The United States federal government has recently expanded its significant Bitcoin holdings by transferring $922 million from wallets linked to Bitfinex hackers in a seizure. This move marks another step in a series of seizures and asset forfeitures that have helped the US government amass a substantial amount of Bitcoin, establishing it as one of the largest whales in the cryptocurrency market.

The Crypto-Anarchist Origins of Bitcoin

In the early days of the Bitcoin ecosystem, a strong crypto-anarchist ethos prevailed, leading to the emergence of various extralegal ventures, most notably the Silk Road. While this era of overtly illegal activities has largely come to an end, the success of these early ventures resulted in the accumulation of significant amounts of Bitcoin, much of which has now found its way into the hands of the US government.

Seizures and Forfeitures

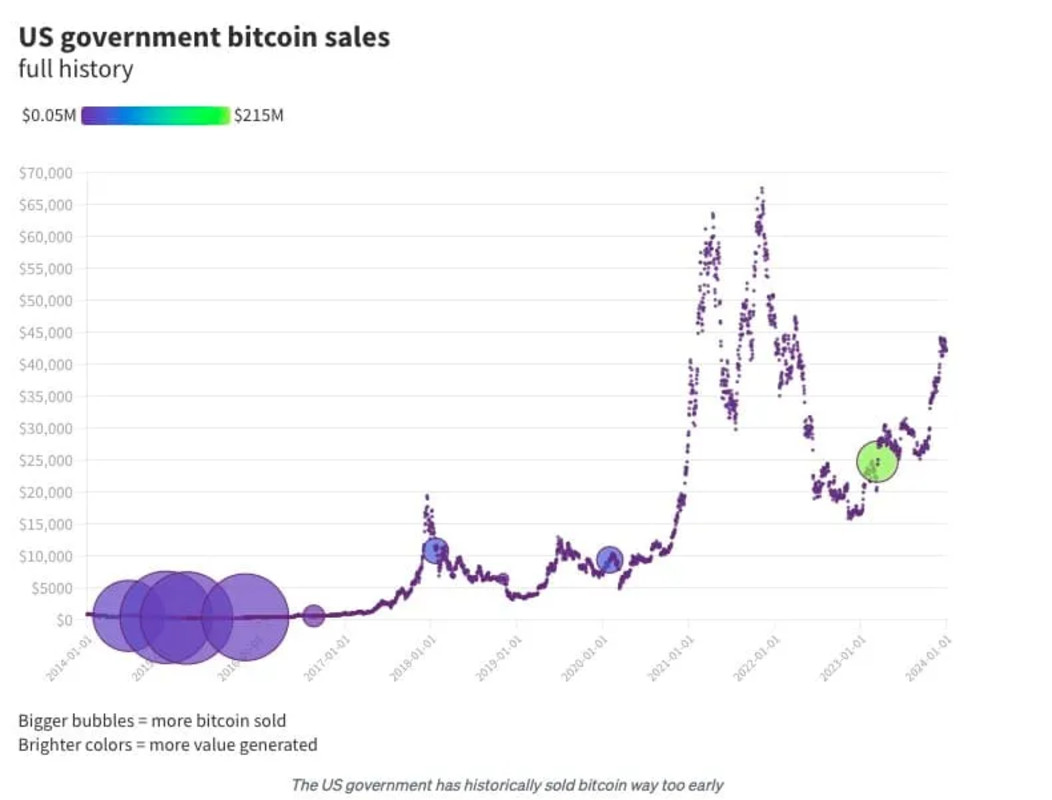

The Silk Road, a notorious online marketplace, has been at the center of multiple large-scale seizures by law enforcement agencies. Apart from the site's own funds, assets seized from hackers involved in the theft of funds from the Silk Road have also contributed to the government's growing Bitcoin reserves. Despite the sale of hundreds of millions of dollars' worth of Bitcoin through auctions, the US government still holds billions in cryptocurrency.

Bitfinex Hackers and Government Seizures

In a recent development, the US government confiscated over 15,000 bitcoins from wallets associated with two Bitfinex hackers, Ilya Lichtenstein and Heather "Razzlekhan" Morgan. These hackers were involved in a major heist in 2016, during which nearly 120,000 bitcoins were stolen from Bitfinex, impacting the exchange's operations significantly.

Government's Bitcoin Holdings and Transparency

Analysts estimate that the US government currently holds close to 200,000 bitcoins, valued at approximately $12.1 billion, making it a major player in the cryptocurrency market. The government's transparent handling of these assets and the public record of Bitcoin transactions provide insights into its significant holdings, which account for nearly 1% of all Bitcoin in circulation.

Implications of Government Seizures

Edward Snowden's comments on governments quietly accumulating Bitcoin reserves reflect the changing landscape of digital assets and traditional finance. While nations like El Salvador have openly embraced Bitcoin, the US government's silent acquisition of cryptocurrency raises questions about its future plans and impact on the market.

Challenges and Opportunities

As governments navigate the evolving cryptocurrency space, the race to build Bitcoin reserves has begun. Transparency issues, potential market influence, and strategic considerations come into play as nations like the UK also explore seizing cryptocurrency assets to bolster their holdings. The legitimization of Bitcoin by regulators worldwide underscores the growing importance of digital assets in global finance.

Conclusion

While the US government's sizeable Bitcoin holdings underscore its influence in the cryptocurrency market, other nations are also positioning themselves to secure their share of digital assets. As the competition for Bitcoin reserves intensifies, the future role of governments in the crypto space remains a topic of keen interest and speculation.

Frequently Asked Questions

What are the pros and disadvantages of a gold IRA

An Individual Retirement Account (IRA), unlike regular savings accounts, doesn't require you to pay tax on interest earned. An IRA is a great option for those who want to save money, but don't want tax on any interest earned. However, there are disadvantages to this type investment.

You could lose all of your accumulated money if you take out too much from your IRA. The IRS may prevent you from taking out your IRA funds until you reach 59 1/2. If you do decide to withdraw funds from your IRA, you'll likely need to pay a penalty fee.

You will also need to pay fees for managing your IRA. Many banks charge between 0.5% and 2.0% per year. Others charge management fees that range from $10 to $50 per month.

If you prefer to keep your money outside a bank, you'll need to purchase insurance. Many insurers require that you own at least one ounce of gold before you can make a claim. It is possible that you will be required to purchase insurance that covers losses of up to $500,000.

If you decide to open a gold IRA, it is important to know how much you can use. You may be limited in the amount of gold you can have by some providers. Others let you choose your weight.

It's also important to decide whether or not to buy gold futures contracts. Gold futures contracts are more expensive than physical gold. Futures contracts allow you to buy gold with more flexibility. They allow you to set up a contract with a specific expiration date.

You will also have to decide which type of insurance coverage is best for you. The standard policy does NOT include theft protection and loss due to fire or flood. The policy does not cover natural disasters. You might consider purchasing additional coverage if your area is at high risk.

Additional to your insurance, you will need to consider how much it costs to store your gold. Storage costs are not covered by insurance. Safekeeping costs can be as high as $25-40 per month at most banks.

To open a IRA in gold, you will need to first speak with a qualified custodian. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians don't have the right to sell assets. Instead, they must keep your assets for as long you request.

Once you've chosen the best type of IRA for you, you need to fill in paperwork describing your goals. Information about your investments such as stocks and bonds, mutual fund, or real property should be included in your plan. Also, you should specify how much each month you plan to invest.

After completing the forms, send them along with a check or a small deposit to your chosen provider. The company will review your application and send you a confirmation letter.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. Financial planners are experts at investing and can help you determine which type of IRA is best for you. They can also help reduce your costs by suggesting cheaper options for purchasing insurance.

Is it a good retirement strategy to buy gold?

Although it may not look appealing at first, buying gold for investment is worth considering when you consider the global average gold consumption per year.

Physical bullion is the most popular method of investing in gold. There are many ways to invest your gold. Research all options carefully and make an informed decision about what you desire from your investments.

If you don’t have the funds to invest in safe places, such as a safe deposit box or mining equipment companies, buying shares of these companies might be a better investment. If you need cash flow from an investment, purchasing gold stocks is a good choice.

You also can put your money into exchange-traded funds (ETFs), which essentially give you exposure to the price of gold by holding gold-related securities instead of actual gold. These ETFs typically include stocks from gold miners, precious metallics refiners, commodity trading companies, and other commodities.

Should You Invest in gold for Retirement?

This will depend on how much money and whether you were able to invest in gold at the time that you started saving. Consider investing in both.

Gold is a safe investment and can also offer potential returns. It is a good choice for retirees.

Most investments have fixed returns, but gold's volatility is what makes it unique. This causes its value to fluctuate over time.

However, this does not mean that gold should be avoided. You should just factor the fluctuations into any overall portfolio.

Another benefit to gold is its tangible value. Unlike stocks and bonds, gold is easier to store. It can also be transported.

Your gold will always be accessible as long you keep it in a safe place. Plus, there are no storage fees associated with holding physical gold.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold rises in the face of a falling stock market.

Gold investment has another advantage: You can sell it anytime. You can easily liquidate your investment, just as with stocks. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all your eggs on one basket.

Don't purchase too much at once. Start with just a few drops. Continue adding more as necessary.

Keep in mind that the goal is not to quickly become wealthy. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

Even though gold is not the best investment, it could be an excellent addition to any retirement plan.

Do you need to open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. If you lose money in your investment, nothing can be done to recover it. This includes investments that have been damaged by fire, flooding, theft, and so on.

Investing in physical gold and silver coins is the best way to protect yourself from this type of loss. These coins have been around for thousands and represent a real asset that can never be lost. If you were to offer them for sale today, they would likely fetch you more than you paid when you bought them.

If you decide to open an IRA account, choose a reputable company that offers competitive rates and products. It is also a smart idea to use a third-party trustee who will help you have access to your assets at all times.

If you decide to open an account, remember that you won't see any returns until after you retire. Don't forget the future!

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

forbes.com

irs.gov

finance.yahoo.com

investopedia.com

How To

Online buying gold and silver is the best way to purchase it.

First, understand the basics of gold. Precious metals like gold are similar to platinum. It is rare and used as money due to its durability and resistance against corrosion. It is difficult to use so people prefer to buy jewelry made from it to gold bars.

There are two types today of gold coins. One is legal tender while the other is bullion. Legal tender coins can be used for circulation within a country. These coins usually come in denominations such $1, $5 and $10.

Bullion coins can only be used as investment currency. They increase in value due to inflation.

They aren’t exchangeable in any currency exchange. A person can buy 100 grams of gold for $100. Each dollar spent by the buyer is worth 1 gram.

When looking to buy precious metals, the next thing you should be aware of is where it can be purchased. There are several options available if your goal is to purchase gold from a dealer. You can start by visiting your local coin shop. You might also consider going through a reputable online seller like eBay. You can also look into buying gold online from private sellers.

Private sellers are individuals that offer gold at wholesale or retail prices. When selling gold through private sellers, you pay a commission fee of 10% to 15% per transaction. This means that you will get less back from a private seller than if you sell it through a coin shop or on eBay. This option is often a great one for investors in gold, as it gives you greater control over the item's value.

The other option is to purchase physical gold. Physical gold is much easier to store than paper certificates, but you still have to worry about storing it safely. It is important to keep your physical gold safe in an impenetrable box such as a vault, safety deposit box or other secure container.

If you are looking to purchase gold on your own, you have two options: a bank or an pawnshop. A bank can give you a loan up to the amount you intend to invest in Gold. The pawnshop is a small business that allows customers to borrow money to buy items. Banks typically charge higher interest rates than pawn shops.

A third way to buy gold? Simply ask someone else! Selling gold is easy too. Contact a company such as GoldMoney.com, and you can set up a simple account and start receiving payments immediately.

—————————————————————————————————————————————————————————————-

By: Landon Manning

Title: The Rise of the United States as a Bitcoin Whale: A Closer Look at Government Seizures

Sourced From: bitcoinmagazine.com/markets/us-government-continues-bitcoin-seizures-controls-nearly-1-of-circulating-supply-

Published Date: Mon, 04 Mar 2024 14:15:46 GMT