Potential for a Price Rise

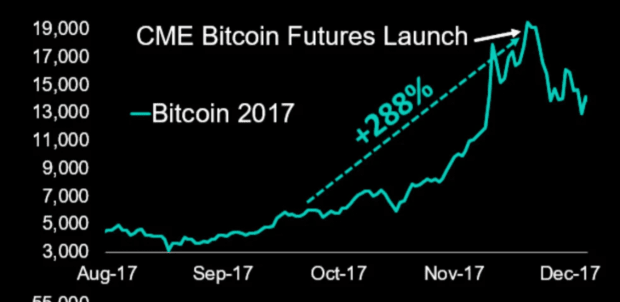

The approval of a Bitcoin exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC) could lead to a surge in Bitcoin's price. Proponents argue that the ETF would attract institutional and retail investors, driving the price of Bitcoin to new heights. Historical events support this claim, as the anticipation of the first Bitcoin ETF in 2017 caused the price to soar over $1,400. However, the SEC's rejection of the proposal resulted in a sharp decline in Bitcoin's price, emphasizing the impact of ETF expectations on the market. The introduction of Bitcoin futures in 2017 also brought attention and pushed the market above $20,000.

Potential for a Price Fall

On the other hand, there are concerns that the approval of a Bitcoin ETF could lead to a price correction. Short sellers might target the ETF, increasing volatility in the market. Additionally, the approval may attract greater regulatory scrutiny, potentially resulting in increased taxation, reporting requirements, and restrictions on Bitcoin's use. Furthermore, if the market has already priced in the possibility of approval, a decision to deny it could lead to disappointment and a sell-off, as seen in 2017 when the Winklevoss Bitcoin ETF was rejected.

Factors Influencing Bitcoin's Price

While the SEC's decision on the Bitcoin ETF is eagerly awaited, it's important to consider other factors that can shape Bitcoin's future. Market sentiment, macroeconomic conditions, and geopolitical events all play a significant role in determining the coin's price. The approval or denial of the ETF is just one piece of the puzzle.

Conclusion

As investors await the SEC's decision, Bitcoin's price hangs in the balance. The past has shown that ETF expectations can have a significant impact on Bitcoin's price. However, it's crucial to consider the broader market dynamics and how they interact with the decision. The future of Bitcoin remains uncertain, but the approval or rejection of the ETF marks a pivotal moment for the world's only decentralized cryptocurrency.

Frequently Asked Questions

How much is gold taxed under a Roth IRA

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. So if you invest $1,000 in a mutual fund or stock and then sell it later, any gains are subject to taxes.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

The rules that govern these accounts differ from one state to the next. For example, in Maryland, you must take withdrawals within 60 days after reaching age 59 1/2 . You can delay until April 1st in Massachusetts. New York offers a waiting period of up to 70 1/2 years. To avoid penalties, plan ahead so you can take distributions at the right time.

Is gold a good IRA investment?

Any person looking to save money is well-served by gold. You can also diversify your portfolio by investing in gold. There's more to gold that meets the eye.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It is often called “the oldest currency in the world.”

But unlike paper currencies, which governments create, gold is mined out of the earth. It's hard to find and very rare, making it extremely valuable.

The supply and demand for gold determine the price of gold. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. This results in gold prices rising.

On the flipside, people may save cash rather than spend it when the economy slows. This increases the production of gold, which in turn drives down its value.

This is why both individuals as well as businesses can benefit from investing in gold. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

Also, your investments will earn you interest which can help increase your wealth. You won't lose your money if gold prices drop.

What is the best precious metal to invest in?

The answer to this question depends on how much risk you are willing to take and what type of return you want. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. For example, if your goal is to make quick money, gold may not suit you. If you have time and patience, you should consider investing in silver instead.

If you're not looking to make quick money, gold is probably your best choice. Silver might be a better investment option if steady returns are desired over a long period of time.

What are the fees associated with an IRA for gold?

$6 per month is the Individual Retirement Account Fee (IRA). This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

If you wish to diversify your portfolio, you may need to pay additional fees. The type of IRA you choose will determine the fees. Some companies offer free checking, but charge monthly fees for IRAs.

Many providers also charge annual management fees. These fees can range from 0% up to 1%. The average rate for a year is.25%. However, these rates are typically waived if you use a broker like TD Ameritrade.

Can I buy gold with my self-directed IRA?

Although you can buy gold using your self-directed IRA account, you will need to open an account at a brokerage like TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

The IRS allows individuals to contribute up to $5,500 annually ($6,500 if married and filing jointly) to a traditional IRA. Individuals can contribute up $1,000 per annum ($2,000 if they are married and jointly) directly to a Roth IRA.

You should consider buying physical gold bullion if you decide to invest in it. Futures contracts, which are financial instruments based upon the price of gold, are financial instruments. You can speculate on future prices, but not own the metal. But, physical bullion is real bars of gold or silver that you can hold in one's hand.

What is a Precious Metal IRA?

You can diversify your retirement savings by investing in precious metal IRAs. This allows you to invest in gold, silver and platinum as well as iridium, osmium and other rare metals. These are called “precious” metals because they're very hard to find and very valuable. These are good investments for your cash and will help you protect yourself from economic instability and inflation.

Precious metals often refer to themselves as “bullion.” Bullion refers only to the actual metal.

Bullion can be bought via various channels, such as online retailers, large coin dealers and grocery stores.

A precious metal IRA allows you to invest directly in bullion, rather than buying stock shares. This ensures that you will receive dividends each and every year.

Unlike regular IRAs, precious metal IRAs don't require paperwork or annual fees. Instead, your gains are subject to a small tax. You can also access your funds whenever it suits you.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

investopedia.com

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

finance.yahoo.com

irs.gov

How To

The History of Gold as an Asset

From the very beginning of time, gold was a currency. It was popular because of its purity, divisibility. uniformity. scarcity and beauty. In addition, because of its value, it was traded internationally. There were different measures and weights for gold, as there was no standard to measure it. For example, in England, one pound sterling was equal to 24 carats of silver; in France, one livre tournois was equal to 25 carats of gold; in Germany, one mark was equal to 28 carats of gold; etc.

In the 1860s the United States began issuing American currency made up 90% copper (10% zinc) and 0.942 gold (0.942 pure). This resulted in a decline of foreign currency demand and an increase in the price. This was when the United States started minting large quantities of gold coins. The result? Gold prices began to fall. Due to the excessive amount of money flowing into the United States, they had to find a way for them to repay some of their debt. To do so, they decided to sell some of the excess gold back to Europe.

Many European countries didn't trust the U.S. dollars and started to accept gold for payment. However, many European nations stopped using gold to pay after World War I and started using paper currency instead. The price of gold has risen significantly since then. Even though the price of gold fluctuates, it remains one the best investments you can make.

—————————————————————————————————————————————————————————————-

By: Reed Macdonald

Title: The Impact of a Bitcoin ETF Approval on Bitcoin's Price

Sourced From: bitcoinmagazine.com/markets/why-the-bitcoin-price-will-rise-or-fall-on-the-secs-spot-etf-ruling

Published Date: Tue, 02 Jan 2024 13:49:59 GMT