prices are competitive, which makes them an excellent choice for anyone looking for a quality gold IRA provider.

Patriot Gold has earned a stellar reputation among leading business and government consumer organizations, including an A+ grade with the Business Consumers Alliance and a 5-Star Grade with the Better Business Bureau.2

Patriot Gold is an investor-directed company that allows investors to purchase precious metals at lower prices than dealers. They don't offer any additional benefits or services compared to a typical dealer. Investors must call or email Patriot directly to get the full scoop on their fees, minimums, etc.

Patriot Gold prides itself on its long history of providing excellent customer service. Account managers take care of every aspect of setting up an account, including online or by telephone, and they help clients achieve their financial goals. They listen carefully to their client's concerns and provide personalized advice.

Best for Transparent Pricing: Augusta Precious Metals

We're proud to be named as one of the best gold IRA companies by our clients. Our prices are transparent, so you know exactly how much you're paying and for what. Low-cost, transparent fee structureMoney-back guarantee. Guaranteed fair pricing on purchases doesn't offer gold or silver either.No minimum investment is specified. No online purchases

Pricing is critical when reviewing gold IRA companies. Many companies say they have a low-cost fee structure, but few actually reveal all their costs. The fee structure and pricing scheme for Augusta Precious Metals is completely transparent and straightforward, making it our choice for the best gold IRA for transparent pricing.

Family-Owners Augusta has built its reputation on being transparent and honest since opening in 2012. They have earned the highest ratings from BBB.2 Augusta further strengthens their customer’s confidence by offering a 100 percent refund for new clients and guaranteeing fair prices along with seven-day pricing protection. For information about setup, annual, storage, and other fees, you can call the business. Augusta also offers an excellent buy-out policy.

Augusta works with a highly reputable Delaware Depository for their customers' storage needs, with vault locations throughout the U.S. Since the account is self-directed, there are no management fees.

Overall, Augusta's customer service is top-notch, as its high consumer ratings indicate. Augusta's onboarding and transaction processes are turnkeys, with specialists assisting customers with all the necessary paperwork. However, customers are not able to make purchases online.

Augusta has two major drawbacks: its limited selection of precious metal investments and its high minimum investment requirements for setting up an IRA. Investors who prefer to buy platinum or palladium will have to look elsewhere because Augusta focuses on gold and coinage. It is attractive for simple IRA rollovers with its clear pricing structure.

If you're looking for a company that offers excellent customer service, then consider buying precious metals from Gold

Goldco Precious Metal's representatives always take the time to explain everything thoroughly so that their clients know exactly what they're buying into. Because of this, we think they offer the best customer service among the companies offering precious metals IRAs.Extensive educational resources. Competitive pricing. You get 10 percent back in free silver coins when you open a new account. Minimum investment applies

Other gold IRA companies take great care to provide investors with clear and concise information. Founded in 2006 by Jack Guttentag, Goldco Precious metals stood out from the crowd when they were founded. But they've built a reputation for offering excellent service and a high level of transparency.

Goldco provides white-gloves service for its clients by providing them with direct access to specialists who can help them at any time. Goldco encourages its clients to take full advantage of its extensive educational resources, including e-books, video tutorials, blogs, and so forth.

It's that customer-centric focus that has earned Gold Coast nearly perfect ratings on consumer affairs and Trustpilot.

For more information about charges, account minimum amounts, custodians, and storing, you'll require contacting Goldco. They additionally provide a free manual if you're prepared to supply them with your name, e-mail, and telephone number. Account setup is straightforward and simple, accomplished mostly online. Goldco likewise provides IRA and 401(d) rollovers so that you can move your current retirement savings.

Best for Smaller Investors: Noble Gold

Noble Gold

Noble Gold has a low minimum investment requirement and comprehensive educational resources and is our top pick as the best gold IRA provider for small investments. Low minimum investment, Flat monthly service, and storage charges. Annual fees can be disproportionately high for small account sizes.

Noble Gold was founded in 2016 and is one of the most popular gold IRA companies for new investors. It offers a low minimum investment requirement and extensive educational resources.

Noble Gold has also garnered a lot of positive attention from consumer rating agencies, which gave them a 5-star rating with Consumer Affairs and an A+ rating with Better Business Bureau.

Noble Gold offers a wide range of educational materials and tools to help people learn about gold investing. It then assigns clients a personal advisor who helps them understand their options and choose the best investment strategy for them.

Noble Gold's fees are not the cheapest, but they are competitively priced. New customers do not receive any sort of set-up fee, but all customers are billed an annual fee of $80. Additionally, all customers are also billed a $150 annual fee for segregated gold vaulting. The good news is these fees are flat rates applied to all customer sizes regardless of account balance. (Noble Gold does not charge a commingling fee.)

Noble Gold has an extensive network of suppliers and distributors, which means that customers get competitive prices for their gold purchases. Noble also provides a no-questions-asked buy-back program.

Noble Gold's custodians are Equity International. You can view your accounts on their website at any time. Noble uses International Depositary Services (IDS) for storing. It has two locations within the United States and one in Canada. Storing at the high-technology IDS facility comes with a Lloyds of London policy.

Customers can browse Noble Gold's website for as long as they want to gather the information they require before contacting a salesperson to sign up for an account. However, you will still be required to contact a salesperson to get started.

Best for IRA Rollovers: Regal Assets

Regal Assets

When most Regal Assets clients are looking for an IRA rollover provider, they know exactly what they're dealing with. That's why we've included them on our list of the best IRA rollover companies. Extensive IRA rollover track record. There are no fees associated with rolling over an IRA into another account. Flat monthly service and storage feeCannot make purchases online.

With its top consumer reviews and competitive pricing, Regal Assets has emerged as one of the leading gold IRA companies since launching in 2010. However, when the bulk of a firm's business comes from IRA transfers, it merits special recognition as the best IRA rollover provider. Regal Assets supports that recognition with superior IRA Rollovers and Transfer services. But if that weren't enough, it now offers no transaction fees.

Despite not having an official consumer affairs rating, Regal is rated AAA by the Business Consumer Alliance and has many positive ratings on third-party websites.

Regal's fees are quite clear and simple to understand. They charge a flat rate for service plus an annual maintenance expense of $250. That covers the costs of storing your coins safely and securely. No extra transaction fees are charged. You'll also receive a minimum investment amount, which can vary depending on how much money you're willing to invest. Contact the firm to find out more about its services and policies.

Regal also excels at customer service. With an extensive library of educational materials, Regal’s IRA specialists begin helping clients from the beginning of the application process and continue holding their hands throughout the entire process.

Best for First-Time Buyers: Advantage Gold

Advantage Gold

Advantage Gold has one of the lowest minimum investment requirements, low fees, and vast educational resources among the top 10 gold IRA companies for new investors. Low annual fees. Relatively short operating history. Online purchases not available

Since 2014, Advantage Gold has been operating successfully in the industry. It offers an excellent service to new investors who want to invest in gold through their retirement accounts.

Since its founding in 2015, Advantage Gold has striven to provide superior customer service by offering exceptional customer service. It has received top ratings from the Better Canada Alliance (AAA), which means there have been no complaints filed against them for the past three consecutive years.

Advantage Gold offers an appealing option for both experienced and novice gold IRA owners alike. It provides extensive educational material and resources that can help new owners learn about investing in gold and other precious metal. There are no high-pressure tactics used by Advantage Gold when selling their products.

Advantages of investing with Advantage Gold include their low fees, high buybacks, and generous investor incentives.

To store their clients' gold, STRATA uses Brinks Global Services USA, Inc. and Delaware Depository, two highly reputable vaults.

Final Verdict

A gold IRA is slightly different from a traditional IRA. But choosing an investment firm that fits your needs is crucial to investing in gold.

Patriot Gold Group is one of the best gold IRA providers because it earns high ratings from consumer groups, has an excellent track record of assisting clients with accessing gold for their IRAs at no extra cost, and it is a direct-dealer company, eliminating any fees usually associated with accessing certain precious metal products.

You're unique, so it's essential to take time to review our full list and choose an IRA provider that matches your financial situation.

Frequently Asked Questions

A gold IRA is an investment account that holds precious metals.

A gold IRA is an individual retirement account (IRA) that invests primarily in precious metal bullion. Unlike a traditional IRA, which generally holds paper investments such as stock certificates and mutual fund shares, a gold IRA is structured to invest exclusively in precious metal holdings. In addition to holding the precious metal itself, the IRA also requires that your portfolio contain no more than 10% of any one type of metal. For example, if your IRA contains 5 ounces of silver, it may not also include 1 ounce of platinum, 0.5 ounces of palladium, and 0.25 ounces of rhodium.

If you want to invest in precious metals, you need to know which ones are acceptable for an IRA. You may be surprised by some of the restrictions imposed by the IRS.

What does an IRA cost?

Gold IRAs generally come with a variety of fees attached. These include an initial set-up charge, an annual maintenance cost, and storage charges. Fees vary based on how much money is invested and where the funds are deposited. For example, if you're investing in physical gold, the fees may be higher than those associated with investments in paper certificates.

Most gold IRA providers do not charge commissions for buying or trading gold. In addition, many add a markup to the spot rate, effectively taking a cut out of the deal. Some brokers are transparent about their markup, while others aren't. Brokers who purchase directly can save money by eliminating the middlemen.

With a gold IRA, you usually pay higher fees than if you invested in a traditional or Roth IRA.

Which one should I buy?

Investors who purchase gold for their gold IRA can either buy it in the form of bullion or sovereigns. Both forms of gold are priced per ounce according to the current market value of gold. However, since sovereigns are backed by the government, they're considered to be less risky than bullion.

Based on an article from https://www.investopedia.com/best-gold-ira-companies-5087720