The Arizona State Senate is contemplating a plan to encourage the Arizona State Retirement System (ASRS) and the Public Safety Personnel Retirement System (PSPRS) to explore the incorporation of Bitcoin ETFs in their investment portfolios.

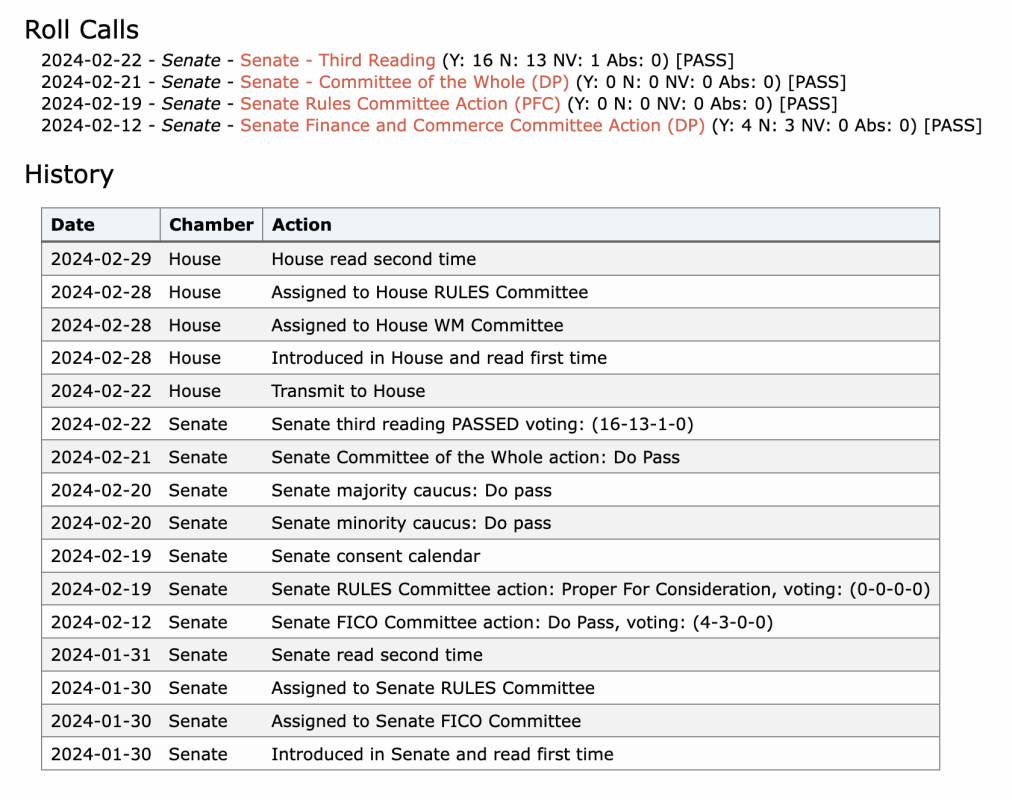

Senate Approval and House Review

On February 22, the bill successfully passed the Senate's Third Reading with a 16-13 vote and is currently under review by the House for the second time.

Emphasis on Monitoring and Consultation

The proposal highlights the significance of staying updated on Bitcoin ETF developments and urges ASRS and PSPRS to assess the implications of including such assets in their portfolios. This involves seeking advice from firms authorized by the U.S. Securities and Exchange Commission to provide Bitcoin ETFs.

Comprehensive Report Requirement

Furthermore, ASRS and PSPRS would need to present a detailed report on the feasibility, risks, and potential advantages of allocating a portion of state retirement system funds to Bitcoin ETFs. This report, containing investment options and recommendations for safely navigating the asset class, must be submitted to key state officials at least three months before the commencement of the Fifty-Seventh Legislature, First Regular Session.

Objective of the Proposal

The objective of the proposal is to equip ASRS and PSPRS with the necessary information to make well-informed decisions regarding the integration of Bitcoin ETFs into their investment strategies. This move could potentially lead to portfolio diversification and the exploration of new avenues for growth.

Frequently Asked Questions

Are gold IRAs a good option for investment?

An investment in gold can be made by buying shares of companies that mine it. You should buy shares in these companies to make money from investing in gold and other precious metals such as silver.

Two drawbacks exist when you own shares directly.

The first is that you could lose money if your stock is held on for too long. Stocks that fall are less than their underlying asset (like silver) and can end up losing more money. It could lead to you losing your money, instead of making it.

Second, you may miss out on potential profits if you wait until the market recovers before selling. It is possible to wait until the market recovers before selling your gold.

However, if you want to separate your investments from your financial affairs, physical gold can still be a great investment option. An IRA in gold can diversify your portfolio and protect you against inflation.

You can find out more information about gold investing on our website.

Can I invest in gold?

Yes, it is possible! You can add gold to your retirement plan. Because it doesn’t lose value over the years, gold makes a good investment. It also protects against inflation. It also protects against inflation.

Before you decide to invest in gold, it is important to understand that it isn't like other investments. You cannot purchase shares of gold companies like bonds and stocks. They can't be sold.

Instead, convert your precious metals to cash. This means you will need to get rid. It's not enough to hold on to it.

This makes gold different than other investments. With other investments, you can always sell them later. That's not true with gold.

You can't even use your gold as collateral to get loans. If you get a mortgage, for example, you might have to give up some of the gold you own in order to pay off the loan.

What does this all mean? You can't just keep your gold forever. You'll eventually need to convert it into cash.

There's no need to be concerned about this right now. Open an IRA account. You can then invest in gold.

What is a Precious Metal IRA?

Precious metals can be a good investment for retirement accounts. They have been around for centuries and are still very valuable today. You can diversify your portfolio by investing in precious metals, such as gold, platinum, and silver.

Many countries also permit citizens to store money in foreign currencies. You can buy Canada gold bars and keep them home. You can then sell the same gold bars to Canadian dollars when you return home to visit your family.

This is a great way to invest in precious metals. It's especially useful if you live outside of North America.

Is it possible to hold precious metals in an IRA

This question is dependent on whether an IRA owner wishes to diversify into gold or silver, or keep them safe.

He has two options if he wishes to diversify. He could either buy bars of physical gold and/or sterling from a dealer or simply sell these items back at the end. Let's say he doesn’t want to sell back his precious metal investment. In that case, he should continue holding onto them as they would be perfectly suitable for storing within an IRA account.

Is it a good idea to have an IRA that holds gold and silver?

If you are looking for an easy way to invest in both gold and silver at once, then this could be an excellent option for you. There are many other options. If you have any questions regarding these types of investments, please feel free to contact us anytime. We're always happy to help!

What is the best way to make money with a gold IRA?

Yes, but not as often as you think. It depends on how much you're willing to risk. It's possible to retire with $1 million if your retirement age is reached if you are able to put aside $10,000 per year for 20 consecutive years. You'll end up losing everything if you place all your eggs in the same basket.

Diversifying your investments is important. When there is inflation, gold does well. You want to invest in an investment asset that rises with inflation. Stocks are able to do this because they rise as companies make more profit. This is also true for bonds. They pay interest each and every year. They are great in times of economic growth.

But what happens when there isn't any inflation? During deflationary periods, bonds fall in value while stocks fall further. Investors should refrain from putting all their savings into one type of investment such as a mutual fund or bond.

Instead, they should invest in a mix of different funds. They could, for example, invest in stocks and bonds. Or they could invest in both cash and bonds.

This gives them exposure to both sides. Inflation and deflation. And they will still see a return over time.

What precious metals can you invest in for retirement?

Understanding what you have now saved and where you are currently saving money is the first step in retirement planning. Start by listing everything you have. This should include all stocks, bonds, mutual fund, certificates of deposits (CDs), insurance policies, life insurance policies and annuities. To determine how much money is available to invest, add all these items.

If you haven't already done so, you may want to consider opening a Roth IRA account if you're younger than 59 1/2 years old. A Roth IRA is not able to allow contributions to be deducted from your taxable earnings, but a traditional IRA can. You won't be allowed to deduct tax for future earnings.

You may need additional money if you decide you want more. Start with a regular broker account.

Statistics

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

External Links

investopedia.com

wsj.com

en.wikipedia.org

regalassets.com

How To

How to Open a Precious Metal IRA

Precious metals are a highly sought-after investment vehicle. Because they offer higher returns than traditional investments such as stocks and bonds, they are very popular. It is worth your time to research and plan before you invest in precious metals. Here are the basics to help you open your precious metal IRA account.

There are two main types in precious metal accounts. These are physical precious metals and paper gold or silver certificates (GSCs). Each type has advantages and drawbacks. For example, physical precious metals accounts offer diversification benefits, while GSCs are easy to access and trade. Continue reading to learn more about each of these options.

Physical precious Metals accounts consist of bullion, bullion, and bars. Although diversification benefits are great, this option has drawbacks. Precious metals can be expensive to store, buy and sell. Moreover, their large size can be difficult to transport them from one location to another.

However, paper silver and gold certificates are relatively cheap. These certificates can also be traded online, and they are easy to access. This makes them ideal for people who don't want to invest in precious physical metals. But, they're not as well-diversified as physical counterparts. They are also backed by government agencies like the U.S. Mint so their value could decline if inflation rates rise.

You should choose the account that best suits your financial needs before you open a precious-metal IRA. The following are important factors to consider before opening an IRA.

- Your tolerance level

- Your preferred asset allocation strategy

- What time do you have available to invest?

- Consider whether you will use the funds to trade short-term.

- Which type of tax treatment would you prefer

- Which precious metal(s), you would like to invest in

- How liquid do your portfolio need to be

- Your retirement age

- Where you'll store your precious metals

- Your income level

- Your current savings rate

- Your future goals

- Your net worth

- Any special circumstances that may affect your decision

- Your overall financial situation

- Your preference between physical and paper assets

- Your willingness to take on risks

- Your ability manage losses

- Your budget constraints

- Your desire to be financially independent

- Your investment experience

- Your familiarity in precious metals

- Your knowledge of precious Metals

- Your confidence and faith in the economy

- Your personal preferences

After you've decided on the best type of precious metal IRA for you, you can start to open an accounts with a reputable broker. You can find these companies through referrals, word of mouth, or online research.

Once you've opened your precious metal IRA, you'll need to determine how much money you want to put into it. Every precious metal IRA account will have a different minimum initial deposit amount. Some accounts only require $100, while others may allow you up to $50,000.

As mentioned above, you can decide how much money you want to invest in your precious metal IRA. If you're looking to build wealth over a long period, you should probably opt for a larger initial deposit. If you are planning to invest small amounts each month, a lower initial investment might be better.

As far as the actual precious metals used in your IRA go, you can purchase any number of different types of investments. The most popular are:

- Bullion bars and rounds of gold, as well as coins

- Silver – Rounds and coins

- Platinum – Coins

- Palladium Round and Bar Forms

- Mercury – Bar and round forms

—————————————————————————————————————————————————————————————-

By: Nik Hoffman

Title: Arizona State Senate Considers Bitcoin ETFs for State Retirement Systems

Sourced From: bitcoinmagazine.com/business/arizona-state-senate-considering-adding-bitcoin-etfs-to-retirement-portfolios

Published Date: Wed, 06 Mar 2024 15:29:53 GMT