Are you ready to dive into the fascinating world of Bitcoin treasury companies and witness the groundbreaking Nakamoto strategy in action? If you're curious about how Bitcoin is reshaping capital markets globally, then fasten your seatbelt as we explore the innovative approach set to transform the financial landscape.

The Vision Behind Nakamoto: Redefining Capital Formation

Unlocking New Avenues for Capital Growth

Let's take a moment to envision Bitcoin not just as a digital currency but as a cornerstone for revolutionizing capital structures on a global scale. Nakamoto is pioneering a strategic shift by leveraging Bitcoin as a fundamental building block for creating a dynamic and interconnected capital framework.

Empowering Bitcoin Treasury Companies

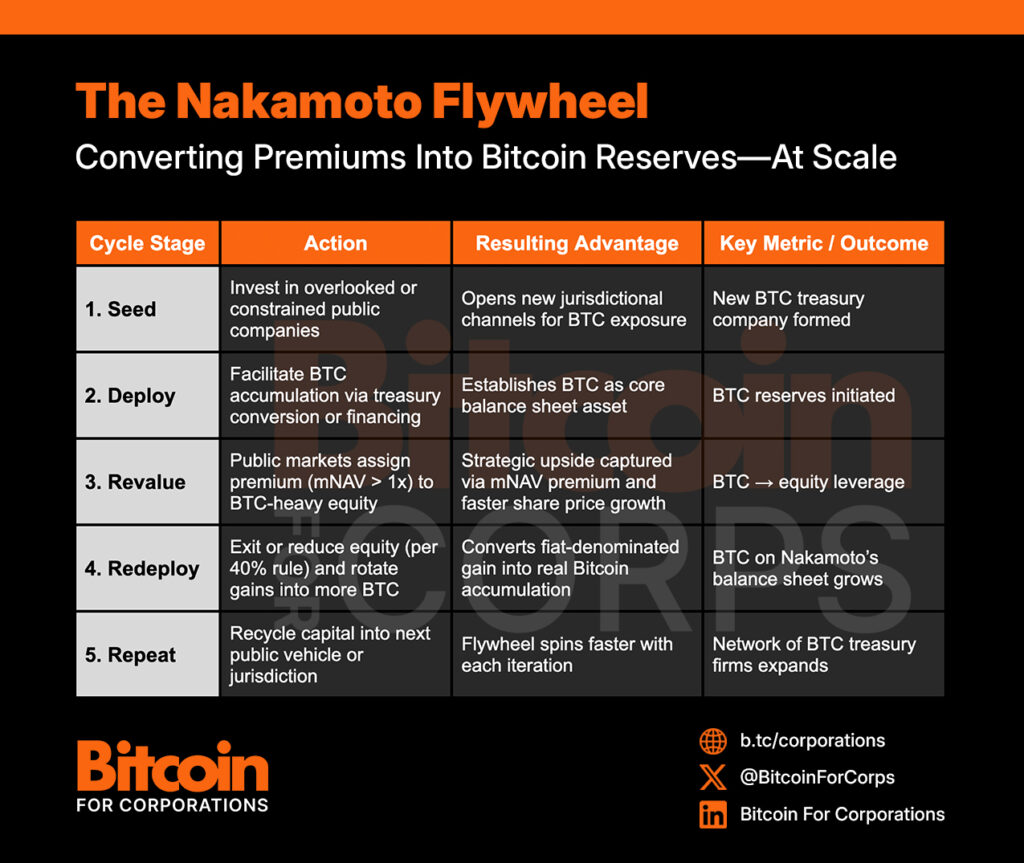

Delve deeper into the Nakamoto strategy, which goes beyond mere Bitcoin accumulation. By treating Bitcoin as a foundational value layer and combining it with public equity, Nakamoto strategically invests in promising small-cap companies to enhance exposure, broaden market reach, and nurture a decentralized, Bitcoin-centric financial ecosystem.

Decoding the Nakamoto Strategy

The Essence of mNAV Arbitrage and Strategic Premiums

Discover the magic of mNAV arbitrage, a core element of the Nakamoto strategy that capitalizes on market dynamics and Bitcoin's limited accessibility in certain regions. Witness how Nakamoto's capital allocation leads to premium valuation of Bitcoin treasury companies, amplifying the market value of Bitcoin reserves.

Unlocking Value through BTC Yield Metrics

Explore Nakamoto's innovative approach of evaluating performance not in traditional metrics but in Bitcoin terms. Learn about BTC Yield, a key metric tracking Bitcoin per diluted share, and how it drives long-term value alignment with Bitcoin-centric growth strategies.

- Seed at Intrinsic Value

- Unlock the Premium

- Recycle Without Dilution

Creating Institutional Bitcoin Exposure Channels

Understand how Nakamoto bridges the gap for institutional investors unable to directly hold Bitcoin by establishing compliant public entities that serve as conduits for Bitcoin investments.

Embracing Public Markets for Operational Efficiency

Explore the advantages Nakamoto gains by operating in public markets, including transparency, liquidity, and efficient capital recycling, fostering rapid expansion and regulatory alignment.

The 40% Rule: Balancing Securities and Bitcoin

Discover how Nakamoto navigates regulatory requirements by adhering to the 40% rule, driving strategic BTC reinvestment and ensuring Bitcoin remains at the core of its balance sheet.

- Structuring Capital Efficiently

- Reinvesting in Bitcoin

- Utilizing Innovative Financial Instruments

Empowering Compliance with Bitcoin-Denominated Convertible Notes

Explore the strategic potential of Bitcoin-denominated convertible notes in optimizing balance sheet exposure, regulatory compliance, and market flexibility for Nakamoto's future endeavors.

- Ensuring Regulatory Flexibility

- Gradual Exposure Management

Responding to Critics: Addressing Misconceptions

Overcoming Tax Complexities and Narrative Risks

Unravel the concerns surrounding tax implications and market hype criticism by examining Nakamoto's focus on sustainable Bitcoin-per-share growth and strategic value capture mechanisms.

Building Beyond Traditional Private Equity Models

Discover how Nakamoto's public infrastructure approach differs from traditional private equity investing, emphasizing liquidity, transparency, and Bitcoin-centric strategies to unlock institutional Bitcoin access at scale.

Embracing a New Era: Nakamoto's Impact on Bitcoin-Native Capital Markets

Join us as we witness Nakamoto's journey in shaping the future of Bitcoin-centric capital markets, bridging the gap between traditional finance and the innovative realm of Bitcoin adoption. The Nakamoto strategy isn't just a financial tactic—it's a visionary response to Bitcoin's expanding influence in the global financial landscape.

Frequently Asked Questions

What tax is gold subject in an IRA

The fair market price of gold when it is sold determines the tax due on its sale. You don't have tax to pay when you buy or sell gold. It is not income. If you sell it later you will have a taxable profit if the price goes down.

Loans can be secured with gold. When you borrow against your assets, lenders try to find the highest return possible. This often means selling gold. There's no guarantee that the lender will do this. They may just keep it. They might decide to sell it. The bottom line is that you could lose potential profit in any case.

If you plan on using your gold as collateral, then you shouldn't lend against it. You should leave it alone if you don't intend to lend against it.

What is a Precious Metal IRA and How Can You Benefit From It?

A precious metal IRA lets you diversify your retirement savings to include gold, silver, palladium, rhodium, iridium, osmium, osmium, rhodium, iridium and other rare metallics. These are “precious metals” because they are hard to find, and therefore very valuable. These are good investments for your cash and will help you protect yourself from economic instability and inflation.

Precious metals are often referred to as “bullion.” Bullion refers actually to the metal.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

You can invest directly in bullion with a precious metal IRA instead of buying shares of stock. This means you'll receive dividends every year.

Precious metal IRAs have no paperwork or annual fees. Instead, your gains are subject to a small tax. Additionally, you have access to your funds at no cost whenever you need them.

How can you withdraw from an IRA of Precious Metals?

First, decide if it is possible to withdraw funds from an IRA. You should also ensure that you have enough money to cover any fees and penalties associated with withdrawing funds.

A taxable brokerage account is a better option than an IRA if you are prepared to pay a penalty for early withdrawals. You will also have to account for taxes due on any amount you withdraw if you choose this option.

Next, calculate how much money your IRA will allow you to withdraw. This calculation depends on several factors, including the age when you withdraw the money, how long you've owned the account, and whether you intend to continue contributing to your retirement plan.

Once you determine the percentage of your total saved money you want to convert into cash, then you need to choose which type IRA you will use. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

Once you have completed these calculations, you need to open your brokerage account. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. However, a debit card is better than a card. This will save you unnecessary fees.

You will need a safe place to store your coins when you are ready to withdraw from your precious metal IRA. Some storage facilities will take bullion bars while others require you only to purchase individual coins. You will need to weigh each one before making a decision.

Bullion bars require less space, as they don't contain individual coins. However, each coin will need to be counted individually. However, you can easily track the value of individual coins by storing them in separate containers.

Some prefer to keep their money in a vault. Some prefer to keep them in a vault. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

How much gold should your portfolio contain?

The amount of capital that you require will determine how much money you can make. You can start small by investing $5k-10k. Then as you grow, you could move into an office space and rent out desks, etc. This way, you don't have to worry about paying rent all at once. It's only one monthly payment.

Also, you need to think about the type of business that you are going to run. In my case, I run a website-creation company. Our clients pay us between $1000-2000/month and depending on their order. If you are doing this type of thing, it is important to think about how much you can expect from each client.

You won't get a monthly paycheck if you work freelance. This is because freelancers are paid. So you might only get paid once every 6 months or so.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I recommend starting with $1k to $2k of gold, and then growing from there.

What is the cost of gold IRA fees

The Individual Retirement Account (IRA), fee is $6 per monthly. This fee includes account maintenance fees as well as any investment costs related to your selected investments.

To diversify your portfolio you might need to pay additional charges. These fees vary depending on what type of IRA you choose. Some companies offer free checking, but charge monthly fees for IRAs.

A majority of providers also charge annual administration fees. These fees range between 0% and 1 percent. The average rate is.25% per year. These rates are usually waived if you use a broker such as TD Ameritrade.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads. Example. And Risk Metrics

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

How To

The History of Gold as an Asset

From the very beginning of time, gold was a currency. It was universally accepted and loved for its beauty, durability, purity and divisibility. Aside from its inherent value, it could be traded internationally. However, since there were no international standards for measuring gold at this point, different weights and measures existed worldwide. One pound sterling in England was equivalent to 24 carats silver, while one livre tournois in France was equal 25 carats. In Germany, one mark was equivalent to 28 carats.

In the 1860s, the United States began issuing American coins made up of 90% copper, 10% zinc, and 0.942 fine gold. The result was a decrease in foreign currency demand, which led to an increase in their price. At this point, the United States minted large amounts of gold coins, causing the price of gold to drop. The U.S. government needed to find a solution to their debt because there was too much money in circulation. They sold some of their excess gold to Europe to pay off the debt.

Many European countries began accepting gold in exchange for the dollar because they did not trust it. However, after World War I, many European countries stopped taking gold and began using paper money instead. The price of gold has risen significantly since then. Today, although the price fluctuates, gold remains one of the safest investments you can make.

—————————————————————————————————————————————————————————————-

By: Nick Ward

Title: The Nakamoto Strategy Unveiled: Revolutionizing Bitcoin Treasury Companies Worldwide

Sourced From: bitcoinmagazine.com/news/nakamoto-seeding-bitcoin-treasury-companies

Published Date: Thu, 03 Jul 2025 10:26:07 +0000