Are you ready to unlock the full potential of the Bitcoin Everything Indicator and skyrocket your profits? This powerful tool goes beyond the basics to provide you with in-depth insights into BTC price movements. Today, we'll dive into how you can enhance this indicator to receive more frequent signals and make smarter trading decisions without compromising accuracy.

Understanding the Bitcoin Everything Indicator

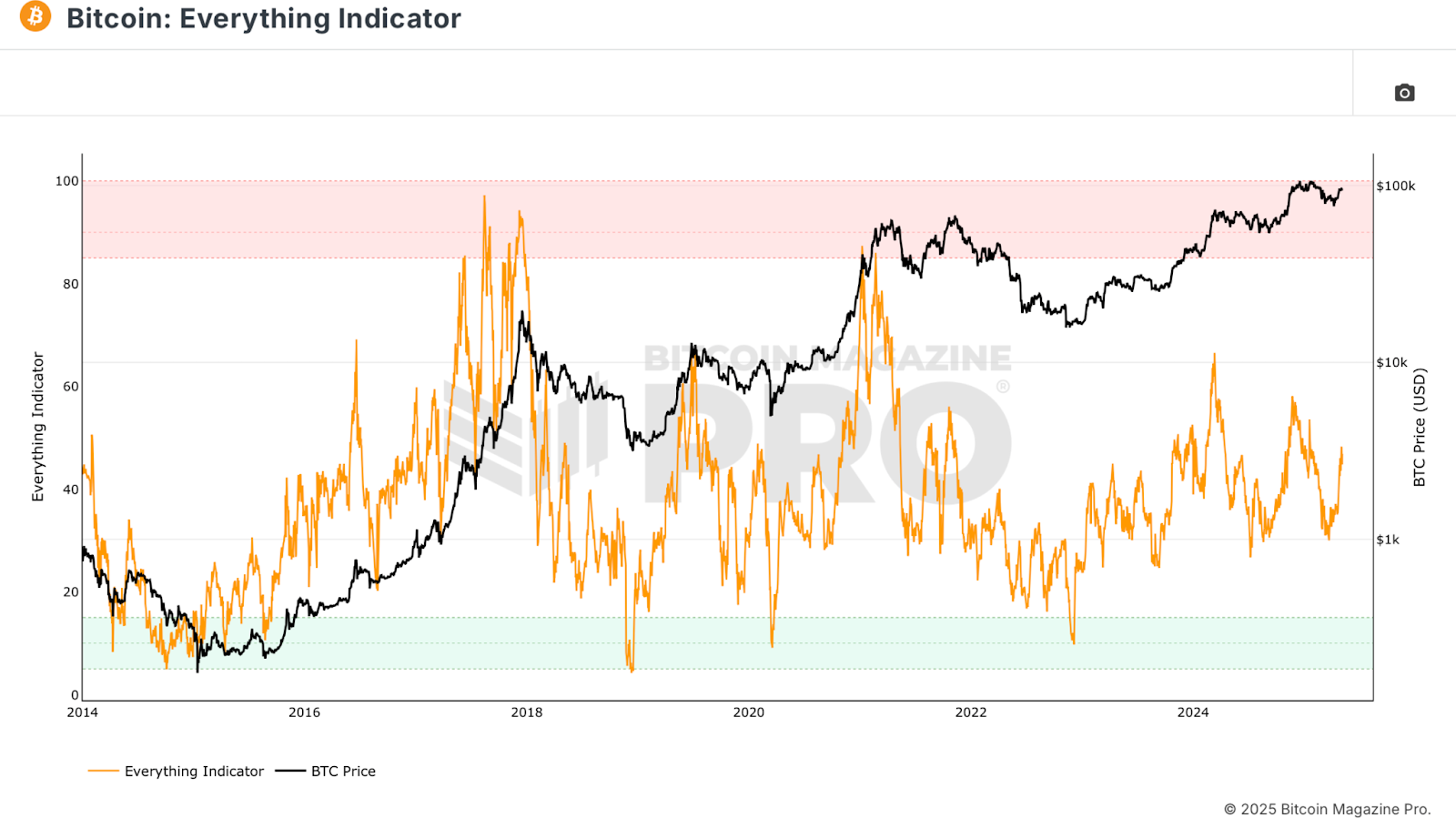

Let's start by breaking down what the Bitcoin Everything Indicator is all about. This comprehensive tool combines various signals from on-chain metrics, macroeconomics, network data, technical analysis, and mining health. By blending these factors, it offers a holistic view of the Bitcoin market, highlighting key trends and potential turning points.

Unpacking the Components

The Bitcoin Everything Indicator includes:

- On-chain metrics like the MVRV Z-Score and SOPR

- Macroeconomic factors such as Global M2 Money Supply

- Network data like active address sentiment

- Technical overlays such as the Crosby Ratio

- Mining health metrics including the Puell Multiple

Enhancing Signal Frequency

Previously, the Bitcoin Everything Indicator provided strong but infrequent signals, ideal for long-term investors. However, for those seeking more active trading strategies, a simple yet effective modification was introduced to increase signal frequency without losing the indicator's core insights.

Introducing Moving Averages

By adding a moving average to the Everything Indicator, we can now identify crossovers that signal changes in market direction. Similar to analyzing price movements, these crossovers offer valuable insights into when to enter or exit trades based on the indicator's trend.

Maximizing Returns with Moving Averages

With a 200-period moving average, you can spot trends early on and capitalize on bullish market movements. This strategy has shown exceptional performance, outperforming traditional buy-and-hold approaches by a significant margin, even factoring in trading fees and slippage.

Optimizing Signal Frequency

For active traders, shortening the moving average to 20 periods can provide more entry and exit signals per cycle. This adjustment maintains the indicator's integrity while offering increased opportunities to act on market fluctuations, ensuring you stay ahead of the game.

Final Thoughts

By leveraging the enhanced Bitcoin Everything Indicator, you can combine macro insights with real-time signals to make informed trading decisions. Whether you're a long-term investor or a dynamic trader, this tool offers a versatile solution to navigate the ever-changing crypto market landscape.

Ready to elevate your trading strategy? Explore the full potential of the Bitcoin Everything Indicator and unlock a world of opportunities. The sooner you implement these enhancements, the sooner you can start maximizing your profits!

Frequently Asked Questions

Is it possible to hold a gold ETF within a Roth IRA

A 401(k) plan may not offer this option, but you should consider other options, such as an Individual Retirement Account (IRA).

A traditional IRA allows for contributions from both employer and employee. Another option is to invest in publicly traded corporations with an Employee Stockownership Plan (ESOP).

An ESOP is a tax-saving tool because employees have a share of company stock as well as the profits that the business generates. The tax rate on money that is invested in an ESOP is lower than if it was held in the employees' hands.

An Individual Retirement Annuity (IRA) is also available. You can make regular payments to your IRA throughout your life, and you will also receive income when you retire. Contributions to IRAs will not be taxed

How much should precious metals be included in your portfolio?

This question can only be answered if we first know what precious metals are. Precious Metals are elements that have a very high relative value to other commodities. This makes them very valuable in terms of trading and investment. Today, gold is the most commonly traded precious metal.

However, many other types of precious metals exist, including silver and platinum. While gold's price fluctuates during economic turmoil, it tends to remain relatively stable. It is also relatively unaffected both by inflation and deflation.

In general, prices for precious metals tend increase with the overall marketplace. However, they may not always move in synchrony with each other. When the economy is in trouble, for example, gold prices tend to rise while other precious metals fall. This is because investors expect lower interest rates, making bonds less attractive investments.

When the economy is healthy, however, the opposite effect occurs. Investors choose safe assets such Treasury Bonds over precious metals. Since these are scarce, they become more expensive and decrease in value.

You must therefore diversify your investments in precious metals to reap the maximum profits. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

What is the Performance of Gold as an Investment?

Gold's price fluctuates depending on the supply and demand. Interest rates are also a factor.

Due to their limited supply, gold prices fluctuate. Additionally, physical gold can be volatile because it must be stored somewhere.

Can I buy gold with my self-directed IRA?

While you can purchase gold from your self-directed IRA (or any other brokerage firm), you must first open a brokerage account such as TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts are financial instruments that are based on gold's price. They let you speculate on future price without having to own the metal. But, physical bullion is real bars of gold or silver that you can hold in one's hand.

How is gold taxed within a Roth IRA

The tax on an investment account is based on its current value, not what you originally paid. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

These rules vary from one state to another. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. Massachusetts allows you to delay withdrawals until April 1. New York has a maximum age limit of 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

Is buying gold a good option for retirement planning?

Buying gold as an investment may not seem very appealing at first glance, but when you consider how much people spend on average on gold per year worldwide, it becomes worth considering.

The most popular form of investing in gold is through physical bullion bars. However, there are many other ways to invest in gold. It's best to thoroughly research all options before you make a decision.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. If you require cash flow, gold stocks can work well.

You also can put your money into exchange-traded funds (ETFs), which essentially give you exposure to the price of gold by holding gold-related securities instead of actual gold. These ETFs typically include stocks from gold miners, precious metallics refiners, commodity trading companies, and other commodities.

How is gold taxed in an IRA?

The fair value of gold sold to determines the price at which tax is due. If you buy gold, there are no taxes. It is not considered income. If you sell it after the purchase, you will get a tax-deductible gain if you increase the price.

For loans, gold can be used to collateral. Lenders seek to get the best return when you borrow against your assets. Selling gold is usually the best option. This is not always possible. They might just hold onto it. They might decide that they want to resell it. The bottom line is that you could lose potential profit in any case.

So to avoid losing money, you should only lend against your gold if you plan to use it as collateral. It's better to keep it alone.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

investopedia.com

bbb.org

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- You want to keep gold in your IRA at home? It's not legal – WSJ