Introduction

The Securities and Exchange Commission (SEC) has recently made a significant decision regarding spot Bitcoin exchange-traded funds (ETFs). Instead of the typical "in kind" transfers, these ETFs will now adopt a cash creation methodology. This change has sparked various discussions and interpretations, but the overall impact on investors will be minimal, while it will have more significant implications for the issuers. In this article, we will delve into the details of this decision and its potential consequences.

The Structure of Exchange Traded Funds

Before diving into the implications of cash creation, it is essential to understand the basic structure of exchange-traded funds. ETF issuers work with Authorized Participants (APs), who have the authority to exchange a predetermined amount of the fund's assets (such as stocks, bonds, commodities) or a specific cash amount, or a combination of both, for a fixed number of ETF shares. In the case of spot Bitcoin ETFs, "in kind" creation would involve exchanging 100 Bitcoin for 100,000 ETF shares. However, with cash creation, the issuer must publish the real-time cash amount required to acquire 100 Bitcoin as the price of Bitcoin fluctuates. They must also publish the cash amount that 100,000 ETF shares can be redeemed for in real time. The issuer is then responsible for purchasing the required Bitcoin or selling it in the case of redemption to ensure compliance with the fund's covenants.

Clarifying Misconceptions

Contrary to some claims, cash creation does not mean that the fund will not be backed 100% by Bitcoin holdings. While there may be a short delay in acquiring the necessary Bitcoin after creation, the longer the delay, the higher the risk for the issuer. If the issuer needs to pay more than the quoted price, it will result in a negative cash balance, lowering the Net Asset Value of the fund and impacting its performance. On the other hand, if the issuer can buy the Bitcoin for less than the cash deposited by the APs, the fund will have a positive cash balance, potentially improving its performance.

The Role of Spreads

Issuers face the challenge of balancing the goal of quoting tight spreads between creation and redemption cash amounts with their ability to trade at or better than the quoted amounts. This requires access to sophisticated technology. The wider the spread between creation and redemption cash amounts, the wider the spread that APs would likely quote in the market to buy and sell ETF shares. While most ETFs trade at tight spreads, the use of cash creation may result in some Bitcoin ETFs having wider spreads compared to others, which could impact overall trading costs.

Technological Hurdles

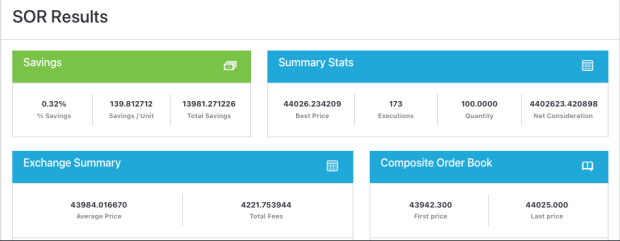

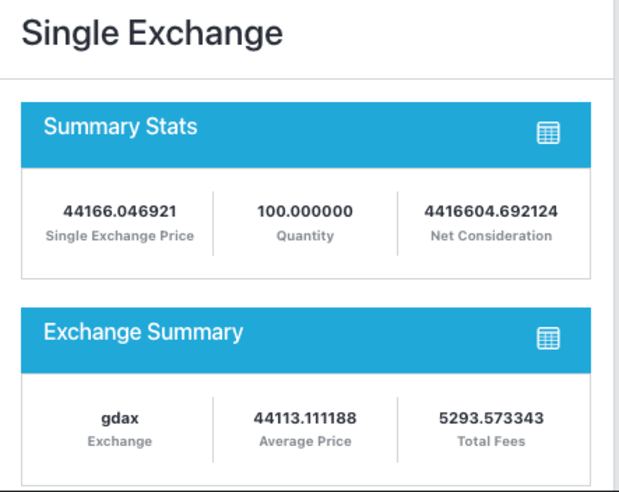

Issuers need advanced technology to achieve tight spreads. For example, quoting a price for 100 Bitcoin based on the liquidity on Coinbase alone may differ from quoting a price based on four regulated exchanges in the U.S. (Coinbase, Kraken, Bitstamp, and Paxos). This discrepancy highlights the technology hurdle faced by issuers. Sophisticated trading technology, such as CoinRoutes' Cost Calculator, can analyze multiple market/price level combinations to optimize trading costs.

Different Approaches Among Issuers

Not all issuers will choose the same approach to trading. Some may trade on a single exchange, while others may opt for over-the-counter trades with market makers or algorithmic trading providers. This diversity among issuers may lead to significant variations in pricing and costs.

The SEC's Decision

The SEC's decision to enforce cash creation/redemption instead of "in kind" transfers was primarily driven by regulatory limitations. Authorized Participants are regulated broker-dealers, and the SEC has not yet approved them to trade spot Bitcoin directly. This decision was not a result of any conspiracy theories or ulterior motives.

Conclusion

The introduction of spot Bitcoin ETFs is a significant step forward for the Bitcoin industry. However, investors should carefully research and understand the mechanisms and strategies each issuer employs for quoting and trading the creation and redemption process. While other concerns such as custodial processes and fees should not be ignored, overlooking the trading approach could have costly consequences. Ultimately, the successful implementation of cash creation will require issuers to have access to superior trading technology, enabling them to offer tighter spreads and superior performance.

This is a guest post by David Weisberger. The opinions expressed are entirely his own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

CFTC

bbb.org

investopedia.com

finance.yahoo.com

How To

How to Hold Physical Gold in an IRA

The easiest way to invest is to buy shares in companies that make gold. This method is not without risks. There's no guarantee these companies will survive. If they survive, there's still the risk of losing money due to fluctuations in the price of gold.

Another option is to purchase physical gold. This requires you to either open up your account at a bank or an online bullion dealer or simply purchase gold from a reputable seller. This option has many advantages, including the ease of access (you don’t have to deal with stock markets) and the ability of making purchases at low prices. It's easier to track how much gold is in your possession. You will receive a receipt detailing exactly what you paid. You also have a lower chance of theft than stocks.

However, there are disadvantages. You won't be able to benefit from investment funds or interest rates offered by banks. You won't have the ability to diversify your holdings; you will be stuck with what you purchased. Finally, the taxman may ask you about where you have put your gold.

BullionVault.com offers more information on buying gold for an IRA.

—————————————————————————————————————————————————————————————-

By: David Weisberger

Title: The Real Implications Of Cash Creation Instead of In Kind

Sourced From: bitcoinmagazine.com/markets/the-real-implications-of-cash-creation-instead-of-in-kind

Published Date: Thu, 04 Jan 2024 18:02:39 GMT