An erroneous news story claiming that the U.S Securities and Exchange Commission (SEC) approved Blackrock's Ishares spot bitcoin exchange-traded fund led to $78.92 million in short positions being liquidated. This figure constitutes 57% of the total $136.29 million in short positions eliminated within the last 24 hours.

False Report on SEC Ruling Jolts Bitcoin Market, Wiping Out Millions in Short Stakes

On a Monday, Cointelegraph, a cryptocurrency-centric media outlet, circulated the misleading information through social media platform X and its Telegram channel, causing a surge of over 10% in the value of bitcoin (BTC) against the US dollar.

The virtual currency briefly peaked at $29,900 per coin before plummeting to $28,100 per unit when the fake news was exposed. Despite Cointelegraph's subsequent apology, it was not sufficient to avert the market turmoil that led to the dissolution of $78.92 million in short positions.

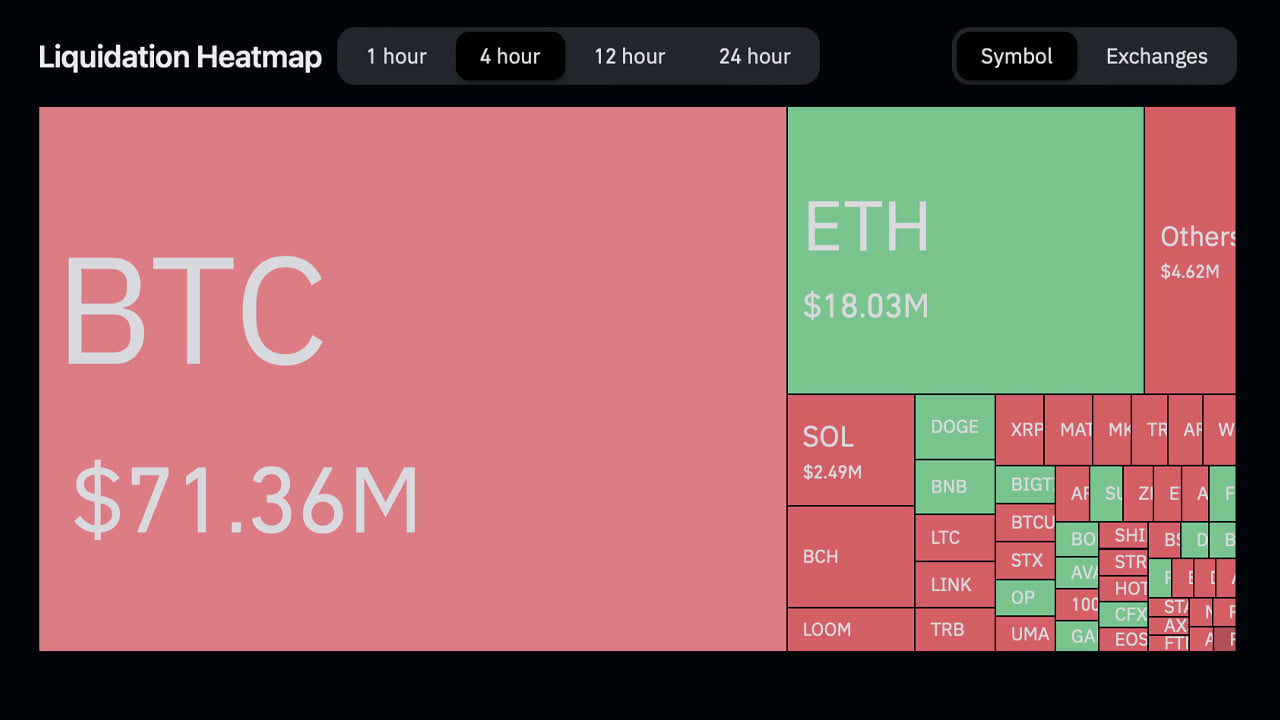

Information from Coinglass reveals that, in the preceding four hours, BTC short positions constituted $71.36 million of the liquidated shorts. Approximately $2.49 million in Solana (SOL) short stakes were also wiped out, among others.

The $78.92 million accounted for an astonishing 57% of the total short positions liquidated in the past 24 hours. Concurrently, within the same four-hour span, Ethereum (ETH) long positions surpassing $18 million were also eliminated.

Impact of the Fraudulent News on Bitfinex Positions

Following the revelation of the bogus news, short stakes on Bitfinex plummeted dramatically. Simultaneously, long positions on Bitfinex experienced a surge before the fake news was verified, but have since decreased.

The spurious news incident led to a significant number of traders being liquidated, potentially reducing the speculation surrounding the actual ruling. The most sizeable liquidations originated from BTC, ETH, XRP, BNB, and SOL.

What are your views on the short traders who were liquidated due to the false news? Share your insights and perspectives on this topic in the comments section below.

Frequently Asked Questions

Are gold- and silver-IRAs a good idea.

This is a great option if you're looking for an easy way of investing in both silver and gold simultaneously. There are also many other options. If you have any questions regarding these types of investments, please feel free to contact us anytime. We're always glad to help!

How Much of Your IRA Should Include Precious Metals?

Investing in precious metals such as gold and silver is the best way to protect yourself from inflation. It's not just for retirement. It can also be used to prepare for economic downturns.

Although silver and gold prices have increased in recent years, they can still be considered safe investments as they don't fluctuate nearly as much as stocks. These materials are always in demand.

Gold and silver prices are usually stable and predictable. They tend to rise during economic growth and drop during recessions. This makes them great money-savers and long-term investments.

Your total portfolio should be 10 percent in precious metals. That percentage could go higher if you want to diversify your portfolio further.

What is a Precious Metal IRA (IRA)?

Precious metals make a great investment in retirement accounts. Precious metals have been around since Biblical times and still hold their value today. The best way to protect yourself from inflation is to invest in precious metallics such as platinum, silver and gold.

In addition, some countries allow citizens to store their money in foreign currencies. You can buy gold bars in Canada and keep them at home. Then, when you go back to visit family, you can sell those same gold bars for Canadian dollars.

This is an easy way to invest precious metals. This is especially helpful if you don't live in North America.

Should You Open a Precious Metal IRA?

Answers will depend on whether you have an investment goal or how high you are willing and able to tolerate risk.

An account should be opened if you are planning to use the money in retirement.

Because precious metals are highly likely to appreciate over time, They can also be used to diversify.

Furthermore, the prices of gold and silver tend to move together. This makes them an excellent choice for investors in both assets.

You shouldn't invest precious metal IRAs if you don't plan on retiring or aren't willing to take risks.

Are gold IRAs a good idea?

Purchase shares in mining companies to invest in precious metals like gold. These companies are a great way to make money investing in precious metals like gold.

However, there are two drawbacks to owning shares directly:

The first is that you could lose money if your stock is held on for too long. Stocks can fall more than their underlying asset (like, gold) when they decline. You could lose your money, rather than make it.

Second, you may miss out on potential profits if you wait until the market recovers before selling. It is possible to wait until the market recovers before selling your gold.

If you prefer to keep your investments apart from your finances, physical gold is still an option. An IRA with gold can diversify and protect your portfolio against inflation.

Visit our website to find out more about investing in gold.

Statistics

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

External Links

takemetothesite.com

en.wikipedia.org

regalassets.com

forbes.com

How To

How to convert your IRA into a Gold IRA

Are you looking to transfer your retirement savings out of a traditional IRA in favor of a gold IRA. This article will assist you in that endeavor. This is how you can make the switch.

“Rolling over” refers to the act of transferring money into an alternative type of IRA (traditional), or vice versa (gold). Rolling over an account offers tax advantages. In addition, some people prefer investing in physical assets like precious metals.

There are two types IRAs – Traditional IRAs (or Roth IRAs). The difference between these two accounts is simple: Traditional IRAs allow investors to deduct taxes when they withdraw their earnings, while Roth IRAs don't. If you put $5,000 into a Traditional IRA today, after five years you can only withdraw $4,850. If you invested the same amount in a Roth IRA, however, you'd be able to keep every penny.

These are some things to consider if you plan to convert from a Traditional IRA to a Gold IRA.

You must first decide whether you want to transfer funds from one account to another or roll over your current balance to a new account. You will pay income tax on earnings above $10,000 when you transfer money. If you decide to roll over your IRA you will not be subject to income tax on these earnings until you turn 59 1/2.

Once you have made up your mind, it is time to open a brand new account. It is likely that you will be asked to prove your identity by providing proof such as a Social Security card or passport. Once you are done, you will fill out paperwork proving ownership of your IRA. After you have completed the forms, submit them to your bank. They'll verify your identity and give instructions on where to send the checks and wire transfers.

Now comes fun. You'll deposit cash into your new account and wait for the IRS to approve your requests. After you receive approval, you'll get a letter stating that you can now begin withdrawing funds.

That's it! Now you can just sit back and enjoy the growth of your money. Keep in mind that if your mind changes about converting your IRA to another type, you can simply close it and transfer any remaining balance to a new IRA.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Phony SEC Approval Report Obliterates $71M in Bitcoin Short Positions

Sourced From: news.bitcoin.com/wipe-out-fake-sec-approval-report-erases-71m-in-bitcoin-short-positions/

Published Date: Mon, 16 Oct 2023 17:30:18 +0000