Solana Emerges as Crypto Winner with a 45% Weekly Surge

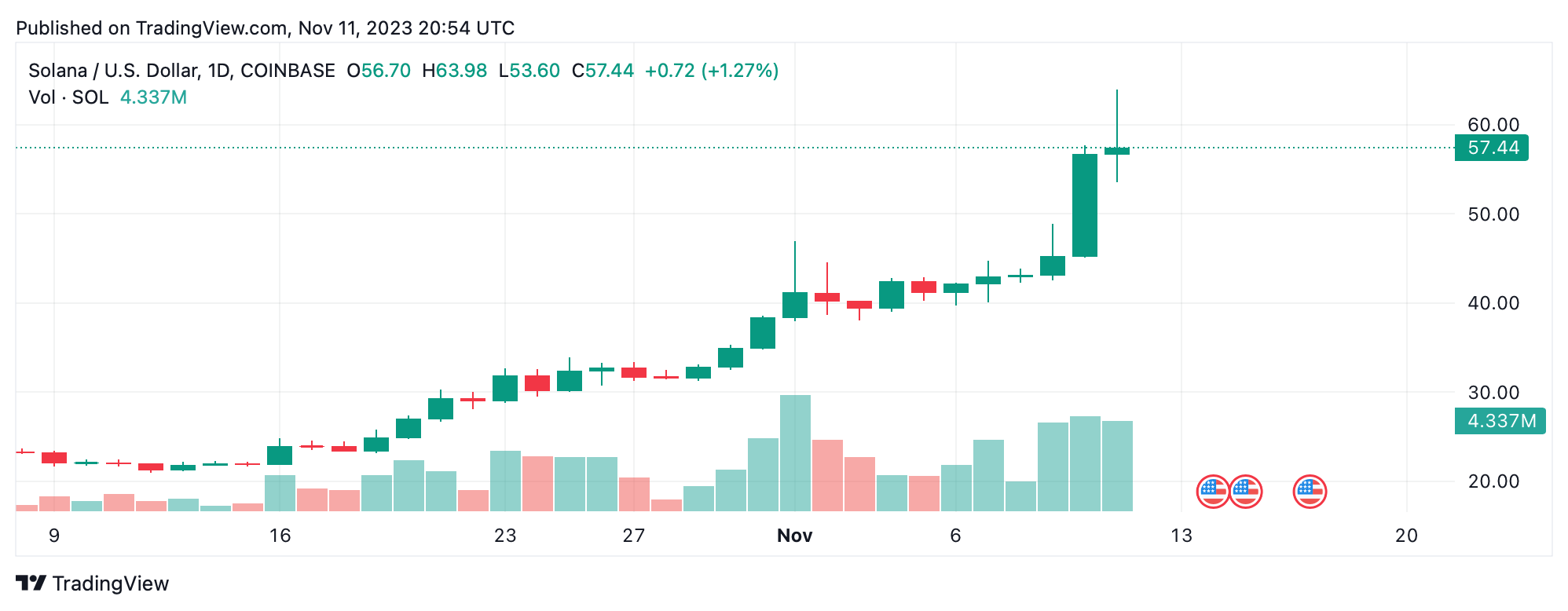

Solana (SOL) has taken the crypto market by storm with its impressive surge in value against the U.S. dollar. In the past 24 hours alone, SOL has gained 11%, and over the course of the week, it has skyrocketed by 45.2%, securing its position as the sixth largest asset by market cap.

Solana Outperforms Competitors with a 45.2% Increase in a Week

Out of the top ten crypto assets in terms of market value, Solana (SOL) has outshined its rivals this week. With a remarkable 45.2% surge in value over the past seven days, SOL has also experienced a staggering 184% growth against the U.S. dollar in the last 30 days. On November 11, SOL's trading prices ranged from $53.59 to $63.44 per coin. SOL is currently the fifth most traded cryptocurrency, with a global trade volume of approximately $4.41 billion in the past day.

Solana Shorts Liquidated as Value Continues to Rise

The recent surge in Solana's value has resulted in the liquidation of a significant number of short positions that bet on the cryptocurrency's decline. According to data from Coinglass, short position liquidations for Solana have amounted to $19.28 million. The community is actively discussing SOL's rise across various social media networks, including X.

"I missed SOL because less than 30 minutes after my bottom call when I went to buy it had pumped to $12 in one straight candle, and now it's at $62," wrote Eric Wall. On the other hand, some individuals have been celebrating their gains from SOL. "Mfers watching me make life-changing gains with Solana right now," remarked one individual. Another added:

GM to all the people who understand why SOL is headed higher than it's ever been! Now is the time to take advantage of this opportunity.

SOL's Trading Pairs and Volumes

Cryptocompare data reveals that SOL's primary trading pair on Saturday was tether (USDT), accounting for 52% of the trading activity. Trades against the U.S. dollar ranked second at 17.83%. The Korean won contributed significantly to SOL's trading volume with a share of 16.27%, while BTC claimed 5.83% of the market share.

Following BTC, SOL's trading volumes were supported by pairs with BUSD, EUR, TRY, USDC, and ETH. Despite Solana's impressive performance over the past month, with triple-digit increases, its current value is still over 75% lower than its peak of $259 per unit, reached on November 6, 2021, two years ago.

What are your thoughts on Solana's recent growth, both in the past day and over the previous month? Share your insights and perspectives on this topic in the comment section below.

Frequently Asked Questions

Can I invest in gold?

The answer is yes! You can add gold to your retirement plan. Because gold doesn't lose its value over time, it is an excellent investment. It also protects against inflation. It is also exempt from taxes.

Before investing in gold, you need to know that it's not like other investments. Unlike stocks or bonds, you can't buy shares of gold companies. You cannot also sell them.

Instead, you must convert your gold to cash. This means that it will be necessary to dispose of the gold. It's not enough to hold on to it.

This makes gold different from other investments. As with other investments you can always make a profit and sell them later. However, gold is different.

You can't even use your gold as collateral to get loans. For example, if a mortgage is taken out, you may have to sell some of your gold in order for the loan to be paid.

So what does this mean? You can't keep your gold indefinitely. You will have to sell it at some point.

However, there is no need to panic about it. All you have to do is open an IRA account. After that, you can start investing in gold.

Can I store my gold IRA in my home?

An online brokerage account is the best option to protect your investment funds. Online brokerage accounts offer all the same investment options and you do not need any special licenses. Plus, there are no fees for investing.

Online brokers often offer free tools to help manage your portfolio. They will even let you download charts to see how your investments perform.

Which type or type of IRA would be best?

When choosing an IRA, it is important to choose one that suits your lifestyle and goals. You should consider whether you wish to maximize tax deferred growth, minimize taxes now, pay penalties later or avoid taxes altogether.

If you have little money to invest, the Roth option might make sense. If you plan to continue working beyond age 59 1/2, and pay income taxes on any account withdrawals, the Roth option may be a good choice.

Traditional IRAs are more suitable if you intend to retire young. However, you will most likely owe taxes on any earnings from those funds. The Roth IRA could be more beneficial if you intend to continue working after age 65. This allows you the freedom to withdraw some, or all, of your earnings.

Are precious metal IRAs a smart investment?

How much risk you are willing to take for an IRA account's value loss will determine the answer. These are good if you have $10,000 of cash and don't expect them grow quickly. These might not be the best options if you're looking to invest in assets that have the potential to rise in value (gold) and plan to save for retirement for many decades. These investments can also be subject to fees that could reduce any gains.

How Do You Make a Withdrawal from a Precious Metal IRA?

If your account is with a precious metal IRA firm such as Goldco International Inc., you may want to consider withdrawing funds. This way, when you decide to sell your metals, they will still be worth much more than if you had left them inside the account.

Here is how to withdraw precious metal IRA funds.

First, determine whether the precious metal IRA provider allows withdrawals. This option is available from some companies, but not all.

Second, determine whether you can take advantage of tax-deferred gains by selling your metals. Most IRA providers offer this benefit. But, not all IRA providers offer this benefit.

Third, you should check with the provider of your precious metal IRA to determine if there are fees for these steps. It is possible that the withdrawal will be more expensive.

Fourth, make sure you keep track for at least three consecutive years of the precious metal IRA investments after you have sold them. For capital gains to be calculated, wait until January 1, each year. You will then need to file Form 8949 which contains instructions on how to calculate the amount of gain that you have realized.

The IRS requires that you report your sale of precious metals. This will ensure that you pay taxes on any profit earned from your sale.

Before selling precious metals, it is a good idea to consult an attorney or trusted accountant. They can help you avoid costly mistakes and ensure you comply with all regulations.

Do you need to open a Precious Metal IRA

Answers will depend on whether you have an investment goal or how high you are willing and able to tolerate risk.

You should start an account if you intend to retire with the money.

The reason is that precious metals are likely to appreciate over time. They can also be used to diversify.

The prices of silver and gold tend to be linked. This makes them a better choice when investing in both assets.

Do not invest in precious metals IRAs if your goal is to save money or take on any risk.

Statistics

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- Silver must be 99.9% pure • (forbes.com)

External Links

takemetothesite.com

regalassets.com

investopedia.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

How to Buy Gold To Your Gold IRA

Precious metal is a term used to describe gold, silver, platinum, palladium, rhodium, iridium, osmium, ruthenium, rhenium, and others. It is any element that has atomic numbers between 79 and 110 (excluding Helium), and which is valued because of its beauty and rarity. Silver and gold are the most well-known precious metals. Precious metals are used in jewelry, money, industrial goods and art objects.

The price of gold fluctuates daily due to supply and demand. In the past decade, there has been a huge demand for precious metals as investors seek safe havens from unstable economies. This increased demand has caused prices to rise significantly. However, the increasing cost of production has made some people concerned about investing in precious metals.

Gold is a solid investment as it is both rare and long-lasting. Gold never loses its value, unlike other investments. Plus, you can buy and sell gold without paying taxes on your profits. You have two options to invest in gold. You can purchase gold coins and bars or invest in gold futures contracts.

Instant liquidity is provided by physical gold coins and bars. They are easy and convenient to trade or store. They do not offer any protection against inflation. Consider purchasing gold bullion if you want to be protected from rising prices. Bullion, also known as physical gold and available in different sizes, is physical. While some billions are sold in one-ounce portions, others come in larger pieces such as kilobars. Bullion is typically stored in vaults to protect it from theft and fire.

Buy gold futures to own shares and not actual gold. Futures allow you to speculate on how the price of gold might change. Gold futures allow you to be exposed to its price without owning any physical commodity.

For example, if I wanted to speculate on whether the price of gold would go up or down, I could purchase a gold contract. My position after the contract expires will be either “long” (or “short”) A long contract indicates that I believe the price for gold will rise. Therefore, I'm willing give money to someone now in exchange of the promise that I will get more money after the contract ends. A short contract on the other side means that I believe gold's price will fall. I'm willing and able to take the money now, in return for the promise that I will make less money later.

When the contract expires, I'll receive the amount of gold specified in the contract plus interest. That way, I've gained exposure to the price of the gold without actually having to hold the gold myself.

Because they are extremely difficult to counterfeit, precious metals make great investments. Paper currencies can be easily faked by printing new bills. Precious metals are not easy to counterfeit. This is why precious metals have always held their value well over time.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Solana's Rally Soars by 184% in 30 Days as $19M in SOL Shorts Liquidate in 24 Hours

Sourced From: news.bitcoin.com/solanas-rally-hits-184-gain-in-30-days-as-19m-in-sol-shorts-liquidate-in-24-hours/

Published Date: Sat, 11 Nov 2023 21:30:05 +0000