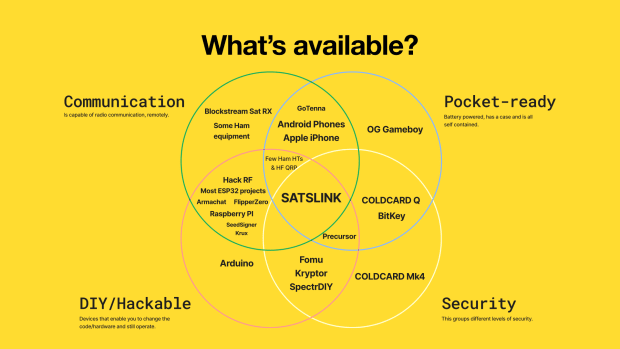

Coinkite, a renowned technology company, has recently unveiled its newest product, Satslink. This innovative piece of hardware is currently in production and is poised to disrupt the traditional modes of communication and mobile technology with its unique application possibilities.

Embracing Open Hardware for Developer Flexibility

Satslink breaks away from the confines of traditional frameworks and instead, taps into the power of open and flexible hardware. Encased within the exterior of the Coldcard Q1, this device offers a rich variety of opportunities for developers. Satslink's open nature allows developers to harness their creativity and explore the different possibilities that this unique piece of hardware has to offer.

Peer-to-Peer and Hackable: The Core of Satslink

At its heart, Satslink is a device designed for peer-to-peer interactions and is fully hackable, providing a versatile tool for various applications. It features a secure element, a signature feature of Coinkite products, enabling users to store private keys securely within the device. Despite sharing an external design with Coldcard Q1, Satslink's internals are distinctively different, opting to focus on secure communications for everyday use rather than air-gapped security.

The Technology Behind Satslink

Satslink harnesses the power of ESP32-S3, a low-power microcontroller unit (MCU)-based system on a chip (SoC). This SoC incorporates integrated 2.4 GHz Wi-Fi and Bluetooth Low Energy (Bluetooth LE) capabilities. The device consists of a high-performance dual-core microprocessor, a low-power coprocessor, Wi-Fi baseband, Bluetooth LE baseband, an RF module, and a range of peripherals. Programmed in micropython, Satslink's source is fully available and is entirely field upgradable. The device also includes a MicroSD slot for data transfer.

Target Audience and Potential Use Cases

"We initially aim this product at developers and enthusiasts," notes NVK. "However, its user-friendly design means that as the community creates new applications, these can be readily adopted by users. This includes hot and sovereign lightning wallets and Nostr clients."

Nostr, the open communications protocol gaining attention due to endorsements and funding from Twitter founder and Block CEO Jack Dorsey, is a prime use-case example for Satslink. Thanks to its peer-to-peer communication capabilities, Satslink can operate as a Nostr client and even as a relay, enabling message sending and receiving without the need for internet connectivity.

Another potential application is the ability to control home-based bitcoin stacks. Bitcoin enthusiasts who run nodes or even self-hosted servers at home could program Satslink to connect to their home stacks as needed, performing actions remotely and securely. While not recommended as a primary cold storage solution for large bitcoin amounts, Satslink could serve as a transaction coordinator or even a full wallet.

NFC, QR Code Reader, and Beyond

Further enhancing its utility, Satslink boasts NFC and a QR code reader, enabling a host of additional use cases. Combined with its programmability and versatility, these features could potentially transform the device into a hardware wallet from another manufacturer, such as Blockstream's JADE wallet or other similar DIY hardware wallets.

As promising as Satslink appears, it's the users who will determine its true potential. The device is currently available for preorder on Coinkite's website for $189, though the shipping date remains to be confirmed.

Frequently Asked Questions

What is a Precious Metal IRA?

A precious metal IRA allows you to diversify your retirement savings into gold, silver, platinum, palladium, rhodium, iridium, osmium, and other rare metals. These metals are known as “precious” because they are rare and extremely valuable. These metals are great investments and can help protect your financial future from economic instability and inflation.

Bullion is often used to refer to precious metals. Bullion refers simply to the physical metal.

You can buy bullion through various channels, including online retailers, large coin dealers, and some grocery stores.

An IRA for precious metals allows you to directly invest in bullion instead of purchasing stock shares. You'll get dividends each year.

Precious metal IRAs have no paperwork or annual fees. Instead, you only pay a small percentage on your gains. Plus, you get free access to your funds whenever you want.

How does a Gold IRA account work?

Individuals who want to invest with precious metals may use the Gold Ira accounts, which are tax-free.

You can purchase physical gold bullion coins anytime. You don’t have to wait to begin investing in gold.

An IRA lets you keep your gold for life. Your gold assets will not be subjected tax upon your death.

Your heirs inherit your gold without paying capital gains taxes. Your gold is not part of your estate and you don't have to include it in the final estate report.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. After you do this, you will be granted an IRA custodian. This company acts as a mediator between you, the IRS.

Your gold IRA custodian is responsible for handling all paperwork and submitting the required forms to the IRS. This includes filing annual reporting.

Once you've set up your gold IRA, it's possible to buy gold bullion. The minimum deposit required to purchase gold bullion coins is $1,000 You'll get a higher rate of interest if you deposit more.

Taxes will apply to gold that you take out of an IRA. You'll have to pay income taxes and a 10% penalty if you withdraw the entire amount.

If you only take out a very small percentage of your income, you may not need to pay tax. There are exceptions. However, there are exceptions. If you take 30% or more of your total IRA asset, you'll owe federal Income Taxes plus a 20% penalty.

Avoid taking out more that 50% of your total IRA assets each year. You could end up with severe financial consequences.

How Much of Your IRA Should Be Made Up Of Precious Metals

The most important thing you should know when investing in precious metals is that they are not just for wealthy people. They don't require you to be wealthy to invest in them. There are many ways to make money on silver and gold investments without spending too much.

You may consider buying physical coins such as bullion bars or rounds. Also, you could buy shares in companies producing precious metals. You may also be interested in an IRA transfer program offered by your retirement provider.

No matter what your preference, precious metals will still be of benefit to you. Even though they aren't stocks, they still offer the possibility of long-term growth.

And, unlike traditional investments, their prices tend to rise over time. If you decide to make a sale of your investment in the future, you will likely realize more profit than with traditional investments.

What are the advantages of a gold IRA

An Individual Retirement Account (IRA) is the best way to put money towards retirement. You can withdraw it at any time, but it is tax-deferred. You have total control over how much each year you take out. There are many types and types of IRAs. Some are better for those who want to save money for college. Others are made for investors seeking higher returns. Roth IRAs permit individuals to contribute after the age 59 1/2. Any earnings earned at retirement are subject to tax. These earnings don't get taxed if they withdraw funds. So if you're planning to retire early, this type of account may make sense.

An IRA with a gold status is like any other IRA because you can put money into different asset classes. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. People who prefer to save their money and invest it instead of spending it are well-suited for gold IRAs.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. That means you won't have to think about making deposits every month. To make sure you don't miss any payments, you can also set up direct deductions.

Finally, the gold investment is among the most reliable. Because it's not tied to any particular country, its value tends to remain steady. Even during economic turmoil, gold prices tend to stay relatively stable. Gold is a good option for protecting your savings from inflation.

What are the pros and disadvantages of a gold IRA

An Individual Retirement account (IRA) is a better option than regular savings accounts in that interest earned is exempted from tax. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. There are some disadvantages to this investment.

To give an example, if your IRA is withdrawn too often, you can lose all your accumulated funds. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. If you do decide to withdraw funds from your IRA, you'll likely need to pay a penalty fee.

Another problem is the cost of managing your IRA. Many banks charge between 0.5%-2.0% per year. Others charge management fees that range from $10 to $50 per month.

If you prefer to keep your money outside a bank, you'll need to purchase insurance. Insurance companies will usually require that you have at least $500,000. You might be required to buy insurance that covers losses up to $500,000.

If you are considering a Gold IRA, you need to first decide how much of it you would like to use. You may be limited in the amount of gold you can have by some providers. Others allow you to pick your weight.

You'll also need to decide whether to buy physical gold or futures contracts. Physical gold is more expensive than gold futures contracts. Futures contracts allow you to buy gold with more flexibility. They let you set up a contract that has a specific expiration.

You'll also need to decide what kind of insurance coverage you want. The standard policy doesn't include theft protection or loss due to fire, flood, or earthquake. It does include coverage for damage due to natural disasters. You might consider purchasing additional coverage if your area is at high risk.

In addition to insurance, you'll need to consider the cost of storing your gold. Storage costs are not covered by insurance. Additionally, safekeeping is usually charged by banks at around $25-$40 per monthly.

If you decide to open a gold IRA, you must first contact a qualified custodian. A custodian maintains track of all your investments and ensures you are in compliance with federal regulations. Custodians aren't allowed to sell your assets. Instead, they must hold them as long as you request.

Once you've decided which type of IRA best suits your needs, you'll need to fill out paperwork specifying your goals. You must include information about what investments you would like to make (e.g. stocks, bonds and mutual funds). It is also important to specify how much money you will invest each month.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. After reviewing your application, the company will send you a confirmation mail.

A financial planner is a good idea when opening a gold IRA. Financial planners have extensive knowledge in investing and can help determine the best type of IRA to suit your needs. They can also help you lower your expenses by finding cheaper alternatives to purchasing insurance.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement funds

irs.gov

finance.yahoo.com

forbes.com

How To

Tips for Investing with Gold

Investing in Gold is one of the most popular investment strategies worldwide. This is due to the many benefits of investing in gold. There are several options to invest in the gold. There are many ways to invest in gold. Some prefer buying physical gold coins while others prefer gold ETFs (Exchange Traded Funds).

Before buying any kind of gold, you need to consider these things.

- First, make sure you check if your country allows you own gold. If you have permission to possess gold in your country, you can then proceed. If not, you may want to consider purchasing gold from overseas.

- Second, it is important to know which type of gold coin you are looking for. You can choose between yellow gold and white gold as well as rose gold.

- You should also consider the price of gold. It is best to begin small and work your ways up. When purchasing gold, diversify your portfolio. Diversifying your portfolio should be a priority, including stocks, bonds and real estate.

- Remember that gold prices are subject to change regularly. Be aware of the current trends.

—————————————————————————————————————————————————————————————-

By: Namcios

Title: Introducing Satslink: Coinkite's Innovative Bitcoin Device

Sourced From: bitcoinmagazine.com/business/coinkites-newest-bitcoin-device-can-serve-as-a-lightning-wallet-and-nostr-client

Published Date: Sat, 14 Oct 2023 15:39:43 GMT