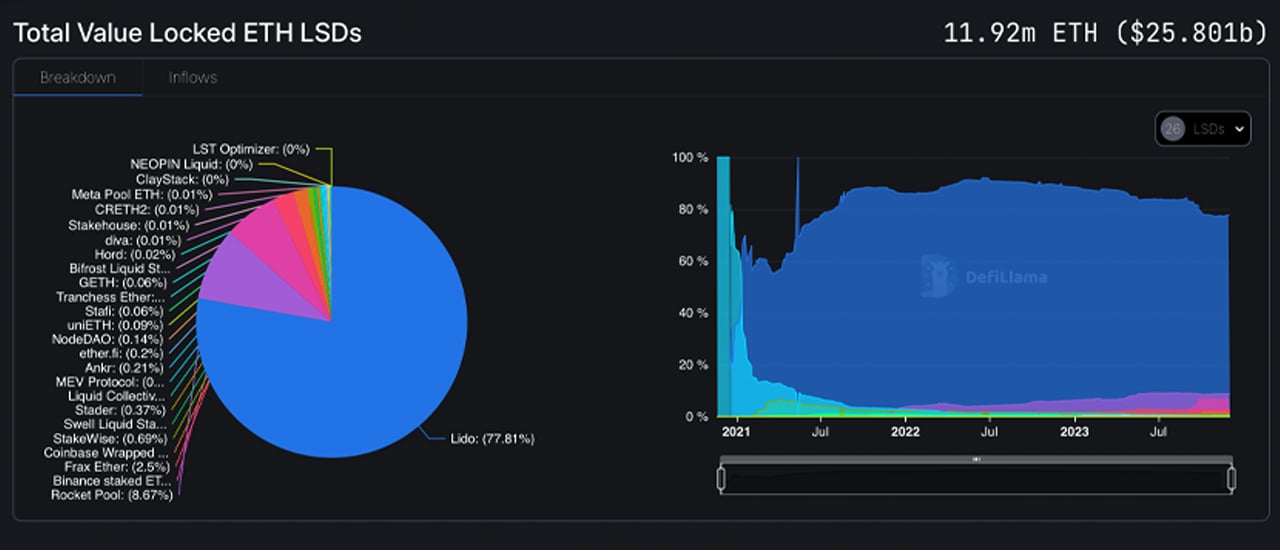

Lido, the leading liquid staking protocol (LSP), has achieved a significant milestone by holding over 9 million ethereum within its system. This represents an impressive 77.81% of the total ethereum value locked in current LSPs, highlighting Lido's dominant position in the market.

Lido and Rocket Pool: Reaching New Heights with 9 Million and 1 Million Ether Milestones

The liquid staking industry, now valued in the billions, is led by Lido, the top liquid staking protocol in today's decentralized finance (defi) landscape. Liquid staking involves staking tokens while keeping the assets "liquid" or "unlocked," enabling various applications. This method allows stakers to earn rewards while maintaining access to their funds.

Lido has been at the forefront of this market for an extended period and, on November 21, 2023, achieved a significant milestone by surpassing 9 million in ether deposits. As of December 3, 2023, Lido holds a substantial 9.28 million ethereum (ETH) in deposits. Over the past 36 days, starting from October 27, 2023, the platform experienced an influx of 490,000 ether.

Lido's Dominance in the Market

Lido accounts for a commanding 77.81% of the market share among the 25 liquid staking protocols (LSPs). The second-largest player, Rocket Pool, recorded a deposit of 49,214 ether in the same 36-day period.

Rocket Pool's Achievement

Rocket Pool recently celebrated a significant milestone by surpassing the 1 million ETH mark in total value locked (TVL). While Lido and Rocket Pool observed deposits of 490,000 and over 49,000 ether respectively, Binance's LSP experienced a more modest increase of 3,459 ETH since October 27.

The Rise of Lido's STETH and Rocket Pool's RETH Tokens

In the realm of staking token derivatives, Lido's STETH ranks among the top ten crypto assets on platforms like coingecko.com. However, it is not listed in the top ten on coinmarketcap.com. If STETH were recognized among the top ten crypto assets today, its market capitalization would rank it as the eighth largest.

On the other hand, Rocket Pool's RETH token currently holds the 52nd position among over 10,000 listed crypto assets. Additionally, LSPs account for more than 52% of the TVL in defi today, according to defillama.com. The milestones achieved by Lido and Rocket Pool highlight their combined control over 10 million locked ether, with a total worth of $22.28 billion.

What are your thoughts on Lido crossing the 9 million mark and Rocket Pool surpassing 1 million ether? Share your opinions in the comments section below.

Frequently Asked Questions

What are the pros and disadvantages of a gold IRA

For those who don't have the ability to access traditional banking services but want to diversify their portfolios, a gold IRA can be a great investment option. It allows investors to invest in precious materials such as gold and silver without paying tax on gains until they are withdrawn.

However, if you withdraw money before the due date, you will be subject to ordinary income tax. However, creditors will not be able to seize these funds if you default on your loan.

A gold IRA could be the best option for you if your goal is to have gold that you can own without worrying about taxes.

Which type of IRA could be used for precious metals

Employers and financial institutions often offer Individual Retirement Accounts (IRA) as an investment vehicle. An IRA allows you to contribute money that is tax-deferred until it is withdrawn.

An IRA lets you save taxes and pay them off later. This means you can save money and pay taxes later on the money that you have deposited to your retirement account.

An IRA has the advantage of allowing contributions and earnings to grow tax-free until you withdraw your funds. Early withdrawals are subject to penalties.

After age 50, you can make additional contributions to an IRA without penalty. You'll owe income tax and a 10% federal penalty if you withdraw from your IRA in retirement.

Withdrawals before age 59 1/2 will be subject to a 5% IRS penal. Withdrawals between ages 59 1/2 and 70 1/2 are subject to a 3.4% IRS penalty.

An IRS penalty of 6.2% applies to withdrawals above $10,000 per year.

What is a Precious Metal IRA and How Can You Benefit From It?

Precious Metals are a great way to invest in retirement funds. They have held their value since biblical times. It is a great way of diversifying your portfolio and protecting against inflation by investing in precious metals like gold, silver, or platinum.

Certain countries permit citizens to hold their money in foreign currencies. You can buy gold bars in Canada, and then keep them at the home. You can then sell the same gold bars to Canadian dollars when you return home to visit your family.

This is a great way to invest in precious metals. It is particularly useful for those who live outside North America.

Is it possible to make money with a gold IRA.

To make money from an investment you must first understand how it works and secondly what products are available.

Trading is not a good idea if you don’t know what you need.

A broker should offer the best service for each account type.

There are many account options available, including Roth IRAs (standard IRAs) and Roth IRAs (Roth IRAs).

If you have other investments such as bonds or stocks, you might also consider a rollover.

How Do You Make a Withdrawal from a Precious Metal IRA?

If you have an account with a precious-metal IRA company like Goldco International Inc, you might consider withdrawing your funds. This will ensure that your metals are worth more than if they were in an account with a precious metal IRA company like Goldco International Inc.

Here are the steps to help you withdraw money from your precious-metal IRA.

First, verify that your precious metal IRA allows withdrawals. Some companies permit this, while some don't.

Second, find out if you are eligible for tax-deferred gains from selling your metals. Most IRA providers offer this benefit. Some do not, however.

Third, make sure to check with your precious metal IRA provider if there are any fees associated with these steps. Extra fees may apply for withdrawals.

Fourth, make sure you keep track for at least three consecutive years of the precious metal IRA investments after you have sold them. In other words, wait until January 1st each year to calculate capital gains on your investment portfolio. Fill out Form 8949 and follow the instructions to calculate how much gain you've realized.

You must file Form 8949 and also report any sale of precious metals to IRS. This will ensure you pay taxes on all the profits that your sales generate.

Before selling precious metals, it is a good idea to consult an attorney or trusted accountant. They can help ensure you follow all necessary procedures and avoid costly mistakes.

Can I get physical ownership of gold in my IRA

Many people are curious if they can possess physical gold in an IRA. This is a valid question as there is no legal route to it.

However, if you examine the law carefully, you will see that there are no restrictions on gold ownership in an IRA.

The problem is that most people aren't aware of how much money they could be saving by putting their precious gold in an IRA.

It's easy for gold coins to be thrown away, but it's much more difficult to keep them in an IRA. You'll have to pay twice taxes if you keep your gold in your home. Once for the IRS and once for the state where you live.

You can also lose your gold and have to pay twice the taxes. Why would you want to keep your gold in your house?

Some might argue that gold should be safe at home. However, to guard yourself against theft, it is worth considering storing your gold in a more secure location.

If you're planning on visiting frequently, it is best to keep your gold safe at home. Theft can easily take your gold when you're not home.

A better option is to store your gold in an insured vault. Then, your gold will be protected from fire, flood, earthquake, and robbery.

You won't be responsible for paying any property tax if you store your gold in a vault. You will have to pay income taxes on any gains from the sale of your gold.

An IRA is a way to avoid paying taxes on gold. With an IRA, you won't have to pay income tax even though you earn interest on your gold.

You don't have to pay capital gains taxes on gold. This means that you can cash out the entire value of your investment at any time you like.

Because IRAs have federal regulation, it won't be difficult to transfer your gold to another bank if there is a move.

The bottom line is that you can own gold in your IRA. Only thing stopping you from owning gold in an IRA is your fear of getting it stolen.

Are silver and gold IRAs a good idea for you?

If you are looking for an easy way to invest in both gold and silver at once, then this could be an excellent option for you. But there are other options. We are happy to answer any questions you may have about these types of investments. We're always happy to help!

Statistics

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

External Links

investopedia.com

wsj.com

takemetothesite.com

kitco.com

How To

How to Determine if a Gold IRA is Right for You

Individual Retirement Account (IRA) is the most popular type. Individual Retirement Accounts (IRAs) are available through financial planners, banks, mutual funds and employers. The IRS allows individuals to contribute up to $5,000 annually without tax consequences. This amount can be deposited into any IRA, regardless your age. You can only put a certain amount into an IRA, but there are restrictions. For example, a Roth IRA contribution is not allowed if you are less than 59 1/2. If you're under 50, you must wait until you reach age 70 1/2 before making contributions. Individuals who work for their employer could be eligible for matching employer contributions.

There are two types of IRAs available: Roth and traditional. Traditional IRAs allow you to invest in stocks, bonds and other investments. A Roth IRA allows you to only invest in after-tax dollars. Roth IRA contributions are not subject to tax when they are made, but Roth IRA withdrawals are. A combination of both accounts may be preferred by some people. There are pros and cons to each type of IRA. What should you look at before deciding which type is best for you? Here are three things to keep in mind:

Traditional IRA pros:

- Contribution options vary by company

- Employer match possible

- Save more than $5,000 per Person

- Tax-deferred tax growth until withdrawal

- Limitations may apply based on income levels

- Maximum contribution limit: $5,500 per annum (or $6,500 for married filing jointly).

- The minimum investment required is $1,000

- After age 70 1/2 you are required to begin mandatory distributions

- For an IRA to be opened, you must have at least five-years-old

- Transfer assets between IRAs cannot be done

Roth IRA Pros:

- Contributions do not attract taxes

- Earnings increase tax-free

- No minimum distributions

- There are only a few investment options available: stocks, bonds and mutual funds.

- There is no maximum contribution limit

- There are no limitations on the ability to transfer assets between IRAs

- An IRA can only be opened by those 55 and older

You should be aware that not every company offers the same IRAs. For example, you might be able to choose between a Roth IRA (or a traditional one) from some companies. Others will give you the option to combine them. Noting that different types IRAs have different requirements, it's worth noting. Roth IRAs don't have a minimum capital requirement. Traditional IRAs only require a $1,000 minimum investment.

The Bottom Line

When choosing an IRA, the critical factor is whether you want to pay taxes now or later. If you are retiring within ten year, a traditional IRA could be the right option. A Roth IRA may be a better choice for you. In either case, it's a smart idea to speak with a professional about your retirement plans. Someone who understands the market will be able to recommend the best options.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Lido Achieves 9 Million Ethereum Milestone as Rocket Pool Surpasses 1 Million in Defi's Booming Staking Sector

Sourced From: news.bitcoin.com/lido-achieves-9-million-ethereum-milestone-as-rocket-pool-surpasses-1-million-in-defis-booming-staking-sector/

Published Date: Sun, 03 Dec 2023 20:30:57 +0000