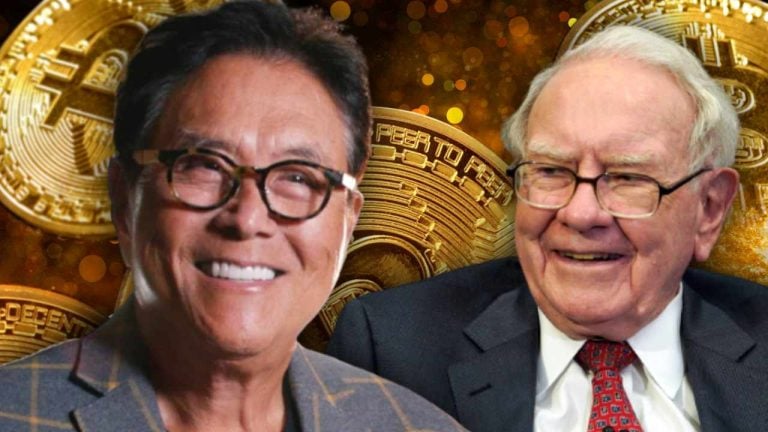

Robert Kiyosaki's Investment Strategy vs. Warren Buffett's Approach

Robert Kiyosaki, the renowned author of the best-selling book Rich Dad Poor Dad, has shared his investment strategy, highlighting the differences between his approach and that of investing legend Warren Buffett. Unlike Buffett, Kiyosaki focuses on accumulating assets for the long term rather than trying to time the market.

The Success of Rich Dad Poor Dad

Rich Dad Poor Dad, a book co-authored by Robert Kiyosaki and Sharon Lechter, has achieved significant success since its publication in 1997. The book has consistently appeared on the New York Times Best Seller List for over six years and has been translated into 51 languages, selling over 32 million copies worldwide.

On Sunday, Kiyosaki took to social media to explain his investment strategy:

"Rather than pretending to be Warren Buffett and trying to pick market bottoms, I am an average investor who focuses on accumulating assets for the long term. I have been investing in gold, silver, bitcoin, and real estate for many years."

Kiyosaki emphasizes the concept of dollar cost averaging, which involves consistently investing a fixed amount of money into an asset over time. He believes that this strategy can help individuals achieve wealth.

He further elaborated on the benefits of dollar cost averaging:

"I bought my first gold coin for $50, and today it's worth $2,000. By being an average investor and using dollar cost averaging, you can become wealthy. This is where dollar cost averaging pays off, especially during market fluctuations."

Warren Buffett's Value Investing Strategy

Warren Buffett, the CEO of Berkshire Hathaway, is well-known for his value investing approach. He seeks out businesses with strong economic characteristics and trustworthy management teams. Buffett believes in making long-term investments in quality companies.

Unlike Kiyosaki, Buffett has expressed skepticism towards cryptocurrencies. He famously referred to Bitcoin as "probably rat poison squared" and stated that it has no intrinsic value. In contrast, Kiyosaki has been a proponent of investing in Bitcoin, gold, and silver for quite some time.

Kiyosaki's Predictions for Bitcoin, Gold, and Silver

Robert Kiyosaki has made several predictions regarding the future prices of Bitcoin, gold, and silver. He believes that Bitcoin will reach $135,000, gold will surpass $2,100, and silver will rise to $68 per ounce. These predictions are based on his analysis of global economic trends.

Back in August, Kiyosaki stated that in the event of a global economic crisis, Bitcoin could surge to $1 million, with gold reaching $75,000 and silver climbing to $60,000. In February, he predicted that Bitcoin would reach $500,000 by 2025, while gold would rise to $5,000 and silver to $500 within the same timeframe.

Share Your Thoughts

What are your thoughts on Robert Kiyosaki's investment strategy? Do you prefer to follow Warren Buffett's value investing approach? Let us know in the comments section below.

Frequently Asked Questions

Are precious metals allowed in an IRA?

The answer to that question will depend on whether the IRA owner plans to diversify his holdings to gold and/or keep them safekeeping.

Two options are available for him if diversification is something he desires. He could either buy physical bars of silver and gold from a dealer, or he could sell the items to the dealer at year's end. Let's say he doesn’t want to sell back his precious metal investment. He could keep the precious metals as long as he wants to.

What are the pros and disadvantages of a gold IRA

A gold IRA is an excellent investment vehicle for those who want to diversify their holdings but don't have access to traditional banking services. It allows you invest in precious metals like platinum, silver, and gold without any taxes, until they're withdrawn.

The downside is that withdrawing money early will pay ordinary income tax on the earnings. The funds are not located in the country and can be easily seized by creditors if your loan defaults.

A gold IRA might be the right choice for you if you enjoy owning gold and don't worry about taxes.

How does a gold IRA generate interest?

It all depends on how big your investment is. If you have $100,000, then yes. You will not be able to answer if your income is less than $100,000

The amount of money that you put into an IRA is what determines whether it earns or not interest.

If your annual retirement savings contributions exceed $100,000, you might want to open a brokerage account.

You will likely earn more interest there, but you'll also be exposed to riskier investments. You don't want your entire portfolio to go bankrupt if the stock markets crash.

An IRA may be better for you if your annual income is less than $100,000. You can do this until the market grows again.

How much money can a gold IRA earn?

Yes, but it's not as simple as you think. It all depends on how risky you are willing to take. A $10,000 investment per year for 20 years could lead to $1 million by retirement age. If you try to put all your eggs into one basket, you will lose everything.

Diversify your investments. Inflation can make gold perform well. You want to invest in an asset class that rises along with inflation. Stocks do this well because they rise when companies increase profits. Bonds also do this well. They pay interest each year. They're great for economic growth.

But what happens if there's no inflation? Stocks fall more and bonds lose value during deflationary times. Investors should not put all of their savings in one investment such as a stock mutual fund or bond.

Instead, they should combine different types funds. They could, for example, invest in stocks and bonds. Or they could invest in both cash and bonds.

So they can see both sides of each coin. Inflation and depression. They will still experience a return with time.

Which type or type of IRA would be best?

When selecting an IRA for yourself, the most important thing is to find one that meets your lifestyle and goals. It is important to consider whether you want tax-deferred, maximized growth of your contributions, reduced taxes now and paid penalties later, or just avoid taxes.

The Roth option can be a smart choice if your retirement savings are limited and you don't have any other investments. It is also an option if you are still working after age 59 1/2. You can expect to pay income taxes for any accounts that are withdrawn.

The traditional IRA is better if you want to retire earlier because you will likely owe tax on your earnings. But if you're going to work well past age 65, the Roth IRA might make more sense since it allows you to withdraw some or all of your earnings without paying taxes.

Statistics

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

External Links

investopedia.com

forbes.com

wsj.com

takemetothesite.com

How To

How to get started buying silver with an IRA

How to start buying silver with your IRA – The best way to invest in gold and silver is through direct ownership of physical bullion. Silver bars and silver coins are a popular way to invest because of their liquidity, diversification, convenience, and ease.

There are many options available if you wish to purchase precious metals such as gold and silver. You can buy them directly from their producers such as refiners and mining companies. You can buy them directly from the producer or a dealer who purchases and sells bullion.

This article will discuss how to start investing in silver with your IRA.

- Investing In Gold & Silver Directly – This is the best option to buy precious metals. This means getting the bullion itself and having it delivered right to your door. Some investors decide to keep their bullion at their home while others prefer to store it in an insured storage facility. It is important to properly store precious metals when you want it to last. Many storage facilities provide insurance coverage against fire, theft, and damage. However, even with insurance you could lose your investments due to natural catastrophes or human error. You should always store your precious metals safely in a bank safe deposit box or credit union.

- Buying Precious Metals Online – If you'd rather avoid carrying around heavy boxes of precious metal, then one alternative is to buy bullion online. Bullion dealers sell bullion online in many forms, including coins or bars. There are many different types of coins. Coins are generally more convenient to carry than bars. Bars come in different weights and sizes. Some bars are heavy and weigh hundreds of pounds while others only weigh a few grams. A good rule of thumb when selecting which type of bar you should get is to look at what you plan to use it for. If you plan on giving it as gifts, you might choose something smaller. On the other hand, if you want to add it to your collection and display it proudly, you might want to spend a little extra money and get something larger.

- Precious Metals From Dealers – A third option to buying bullion is from a dealer. Most dealers are experts in one part of the market: gold or silver. Some dealers specialize in certain types of bullion, such as rounds or minted coins. Some specialize in particular regions. Others specialize in bulk buying. You'll find them all to be competitive in price and offer convenient payment methods.

- Buying Precious Metallics Through Retirement Accounts – While not technically considered an “investment,” another way to gain exposure to precious metals is by investing in retirement accounts. Investments in precious metals must be made through a qualified retirement plan to receive tax benefits as per Section 219 of IRS Code. These accounts include IRAs. These accounts can offer better returns than other investment options because they are specifically designed to help you save money for retirement. Most accounts allow you the ability to diversify between different metals. But what's the downside? Retirement accounts don't allow everyone to invest. These accounts can only be opened by employees who are sponsored by their employers.

—————————————————————————————————————————————————————————————-

By: Kevin Helms

Title: Robert Kiyosaki Reveals His Unique Investment Strategy

Sourced From: news.bitcoin.com/robert-kiyosaki-shares-his-investment-strategy-says-hes-not-trying-to-be-warren-buffett/

Published Date: Wed, 25 Oct 2023 00:30:12 +0000