Introduction

In this article, we will explore the concept of cooperation in economic theory and its relevance to Bitcoin. We will discuss the work of renowned mathematician John F. Nash Jr. and his contributions to game theory, particularly the Nash Bargaining solution. Furthermore, we will examine the axioms present in Bitcoin that align with Nash's ideas of cooperation and how they benefit the cryptocurrency system.

The Bargaining Problem by John F. Nash Jr.

In 1950, John F. Nash Jr. published a paper titled "The Bargaining Problem," which is considered a significant contribution to social sciences as it introduced an axiomatic approach. Nash presented the problem as a nonzero-sum, two-person game and proposed a solution to determine how to split a given amount of money fairly between the participants. This solution was based on a set of axioms that defined a unique outcome.

Nash Equilibrium versus Nash Bargaining

In his subsequent paper "Non-Cooperative Games," Nash introduced the concept of Nash equilibria, which became widely recognized and earned him a Nobel prize. Nash equilibria are based on the absence of coalitions, assuming that each participant acts independently. On the other hand, Nash Bargaining focuses on reaching a fair agreement through cooperation, making it a cooperative game theory. Nash extended his axiomatic treatment of the Bargaining Problem in "Two-Person Cooperative Games," where he introduced a threat approach and the enforcement of contracts.

Ideal Money and Asymptotically Ideal Money

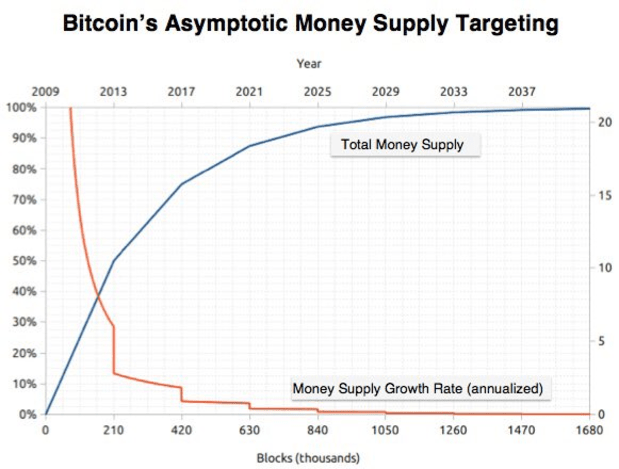

John Nash's later work revolved around the concept of Ideal Money, which he defined as money free from inflationary decadence. Nash criticized Keynesianism, suggesting it promoted continuous inflation and currency devaluation. He argued for stable value as an essential characteristic of money issued by central authorities. Nash proposed a missing axiom that emphasized the need for long-term value stability.

Bitcoin as an Axiomatic Design

Given Nash's belief that economics lacks immediate morals and that values can be introduced to determine fair outcomes, we can examine whether Bitcoin aligns with Nash's axioms. Both Nash and Bitcoin's anonymous creator Satoshi Nakamoto criticized the arbitrary nature of centrally managed currencies. We can identify several characteristics in Bitcoin that align with Nash's axioms:

Pareto Efficiency

Bitcoin's cumulative supply density and distribution follow the Pareto 80/20 power law, demonstrating the presence of Pareto efficiency, a key Nash bargaining axiom.

Scale Invariance

Bitcoin's difficulty adjustment mechanism ensures a steady and constant supply, regardless of its popularity or mining difficulty. This scale invariance allows participants to form realistic expectations about Bitcoin's value and ensures that underlying preferences remain unchanged.

Symmetry

Bitcoin's pseudonymity and decentralization provide equality of bargaining skill, as participants do not need to prove their identity to participate in the network. This symmetry aligns with Nash's axiom, which states that players should receive the same amount if they have the same utility function.

Independence of Irrelevant Alternatives (IIA)

In Bitcoin's proof-of-work system, the presence of a third party (the software) does not alter the outcome of the game. This aligns with Nash's axiom of independence of irrelevant alternatives, where the addition of a non-winning candidate should not affect the outcome of an election between two players.

Characteristics and Benefits of Cooperation

Cooperative games require reduced participants, enforceable contracts, and communication and collaboration based on trusted information. The benefits of cooperation in the context of Bitcoin include reduced mediation or dispute resolution, less border friction in trading, a nonzero-sum outcome, intuitive decision-making, and the possibility of coalition formation.

Conclusion

Bitcoin can be seen as a cooperative game within a non-cooperative setting, aligning with Nash's ideas of cooperation and fairness. The

Frequently Asked Questions

What are the pros & con's of a golden IRA?

An Individual Retirement Account (IRA), unlike regular savings accounts, doesn't require you to pay tax on interest earned. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. However, there are disadvantages to this type investment.

For example, if you withdraw too much from your IRA once, you could lose all your accumulated funds. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. If you do decide to withdraw funds from your IRA, you'll likely need to pay a penalty fee.

The downside is that managing your IRA requires fees. Most banks charge 0.5% to 2.0% per annum. Other providers charge monthly management fees ranging from $10 to $50.

Insurance is necessary if you wish to keep your money safe from the banks. A majority of insurance companies require that you possess a minimum amount gold to be eligible for a claim. You might be required to buy insurance that covers losses up to $500,000.

You will need to decide how much gold you wish to use if you opt for a gold IRA. Some providers limit the amount of gold that you are allowed to own. Others allow you to pick your weight.

You will also have to decide whether to purchase futures or physical gold. Futures contracts for gold are less expensive than physical gold. Futures contracts offer flexibility for buying gold. You can set up futures contracts with a fixed expiration date.

You'll also need to decide what kind of insurance coverage you want. Standard policies don't cover theft protection, loss due to fire, flood or earthquake. However, it does cover damage caused by natural disasters. You might consider purchasing additional coverage if your area is at high risk.

In addition to insurance, you'll need to consider the cost of storing your gold. Storage costs will not be covered by insurance. Additionally, safekeeping is usually charged by banks at around $25-$40 per monthly.

If you decide to open a gold IRA, you must first contact a qualified custodian. A custodian keeps track of your investments and ensures that you comply with federal regulations. Custodians are not allowed to sell your assets. Instead, they must retain them for as long and as you require.

Once you've chosen the best type of IRA for you, you need to fill in paperwork describing your goals. You must include information about what investments you would like to make (e.g. stocks, bonds and mutual funds). The plan should also include information about how much you are willing to invest each month.

After filling out the forms, you'll need to send them to your chosen provider along with a check for a small deposit. The company will then review your application and mail you a letter of confirmation.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. Financial planners are experts in investing and will help you decide which type of IRA works best for your situation. They can help you find cheaper insurance options to lower your costs.

Should you Invest In Gold For Retirement?

This will depend on how much money and whether you were able to invest in gold at the time that you started saving. If you are unsure of which option to invest in, consider both.

Gold offers potential returns and is therefore a safe investment. Retirement investors will find gold a worthy investment.

Most investments have fixed returns, but gold's volatility is what makes it unique. As a result, its value changes over time.

However, this does not mean that gold should be avoided. It is important to consider the fluctuations when planning your portfolio.

Another benefit to gold is its tangible value. Gold is more convenient than bonds or stocks because it can be stored easily. It can also be transported.

You can always access your gold if it is stored in a secure place. There are no storage charges for holding physical gold.

Investing in gold can help protect against inflation. It's a great way to hedge against rising prices, as gold prices tend to increase along with other commodities.

It's also a good idea to have a portion your savings invested in something which isn't losing value. Gold tends to rise when the stock markets fall.

Another benefit to investing in gold? You can always sell it. As with stocks, your position can be liquidated whenever you require cash. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Don't purchase too much at once. Start with just a few drops. Next, add more as required.

It's not about getting rich fast. It's not to get rich quickly, but to accumulate enough wealth to no longer need Social Security benefits.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

How does a gold IRA account work?

Individuals who want to invest with precious metals may use the Gold Ira accounts, which are tax-free.

You can buy physical gold bullion coins at any time. You don't have to wait until retirement to start investing in gold.

You can keep gold in an IRA forever. Your gold holdings will not be subject to tax when you are gone.

Your gold is passed to your heirs without capital gains tax. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

To open a IRA for gold, you must first create an individual retirement plan (IRA). After you do this, you will be granted an IRA custodian. This company acts as a mediator between you, the IRS.

Your gold IRA custodian can handle all paperwork and submit necessary forms to IRS. This includes filing annual reports.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. The minimum deposit required for gold bullion coins purchase is $1,000 A higher interest rate will be offered if you invest more.

You will pay taxes when you withdraw your gold from your IRA. You'll have to pay income taxes and a 10% penalty if you withdraw the entire amount.

A small percentage may mean that you don't have to pay taxes. However, there are some exceptions. There are some exceptions. For instance, if you take out 30% or more from your total IRA assets, federal income taxes will apply plus a 20 percent penalty.

Avoid taking out more that 50% of your total IRA assets each year. You could end up with severe financial consequences.

What is the value of a gold IRA

Many benefits come with a gold IRA. It's an investment vehicle that allows you to diversify your portfolio. You decide how much money you want to put into each account, and when you want it to be withdrawn.

Another option is to rollover funds from another retirement account into a IRA with gold. This allows you to easily transition if your retirement is early.

The best thing is that investing in gold IRAs doesn't require any special skills. They are offered by most banks and brokerage companies. You don't have to worry about penalties or fees when withdrawing money.

There are also drawbacks. Gold has always been volatile. Understanding why you want to invest in gold is essential. Are you looking for growth or safety? Is it for security or long-term planning? Only then will you be able make informed decisions.

You might want to buy more gold if you intend to keep your gold IRA for a long time. A single ounce isn't enough to cover all of your needs. Depending on your plans for using your gold, you may need multiple ounces.

You don’t necessarily need a lot if you’re looking to sell your gold. You can even live with just one ounce. But you won't be able to buy anything else with those funds.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- You want to keep gold in your IRA at home? It's not legal – WSJ

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor