Introduction

In recent times, there has been a noticeable shift in social media conversations and mainstream media mentions regarding Bitcoin. The interest in Bitcoin has grown significantly, with more people asking questions about it and expressing a desire to invest. This article aims to provide a brief guide to those who are new to Bitcoin and are seeking information on how to get started.

The Growing Interest in Bitcoin

Bitcoin, once a niche topic, has now become a subject of interest for many individuals. People who were previously unfamiliar with cryptocurrencies are now curious about Bitcoin and its potential as an investment. The shift in questions from "What is Bitcoin?" to "How do I buy it?" indicates a fundamental change in market sentiment.

It's important to note that this growing interest in Bitcoin is not merely driven by FOMO (fear of missing out). Instead, it reflects a recognition of the monetary revolution that Bitcoin represents. The limitations of the traditional financial system and the fragility of fiat currencies are becoming increasingly evident. In contrast, Bitcoin offers sound money and individual sovereignty, making it an attractive option for those seeking financial security.

Getting Started with Bitcoin

When it comes to investing in Bitcoin, there is no one-size-fits-all approach. Each individual's journey into Bitcoin is unique, influenced by their circumstances and risk tolerance. However, for those interested in exploring Bitcoin as a safe haven asset, here are some steps to consider:

1. Educate Yourself

Before investing any money in Bitcoin, it's crucial to invest time in understanding how the Bitcoin network works. Conduct thorough research, explore reputable sources, and familiarize yourself with the basics of Bitcoin. This will help you make informed decisions and mitigate potential risks.

2. Consider Expert Opinions

Leading asset management firms like BlackRock and Fidelity have expressed bullish views on Bitcoin. While it's essential to conduct your own research, it's worth considering the insights shared by these industry giants. However, always remember to exercise critical thinking and not blindly trust any source.

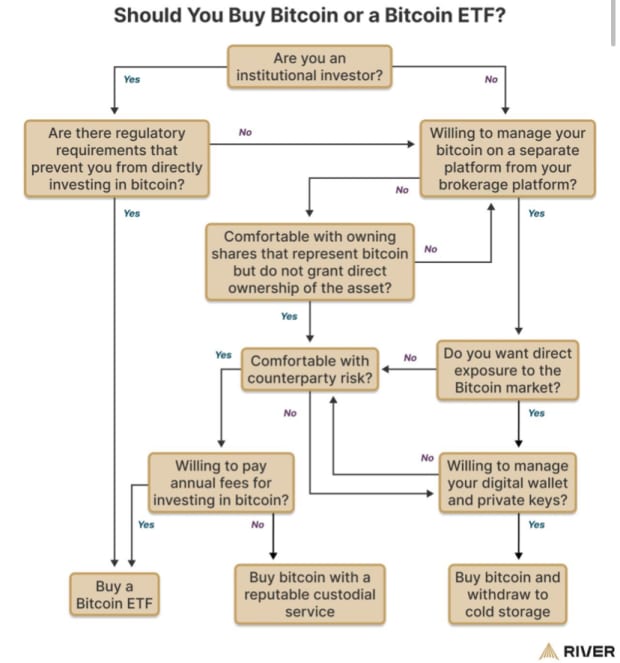

3. Choose Your Approach

When it comes to owning Bitcoin, you have several options. You can either hold your own keys by using a hardware wallet, entrust a third-party custodian with your Bitcoin, or invest in a Bitcoin ETF through a broker. Each approach has its pros and cons, and the decision depends on your individual needs and preferences.

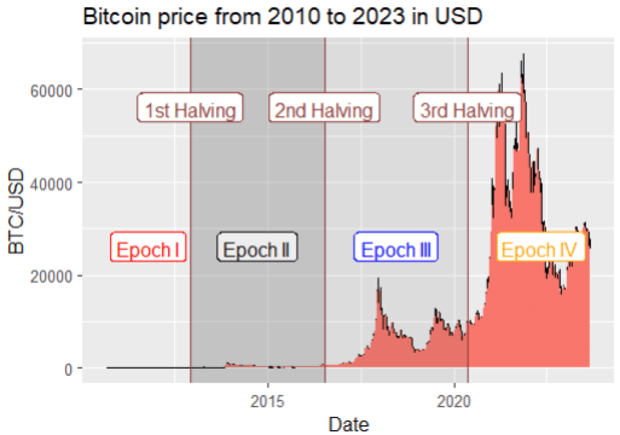

4. Understand the Halving and Epochs

Bitcoin goes through a process called "Halving" approximately every four years. This event involves reducing the number of bitcoins entering circulation by half. The halving and epochs play a crucial role in Bitcoin's monetary policy and are important considerations for investors. Familiarize yourself with these concepts to gain a deeper understanding of Bitcoin's supply dynamics.

5. Choose an Accumulation Strategy

When it comes to accumulating Bitcoin, there are two main strategies: lump-sum investing and dollar-cost averaging (DCA). Lump-sum investing involves investing all available funds at once, while DCA involves allocating funds over regular intervals. Consider your financial situation and risk tolerance to determine which strategy aligns best with your goals.

Conclusion

Investing in Bitcoin is a personal journey that requires careful consideration and research. While Bitcoin offers significant potential, it's important to approach it with a long-term mindset and understand the risks involved. Whether you choose to be your own custodian or rely on a third-party, Bitcoin has the potential to reshape the financial landscape. So, take the first step, educate yourself, and embark on your Bitcoin journey today!

This is a guest post by Santiago Varela. Opinions expressed are entirely his own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

CFTC

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement funds

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Legal – WSJ

How To

How to keep physical gold in an IRA

The best way of investing in gold is to purchase shares from companies that produce gold. However, there are risks associated with this strategy. It isn't always possible for these companies to survive. Even if the company survives, they still face the risk of losing their investment due to fluctuations in gold's price.

The alternative is to buy physical gold. This means that you will need to open an account at a bank, bullion seller online, or purchase gold from a trusted seller. This option offers the advantages of being able to purchase gold at low prices and easy access (you don’t need to deal directly with stock exchanges). It is easier to view how much gold has been stored. So you can see exactly what you have paid and if you missed any taxes, you will get a receipt. You also have a lower chance of theft than stocks.

There are however some disadvantages. You won't be able to benefit from investment funds or interest rates offered by banks. Additionally, you won’t be able diversify your holdings. You will remain with the same items you bought. Finally, the tax man might ask questions about where you've put your gold!

BullionVault.com has more information about how to buy gold in an IRA.

—————————————————————————————————————————————————————————————-

By: Santiago Varela

Title: The Rise of Bitcoin: A Guide for New Investors

Sourced From: bitcoinmagazine.com/culture/the-no-coiner-texts-arrive-a-bull-market-beckons

Published Date: Fri, 09 Feb 2024 15:47:52 GMT