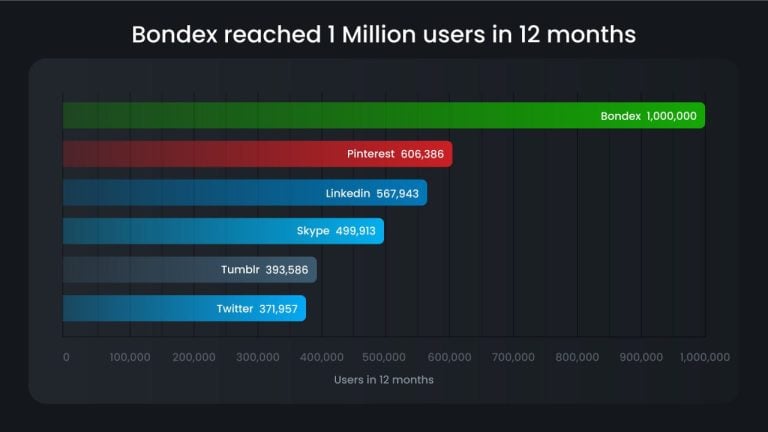

The Launch of Bondex's Innovative Job Portal

London, United Kingdom, 29th November, 2023 – Bondex, the groundbreaking decentralized professional talent network, is excited to announce the introduction of its innovative Job Portal, marking a paradigm shift in the recruitment landscape. In collaboration with industry leaders such as Coinlist and Chainlink, Bondex aims to become the leading talent platform in the Web 3 era.

A New Era of Recruitment

Bondex introduces a revolutionary referral reward system that democratizes the hiring process and creates a symbiotic ecosystem where talent, employers, and recruiters converge for mutual benefit and potential financial gains. This system offers users a unique opportunity to generate passive income. As part of the ongoing campaign with Coinlist over the next three months, users have the potential to enhance their airdrop eligibility, increasing their chances of receiving greater financial rewards.

The Power of Bondex

The Bondex platform and app, available on Google Play and the App Store, have gained immense popularity with over three million downloads, four million registered users, and a thriving community of monthly active users. Bondex is a gamified decentralized token-based professional talent network that incentivizes user participation for career advancement, talent referrals, networking, and skill development. By sharing the resulting economic value with its participants, Bondex creates a decentralized professional network where user participation is determined by reputation.

Redefining Recruitment with the Job Portal

Bondex's Job Portal revolutionizes traditional recruitment by offering users incentives to become recruiters themselves. By leveraging their professional networks, users can benefit from hiring companies' bounties. This crowdsourced approach ensures the best possible matches between employers and candidates, setting Bondex apart from outdated Web 2 leaders.

About Bondex

Bondex is a decentralized professional talent network and job portal that empowers users to become recruiters, connecting talent with employers through a unique referral rewards system. With a gamified approach and a user base of over three million downloads and four million registered users, Bondex disrupts traditional recruitment models, fostering a symbiotic ecosystem for mutual benefit.

For media inquiries, please contact:

Dina Mattar, CEO of DVerse

dina@dverse.xyz

This is a press release. Readers should conduct their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned in the press release.

Frequently Asked Questions

How much should you have of gold in your portfolio

The amount of money you need to make depends on how much capital you are looking for. A small investment of $5k-10k would be a great option if you are looking to start small. As you grow, you can move into an office and rent out desks. This way, you don't have to worry about paying rent all at once. Only one month's rent is required.

You also need to consider what type of business you will run. My website design company charges clients $1000-2000 per month depending on the order. This is why you should consider what you expect from each client if you're doing this kind of thing.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. This means that you may only be paid once every six months.

Decide what kind of income do you want before you calculate how much gold is needed.

I suggest starting with $1k-2k gold and building from there.

How much should precious metals make up your portfolio?

To answer this question we need to first define precious metals. Precious metals are those elements that have an extremely high value relative to other commodities. This makes them valuable in investment and trading. Gold is today the most popular precious metal.

There are also many other precious metals such as platinum and silver. The price of gold tends to fluctuate but generally stays at a reasonably stable level during periods of economic turmoil. It is also relatively unaffected both by inflation and deflation.

In general, all precious metals have a tendency to go up with the market. That said, they do not always move in lockstep with each other. For instance, gold's price will rise when the economy is weak, while precious metals prices will fall. Investors are more likely to expect lower interest rates making bonds less attractive investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors are more inclined to invest in safe assets, such as Treasury Bonds, and they will not demand precious metals. These precious metals are rare and become more costly.

You must therefore diversify your investments in precious metals to reap the maximum profits. Furthermore, because the price of precious Metals fluctuates, it is best not to focus on just one type of precious Metals.

Who owns the gold in a Gold IRA?

The IRS considers anyone who owns gold to be “a form money” and therefore subject to taxation.

This tax-free status is only available to those who have owned at least $10,000 of gold and have kept it for at minimum five years.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you plan on selling the gold someday, you'll need to report its value, which could affect how much capital gains taxes you owe when you cash in your investments.

You should consult a financial planner or accountant to see what options are available to you.

What are the benefits to having a gold IRA

The best way to invest money for retirement is by putting it into an Individual Retirement Account (IRA). It is tax-deferred until it's withdrawn. You are in complete control of how much you take out each fiscal year. There are many types of IRAs. Some are better suited for people who want to save for college expenses. Others are designed for investors looking for higher returns. Roth IRAs permit individuals to contribute after the age 59 1/2. Any earnings earned at retirement are subject to tax. But once they start withdrawing funds, those earnings aren't taxed again. This account may be worth considering if you are looking to retire earlier.

A gold IRA is similar to other IRAs because it allows you to invest money in various asset classes. Unlike a regular IRA, you don't have to worry about paying taxes on your gains while you wait to access them. People who want to invest their money rather than spend it make gold IRA accounts a great option.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. That means you won't have to think about making deposits every month. To avoid missing a payment, direct debits can be set up.

Finally, gold remains one of the best investment options today. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even in times of economic turmoil gold prices tend to remain stable. It is therefore a great choice for protecting your savings against inflation.

What is the best way to hold physical gold?

Gold is money. Not just paper currency. People have used gold as a currency for thousands of centuries to preserve their wealth and keep it safe from inflation. Today, investors invest in gold as part a diversified portfolio. This is because gold tends do better in financial turmoil.

Many Americans now invest in precious metals. It is possible to make money by investing in gold. However, it doesn't guarantee that you'll make a lot of money.

One reason is that gold has historically performed better than other assets during periods of financial panic. Between August 2011 and early 2013 gold prices soared nearly 100 percent, while the S&P 500 plunged 21 percent. During these turbulent market times, gold was among few assets that outperformed the stocks.

Another benefit to investing in gold? It has virtually zero counterparty exposure. If your stock portfolio goes down, you still own your shares. If you have gold, it will still be worth your shares even if the company in which you invested defaults on its debt.

Finally, gold offers liquidity. This allows you to sell your gold whenever you want, unlike many other investments. You can buy gold in small amounts because it is so liquid. This allows one to take advantage short-term fluctuations within the gold price.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

bbb.org

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement accounts