As we step into 2024, the excitement in the cryptocurrency community is palpable as we gear up for Bitcoin's upcoming halving event. This event has historically had a profound impact on the crypto market landscape, and it is crucial to delve into how it may unfold this time around. Let's explore the potential implications of the 2024 Bitcoin halving.

Bitcoin's Evolution: From Digital Gold to Rare Platinum

Bitcoin's fundamental design revolves around increasing scarcity over time to maintain its value. With a maximum cap of 21 million Bitcoins, we are rapidly approaching this limit, with over 19.62 million Bitcoins already in circulation. This scarcity, coupled with the controlled release of new Bitcoins into the market, has earned Bitcoin the moniker "digital gold," highlighting its rarity and value akin to precious metals.

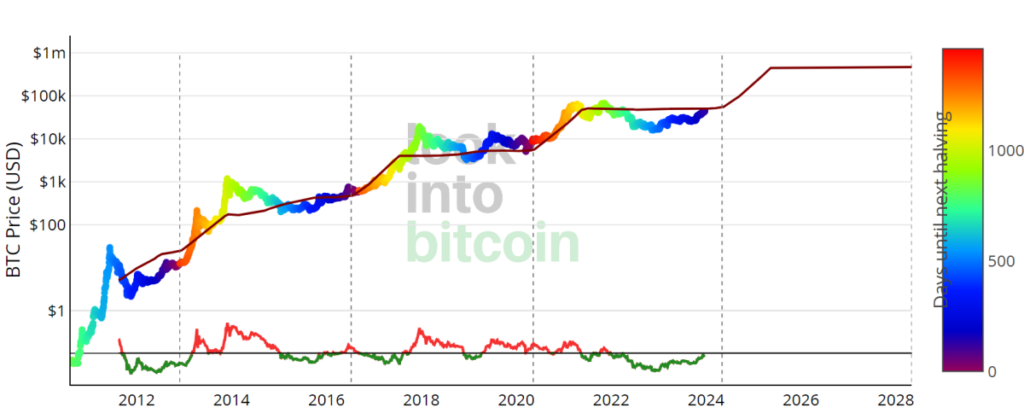

Visualizing the Bitcoin blockchain as a ticking clock, we observe that halving events occur approximately every four years or every 210,000 blocks. During these halvings, the reward for mining new blocks is halved. Since Bitcoin's inception in 2009, the block rewards have decreased from 50 BTC per block to 3.125 BTC in 2024.

Bitcoin's Post-Halving Performance

Looking back at Bitcoin's past halving events sheds light on its remarkable growth patterns. Following the 2012 halving, Bitcoin's price surged, with a 342% increase in market cap within 100 days. Subsequently, the price skyrocketed to $1,152, marking an 8,761% surge the following year. The 2016 halving witnessed a similar trend, with a 2,572% price increase to $17,760 after the rewards dropped to 12.5 BTC. The most recent halving in 2020 saw Bitcoin's price reaching $67,549, a 594% growth following the reduction to 6.25 BTC.

By analyzing the historical growth rates post-halving, we can estimate a potential growth rate of approximately 155.79% after the 2024 halving, projecting a speculated price of around $111,807 within one to one and a half years post-event. However, it is essential to note that these projections are speculative and should not be the sole basis for investment decisions.

Challenges for Miners in the Face of Halving

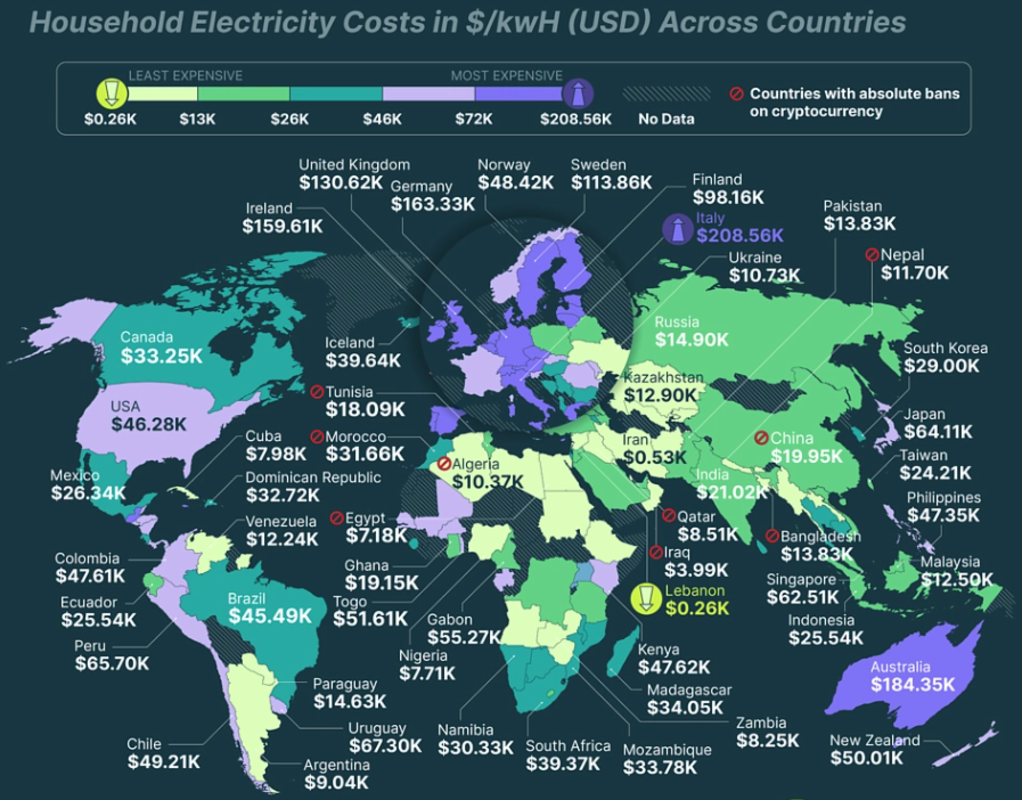

The 2024 halving poses significant challenges for Bitcoin miners, particularly those with outdated equipment and high operating costs. In regions like Italy, mining a single Bitcoin can cost as much as a luxury sports car, reaching up to $208,560. The halving event will create a competitive environment akin to "The Hunger Games," where only the most efficient and cost-effective miners will survive the reduced rewards.

Final Reflections

The 2024 Bitcoin halving is set to bring substantial changes to the cryptocurrency landscape, impacting mining operations and potentially influencing Bitcoin's price trajectory. This event merges economic theories with technological advancements, encapsulating the essence of the crypto industry's allure. Whether you are actively involved in mining, holding Bitcoin, or observing from the sidelines, the 2024 halving promises to be a significant moment in the history of cryptocurrency.

Frequently Asked Questions

What is a Precious Metal IRA (IRA)?

A precious metal IRA lets you diversify your retirement savings to include gold, silver, palladium, rhodium, iridium, osmium, osmium, rhodium, iridium and other rare metallics. These precious metals are extremely rare and valuable. They are great investments for your money, and they can protect you from inflation or economic instability.

Bullion is often used to refer to precious metals. Bullion refers to the actual physical metal itself.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

You can invest directly in bullion with a precious metal IRA instead of buying shares of stock. You'll get dividends each year.

Precious metal IRAs have no paperwork or annual fees. Instead, you pay a small percentage tax on the gains. Plus, you can access your funds whenever you like.

Is buying gold a good way to save money for retirement?

Buying gold as an investment may not seem very appealing at first glance, but when you consider how much people spend on average on gold per year worldwide, it becomes worth considering.

Physical bullion bar is the best way to invest in precious metals. However, there are many other ways to invest in gold. It is best to research all options and make informed decisions based on your goals.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. If you are looking for cash flow from your investment, buying gold stocks will work well.

You can also invest your money in exchange-traded fund (ETFs), which give you exposure to the gold price by holding securities related to gold. These ETFs can include stocks of precious metals refiners and gold miners.

How can I withdraw from a Precious metal IRA?

First, you must decide if you wish to withdraw money from your IRA account. You should also ensure that you have enough money to cover any fees and penalties associated with withdrawing funds.

If you are willing to pay a penalty for early withdrawal, you should consider opening a taxable brokerage account instead of an IRA. If you decide to go with this option, you will need to take into account the taxes due on the amount you withdraw.

Next, calculate how much money your IRA will allow you to withdraw. This calculation is affected by many factors, such as the age at which you withdraw the money, the amount of time the account has been owned, and whether your plans to continue contributing to your retirement fund.

Once you have determined the percentage of your total savings that you would like to convert to cash, you can then decide which type of IRA to use. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

Once these calculations have been completed you will need to open an account with a brokerage. A majority of brokers offer free signup bonuses, as well as other promotions, to get people to open accounts. Avoid unnecessary fees by opening an account with your debit card, rather than your credit card.

You will need a safe place to store your coins when you are ready to withdraw from your precious metal IRA. Some storage facilities will take bullion bars while others require you only to purchase individual coins. You'll have to weigh the pros of each option before you make a decision.

Because you don't have to store individual coins, bullion bars take up less space than other items. But, each coin must be counted separately. However, keeping individual coins in a separate place allows you to easily track their values.

Some people prefer to keep coins safe in a vault. Others prefer to store their coins in a vault. You can still enjoy the benefits of bullion for many years, regardless of which method you choose.

What is the cost of gold IRA fees

A monthly fee of $6 for an Individual Retirement Account is charged. This includes account maintenance fees and investment costs for your chosen investments.

You may have to pay additional fees if you want to diversify your portfolio. These fees can vary depending on which type of IRA account you choose. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

Most providers also charge annual management costs. These fees range from 0% to 1%. The average rate is.25% annually. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

Who holds the gold in a gold IRA?

The IRS considers any individual who holds gold “a form of income” that is subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you are planning to sell your gold someday, it is necessary that you report its value. This can affect the capital gains taxes that you owe when cashing in on investments.

Consult a financial advisor or accountant to determine your options.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)