Imagine a rollercoaster ride of financial success that started at a mere $0.07 and soared to over $100,000 by 2025. Yes, I'm talking about the incredible journey of Bitcoin. This digital currency has not only created millionaires but has also revolutionized investment strategies, solidifying its position as a pivotal player in the future financial landscape.

The Unprecedented Success Story of Bitcoin

Bitcoin's Remarkable Profitability Streak

Let's dive into the numbers – out of a total of 5,442 trading days, a staggering 5,441 days have seen profits when compared to today's value. That's an astonishing success rate of 99.98%. For early believers who weathered the storm of volatility, the rewards have been nothing short of historic.

The Consistent Rise of Bitcoin

Did you know that over 80% of Bitcoin's trading days have ended in profit? This means that the current value exceeds the past prices on the majority of trading days. This unwavering consistency is a major driving force behind the confidence of long-term investors who choose to 'hodl' onto their assets.

Bitcoin's Role as a Financial Safe Haven

Bitcoin: The Inflation Hedge and Store of Value

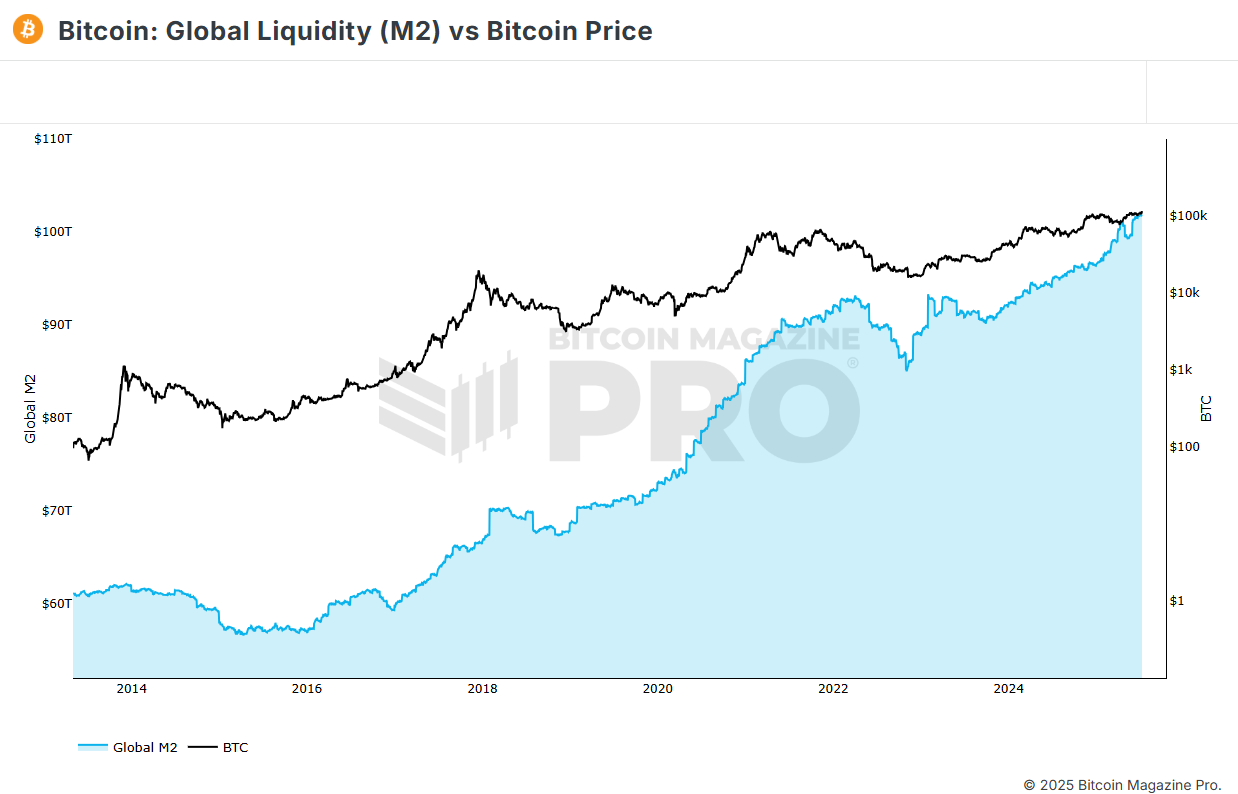

As the global money supply (M2) has surged from $61 trillion to over $102 trillion since 2013, Bitcoin's value has skyrocketed from around $113 to a peak of over $118,000. This correlation underlines Bitcoin's significance as a hedge against inflation and a dependable store of value in turbulent financial times.

Comparing Bitcoin's Returns to Traditional Assets

Bitcoin's Stellar Performance Against Gold and Stocks

Consider this – if you had been Dollar Cost Averaging (DCA) $100 monthly into Bitcoin for the past nine years, you would now be looking at a portfolio worth over $230,670 from a total investment of $10,900. That's an incredible return of over 2,016%. In stark comparison, traditional assets like gold, Apple stock, and the Dow Jones Industrial (DJI) pale in comparison, with Bitcoin leading the pack by a substantial margin.

For instance, gold would have yielded a 103% return, turning $10,900 into $22,152, Apple stock a 204% return resulting in $33,081, and DJI a 56% return amounting to $16,993. The unmatched performance of Bitcoin speaks volumes about its potential as a lucrative investment avenue.

Exploring Bitcoin's Investment Potential

The Future of Bitcoin Investments

Curious about how your investments in Bitcoin could fare across various timeframes? The Dollar Cost Average Strategies tool by Bitcoin Magazine Pro lets you compare Bitcoin's performance against assets like the US dollar, gold, Apple stock, and the DJI. Dive into the world of Bitcoin investments and discover its prowess as a premier store of value within a diversified portfolio. Explore the data firsthand here.

As you embark on your journey into the realm of Bitcoin investments, remember – the key lies in understanding the past to make informed decisions for a prosperous future. Embrace the potential of Bitcoin, harness its unparalleled growth, and watch your investments flourish like never before.

Frequently Asked Questions

Can I have a gold ETF in a Roth IRA

This option may not be available in a 401(k), but you should look into other options such as an Individual Retirement account (IRA).

An IRA traditional allows both employees and employers to contribute. You can also invest in publicly traded businesses by creating an Employee Stock Ownership Plan (ESOP).

An ESOP can provide tax advantages, as employees are allowed to share in company stock and the profits generated by the business. The tax rate on money that is invested in an ESOP is lower than if it was held in the employees' hands.

An Individual Retirement Annuity (IRA) is also available. An IRA allows you to make regular payments throughout your life and earn income in retirement. Contributions made to IRAs are not taxable.

How much is gold taxed under a Roth IRA

An investment account's tax rate is determined based upon its current value, rather than what you originally paid. So if you invest $1,000 in a mutual fund or stock and then sell it later, any gains are subject to taxes.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

The rules governing these accounts vary by state. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. You can delay until April 1st in Massachusetts. New York has a maximum age limit of 70 1/2. To avoid penalties, you should plan ahead and take distributions as soon as possible.

How can I withdraw from a Precious metal IRA?

First decide if your IRA account allows you to withdraw funds. Then make sure you have enough cash to cover any fees or penalties that may come with withdrawing funds from your retirement plan.

If you are willing to pay a penalty for early withdrawal, you should consider opening a taxable brokerage account instead of an IRA. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, you'll need to figure out how much money you will take out of your IRA. This calculation depends on several factors, including the age when you withdraw the money, how long you've owned the account, and whether you intend to continue contributing to your retirement plan.

Once you know how much of your total savings to convert to cash, it's time to choose the type of IRA that you want. Traditional IRAs permit you to withdraw your funds tax-free once you turn 59 1/2. Roth IRAs have income taxes upfront, but you can access the earnings later on without paying additional taxes.

After these calculations have been completed, you will need to open a brokerage bank account. Most brokers offer free signup bonuses and other promotions to entice people to open accounts. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When you do finally decide to withdraw from your precious metallic IRA, you will need a safe space where you can safely store your coins. Some storage facilities can accept bullion bar, while others require you buy individual coins. Before choosing one, consider the pros and disadvantages of each.

Bullion bars are easier to store than individual coins. But you will have to count each coin separately. You can track their value by keeping individual coins.

Some people like to keep their coins in vaults. Others prefer to store their coins in a vault. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Lawful – WSJ

irs.gov

finance.yahoo.com

bbb.org

How To

Gold Roth IRA guidelines

The best way to invest for retirement is by starting early. Start saving as soon as possible, usually at age 50. You can continue to save throughout your career. It is essential to save enough money each year in order to maintain a steady growth rate.

Additionally, tax-free opportunities like a traditional 401k or SEP IRA are available. These savings vehicles enable you to make contributions while not paying any taxes on the earnings, until they are withdrawn. They are a great option for those who do not have access to employer matching money.

It's important to save regularly and over time. You will lose any potential tax advantages if you don't contribute enough.

—————————————————————————————————————————————————————————————-

By: Oscar Zarraga Perez

Title: Unlocking Bitcoin's Phenomenal Growth: A Deep Dive into Unmatched Profitability

Sourced From: bitcoinmagazine.com/news/bitcoin-breaks-records-with-100-profitable-days-and-unmatched-returns

Published Date: Fri, 11 Jul 2025 19:26:02 +0000