When you are thinking about rolling your retirement funds over, one of the best options is to invest in precious metals. These investments are more stable and you can reallocate them as you see fit. Moreover, you can diversify your portfolio by investing in different precious metals. You can find many options to choose from with the gold IRA rollover guide.

Self-directed IRAs are better than traditional IRAs

Traditional IRAs are the most basic type of individual retirement account. They are created by a SEC-approved institution and invest your funds in stocks and bonds. Contributions are tax-deductible and your taxes are deferred until you withdraw your money. Self-directed IRAs, on the other hand, allow you to invest in a wide variety of hard assets such as real estate.

Self-directed IRAs are more flexible and offer a number of advantages. They allow you to purchase and sell real estate assets without paying taxes on those sales. They also allow you to delay taxes on capital gains and income and allow you to reinvest profits. Many millionaires have substantial property holdings. You can also invest in real estate debt.

They protect you from inflation

A gold IRA rollover is a great way to diversify your portfolio while protecting yourself from inflation and market fluctuations. For thousands of years, gold and other precious metals have been used as a store of value. In many cultures, gold coins are highly valued. After the Great Depression, the Gold Standard was abandoned.

Inflation is a very real concern for investors. The US is experiencing the worst inflation in 40 years. Meanwhile, interest rates are rising sharply and hyper-extended stock markets are teetering on the brink of collapse. In fact, the S&P 500, Dow and NASDAQ are already in bear market territory. On top of all that, the US Federal Reserve is in Quantitative Tightening mode, which adds downward pressure.

They don't have transfer fees

If you are considering making a rollover from a traditional IRA to a gold IRA, you need to know what fees to expect. A gold IRA can be any type of IRA, including traditional, Roth, SEP, and inherited. The rules for these different types of accounts are the same, but there are some differences as well. For instance, a traditional IRA may only have certain limits on the types of precious metals you can buy, and a gold IRA will allow you to buy coins and bars.

The first important rule to remember when making a gold IRA rollover is that you can only roll over funds that are in your name. This is different from holding gold in a self-directed retirement account. You can also use cash from other tax-advantaged retirement accounts to make a gold IRA rollover. These include 401(k)s, 403(b)s, and 457s, as well as federal Thrift Savings Plans.

They offer low fees

Many gold IRA companies charge a low or no fee to roll over your account. If you have a large account balance, some custodians will waive these fees. Keep in mind that you could still be charged extra if you have a small account balance.

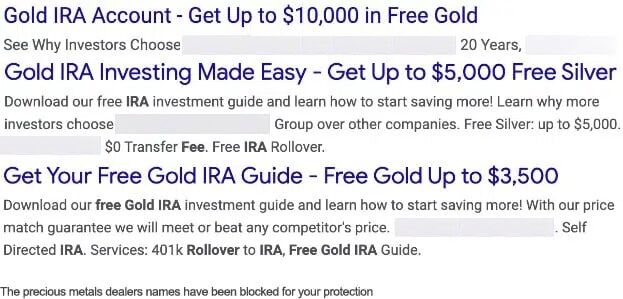

When investing in precious metals, you want to choose a company that offers low fees and has been in business for a long time. Make sure that you avoid companies with suspicious practices and those that overcharge you. Be sure to check out Google Reviews and the Better Business Bureau to make sure that the company is legitimate. Also, if you notice that a gold IRA rollover company has many red flags, avoid them.

They're a good investment

If you are interested in investing in precious metals, you might consider a Gold IRA rollover. These investments are less liquid than traditional stocks and bonds, and they must be stored at an IRS-approved depositories. You should be able to find several companies offering these investments, so be sure to shop around. While these companies may all seem similar at first, you should choose the one that seems the most trustworthy to you. You should also look for a company with a good reputation and good ratings from actual customers. If the company has any complaints, it is best to find out how they resolved them. Also, you should consider the fees associated with a precious metals IRA, including annual account fees and storage fees.

Investing in gold is a great way to diversify your retirement savings. It reduces the risk of losing money and can provide a sense of peace of mind. However, it is important to know what the requirements are before you begin the process. For example, you will need to know how much of your traditional IRA account you would like to transfer and how much you want to invest in new gold holdings.

Frequently Asked Questions

Can I hold a gold ETF in a Roth IRA?

While a 401k may not offer this option for you, it is worth considering other options, such an Individual Retirement Plan (IRA).

Traditional IRAs allow for contributions from both employees and employers. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money invested in ESOPs is taxed at a lower rate that if it were owned directly by an employee.

You can also get an Individual Retirement Annuity, or IRA. An IRA allows for you to make regular income payments during your life. Contributions to IRAs will not be taxed

What is a Precious Metal IRA, and how can you get one?

A precious metal IRA allows for you to diversify your retirement savings in gold, silver, palladium and iridium. These metals are known as “precious” because they are rare and extremely valuable. These are good investments for your cash and will help you protect yourself from economic instability and inflation.

Precious metals are sometimes called “bullion.” Bullion refers actually to the metal.

Bullion can be bought through many channels, including online retailers, large coins dealers, and some grocery shops.

With a precious metal IRA, you invest in bullion directly rather than purchasing shares of stock. This ensures that you will receive dividends each and every year.

Unlike regular IRAs, precious metal IRAs don't require paperwork or annual fees. You pay only a small percentage of your gains tax. You also have unlimited access to your funds whenever and wherever you wish.

Is gold a good investment IRA?

For anyone who wants to save some money, gold can be a good investment. It can be used to diversify your portfolio. But gold has more to it than meets the eyes.

It has been used as a currency throughout history and is still a popular method of payment. It is often called “the most ancient currency in the universe.”

Gold is not created by governments, but it is extracted from the earth. That makes it very valuable because it's rare and hard to create.

The supply and demand for gold determine the price of gold. When the economy is strong, people tend to spend more money, which means fewer people mine gold. Gold's value rises as a result.

On the flipside, people may save cash rather than spend it when the economy slows. This results in more gold being produced, which drives down its value.

This is why both individuals as well as businesses can benefit from investing in gold. If you invest in gold, you'll benefit whenever the economy grows.

You'll also earn interest on your investments, which helps you grow your wealth. Additionally, you won't lose cash if the gold price falls.

What is the best precious-metal to invest?

This question is dependent on the amount of risk you are willing and able to accept as well as the type of return you desire. Gold has been traditionally considered a haven investment, but it's not always the most profitable choice. For example, if your goal is to make quick money, gold may not suit you. If you have the patience to wait, then you might consider investing in silver.

If you don't care about getting rich quickly, gold is probably the way to go. If you are looking for a long-term investment that will provide steady returns, silver may be a better choice.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

investopedia.com

bbb.org

forbes.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Want to Keep Gold in Your IRA at Home? It's not legal – WSJ

How To

The best way to buy gold (or silver) online

You must first understand the workings of gold before you can purchase it. Gold is a precious metal similar to platinum. It's very rare, and it is often used as money for its durability and resistance. It's difficult to use, so most people prefer purchasing jewelry made from it rather than actual bars.

Two types of gold coins are available today: the legal tender type and the bullion type. Legal tender coins are designed for circulation in a country. They often have denominations like $1 or $5 or $10.

Bullion coins should only be used for investment purposes. Inflation can cause their value to increase.

They can't be exchanged in currency exchange systems. For example, a person who buys $100 worth or gold gets 100 grams. This gold has a $100 price. For every dollar spent, the buyer gets 1 gram of Gold.

You should also know where to buy your gold. If you want to purchase gold directly from a dealer, then a few options are available. First, go to your local coin shop. You could also look into eBay or other reputable websites. Finally, you can look into purchasing gold through private sellers online.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. Private sellers charge a 10% to 15% commission per transaction. That means you would get back less money from a private seller than from a coin shop or eBay. However, this option is often a great choice when investing in gold since it gives you more control over the item's price.

The other option is to purchase physical gold. Although physical gold is easier to store than paper certificates you will still need to ensure it is safe. Physical gold must be kept safe in an impassible container, such as a vault.

When buying gold on your own, you can visit a bank or a pawnshop. A bank will provide you with a loan that allows you to purchase the amount of gold you desire. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks usually charge higher interest rates that pawn shops.

The final option is to ask someone to buy your gold! Selling gold is easy too. A company such as GoldMoney.com can help you set up a simple bank account and get paid immediately.