For years, Bitcoin skeptics have hesitated, believing they missed the opportunity to invest in the cryptocurrency. However, the truth is far from that. It is not too late to invest in Bitcoin, and it continues to prove itself as a superior investment choice compared to traditional assets, regardless of your budget.

Bitcoin's Performance with Dollar Cost Averaging

Dollar cost averaging (DCA) involves investing a fixed amount regularly in an asset, irrespective of its price fluctuations. This strategy eliminates emotional decisions and smoothens the impact of market volatility. By consistently purchasing Bitcoin over time, investors can benefit from market fluctuations while building their portfolios steadily.

Outperforming Traditional Assets

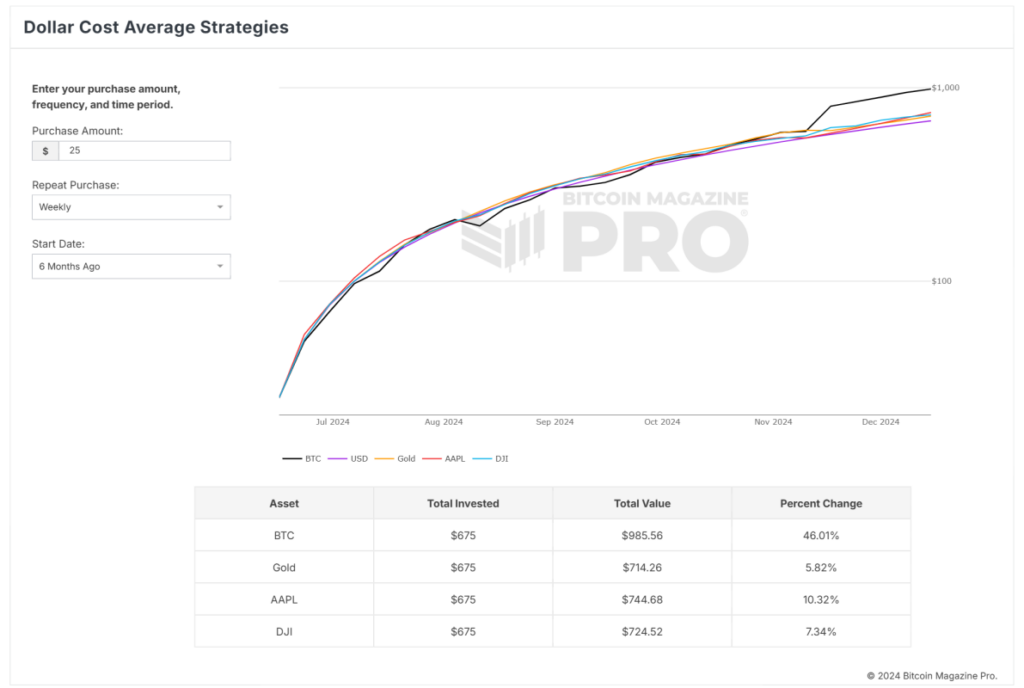

Using the DCA Strategies tool, let's examine how Bitcoin has outperformed traditional assets over different timeframes:

- 6 Months: Investing $25 weekly in Bitcoin resulted in a 46.01% return, compared to just 5.82% for Gold, 10.32% for Apple (AAPL), and 7.34% for the Dow Jones (DJI).

- 1 Year: A total investment of $1,325 in Bitcoin would yield a 61.52% return, outperforming Gold (14.50%), Apple (22.80%), and the Dow Jones (11.36%).

- 2 Years: A $25 weekly investment totaling $2,650 in Bitcoin would result in a 169.64% return, surpassing Gold (26.56%), Apple (36.22%), and the Dow Jones (21.13%).

- 4 Years: With a $5,250 investment, Bitcoin would deliver an impressive 183.39% return, outshining Gold (37.26%), Apple (54.05%), and the Dow Jones (27.32%).

Market Timing and Bitcoin

Timing the market is not crucial when it comes to Bitcoin. Historical data demonstrates that a DCA strategy reduces market timing risks and enhances returns over time. Regular investments, no matter how small, can lead to substantial growth as Bitcoin appreciates.

Bitcoin's Growth Potential

Despite its stellar performance, Bitcoin's market capitalization remains small compared to traditional assets like Gold. With increasing institutional adoption and limited supply, Bitcoin's long-term outlook remains positive. The cryptocurrency has the potential to reach parity with Gold, indicating significant growth opportunities.

Start Investing Today

Regardless of your budget, tools like Bitcoin Magazine Pro's DCA Strategies can help you create a personalized investment approach. It's never too late to start investing in Bitcoin and benefit from its long-term growth potential.

Take Action Now

Don't miss out on the opportunity to invest in Bitcoin. Utilize Bitcoin Magazine Pro's DCA Strategies tool to kickstart your investment journey today. With the cryptocurrency's bright future and historical performance, there's no better time to get started.

Visit bitcoinmagazinepro.com for real-time data and expert analysis to stay informed about Bitcoin's market trends.

Disclaimer: This article serves informational purposes only and does not constitute financial advice. Always conduct thorough research before making any investment decisions. The views expressed are solely those of the author and do not reflect BTC Inc or Bitcoin Magazine's opinions.

Frequently Asked Questions

What are the fees for an IRA that holds gold?

An individual retirement account's average annual fee (IRA) costs $1,000. However, there are many different types of IRAs, such as traditional, Roth, SEP-IRAs, and SIMPLE IRAs. Each type has its own set of rules and requirements. If your investments are not tax-deferred, you might have to pay taxes on the earnings. You must also consider how long you want to hold onto the money. If you plan to keep your money longer, you can save more money by opening a Traditional IRA instead of a Roth IRA.

Traditional IRAs allow you to contribute up $5,500 annually ($6,500 if 50+). A Roth IRA allows you to contribute unlimited amounts every year. The difference is that a traditional IRA allows you to withdraw your money without having to pay taxes. On the other hand, you'll owe taxes on any withdrawals made from a Roth IRA.

What is the difference between a gold and silver IRA?

You can make investments in precious metals (such as gold or silver) without having to pay tax. These precious metals are an attractive investment for anyone looking to diversify their portfolios.

You do not have to pay income tax on interest earned from these accounts if you are over 59 1/2. The appreciation of the account's value does not trigger capital gains tax. There are limits on the amount of money that you can place into this account. Minimum amount allowed is $10,000 If you're under the age of 59 1/2, investing is not allowed. The maximum annual contribution allowed is $5,500

You may not receive the entire amount if you pass away before retirement. Your estate must include enough assets to cover the balance remaining in your account after all other expenses and debts have been paid.

Some banks offer gold and silver IRA options, while others require you to open a regular brokerage account through which you buy shares or certificates.

Are gold and silver IRAs a good idea?

This could be a great way to simultaneously invest in gold and silver. There are also many other options. If you have any questions regarding these types of investments, please feel free to contact us anytime. We're always happy to help!

What precious metals may I allow in my IRA?

Gold is the most popular precious metal for IRA accounts. Also available as investments are bars and bullion gold coins.

Precious metals can be considered safe investments as they don't lose their value over time. They are also a great way of diversifying your investment portfolio.

Precious Metals include palladium, silver, and platinum. These metals all share similar properties. Each one has its own uses.

In jewelry making, for instance, platinum is used. The catalysts are made from palladium. For producing coins, silver is used.

Think about how much you can afford to purchase your gold, before you make a decision on the precious metal. It may be more cost-effective to purchase gold at lower prices per ounce.

Also, think about whether or not you wish to keep your investment secret. If you do, you should choose palladium.

Palladium can be more valuable than gold. However, it is also rarer. It's likely that you will have to pay more.

Another important factor when choosing between gold and silver is their storage fees. You store gold by weight. So you'll pay a higher fee for storing larger amounts of gold.

Silver is best stored in volumes. So you'll pay less for storing smaller amounts of silver.

All IRS rules concerning gold and silver should be followed if your precious metals are stored in an IRA. This includes keeping track of transactions and reporting them to the IRS.

Statistics

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

External Links

forbes.com

investopedia.com

en.wikipedia.org

regalassets.com

How To

Things to Remember: Best Precious Metals Ira, 2022

Precious Metals Ira is one of the most popular investment options among investors. This article will teach you what makes precious metals so attractive, and how to make informed decisions about investing in precious materials.

The key attraction of these assets lies in their long-term growth potential. The historical data shows incredible returns for gold prices. Gold prices have increased by almost $1900 per troy ounce in the past 200 year, from $20 an ounce to nearly $1900 over that time. The S&P 500 Index, however, grew by only around half of that amount.

During economic uncertainty, gold can also be considered a refuge. People tend to sell stocks when the stock market is in trouble and shift into gold for safety. The safety of gold is also considered an insurance against inflation. Many economists believe in inflation. They believe that physical gold can be used to protect your savings against future price rises.

Before you buy any precious metal, such as silver, gold, palladium or platinum, there are some things you should consider. First, you should know whether you want to invest in bullion bars or coins. Bullion bars can be bought in large quantities (like 100-ounces) and kept aside until required. Bullion bars are often replaced by coins, which can be used to buy smaller amounts of bullion.

The second thing you need to consider is where you will store your precious metals. Some countries are safer then others. It might make sense to store precious metals in another country if you reside in the US. You might also want to consider why you would store them in Switzerland if they aren't already.

Finally, decide whether you want investment in precious metals directly (or through precious metals exchange traded funds) (ETFs). ETFs are financial instruments which track the performance and price movements of different commodities like gold. These are a way to have exposure to precious metals but not necessarily own them.

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: Why Investing in Bitcoin is Still a Smart Move

Sourced From: bitcoinmagazine.com/markets/why-its-not-too-late-to-invest-in-bitcoin

Published Date: Wed, 11 Dec 2024 20:14:04 GMT