Overview

In the third quarter, Coinbase exceeded expectations by recording favorable net income and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), despite the extended crypto market slump. The publicly-traded cryptocurrency exchange disclosed a net income of $2 million and an adjusted EBITDA of $181 million for the quarter ending on September 30, 2023.

Q3 Earnings Report

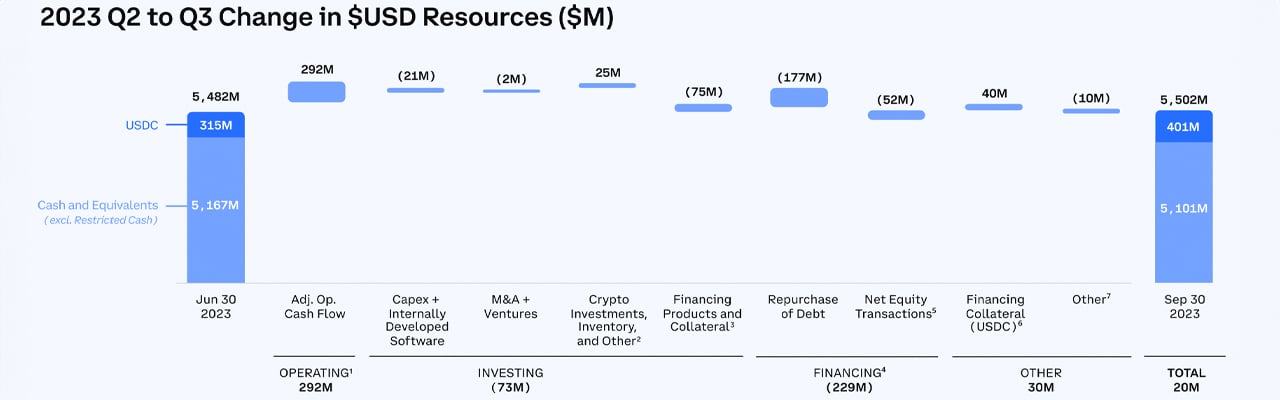

Coinbase (Nasdaq: COIN) released their earnings report in a shareholder letter published on November 2, 2023. The company's total revenue declined from $736 million to $674 million compared to the second quarter. The decrease in revenue was attributed to lower crypto asset volatility and declining global spot trading volumes. Transaction revenue, which comprises the majority of revenue, dropped 12% sequentially to $289 million.

Crypto Market Performance

Coinbase stated that the overall crypto market cap declined by 9% from the end of Q2 to the end of Q3, reaching $1.1 trillion. The average crypto market cap also experienced a 3% decline during the same period. The price of BTC, which accounts for approximately half of the crypto market cap, decreased by 12%.

Revenue Breakdown

Subscription and services revenue remained steady at $334 million, while stablecoin revenue saw a 14% increase to $172 million due to higher interest rates. However, blockchain rewards revenue fell by 15% and interest income dropped by 21%. Operating expenses decreased by 4% sequentially to $754 million, with technology and development, sales and marketing, and general and administrative expenses collectively falling by 1%.

Financial Outlook

For the fourth quarter, Coinbase reported generating approximately $105 million in transaction revenue in October. It projected that subscription and services revenue would remain relatively flat sequentially. The company also expects expenses to decrease, primarily due to reduced stock-based compensation. Coinbase shares have seen a positive trend, with an increase of more than 10% over the past five days and over 13% in the last month.

Future Plans and Regulatory Landscape

Coinbase emphasized its focus on product development and international expansion despite the uncertain market conditions. The company highlighted progress in bringing regulated crypto derivatives to the U.S. and overseas markets. In terms of regulation, Coinbase continues to advocate for clear legislation in the United States.

The company's court battle with the U.S. Securities and Exchange Commission (SEC) is progressing, with oral arguments scheduled for January 2024. Coinbase also noted that 83% of G20 nations have implemented crypto regulations, emphasizing the need for clearer regulations in the United States.

Conclusion

Coinbase's Q3 earnings report showcases its ability to outperform expectations in a challenging crypto market. The company's focus on product development, international expansion, and regulatory advocacy positions it for future success. As the industry continues to evolve, Coinbase remains committed to driving innovation and growth.

What are your thoughts on Coinbase's shareholder letter? Share your opinions in the comments section below!

Frequently Asked Questions

Can I buy gold with my self-directed IRA?

However, gold can only be purchased with your self-directed IRA. To do so, you must first open a brokerage account at TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts can be described as financial instruments that are determined by the gold price. You can speculate on future prices, but not own the metal. But, physical bullion is real bars of gold or silver that you can hold in one's hand.

How can I withdraw from a Precious metal IRA?

First, determine if you would like to withdraw money directly from an IRA. Then make sure you have enough cash to cover any fees or penalties that may come with withdrawing funds from your retirement plan.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, calculate how much money your IRA will allow you to withdraw. This calculation is affected by many factors, such as the age at which you withdraw the money, the amount of time the account has been owned, and whether your plans to continue contributing to your retirement fund.

Once you know what percentage of your total savings you'd like to convert into cash, you'll need to determine which type of IRA you want to use. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. Brokers often offer promotional offers and signup bonuses to encourage people into opening accounts. Avoid unnecessary fees by opening an account with your debit card, rather than your credit card.

When you finally get around to making withdrawals from your precious metal IRA, you'll need a safe place where you can store your coins. Some storage areas will accept bullion, while others require you to purchase individual coins. Before choosing one, consider the pros and disadvantages of each.

Bullion bars are easier to store than individual coins. You will need to count each coin individually. However, keeping individual coins in a separate place allows you to easily track their values.

Some prefer to store their coins in a vault. Some people prefer to store their coins safely in a vault. Regardless of the method you prefer, ensure that your bullion is safe so that you can continue to enjoy its benefits for many years.

How much gold can you keep in your portfolio

The amount of capital required will affect the amount you make. A small investment of $5k-10k would be a great option if you are looking to start small. Then as you grow, you could move into an office space and rent out desks, etc. This way, you don't have to worry about paying rent all at once. Rent is only paid per month.

Consider what type of business your company will be running. In my case, I run a website-creation company. Our clients pay us between $1000-2000/month and depending on their order. So if you do this kind of thing, you need to consider how much income you expect from each client.

Freelance work is not likely to pay a monthly salary. The project pays freelancers. You may get paid just once every 6 months.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I suggest starting with $1k-2k gold and building from there.

What are the pros & con's of a golden IRA?

An Individual Retirement Account (IRA), unlike regular savings accounts, doesn't require you to pay tax on interest earned. An IRA is a great way to save money and not have to pay taxes on the interest you earn. This type of investment has its downsides.

You may lose all your accumulated savings if you take too much out of your IRA. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. You will likely have to pay a penalty fee if you withdraw funds from an IRA.

You will also need to pay fees for managing your IRA. Many banks charge between 0.5%-2.0% per year. Others charge management fees that range from $10 to $50 per month.

If you prefer your money to be kept out of a bank, then you will need insurance. Insurance companies will usually require that you have at least $500,000. You might be required to buy insurance that covers losses up to $500,000.

If you are considering a Gold IRA, you need to first decide how much of it you would like to use. You may be limited in the amount of gold you can have by some providers. Others let you pick your weight.

You will also have to decide whether to purchase futures or physical gold. Physical gold is more costly than gold futures. Futures contracts allow you to buy gold with more flexibility. They let you set up a contract that has a specific expiration.

Also, you will need to decide on the type of insurance coverage you would like. The standard policy does NOT include theft protection and loss due to fire or flood. However, it does cover damage caused by natural disasters. If you live in a high-risk area, you may want to add additional coverage.

Apart from insurance, you should consider the costs of storing your precious metals. Insurance doesn't cover storage costs. In addition, most banks charge around $25-$40 per month for safekeeping.

You must first contact a qualified custodian before you open a gold IRA. A custodian keeps track of your investments and ensures that you comply with federal regulations. Custodians aren't allowed to sell your assets. Instead, they must maintain them for as long a time as you request.

After you've determined which type of IRA is best for you, fill out the paperwork indicating your goals. The plan should contain information about the types of investments you wish to make such as stocks, bonds or mutual funds. Also, you should specify how much each month you plan to invest.

After filling in the forms, please send them to the provider. The company will review your application and send you a confirmation letter.

When opening a gold IRA, you should consider using a financial planner. Financial planners are experts in investing and will help you decide which type of IRA works best for your situation. They can help reduce your expenses by helping you find cheaper alternatives to buying insurance.

Should You Invest Gold in Retirement?

This will depend on how much money and whether you were able to invest in gold at the time that you started saving. If you are unsure which option to choose, consider investing in both options.

In addition to being a safe investment, gold also offers potential returns. It is a good choice for retirees.

While many investments promise fixed returns, gold is subject to fluctuations. This causes its value to fluctuate over time.

But this doesn't mean you shouldn't invest in gold. This just means you need to account for fluctuations in your overall portfolio.

Another advantage of gold is its tangible nature. Gold is more convenient than bonds or stocks because it can be stored easily. It is also easily portable.

You can always access your gold as long as it is kept safe. You don't have to pay storage fees for physical gold.

Investing in gold can help protect against inflation. It's a great way to hedge against rising prices, as gold prices tend to increase along with other commodities.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. Gold usually rises when stocks fall.

Investing in gold has another advantage: you can sell it anytime you want. You can also liquidate your gold position at any time you need cash, just like stocks. You don’t even need to wait until retirement to liquidate your position.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all of your eggs in one basket.

Don't buy too many at once. Start with just a few drops. Then add more as needed.

It's not about getting rich fast. Instead, the goal is to accumulate enough wealth that you don't have to rely on Social Security.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

How much are gold IRA fees?

A monthly fee of $6 for an Individual Retirement Account is charged. This includes account maintenance and any investment costs.

You may have to pay additional fees if you want to diversify your portfolio. These fees can vary depending on which type of IRA account you choose. Some companies offer free checking, but charge monthly fees for IRAs.

In addition, most providers charge annual management fees. These fees vary from 0% to 11%. The average rate is.25% annually. These rates are usually waived if you use a broker such as TD Ameritrade.

What should I pay into my Roth IRA

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. These accounts cannot be withdrawn until you turn 59 1/2. However, if your goal is to withdraw funds before that time, there are certain rules you must observe. First, you can't touch your principal (the initial amount that was deposited). No matter how much money you contribute, you cannot take out more than was originally deposited to the account. You must pay taxes on the difference if you want to take out more than what you initially contributed.

You cannot withhold your earnings from income taxes. Withdrawing your earnings will result in you paying taxes. Let's suppose that you contribute $5,000 annually to your Roth IRA. Let's also assume that you make $10,000 per year from your Roth IRA contributions. You would owe $3,500 in federal income taxes on the earnings. The remaining $6,500 is yours. Since you're limited to taking out only what you initially contributed, that's all you could take out.

So, if you were to take out $4,000 of your earnings, you'd still owe taxes on the remaining $1,500. You would also lose half of your earnings because they are subject to another 50% tax (half off 40%). You only got back $4,000. Even though you were able to withdraw $7,000 from your Roth IRA,

There are two types if Roth IRAs: Roth and Traditional. A traditional IRA allows for you to deduct pretax contributions of your taxable income. Your traditional IRA can be used to withdraw your balance and interest when you are retired. There is no limit on how much you can withdraw from a traditional IRA.

Roth IRAs do not allow you to deduct your contributions. After you have retired, the full amount of your contributions and accrued interest can be withdrawn. There is no minimum withdrawal required, unlike a traditional IRA. You don’t have to wait for your turn 70 1/2 years before you can withdraw your contributions.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)