Bitcoin's Scarcity Defies Price Rally, as per Glassnode Study

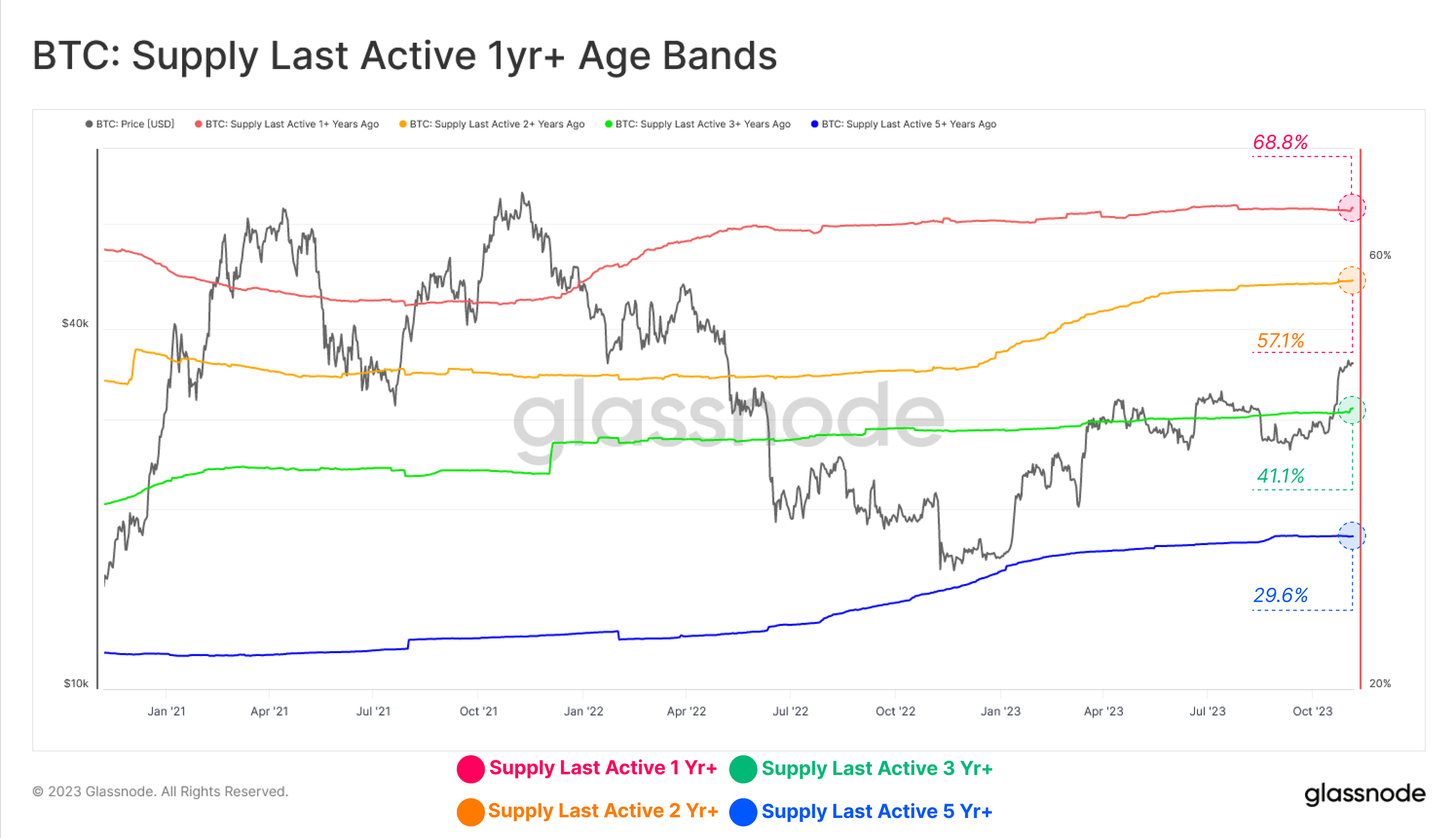

A recent study conducted by Glassnode on onchain activities shows that the scarcity of the bitcoin supply has tightened, despite the significant increase in bitcoin's value this year. The study highlights that the inactivity of coins has reached both multi-year and unprecedented peaks.

Reflecting on the trend over the past year, BTC has experienced a surge of 71%, with a 114% increase from the beginning of the year until now. However, Glassnode's latest report indicates that the availability of bitcoin remains limited, primarily due to steadfast holders dominating the market.

Onchain Report Highlights Limited Bitcoin Movement

The onchain report reveals that 68.8% of bitcoin (BTC) has not moved in over a year. Additionally, the non-liquid supply index has reached a record-breaking 15.4 million BTC. This data suggests that long-term investors are holding onto their bitcoin at record levels, while short-term investors have significantly reduced their supply.

According to Glassnode, this growing gap between long-standing and recent investors indicates a solidifying of the bitcoin supply. Current investors show reluctance to sell their holdings, leading to a stark contrast between dormant and circulating supplies.

Declining Activity-to-Vaulting Ratio and Market Exuberance

Glassnode's newly introduced metric, the Activity-to-Vaulting Ratio, has been declining since June 2021, with a notable dip in trajectory after June 2022. This shift signifies a decrease in market exuberance from the 2021-22 cycle, according to Glassnode.

Furthermore, Glassnode's analysis of spending patterns indicates a trend of investor accumulation and retention rather than active trading. The Sell-Side Risk Ratio for short-term holders has increased, suggesting some profit-taking in the short run. In contrast, this metric remains historically low for long-term holders.

Boost in Investor Confidence and Wallet Activity

Glassnode's evaluation of wallet activity reveals an increase in wallet sizes across the board, indicating a boost in investor confidence. Retail investors, referred to as "Shrimps" and "Crabs," have absorbed 92% of the bitcoin mined since May 2022. "Shrimps" hold less than one bitcoin, "Crabs" hold 1-10 BTC, and "Fish" hold anywhere between 10-100 BTC.

Conclusion: Bitcoin Supply Tight and Impressive

Glassnode analysts conclude that the bitcoin supply is historically tight, with many supply metrics describing high levels of coin inactivity. This suggests that the bitcoin supply is tightly held, despite the strong price performance this year.

What are your thoughts on Glassnode's report about the tightening bitcoin supply? Share your opinions in the comments section below.

Frequently Asked Questions

Are precious metal IRAs a smart investment?

Answers will depend on the amount of risk you are willing and able to take in order for your IRA account to lose value. These are good if you have $10,000 of cash and don't expect them grow quickly. These might not be the best options if you're looking to invest in assets that have the potential to rise in value (gold) and plan to save for retirement for many decades. These fees can reduce any gains.

Which precious metals are best to invest in retirement?

Understanding what you have now saved and where you are currently saving money is the first step in retirement planning. Start by listing everything you have. This includes stocks, bonds and mutual funds, as well as certificates of deposit (CDs), life policies, annuities and 401(k), plans, real estate investments and other assets, such precious metals. You can then add up all these items to determine the amount of investment you have.

If you haven't already done so, you may want to consider opening a Roth IRA account if you're younger than 59 1/2 years old. Traditional IRAs allow you to deduct contributions out of your taxable income. Roth IRAs don't. But, future earnings won't allow you to take tax deductions.

If you decide that you need more money you'll need another investment account. Begin with a regular brokerage.

How much of your portfolio should be in precious metals?

Investing in physical gold is the best way to protect yourself from inflation. This is because when you invest in precious metals, you buy into the future value of these assets, not just the current price. You can expect your investment to increase in value with the rise of metal prices.

Gains will be taxed if you keep your investments for at minimum five years. Capital gains taxes will apply if you sell the investments within this time period. Learn more about how you can buy gold coins on our website.

Which type of IRA works best?

It is essential to find an IRA that matches your needs and lifestyle when you are choosing one. You should consider whether you wish to maximize tax deferred growth, minimize taxes now, pay penalties later or avoid taxes altogether.

The Roth option may make sense if you are saving for retirement but don't have much other money invested. It also makes sense if you continue working after age 59 1/2 and expect to pay income taxes on any accounts withdrawals.

If you plan to retire early, the traditional IRA might make more sense because you'll likely owe taxes on the earnings of those funds. But if you're going to work well past age 65, the Roth IRA might make more sense since it allows you to withdraw some or all of your earnings without paying taxes.

How do I Withdraw from an IRA of Precious Metals?

If you have an account with a precious-metal IRA company like Goldco International Inc, you might consider withdrawing your funds. When you sell your metals, the value of those funds will be higher than if it was kept in the account.

If you are unsure how to withdraw money from your precious metal IRA, here is what you need to know.

First, determine whether the precious metal IRA provider allows withdrawals. Some companies allow this option, while others don't.

Second, you should determine if your metals are tax-deferred. Most IRA providers offer this benefit. Some providers do not offer this benefit.

Third, make sure to check with your precious metal IRA provider if there are any fees associated with these steps. You may have to pay an additional fee for the withdrawal.

Fourth, make sure you keep track for at least three consecutive years of the precious metal IRA investments after you have sold them. This means that you must wait until January 1st of each year to calculate capital gain on your investment portfolio. Fill out Form 8949 and follow the instructions to calculate how much gain you've realized.

Not only must you file Form 8949 but also have to report to the IRS the sale of precious metals. This step ensures that you pay taxes on all profits earned from your sales.

Finally, consult a trusted accountant or attorney before selling your precious metals. They can assist you in following the correct procedures and avoiding costly mistakes.

Can you make money from a gold IRA

To make money from an investment you must first understand how it works and secondly what products are available.

You shouldn't trade if you don't have the right information.

Also, you should find the broker that provides the best service possible for your account type.

There are many accounts available, including Roth IRAs and standard IRAs.

A rollover may be an option if you have other investments like stocks or bonds.

Which is more powerful: sterling silver or 14k gold?

Both gold and silver make strong metals. Sterling silver is more affordable than sterling silver which has only 24% pure silver.

Sterling silver is also known as fine silver because it is made from a mixture of silver and other metals such as copper and zinc.

Gold is considered very strong. It takes tremendous pressure to split it apart. If you drop something on top of a chunk of gold it will shatter into thousands of pieces rather than breaking into two halves.

But silver isn’t nearly as sturdy as gold. If you dropped something onto a sheet made of silver, it would most likely bend and fold easily without breaking.

Silver is often used in jewelry and coins. Its value fluctuates based on demand and supply.

Statistics

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

External Links

investopedia.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

kitco.com

regalassets.com

How To

How to Buy Gold For Your Gold IRA

Precious metal is used to describe precious metals such as gold, silver (excluding helium), palladium, palladium or osmium), ruthenium, rose, rhenium, ruthenium and others. It's any element naturally occurring with atomic numbers 79 to 110 (excluding helium), that is valued for its rarity or beauty. Precious metals include gold and silver. Precious Metals are often used for money, jewelry and industrial goods.

Gold's price fluctuates each day due to supply/demand. Investors are looking for safe havens away from unstable countries and precious metals has seen a large demand over the past decade. The increased demand has led to a significant rise in prices. But, investors in precious metals are becoming more cautious due to rising production costs.

Because it is rare and long-lasting, gold makes a great investment. Contrary to other investments, gold does not lose its value. You can also buy and sell gold, without having to pay taxes. There are two ways that you can invest your gold. You can either purchase gold bars and coins or invest in futures gold contracts.

In-dispute liquidity can be achieved with physical gold bars or coins. They're easy to trade and store. They do not offer any protection against inflation. You can protect yourself against rising prices by purchasing gold bullion. Bullion is physical, or pure gold. One-ounce pieces are available for billions, while larger quantities such as kilobars and tens of thousands can be purchased. Bullion is normally stored in vaults that are fire- and theft-resistant.

If you prefer owning shares of gold rather than holding actual gold, you should consider buying gold futures. Futures allow you to speculate on how the price of gold might change. You can purchase gold futures to get exposure to the gold price, but not the actual commodity.

A gold contract could be purchased if you wanted to speculate on the future price of gold. My position at the expiration of the contract will be either “long-term” or “short-term.” A long contract is one in which I believe that the price of gold will rise. I'm willing now to pay someone else money, but I promise I'll get more money at the end. A shorter contract would mean that I believe the gold price will fall. So, I'm willing to take the money now in exchange for the promise that I'll make less money later.

I'll be paid the amount of gold and interest specified in the contract when it expires. I am now exposed to the price of gold, without actually holding it.

Precious metals can be a great investment because they are very hard to counterfeit. Precious metals are more difficult to counterfeit than paper currency. Precious metals have remained stable over time because of this.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Glassnode Study Reveals Bitcoin Supply Less Liquid Despite Market Gains

Sourced From: news.bitcoin.com/glassnode-data-shows-bitcoin-supply-less-liquid-than-ever-despite-market-gains/

Published Date: Wed, 08 Nov 2023 18:30:10 +0000