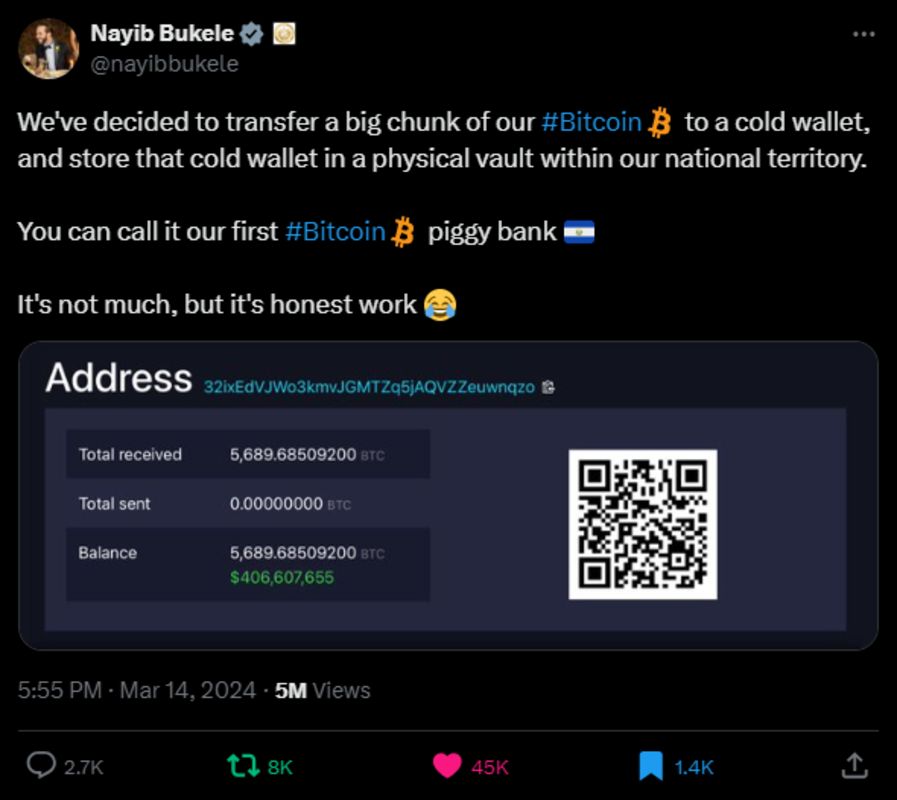

On March 14, 2024, El Salvador's president-elect, Nayib Bukele, unveiled a historic bold maneuver that echoed across the Bitcoin world: El Salvador confirmed the transfer of a substantial portion of its Bitcoin holdings into cold storage, securely kept within a vault in its national borders. This strategic decision marks a pivotal juncture in El Salvador's Bitcoin journey since the introduction of the Bitcoin Law, which has drawn both admiration and skepticism worldwide.

Challenges and Commitment

Amidst a cacophony of critiques ranging from allegations of human rights violations to inadequate modern infrastructure, El Salvador has stood committed, weathering storms of disapproval from traditional finance stalwarts and even fervent Bitcoin maximalists on Twitter (X) Spaces. The veil of ambiguity surrounding the size of El Salvador's Bitcoin reserves, a point of contention and criticism for many, has now been decisively lifted, ushering in a new era of transparency and confidence in the nation's commitment to fostering a thriving Bitcoin-friendly ecosystem.

Transparency and Confidence

With this groundbreaking move, Salvadorans and Bitcoin enthusiasts worldwide have the ability to audit El Salvador's Bitcoin reserves and can see all inbound and outbound transactions. This audacious step wasn't mandated but was taken willingly, embodying El Salvador's commitment to its citizens' trust and the global Bitcoin community's ethos of openness. Unsurprisingly, shortly after Bukele announced El Salvador's Bitcoin address, Bitcoiners began to send donations to the wallet, with nearly 6 Million Sats in transactions as of this writing. To date, plebs can track El Salvador's daily 1 bitcoin DCA purchases. In this historic moment, El Salvador not only charts a new course in financial governance but also silences its critics by setting a precedent of leading by example in responsibly disclosing and managing its modest but modern sovereign Bitcoin wealth reserves.

Strategic Imperative

With 5,689 Bitcoins—valued at $385,111,456 USD as of this writing—El Salvador has secured its digital wealth and aptly navigated the treacherous waters of international politics. The decision to shift its Bitcoin holdings from Bitgo, an American custodian, to a vault within its sovereign borders wasn't just a public relations masterstroke; it was a strategic imperative. Given the strained relations between the American government and El Salvador over the Bitcoin Law, the mounting holdings under Bitgo's custody risked becoming entangled in potential sanctions and regulatory quagmires. This decisive action safeguards El Salvador's financial autonomy and showcases a shrewd understanding of the intricacies of the American regulatory landscape.

Balancing Transparency and Strategy

While the disclosure of the reserves has garnered widespread approval, there may have been compelling and strategic reasons behind the nation's initial reluctance to divulge its complete holdings. Nayib Bukele's affirmation that only a "big chunk" of the total Bitcoin reserves has been transferred to cold storage underscores a nuanced understanding of the country's strategic financial management. In the complex realm of nation-states navigating the uncharted waters of a Bitcoin Standard, maintaining a degree of opacity can be a prudent strategy. El Salvador, in its quest to carve a distinct path in the world, has tactically kept some cards close to its chest, waiting for the opportune moment to unveil its Bitcoin wealth in a calculated move. This wise approach reflects a careful balancing act between transparency and strategic advantage in the dynamic landscape of geopolitics.

Innovative Approaches and Financial Management

Bukele shed light on El Salvador's Bitcoin holdings in earlier tweets, surpassing their earlier acquisition strategies and dollar-cost averaging efforts. Contrary to speculations circulating on social media, Bukele revealed a multifaceted approach that had propelled the nation's Bitcoin reserves. Beyond mere purchases, El Salvador's innovative visa program, profits from Bitcoin-to-dollar exchanges held in escrow, revenue from government services, and mining endeavors have collectively contributed to a handsome Bitcoin treasury. This revelation further dispels misconceptions propagated by armchair quarterbacks and highlights El Salvador's innovative courage in leveraging diverse avenues to bolster its growing Bitcoin wealth.

Building Trust and Prosperity

Disclosing El Salvador's Bitcoin reserves represents a significant stride toward transparency and accountability for its citizens. Yet, it's crucial to recognize that there will always be a segment of critics who demand more and complain about every detail in an attempt to find fault. However, it's essential to remember that these measures are not solely aimed at appeasing detractors. Instead, they serve as a foundational step in creating a positive business environment where Bitcoiners can confidently establish their ventures, knowing that the country is dedicated to their success.

A Vision for the Future

The ultimate goal for Bukele and El Salvador extends beyond merely silencing critics; it's about transforming the nation into a prosperous hub of opportunity for Salvadorans. In a stroke of genius, El Salvador has built its own digital Fort Knox, with the exceptional feature that citizens can verify the existence of the funds. The Salvadoran government aims to nurture a culture of trust and investment in the country's future by rewarding proof-of-work and low-time preference. This vision encompasses building a new El Salvador where citizens can thrive, seize opportunities at home, and contribute to the nation's growth, rather than seeking elusive promises abroad. As El Salvador continues its journey toward economic empowerment and progress, these strategic moves serve as foundational pillars for a brighter and more prosperous future.

Frequently Asked Questions

How can I withdraw from a Precious metal IRA?

First, you must decide if you wish to withdraw money from your IRA account. Then make sure you have enough cash to cover any fees or penalties that may come with withdrawing funds from your retirement plan.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. This option is also available if you are willing to pay taxes on the amount you withdraw.

Next, you'll need to figure out how much money you will take out of your IRA. The calculation is influenced by several factors such as your age at withdrawal, the length of time you have owned the account and whether or not you plan to continue contributing to retirement plans.

Once you have an idea of the amount of your total savings you wish to convert into cash you will need to decide what type of IRA you want. Traditional IRAs allow for you to withdraw funds without tax when you turn 59 1/2. Roth IRAs, on the other hand, charge income taxes upfront but you can access your earnings later and pay no additional taxes.

After these calculations have been completed, you will need to open a brokerage bank account. Most brokers offer free signup bonuses and other promotions to entice people to open accounts. It is better to open an account with a debit than a creditcard in order to avoid any unnecessary fees.

When you do finally decide to withdraw from your precious metallic IRA, you will need a safe space where you can safely store your coins. Some storage facilities will take bullion bars while others require you only to purchase individual coins. Before choosing one, consider the pros and disadvantages of each.

Bullion bars, for example, require less space as you're not dealing with individual coins. However, each coin will need to be counted individually. On the flip side, storing individual coins allows you to easily track their value.

Some prefer to store their coins in a vault. Some people prefer to store their coins safely in a vault. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

Is buying gold a good option for retirement planning?

Although it may not look appealing at first, buying gold for investment is worth considering when you consider the global average gold consumption per year.

Physical bullion bar is the best way to invest in precious metals. There are many ways to invest your gold. You should research all options thoroughly before making a decision on which option you prefer.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. Owning gold stocks should work well if you need cash flow from your investment.

You also can put your money into exchange-traded funds (ETFs), which essentially give you exposure to the price of gold by holding gold-related securities instead of actual gold. These ETFs can include stocks of precious metals refiners and gold miners.

Do you need to open a Precious Metal IRA

You should be aware that precious metals cannot be covered by insurance. If you lose money in your investment, nothing can be done to recover it. This includes investments that have been damaged by fire, flooding, theft, and so on.

You can protect yourself against such losses by purchasing physical gold and silver coins. These coins have been around for thousands and represent a real asset that can never be lost. If you were to offer them for sale today, they would likely fetch you more than you paid when you bought them.

If you decide to open an IRA account, choose a reputable company that offers competitive rates and products. It's also wise to consider using a third-party custodian who will keep your assets safe while giving you access to them anytime.

Do not open an account unless you're ready to retire. Do not forget about the future!

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement account

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor