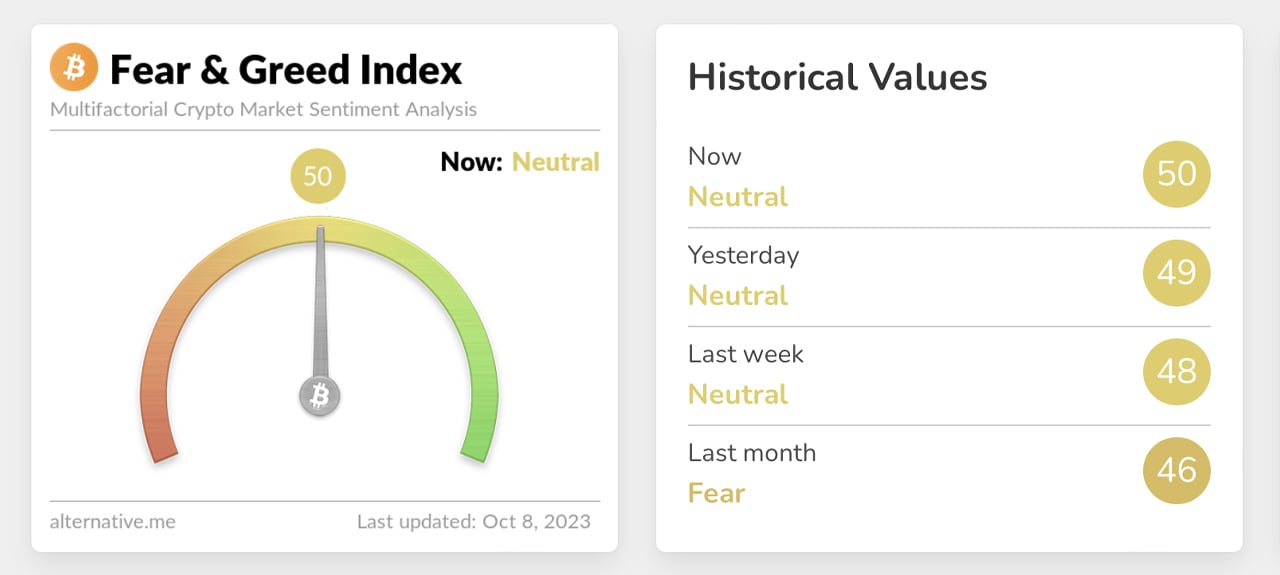

Bitcoin demonstrates stability beneath the $28K mark on October 8, 2023, endorsing a minor leap from the preceding week by 2.6%. The Crypto Fear and Greed Index (CFGI) seems well-poised at a balanced figure of 50 on its 100-point scale, affirming identical standings throughout the week. Furthering the poised conception, Bitcoin's price pattern showcases consolidation into a narrow sphere.

Bitcoin’s Market Balance: The Fear and Greed Index as A Measure of Market Sentiment

In the preceding week, Bitcoin’s (BTC) value was noted at a sum of $27,189 per unit. The recent 24 hours witnessed a shift between $28,103 and $27,770 within the BTC value. Bitcoin has observed a 2.6% upswing in the past week and an overall 7.9% surge over a 30-day interval.

The Crypto Fear and Greed Index (CFGI), an enhancing sign of Bitcoin's market mood, has steadfastly held its 'neutral' position. The CFGI, functioning as a market mood indicator, aims to equip traders with insightful anticipation of the market's collective consciousness.

The CFGI believes paranormal fear could depress prices more than they should be, while unchecked greed might hyperinflate them. Therefore, by capturing this sentiment, traders can spot potential transaction opportunities. This includes phases like extreme fear, fear, neutral, greed, and extreme greed—all intricate parts of the CFGI.

Bitcoin Market Mood: Neutrality as a Balance Between Bullish and Bearish Forces

The CFGI registering 50 on October 8, 2023, slightly higher than last weekend's 48, mirrors the ‘Fear and Greed’ index of Coinmarketcap.com that signals a neutral rating of 46. The market presenting such neutrality and Bitcoin settling for a more systematic range denotes the market's uncertainty.

Existing in a neutral domain suggests a lack of dominant sentiment. The market abides by a balance where neither the pessimists nor the optimists take complete control. However, neutrality shouldn’t be mistaken for market stagnation. Prices may fluctuate within certain boundaries, but the overall feeling remains balanced between buyers and sellers.

Bitcoin’s technical indicators such as oscillators, including the relative strength index (RSI) and stochastic (14, 3, 3), further validate this balanced sentiment. Neutrality in oscillators like the RSI and stochastic (14, 3, 3) confirms that the asset has achieved an equilibrium – where it’s neither overbought nor oversold.

Bitcoin’s Market Stability: Consolidation Phase in Sight?

The current RSI hovers around 61 with a stochastic reading close to 75, indicating a balance between buyers' and sellers' pressures. Given this balanced reading from both the oscillators and CFGI, it's plausible that the market is well poised for a consolidation phase, primed for future actions or triggers.

Your perspective on the Crypto Fear and Greed signals and potential market consolidation would be valuable. Kindly share your point of view and understanding regarding this discussion in the comments section below.

Frequently Asked Questions

Can you make money from a gold IRA

It is important to first understand the market in order to be able to invest and secondly to identify what products are currently available.

Trading should not be started if you don’t have sufficient information.

Also, you should find the broker that provides the best service possible for your account type.

There are many accounts available, including Roth IRAs and standard IRAs.

If you have other investments such as bonds or stocks, you might also consider a rollover.

Which type of IRA could be used for precious metals

Most financial institutions and employers offer an Individual Retirement Account (IRA). This is an investment vehicle that most people can use. An IRA allows you to contribute money that is tax-deferred until it is withdrawn.

An IRA allows you to save taxes and pay them later when you retire. This allows for more money to be deposited in your retirement plan today than having to pay taxes tomorrow on it.

The beauty of an IRA is that contributions and earnings grow tax-free until you withdraw the funds. Early withdrawals are subject to penalties.

Additional contributions can be made to your IRA even after you turn 50, without any penalty. If you decide to withdraw your IRA from retirement, you will owe income taxes as well as a 10% federal penalty.

A 5% IRS penalty is applicable to withdrawals made before the age of 59 1/2. A 3.4% IRS penalty is applicable to withdrawals made between the ages of 59 1/2 and 701/2.

An IRS penalty of 6.2% applies to withdrawals above $10,000 per year.

What precious metals may I allow in my IRA?

Gold is the most widely used precious metal for IRA account accounts. You can also invest in gold bullion bars and coins.

Precious metals, which don't lose any value over time, are considered safe investments. They can also be used to diversify investment portfolios.

Precious metals include silver, platinum, and palladium. These three metals all have similar properties. Each metal has its own unique uses.

One example is platinum, which is used to create jewelry. The catalysts are made from palladium. To produce coins, silver can be used.

You should consider the amount you will spend on your gold before you decide which precious metal. A lower-cost ounce of gold might be a better option.

You need to decide if you want your investment to remain private. If you are unsure, palladium is the right choice.

Palladium is more expensive than gold. But it's also less common. So you'll likely have to pay more for it.

Storage fees are another important consideration when choosing between silver and gold. Gold is stored by weight. If you have larger amounts of gold to store, you will be charged more.

Silver is stored by volume. You'll pay less if you store smaller quantities of silver.

Follow all IRS rules regarding silver and gold if you are storing precious metals within an IRA. This includes keeping records of transactions and reporting them back to the IRS.

What are the pros & cons of a Gold IRA?

For those who don't have the ability to access traditional banking services but want to diversify their portfolios, a gold IRA can be a great investment option. It allows investors to invest in precious materials such as gold and silver without paying tax on gains until they are withdrawn.

However, if you withdraw money before the due date, you will be subject to ordinary income tax. However, these funds are kept outside the country and cannot be seized by creditors if you default.

A gold IRA is a great option if you want to own gold but not worry about taxes.

Which is stronger? 14k Gold or Sterling Silver?

Sterling silver, which contains 92% pure sterling silver instead of just 24%, is a stronger metal than gold or silver.

Sterling silver, also known as fine or sterling silver, is made of a combination of silver and other metals like copper and zinc.

Gold is considered very strong. It takes a lot of pressure to break it down. If you dropped an object onto a piece or gold, it would break into thousands instead of two halves.

However, silver doesn't have the same strength as gold. If you dropped an item onto a sheet of silver, it would probably bend and fold without shattering.

It is commonly used in coins and jewelry. Its value fluctuates based on demand and supply.

Statistics

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

External Links

investopedia.com

kitco.com

regalassets.com

en.wikipedia.org

How To

Precious Metals that have been approved by the IRA

IRA-approved precious metallics are great investments, whether you want to save for retirement and invest in your next venture. There are many options available to diversify and protect your portfolio from gold bars through silver coins.

There are two types of precious metal investment products. Bars and coins, which are physical bullion products, can be considered tangible assets as they are in tangible form. On the other hand, exchange-traded funds (ETFs) are financial instruments that track the price movements of an underlying asset, such as gold. ETFs trade like stocks on stock exchanges, which means investors can buy shares of them directly from the company issuing them.

There are many different types of precious metallics available to purchase. Silver and gold are commonly used for jewellery making and decoration. However, platinum and palladium tend to be associated with luxury goods. Palladium is more stable than platinum and therefore better suited for industrial purposes. While silver is used in industry, decorative uses are preferred over it.

Because of the costs involved in mining and refining raw material, physical bullion products can be more costly. They are safer than paper currencies, and offer buyers greater security. One example is that consumers could lose trust in the currency, and may look for other currencies if the U.S. Dollar loses its purchasing power. However, physical bullion products don't rely on trust between nations or companies. Instead, they are backed by governments and central banks, giving customers peace of mind.

The supply and demand for gold affect the price of gold. In other words, demand drives the price up. However, supply is greater than demand and prices fall. Investors have the opportunity to profit by fluctuations in gold's price. Investors who own physical bullion products benefit from these fluctuations because they receive a higher return on their money.

Precious metals are not affected by interest rate changes or economic recessions, unlike traditional investments. As long as demand remains strong, the price of gold will continue to rise. Because of this, precious metals are considered safe havens during times of uncertainty.

These precious metals are the most in demand:

- Gold – It is the oldest form of precious metallic and is sometimes called “yellow material”. While gold is a familiar name, it is an extremely rare element that is found underground. Most of the world’s gold reserves can be found in South Africa and Peru, Canada, Russia and China.

- Silver – After gold, silver ranks second in precious metals. Silver is mined from the earth's natural resources. Silver, unlike gold, is often extracted from ore instead of rock formations. Because of its durability and malleability, as well as resistance to tarnishing, silver is widely used in commerce and industry. The United States makes more than 98% all of the global silver production.

- Platinum – The third most precious precious metal is platinum. It can be used to make high-end medical equipment, fuel cells, and catalytic converters. Dental crowns, bridges, and fillings can also be made from platinum.

- Palladium- Palladium, the fourth most precious precious metal, is Palladium. Manufacturers are gaining more interest in palladium due to its strength & stability. Palladium is also used in electronics, automobiles, aerospace, and military technology.

- Rhodium – Rhodium is fifth most valuable precious metal. Rhodium is very rare but is highly sought for its use in automotive catalysts.

- Ruthenium-Ruthenium is the sixth-most valuable precious metal. Although there is a limited supply of palladium and platinum, ruthenium can be found in abundance. It is used in steelmaking, chemical manufacturing, and engine design.

- Iridium- Iridium, the seventh most precious precious metal, is also known as Iridium. Iridium is a key component in satellite technology. It is used to build satellites orbiting that transmit television signals, phone calls, and other communications.

- Osmium (Osmium) – Osmium has the eighth highest value precious metal. Osmium has a high resistance to extreme temperatures, which is why it is used frequently in nuclear reactors. Osmium is used in medicine, cutting tools, jewelry, as well as medicine.

- Rhenium: Rhenium ranks as the ninth-most valuable precious metal. Rhenium is used to refining oil and natural gas, in semiconductors, and rocketry.

- Iodine – Iodine is the tenth most valuable precious metal. Iodine's uses include radiography, photography and pharmaceuticals.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Bitcoin's Market Stability in Focus as Fear and Greed Index Marks Equilibrium

Sourced From: news.bitcoin.com/bitcoin-lingers-in-a-neutral-phase-as-the-fear-and-greed-index-signals-market-consolidation/

Published Date: Sun, 08 Oct 2023 16:30:46 +0000