In the world of Bitcoin investing, understanding market cycles is crucial to identifying buying opportunities and potential price peaks. One indicator that has proven reliable in this aspect is the Puell Multiple. Created by David Puell, this metric analyzes Bitcoin's valuation based on miner revenue, providing insights into whether Bitcoin is undervalued or overvalued compared to its historical averages.

What is the Puell Multiple?

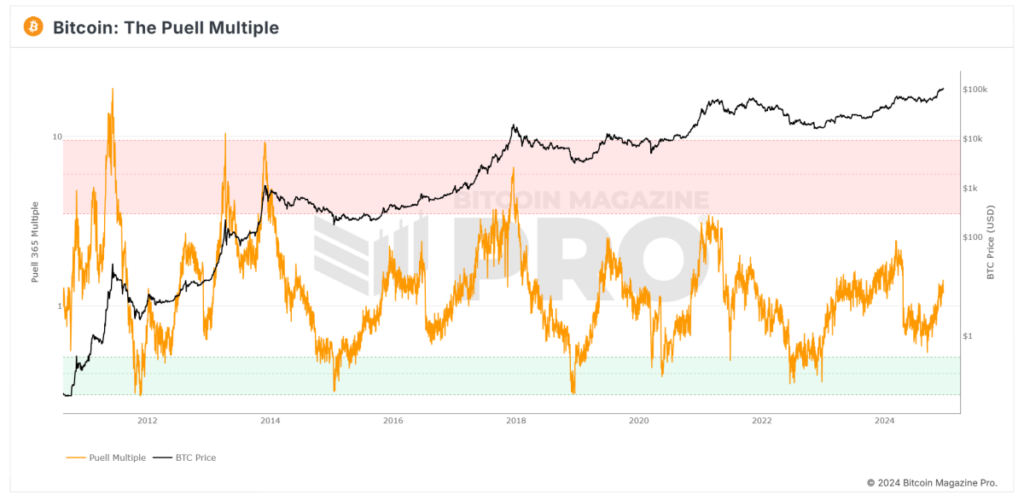

The Puell Multiple is an indicator that compares Bitcoin miners' daily revenue to its long-term average. Miners, being the suppliers in Bitcoin's economy, sell portions of their BTC rewards to cover operational costs, influencing Bitcoin's price dynamics significantly.

Calculating the Puell Multiple

The formula for Puell Multiple is straightforward:

Puell Multiple = Daily Issuance Value of BTC (in USD) ÷ 365-Day Moving Average of Daily Issuance Value

By comparing current miner revenues to their yearly averages, the Puell Multiple identifies periods of unusually high or low miner profits, indicating potential market tops or bottoms.

Interpreting the Puell Multiple Chart

The Puell Multiple chart uses color-coded zones for easy interpretation:

1. Red Zone (Overvaluation)

- When the Puell Multiple is above 3.4, it suggests high miner revenues, historically coinciding with Bitcoin price peaks.

2. Green Zone (Undervaluation)

- When the Puell Multiple drops below 0.5, it indicates low miner revenues, aligning with Bitcoin market bottoms.

3. Neutral Zone

- When the Puell Multiple is between the red and green zones, Bitcoin's price tends to be steady.

Current Insights from the Puell Multiple

Analysis of the current Puell Multiple chart shows:

- The Puell Multiple is trending upwards but remains below the red overvaluation zone.

- Bitcoin is not in an overheated phase yet, indicating potential for further price growth.

- The metric is above the green undervaluation zone, suggesting the market is not at a bottom phase.

Implications for Investors

The current Puell Multiple reading indicates Bitcoin is in a mid-market cycle:

- Bullish Momentum: Market is moving towards a bullish phase with room for growth.

- No Immediate Peak: Absence of red zone suggests potential for more growth before correction.

Investors should monitor the Puell Multiple closely, especially with Bitcoin's upcoming halving event in 2028, which could impact miner revenues.

Why Puell Multiple Matters for Investors

The Puell Multiple provides a unique perspective on Bitcoin's market cycles, focusing on miner revenue. It helps investors in:

- Identifying Buying Opportunities during undervaluation.

- Spotting Market Peaks associated with overvaluation.

- Navigating Market Cycles strategically by combining with other indicators.

Stay Informed with Bitcoin Magazine Pro

For professional investors and Bitcoin enthusiasts, tools like the Puell Multiple chart on Bitcoin Magazine Pro offer essential insights into Bitcoin's valuation trends. By utilizing the Puell Multiple and understanding its historical significance, investors can make informed decisions and navigate Bitcoin's market cycles effectively.

Disclaimer: This article provides information and not financial advice. Always conduct thorough research before making investment decisions.

Frequently Asked Questions

Is it a good idea to open a Precious Metal IRA

It is essential to be aware of the fact that precious metals do not have insurance coverage before opening an IRA. If you lose money in your investment, nothing can be done to recover it. This includes investments that have been damaged by fire, flooding, theft, and so on.

You can protect yourself against such losses by purchasing physical gold and silver coins. These items have been around thousands of years and are irreplaceable. If you were to sell them today, you would likely receive more than what you paid for them when they were first minted.

You should choose a reputable firm that offers competitive rates. It is also a smart idea to use a third-party trustee who will help you have access to your assets at all times.

When you open an account, keep in mind that you won't receive any returns until your retirement. Do not forget about the future!

What are the advantages of a gold IRA

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It's tax-deferred until you withdraw it. You control how much you take each year. There are many types available. Some are better suited to college savings. Others are intended for investors seeking higher returns. Roth IRAs permit individuals to contribute after the age 59 1/2. Any earnings earned at retirement are subject to tax. However, once they begin withdrawing funds, these earnings are not taxed again. This type account may make sense if it is your intention to retire early.

The gold IRA allows you to invest in different asset classes, which is similar to other IRAs. Unlike a regular IRA where you pay taxes on gains, a gold IRA doesn't require you to worry about taxation while you wait to get them. This makes gold IRA accounts excellent options for people who prefer to keep their money invested instead of spending it.

Another benefit of owning gold through an IRA is that you get to enjoy the convenience of automatic withdrawals. You won't have the hassle of making deposits each month. To avoid missing a payment, direct debits can be set up.

Finally, the gold investment is among the most reliable. Because it's not tied to any particular country, its value tends to remain steady. Even during economic turmoil, gold prices tend to stay relatively stable. As a result, it's often considered a good choice when protecting your savings from inflation.

What is the cost of gold IRA fees

Six dollars per month is the fee for an Individual Retirement Account (IRA). This includes account maintenance fees and investment costs for your chosen investments.

You may have to pay additional fees if you want to diversify your portfolio. These fees vary depending on what type of IRA you choose. For example, some companies offer free checking accounts but charge monthly fees for IRA accounts.

A majority of providers also charge annual administration fees. These fees are usually between 0% and 1%. The average rate is.25% annually. These rates are often waived if a broker like TD Ameritrade is used.

How to Open a Precious Metal IRA?

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. Once you have decided to open an Individual Retirement Account (IRA), you will need to complete Form 806. You will then need to complete Form 5204 in order to determine which type IRA you are eligible. This form must be submitted within 60 days of the account opening. Once this has been completed, you can begin investing. You can also contribute directly to your paycheck via payroll deduction.

Complete Form 8903 if your Roth IRA option is chosen. Otherwise, the process will look identical to an existing IRA.

To be eligible to have a precious metals IRA you must meet certain criteria. The IRS states that you must be at least 18 and have earned income. You can't earn more than $110,000 per annum ($220,000 in married filing jointly) for any given tax year. Contributions must be made regularly. These rules are applicable whether you contribute through your employer or directly from the paychecks.

A precious metals IRA can be used to invest in palladium or platinum, gold, silver, palladium or rhodium. However, physical bullion will not be available for purchase. This means you won't be allowed to trade shares of stock or bonds.

To invest directly in precious metals companies, you can also use precious metals IRA. This option is offered by some IRA providers.

There are two main drawbacks to investing through an IRA in precious metallics. They aren't as liquid as bonds or stocks. This makes it harder to sell them when needed. Second, they don’t produce dividends like stocks or bonds. Therefore, you will lose more money than you gain over time.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

bbb.org

finance.yahoo.com

How To

The History of Gold as an Asset

From the very beginning of time, gold was a currency. It was accepted worldwide and became popular due to its durability, purity, divisibility, uniformity, scarcity, and beauty. Because of its intrinsic value, it was also widely traded. Different weights and measurements existed around the world, however, because there were not international standards to measure gold. For example, one pound sterling in England equals 24 carats; one livre tournois equals 25 carats; one mark equals 28 carats; and so on.

The United States began issuing American coin made up 90% copper, 10% zinc and 0.942 fine-gold in the 1860s. This led to a decrease of demand for foreign currencies which in turn caused their prices to rise. The price of gold dropped because the United States began to mint large quantities of gold coins. Due to the excessive amount of money flowing into the United States, they had to find a way for them to repay some of their debt. They sold some of their excess gold to Europe to pay off the debt.

Since most European countries were not confident in the U.S. dollar they began accepting gold as payment. However, many European nations stopped using gold to pay after World War I and started using paper currency instead. Since then, the price of gold has increased significantly. Even though gold's price fluctuates, it is still one of the most secure investments you could make.

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: The Significance of Puell Multiple in Bitcoin Investing

Sourced From: bitcoinmagazine.com/markets/what-is-the-bitcoin-puell-multiple-indicator-and-how-does-it-work

Published Date: Wed, 18 Dec 2024 16:53:49 GMT