Legendary commodities trader Peter Brandt has made a bold prediction, foreseeing a potential 230% increase in Bitcoin's price compared to Gold within the next 12 to 18 months.

Peter Brandt's Projection on Bitcoin's Price Movement

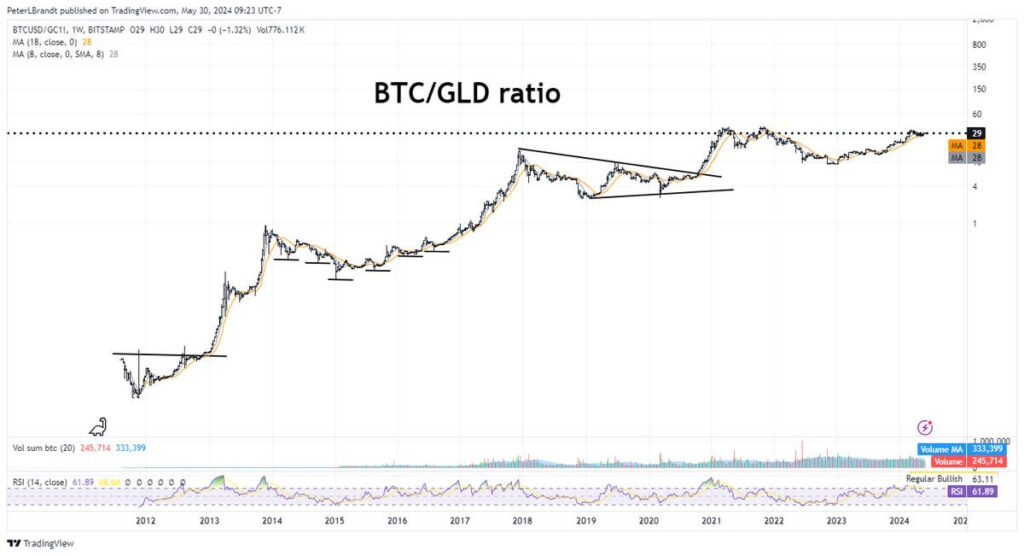

Peter Brandt, known for his exceptional trading acumen honed over 50 years, has recently forecasted a remarkable surge in Bitcoin's value in relation to Gold. He accurately predicted Bitcoin's parabolic bull market back in 2017 and now anticipates the bitcoin-to-gold ratio to reach 100 ounces following a period of consolidation.

Current Scenario and Future Outlook

As per Brandt's analysis, the BTC/GLD ratio presently stands at 29, indicating that it requires 29 ounces of gold valued at $68,000 to acquire one Bitcoin. However, he envisions this ratio tripling to 100 ounces post the conclusion of Bitcoin's consolidation phase.

At today's gold prices, this shift would translate to a single bitcoin being valued at over $234,000, marking a substantial 230% price upsurge.

Bitcoin's Dominance Over Gold

Since its inception in 2009, Bitcoin has demonstrated exceptional performance against Gold, showcasing a staggering over 375,000% growth in value compared to the traditional safe-haven asset.

Despite the significant gains already achieved, Brandt remains optimistic about Bitcoin's future prospects in surpassing Gold. The BTC/GLD ratio chart indicates a prolonged upward trend for Bitcoin against Gold, suggesting further advancements in the future.

Future Outlook and Institutional Adoption

Brandt believes that Bitcoin will continue to outshine Gold in the foreseeable future, especially with the recent approval and successful introduction of US Bitcoin spot ETFs earlier this year. This has further solidified Bitcoin's reputation as a digital store of value, gaining increased recognition among institutional investors.

Frequently Asked Questions

What kind of IRA can you use to hold precious metals in?

Most financial institutions and employers offer an Individual Retirement Account (IRA). This is an investment vehicle that most people can use. You can contribute to an IRA account which grows tax-deferred and can be withdrawn at any time.

You can save taxes by setting up an IRA and then paying them off when you retire. This allows for more money to be deposited in your retirement plan today than having to pay taxes tomorrow on it.

An IRA is a tax-free way to make contributions and earn income until you withdraw the funds. You can face penalties if you withdraw funds before the deadline.

You can also make additional contributions to your IRA after age 50 without penalty. You'll owe income tax and a 10% federal penalty if you withdraw from your IRA in retirement.

Withdrawals made before age 59 1/2 are subject to a 5% IRS penalty. A 3.4% IRS penalty is applicable to withdrawals made between the ages of 59 1/2 and 701/2.

Withdrawal amounts exceeding $10,000 per year are subject to a 6.2% IRS penalty.

Which is better: sterling silver or 14k-gold?

Sterling silver, which contains 92% pure sterling silver instead of just 24%, is a stronger metal than gold or silver.

Sterling silver is also called fine silver. It is made from a combination silver and other metals, such as zinc and copper.

Gold is considered very strong. It is very difficult to separate it from its metal counterpart. If you were to drop an object on top of a piece of gold, it would shatter into thousands of pieces instead of breaking into two halves.

On the other hand, silver is not nearly as strong as gold. If you dropped an item onto silver sheets, it would likely fold and bend without cracking.

Silver is usually used in jewelry and coins. The price of silver can fluctuate according to supply and demande.

What are the pros and disadvantages of a gold IRA

A gold IRA is an excellent investment vehicle for those who want to diversify their holdings but don't have access to traditional banking services. It allows you to invest freely in precious metals, such as gold, silver and platinum until they are withdrawn.

However, early withdrawals of funds will incur ordinary income tax. The funds are not located in the country and can be easily seized by creditors if your loan defaults.

A gold IRA might be the right choice for you if you enjoy owning gold and don't worry about taxes.

What are the three types?

There are three main types of IRAs. Each type has its advantages and limitations. Each type will be covered in detail below.

Traditional Individual Retirement Accounts

Traditional IRAs allow you to make pretax contributions to an account that allows you to defer taxes while still earning interest. The account can be withdrawn tax-free once you are retired.

Roth IRA

Roth IRAs allow you to deposit after-tax dollars into an account. This allows earnings to grow tax-free. Withdrawals from the account are also tax-free when you withdraw funds for retirement purposes.

SEP IRA

This is similar to a Roth IRA but requires additional contributions from employees. The additional contributions are taxed but earnings remain tax-deferred. When you leave your company, you may convert the entire amount into a Roth IRA.

Statistics

- Silver must be 99.9% pure • (forbes.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

External Links

investopedia.com

regalassets.com

kitco.com

takemetothesite.com

How To

How to Start Buying Silver with Your IRA

How to buy silver with an IRA – Direct ownership of physical bullion is the best way to invest. Bars and silver coins are the most common form of investment. They offer liquidity, diversification, and convenience.

There are many options to buy precious metals like silver and gold. You can buy them directly from their producers such as refiners and mining companies. You can also purchase them through a dealer, who buys and sellers bullion products, if you don’t want to deal directly with the producer.

This article will help you to start investing silver with your IRA.

- Investing in Gold & Silver through Direct Ownership – The best way to purchase precious metals is to directly go to the source. This means that you can get the bullion straight from the source, and it will be delivered directly to your front door. Some investors store their bullion in their home. Others choose to store their bullion in a safe storage location that is insured and protected. When you hold onto your precious metal, ensure you're storing it properly. Many storage facilities offer insurance coverage for fire, theft, damage, and other risks. You could lose your investments due either to natural disasters, human error, or even insurance. The safe storage of precious metals at a bank or credit card union is always recommended.

- Online Precious Metals Buying – If you prefer not to transport heavy boxes of precious metal around, then buying bullion online is an option. Bullion dealers sell bullion online in many forms, including coins or bars. There are many different types of coins. Generally speaking, coins are easier to carry around and less expensive than bars. There are many different sizes and weights available for bars. Some bars weigh hundreds of pounds, while others only weigh a few ounces. It is important to think about what you intend to use the bar for when choosing the type of bar that you should buy. If you plan on giving it as gifts, you might choose something smaller. On the other hand, if you want to add it to your collection and display it proudly, you might want to spend a little extra money and get something larger.

- Buy Precious Metals from Dealers – Another option is to purchase bullion directly from a dealer. Most dealers only specialize in one type of market, either silver or gold. Some dealers specialize in particular types of bullion like rounds or minted currency. Some specialize in particular regions. Some specialize in bulk purchasing. No matter what dealer you choose you will find that they offer great prices and flexible payment options.

- Investment in Retirement Accounts: Buying precious metallics through retirement accounts – Although not technically an investment, this is another way to get exposure to precious metals. For Section 219 to receive tax benefits, you must have a qualified retirement fund that invests in precious metallics. These accounts include IRAs. These accounts are designed to help you save for retirement and often provide higher returns than other investment vehicles. You can also diversify your holdings by opening these accounts. The downside? Investments in retirement accounts aren't available to everyone. Only people who work for employers that sponsor them can invest in these accounts.

—————————————————————————————————————————————————————————————-

By: Vivek Sen

Title: Renowned Trader Peter Brandt Predicts 230% Surge in Bitcoin Price Against Gold

Sourced From: bitcoinmagazine.com/business/legendary-trader-peter-brandt-predicts-230-bitcoin-price-increase

Published Date: Fri, 31 May 2024 14:04:22 GMT