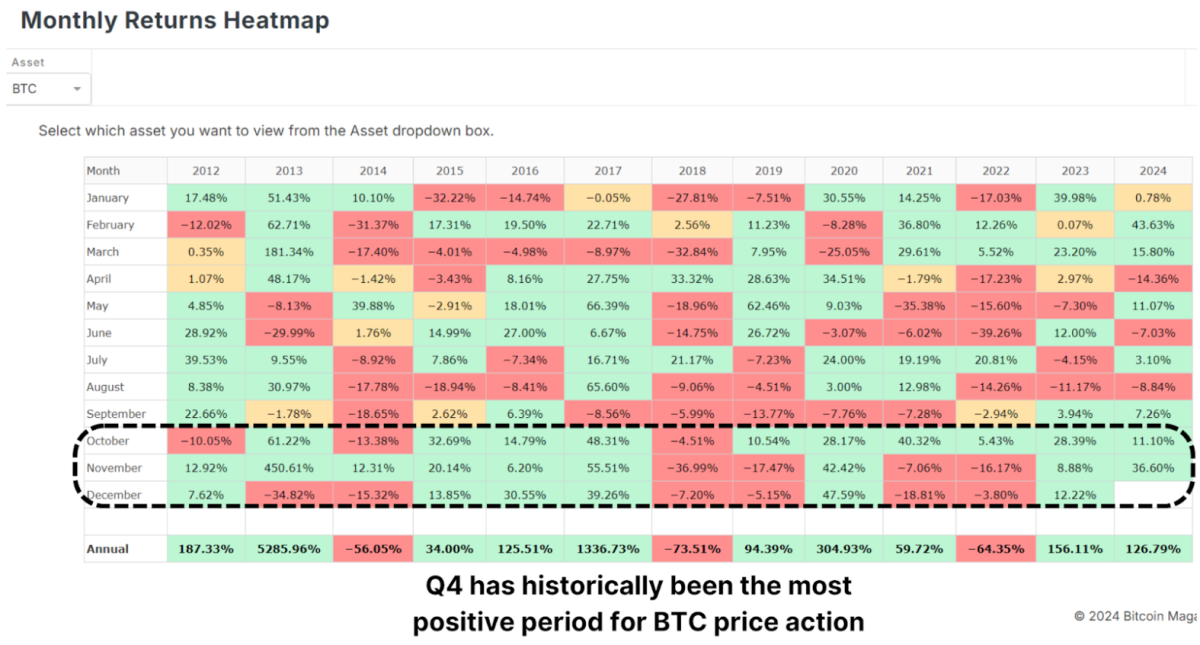

Bitcoin is experiencing one of its most remarkable months in history, with a surge of over $30,000 in November. This surge has sparked a renewed bullish sentiment in the market, leaving investors eager to see if Bitcoin's momentum can carry into 2025. Let's delve into the factors at play and what they could mean for the future.

Record-Breaking Performance in November

November 2024 was a historic month for Bitcoin, witnessing an unprecedented rise from around $67,000 to nearly $100,000. This roughly 50% peak-to-trough increase marked the best-performing month ever in terms of dollar gains. Long-term holders who weathered months of consolidation post Bitcoin's previous all-time high of $74,000 were handsomely rewarded by this rally.

The Role of the Dollar and Global Liquidity

Bitcoin's surge in the face of a strengthening U.S. Dollar Strength Index (DXY) is intriguing, as traditionally, Bitcoin tends to underperform in such scenarios due to their inverse relationship. Furthermore, the slight contraction in the Global M2 money supply, a key metric, contrasts with Bitcoin's usual positive correlation with global liquidity. If liquidity conditions improve in the future, it could propel Bitcoin's price even higher.

Parallels to Past Bull Cycles

The current trajectory of Bitcoin mirrors previous bull markets, notably the 2016–2017 cycle, which began with gradual price increases before entering an exponential growth phase after breaking key resistance levels.

Institutional Adoption and Accumulation

Institutional accumulation remains a significant driver of Bitcoin's strength, with Bitcoin ETFs and corporations like MicroStrategy adding substantial amounts of BTC to their holdings. Despite reaching new all-time highs, institutional players are aggressively accumulating Bitcoin to stay ahead of the curve.

Predictions for the Future

While December historically favors Bitcoin, short-term volatility may temper gains after November's sharp rally. However, with institutional accumulation on the rise, the long-term outlook remains bullish. Breaking the $100,000 milestone could set the stage for a larger rally in 2025, aligning with positive macroeconomic, technical, and on-chain indicators.

For a more detailed analysis, consider watching a recent YouTube video titled "The BIGGEST Bitcoin Month EVER – So What Happens Next?"

Frequently Asked Questions

What type of IRA is best?

It is essential to find an IRA that matches your needs and lifestyle when you are choosing one. You should consider whether you wish to maximize tax deferred growth, minimize taxes now, pay penalties later or avoid taxes altogether.

The Roth option can be a smart choice if your retirement savings are limited and you don't have any other investments. If you plan to continue working beyond age 59 1/2, and pay income taxes on any account withdrawals, the Roth option may be a good choice.

If you plan on retiring early, the traditional IRA may be better because you'll likely owe any taxes on the earnings. If you are going to be working beyond 65 years old, the traditional IRA may make more sense because you can withdraw all or part of your earnings without having to pay taxes.

Is it a good idea to have an IRA that holds gold and silver?

This could be a great way to simultaneously invest in gold and silver. But there are other options. You can contact us at any time with questions about these types investments. We are always here to help!

What Is a Precious Metal IRA?

Precious metals can be a good investment for retirement accounts. They have been around for centuries and are still very valuable today. You can diversify your portfolio by investing in precious metals, such as gold, platinum, and silver.

In addition, some countries allow citizens to store their money in foreign currencies. You can buy gold bars in Canada, and then keep them at the home. You can then sell the same gold bars to Canadian dollars when you return home to visit your family.

This is a very easy way to invest in precious metals. It's especially useful for anyone who lives outside North America.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

External Links

investopedia.com

en.wikipedia.org

regalassets.com

takemetothesite.com

How To

How to Determine if a Gold IRA is Right for You

Individual Retirement accounts (IRAs) are the most common type of retirement account. IRAs may be obtained from financial planners or banks as well as mutual funds and banks. The IRS allows individuals to contribute up to $5,000 annually without tax consequences. This amount is available to all IRAs, regardless of age. You can only put a certain amount into an IRA, but there are restrictions. For example, a Roth IRA contribution is not allowed if you are less than 59 1/2. If you're under 50, you must wait until you reach age 70 1/2 before making contributions. Additional, employees who work for their employer might be eligible to receive matching contributions.

There are two main types of IRAs: Traditional and Roth. Traditional IRAs allow you to invest in stocks, bonds and other investments. A Roth IRA allows you to only invest in after-tax dollars. Roth IRA contributions can be made without tax, but they will still be subject to taxes if you withdraw from it. Some people combine both of these accounts. There are pros and cons to each type of IRA. What should you look at before deciding which type is best for you? Here are three things to keep in mind:

Traditional IRA Pros:

- Each company has its own contribution options

- Employer match possible

- More than $5,000 in savings per person

- Tax-deferred growth up to withdrawal

- There may be restrictions based upon income level

- The maximum annual contribution limit is $5.500 (or $6.500 if married filing jointly).

- The minimum investment is $1,000

- After age 70 1/2 you are required to begin mandatory distributions

- An IRA can only be opened by someone who is at least five years older than you.

- Transfer assets between IRAs is not possible

Roth IRA Pros:

- Contributions are free of taxes

- Earnings increase tax-free

- No minimum distributions

- Investment options are limited to stocks, bonds, and mutual funds

- There is no maximum contribution limit

- Transfer assets between IRAs is possible without restrictions

- Age 55 or older to open an IRA

When opening a new IRA it's important to realize that not all companies offer identical IRAs. Some companies offer the option of a Roth IRA, while others provide a choice between a Roth IRA and a traditional IRA. Others allow you to combine them. There are different requirements for different types. Roth IRAs don't have a minimum capital requirement. Traditional IRAs only require a $1,000 minimum investment.

The bottom line

The key factor in choosing an IRA account is whether you wish to pay taxes now, or later. If you plan to retire in the next ten years, a traditional IRA might be the best choice. A Roth IRA might be better suited to you. It doesn't matter what, it is a good idea consult a professional to discuss your retirement plans. An expert can advise you on the best options and how to navigate the market.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: The Future of Bitcoin: Analyzing the Current Surge and Predicting 2025

Sourced From: bitcoinmagazine.com/markets/will-december-surpass-novembers-record-breaking-bitcoin-price-increase

Published Date: Fri, 29 Nov 2024 14:00:00 GMT