Rise in Bitcoin Ownership among Americans

Unchained, a prominent Bitcoin financial services provider, has released a new report revealing a significant surge in bitcoin ownership among Americans. According to their findings, one in four Americans and 55% of surveyed investors between the ages of 18 and 78, who have at least one investment account, own bitcoin.

Potential Increase in Bitcoin Holdings

The study, which surveyed 402 US investors, discovered that 95% of current bitcoin owners are considering increasing their holdings in 2024. Interestingly, almost half of non-bitcoin owners expressed a strong inclination towards purchasing bitcoin within the upcoming year.

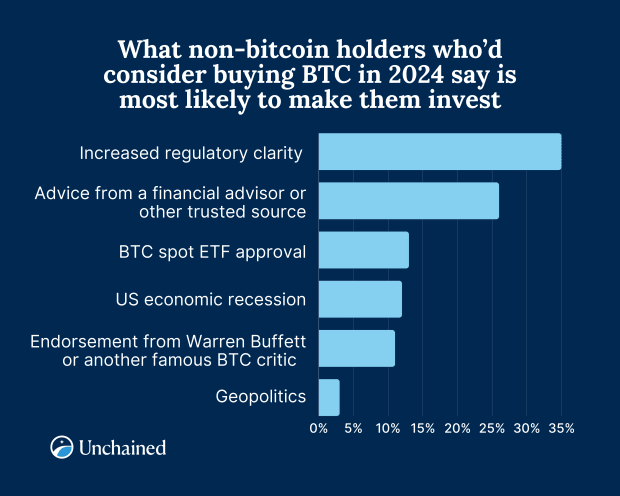

Key Drivers for Bitcoin Purchases in 2024

The survey identified several key factors influencing potential bitcoin purchases in 2024. Increased regulatory clarity around digital assets was cited by 42% of current bitcoin owners and 35% of non-owners. Additionally, the potential approval of a bitcoin spot Exchange-Traded Fund (ETF) by the Securities and Exchange Commission (SEC) and the anticipation of a US economic recession were also influential elements.

Optimistic Outlook on Bitcoin

Despite the price of bitcoin being down over 50% from its peak, 79% of investors believe that bitcoin will surpass its all-time high of $69,000. Furthermore, over half of the surveyed investors predict a new all-time high for bitcoin in 2024, with a third believing that it will outperform cash, gold, and the S&P 500.

Bitcoin Allocation in Retirement Portfolios

Unchained's survey also indicates a significant rise in bitcoin allocation within retirement portfolios. Nearly half of current bitcoin owners already have bitcoin in their retirement accounts, and an additional 35% are considering adding it in 2024. Among non-bitcoin owners open to investing in the asset, 23% expressed interest in including bitcoin in their retirement accounts.

Unchained's Commitment to Bitcoin Investors

Joe Kelly, co-founder and CEO of Unchained, stated that the company is witnessing an influx of bitcoin newcomers who now recognize the longevity of the asset. He emphasized that US investors are eager to gain or expand their bitcoin exposure, particularly through tax-advantaged vehicles like Unchained's bitcoin IRA. Unchained is committed to serving these investors through collaborative custody, the Unchained IRA, their trading desk, and inheritance solutions.

Valuable Insights for US Investors

With an estimated 158 million Americans owning investment accounts, Unchained's survey provides valuable insights into the sentiment and expectations of the US investor population. The survey was conducted digitally from October 26 to 28, 2023, during a period when the price of bitcoin ranged from $33,610 to $34,977. The survey represents the US investor population with a 5% margin of error at a 95% confidence level, making it a reliable source of information for investors.

Frequently Asked Questions

What are the pros & con's of a golden IRA?

An Individual Retirement Account (IRA), unlike regular savings accounts, doesn't require you to pay tax on interest earned. An IRA is a great option for those who want to save money, but don't want tax on any interest earned. This type of investment has its downsides.

If you withdraw too many funds from your IRA at once, you may lose all your accumulated assets. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. If you do withdraw funds from your IRA you will most likely be required to pay a penalty.

Another problem is the cost of managing your IRA. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management fees ranging from $10 to $50.

If you prefer your money to be kept out of a bank, then you will need insurance. Insurance companies will usually require that you have at least $500,000. You might be required to buy insurance that covers losses up to $500,000.

You will need to decide how much gold you wish to use if you opt for a gold IRA. Some providers limit the number of ounces of gold that you can own. Others let you pick your weight.

You will also have to decide whether to purchase futures or physical gold. Physical gold is more costly than gold futures. Futures contracts provide flexibility for purchasing gold. Futures contracts allow you to create a contract with a specified expiration date.

You also need to decide the type and level of insurance coverage you want. The standard policy does NOT include theft protection and loss due to fire or flood. The policy does not cover natural disasters. Additional coverage may be necessary if you reside in high-risk areas.

In addition to insurance, you'll need to consider the cost of storing your gold. Storage costs are not covered by insurance. Additionally, safekeeping is usually charged by banks at around $25-$40 per monthly.

If you decide to open a gold IRA, you must first contact a qualified custodian. A custodian is responsible for keeping track of your investments. They also ensure that you adhere to federal regulations. Custodians are not allowed to sell your assets. Instead, they must keep your assets for as long you request.

After you've determined which type of IRA is best for you, fill out the paperwork indicating your goals. The plan should contain information about the types of investments you wish to make such as stocks, bonds or mutual funds. The plan should also include information about how much you are willing to invest each month.

After completing the forms, send them along with a check or a small deposit to your chosen provider. After reviewing your application, the company will send you a confirmation mail.

You should consult a financial planner before opening a Gold IRA. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can help you find cheaper insurance options to lower your costs.

Can the government take your gold?

Your gold is yours and the government cannot take it. You earned it through hard work. It belongs exclusively to you. This rule could be broken by exceptions. You can lose your gold if you have been convicted for fraud against the federal governments. Additionally, your precious metals may be forfeited if you owe the IRS taxes. However, even though your taxes have not been paid, you can still keep your precious metals, even though they are considered the property of United States Government.

How much gold do you need in your portfolio?

The amount of capital that you require will determine how much money you can make. For a small start, $5k to $10k is a good range. You could then rent out desks and office space as your business grows. This will allow you to pay rent monthly, and not worry about it all at once. It's only one monthly payment.

You also need to consider what type of business you will run. My company is a website creator. We charge our clients about $1000-2000 per monthly depending on what they order. You should also consider the expected income from each client when you do this type of thing.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. You may get paid just once every 6 months.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I recommend starting with $1k-$2k in gold and working my way up.

How does gold perform as an investment?

Supply and demand determine the gold price. Interest rates also have an impact on the price of gold.

Due to limited supplies, gold prices are subject to volatility. Physical gold is not always in stock.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Want to Keep Gold in Your IRA at Home? It's not legal – WSJ

bbb.org

investopedia.com

irs.gov

How To

The best place online to buy silver and gold

Understanding how gold works is essential before you buy it. Gold is a precious metal similar to platinum. It's very rare, and it is often used as money for its durability and resistance. It is very difficult to use and most people prefer to purchase jewelry made of it over actual bars of Gold.

There are two types of gold coins available today – one type is legal tender, while the other is called bullion. The legal tender coins are issued for circulation in a country. They usually have denominations such as $1, $5, $10, and so on.

Bullion coin are not intended for investment. However, their value will increase with inflation.

They aren't circulated in any currency exchange systems. One example is that if someone buys $100 worth gold, they get 100 grams with a $100 value. The buyer receives 1 gram of gold for every dollar spent.

When you are looking to purchase gold, the next thing to know is where to get it. There are several options available if your goal is to purchase gold from a dealer. You can start by visiting your local coin shop. Another option is to go through a reputable site like eBay. You may also be interested in buying gold through private sellers online.

Individuals selling gold at wholesale prices and retail prices are known as private sellers. When selling gold through private sellers, you pay a commission fee of 10% to 15% per transaction. You would receive less money from a private buyer than you would from a coin store or eBay. However, this option is often a great choice when investing in gold since it gives you more control over the item's price.

An alternative option to buying gold is to buy physical gold. Although physical gold is easier to store than paper certificates you will still need to ensure it is safe. Physical gold should be stored in an impenetrable container, such a vault and safety deposit box to ensure its safety.

A bank or pawnshop can help you buy gold. A bank can provide you with a loan to cover the amount you wish to invest in gold. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks usually charge higher interest rates that pawn shops.

You can also ask for help to purchase gold. Selling gold is also easy. It is easy to sell gold by contacting a company like GoldMoney.com. You can create a simple account immediately and begin receiving payments.

—————————————————————————————————————————————————————————————-

By: Nik Hoffman

Title: One in Four Americans Own Bitcoin: Unchained Study

Sourced From: bitcoinmagazine.com/markets/one-in-four-americans-own-bitcoin-unchained-study

Published Date: Wed, 29 Nov 2023 20:00:00 GMT