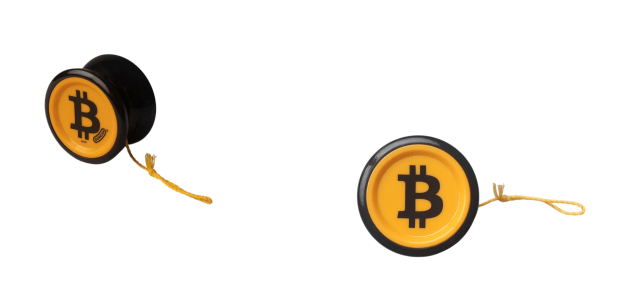

Collect & HODL Co, a subsidiary of ProSnacktive Sales LLC, has partnered with renowned toy company Duncan Toys to unveil a Limited Edition, first-ever Bitcoin-themed Duncan Butterfly XT Yo-yo. This exciting collaboration aims to capture the essence of Bitcoin's market fluctuations and offer a playful representation of the Bitcoin journey. The Bitcoin-themed yo-yos are exclusively available for purchase on Walmart Marketplace.

A Playful Twist on Bitcoin

The launch of the Bitcoin-themed Duncan Butterfly XT Yo-yo marks another innovative addition to Collect & HODL Co's collection of Bitcoin-inspired merchandise. This yo-yo symbolizes the ups and downs of the market, mirroring Bitcoin's price fluctuations. It serves as a reminder of the dynamic nature of the cryptocurrency market and the potential for both excitement and volatility.

By partnering with Duncan Toys, a company with over 90 years of history, Collect & HODL Co brings together the timeless charm of yo-yos with the modern world of Bitcoin. This collaboration aims to appeal to Bitcoin enthusiasts of all ages, combining the nostalgia of classic toys with the thrill of digital currency.

A Growing Portfolio of Bitcoin Collectibles

Collect & HODL Co has been at the forefront of creating unique Bitcoin-themed collectibles. In March 2023, the company introduced the world's first Bitcoin-themed PEZ dispenser, offering a limited edition of 30,000 units. This collaboration between Bitcoin and the iconic candy dispenser captured the attention of both cryptocurrency enthusiasts and collectors.

Building on the success of the PEZ dispenser, Collect & HODL Co expanded its portfolio with the launch of the first-ever Bitcoin-themed Crocs in November of the same year. This collaboration brought together the comfort and style of Crocs with the excitement of Bitcoin, creating a must-have item for both Bitcoin investors and fashion-forward individuals.

Embracing the Bullish Outlook on Bitcoin

Chris Coradini, the Owner of Collect & HODL Co, expresses his enthusiasm for the Bitcoin market and the demand for Bitcoin-themed merchandise. He states, "We're back with a new Bitcoin item that all ages can enjoy! We've worked with another iconic, 90+ year old company, Duncan Toys, to bring this to all Bitcoin (and yo-yo) enthusiasts. We continue to feel overly bullish on the market and demand for Bitcoin. That's why we're laser focused on blending Bitcoin with meaningful brands that all Bitcoin investors will appreciate!"

Collect & HODL Co's dedication to blending Bitcoin with established brands showcases their commitment to creating unique and meaningful products for Bitcoin enthusiasts. By leveraging the popularity of Bitcoin and partnering with reputable companies like Duncan Toys, Collect & HODL Co aims to provide a valuable and enjoyable experience for Bitcoin investors and collectors alike.

Don't miss your chance to own a piece of Bitcoin history with the Limited Edition Bitcoin-themed Duncan Butterfly XT Yo-yo, exclusively available on Walmart Marketplace. Get ready to embrace the excitement and unpredictability of Bitcoin's journey with this one-of-a-kind collectible.

Frequently Asked Questions

What is a Precious Metal IRA, and how can you get one?

Precious metals make a great investment in retirement accounts. They are a timeless investment that has held its value since the beginning of time. Investing in precious metals such as gold, silver, and platinum is also a great way to diversify your portfolio and protect against inflation.

Certain countries even allow their citizens to save money in foreign currencies. You can buy gold bars in Canada, and then keep them at the home. Then, when you travel to Canada, you can make the same gold bars and sell them for Canadian Dollars.

This is a quick and easy way of investing in precious metals. It's particularly helpful for people who don't reside in North America.

How do I Withdraw from an IRA of Precious Metals?

If you have a precious metal IRA account such as Goldco International Inc., it may be worth considering withdrawing your funds. When you sell your metals, the value of those funds will be higher than if it was kept in the account.

This article will help you understand how to withdraw funds from an IRA that holds precious metals.

First, verify that your precious metal IRA allows withdrawals. Some companies permit this, while some don't.

Second, find out if you are eligible for tax-deferred gains from selling your metals. This benefit is available from most IRA providers. However, some don't.

To find out if fees apply, thirdly check with your precious-metal IRA provider. The withdrawal may cost extra.

Fourth, ensure that you keep track your precious metal IRA investment for at least 3 years after selling them. For capital gains to be calculated, wait until January 1, each year. Follow the instructions on Form 8949 to calculate the gain.

In addition to filing Form 8949, you must also report the sale of your precious metals to the IRS. This will ensure you pay taxes on all the profits that your sales generate.

Finally, consult a trusted accountant or attorney before selling your precious metals. They can assist you in following the correct procedures and avoiding costly mistakes.

How to Open a Precious Metal IRA

An IRA to hold precious metals can be opened by opening a Roth Individual Retirement Account (IRA) that is self-directed.

This type account is better than others because you don’t have any tax on the interest that you earn from investments until you remove them.

This makes it attractive to those who want a tax break but still want to save some money.

You don't have to invest in silver or gold. You can put your money in almost any item that meets the IRS guidelines.

Although most people think of gold and silver when they hear the term “precious metal,” there are many kinds of precious metals.

Examples include platinum, palladium and rhodium.

There are several ways you can invest in precious metals. There are two main options: buying bullion bars and coins, and purchasing shares in mining companies.

Bullion Coins & Bars

Buying bullion coins and bars is one of the easiest ways to invest in precious metals. Bullion refers to physical ounces (or grams) of gold and/or silver.

Bullion bars and bullion coins are actual pieces of the metal.

Although you may not be able to see any change immediately after purchasing bullion bars and coins at a shop, you will soon notice some positive effects.

You will receive a tangible piece if history, for example. Each coin or bar has its own story.

It is often worth less than its nominal price if you examine the face value. When it was first introduced in 1986, the American Eagle Silver Coin cost only $1.00 per troy ounce. The price of an American Eagle is now closer to $40.00 a ounce.

Bullion has had a tremendous increase in its value since its introduction. This is why many investors choose bullion bars and bullion coin over futures.

Mining Companies

A great way to get precious metals is by investing in shares in mining companies. You are investing in the ability of mining companies to produce gold or silver.

You will then be entitled to dividends which are based upon the company’s profit. These dividends can then be used to pay out shareholders.

The company's growth potential will also be of benefit to you. As demand for the product increases, so should the share prices of your company.

Because these stocks fluctuate in price, it's important to diversify your portfolio. This allows you to spread your risk among multiple companies.

But, remember that mining companies, like all stock market investments, are susceptible to financial loss.

Your share of ownership may be worthless if gold prices fall significantly.

The Bottom Line

Precious metals such silver and gold provide an economic refuge from uncertainty.

However, both gold and silver are subject to wild swings in price. If you're looking to make a long-term, profitable investment in precious metallics, then consider opening a precious precious metals IRA Account with a reputable business.

By doing this, you can reap the tax benefits and still have physical assets.

Should You Open a Precious Metal IRA?

This will depend on whether or not you have an investment objective and what level of risk you are willing to accept.

Register now if you want to save money for retirement.

Because precious metals are highly likely to appreciate over time, They can also be used to diversify.

Additionally, silver and gold prices tend to move in tandem. This makes them an excellent choice for investors in both assets.

If you're not planning on using your money for retirement or don't want to take any risks, you probably shouldn't invest in precious metal IRAs.

How does gold and silver IRA work?

A gold and silver IRA allows you to invest in precious metals, such as gold and silver, without paying taxes on any gains. They make a great investment choice for those looking to diversify.

If you're over 59 1/2, you don't have to pay income taxes on interest earned through these accounts. Any appreciation in the account's worth does not attract capital gains tax. There are limits on the amount of money that you can place into this account. The minimum amount you can put into this account is $10,000. If you are less than 59 1/2, you cannot invest. Maximum annual contribution is $5,000.

Your beneficiaries could receive less if you die before your retirement. Your estate must include enough assets to cover the balance remaining in your account after all other expenses and debts have been paid.

Some banks offer gold and silver IRA options, while others require you to open a regular brokerage account through which you buy shares or certificates.

How much money can a gold IRA earn?

Yes, but not as often as you think. It all depends on your willingness to take on risk. A $10,000 investment per year for 20 years could lead to $1 million by retirement age. However, if all your eggs are in one basket, then you will lose everything.

Diversifying investments is crucial. Gold does well when there is inflation. You want to make investments in an asset class that rises with inflation. Stocks perform this well because they rise whenever companies increase their profits. Bonds are also able to do this. They pay interest every year. They're great for economic growth.

But what happens if inflation is not present? When there is no inflation, stocks and bonds will lose even more value. This is why investors should avoid putting all their savings into one investment, such as a bond or stock mutual fund.

Instead, they should diversify their investments by investing in different types of funds. They could, for example, invest in stocks and bonds. They could invest in both cash as well as bonds.

They are exposed to both sides of a coin. Both deflation and inflation. And they will still see a return over time.

Which is more powerful: sterling silver or 14k gold?

Although gold and silver can be strong metals, sterling silver is far less expensive as it contains 92% silver instead of 24%.

Sterling silver is also called fine silver. It is made from a combination silver and other metals, such as zinc and copper.

Gold is usually considered to be extremely strong. It takes a lot of pressure to break it down. If you dropped an object on top to a gold piece, it would shatter into thousands rather than breaking into two halves.

However, silver doesn't have the same strength as gold. If you dropped an item onto a sheet of silver, it would probably bend and fold without shattering.

Silver is usually used in jewelry and coins. The price of silver can fluctuate according to supply and demande.

Statistics

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

External Links

forbes.com

kitco.com

takemetothesite.com

wsj.com

How To

How to start buying silver with your IRA

How to start buying Silver with Your IRA – The best method to invest directly in silver or gold is through the direct ownership of physical bullion. Silver coins and bars are the most popular form of investment because they offer diversification, liquidity, and convenience.However, many prefer owning physical bullion over paper certificates or electronic currency.

There are several options for buying precious metals, such as silver and gold. They can be purchased directly from the producers (mining companies or refiners). You can also purchase them through a dealer, who buys and sellers bullion products, if you don’t want to deal directly with the producer.

This article will explain how to invest in silver with an IRA.

- Investing In Gold & Silver Directly – This is the best option to buy precious metals. This is the best way to get bullion right from the source and have it delivered straight to your house. Some investors keep their bullion at home, while others store it in a secure storage unit. Protect your precious metal by storing it correctly. Many storage facilities offer insurance against fire, theft and damage. But even with insurance, you risk losing your investments due to natural disasters or human error. The safe storage of precious metals at a bank or credit card union is always recommended.

- Buying Precious Metals Online – If you'd rather avoid carrying around heavy boxes of precious metal, then one alternative is to buy bullion online. Bullion dealers offer bullion in a variety of forms, including bars and coins. There are many different types of coins. Coins are generally lighter than bars and easier to transport. Bars come with a range of weights and sizes. Some bars can weigh hundreds of grams, while others are only a few ounces. A good rule of thumb when selecting which type of bar you should get is to look at what you plan to use it for. If you plan on giving it as gifts, you might choose something smaller. However, if it's something you intend to use as a gift, it might be a smaller model. If you wish to add it to a collection and proudly display it, it may be worth spending fewer dollars.

- Buying Precious metal from Dealers-A third option is buying bullion through a dealer. Dealers usually specialize in one market area, such as silver or gold. Some dealers specialize in certain types of bullion, such as rounds or minted coins. Others may specialize in specific areas. Others specialize in bulk sales. You'll find them all to be competitive in price and offer convenient payment methods.

- Buy Precious Metallics from Retirement Accounts. While technically not an “investment”, it's possible to invest in retirement accounts to gain exposure. Investments in precious metals must be made through a qualified retirement plan to receive tax benefits as per Section 219 of IRS Code. These accounts can be IRAs, 401 (k)s or 403 (3(b) plans). These accounts are designed to help you save for retirement and often provide higher returns than other investment vehicles. Most accounts allow you the ability to diversify between different metals. What is the drawback? The drawback? These accounts can only, however, be accessed by those who work for an employer that sponsors them.

—————————————————————————————————————————————————————————————-

By: Nik Hoffman

Title: Introducing the First-Ever Bitcoin Duncan Yo-Yo

Sourced From: bitcoinmagazine.com/business/first-ever-bitcoin-duncan-yo-yo-launches

Published Date: Wed, 03 Jan 2024 22:00:47 GMT