Introduction

Gold mining has a long history, with its allure and value established over centuries. However, the environmental consequences of gold mining are often overlooked. In recent times, Bitcoin has emerged as a potential alternative store of value, with its proponents arguing for its environmental superiority. This article aims to explore the environmental impact of gold mining and compare it with the emerging digital currency, Bitcoin.

The Environmental Reality of Gold Mining

Contrary to the perception of gold as a pure and clean substance, the reality of gold production is far from ideal. Gold mining is one of the most polluting industries globally, ranking second only to coal mining in terms of land coverage. Gold mining sites cover more land than the combined areas of copper, iron, and aluminum mining sites. As high-yield gold mines become exhausted, chemical processes involving toxic substances like cyanide and mercury are increasingly being used.

Water Pollution and Acid Mine Drainage

Gold mining generates significant water pollution, known as acid mine drainage. This contaminated water, which contains toxic substances, poses a serious threat to aquatic life and can enter the food chain. Incidents like the Gold King Mine spill in Colorado in 2015, where three million gallons of toxic waste water turned the Animas River yellow, highlight the environmental risks associated with gold mining.

Toxic Chemicals and Cyanide Usage

The production and transport of gold involve the extensive use of toxic chemicals, particularly cyanide. In the United States, 90% of cyanide is used solely for recovering hard-to-extract gold. Gold mines consume over 100,000 tons of cyanide annually, necessitating the massive production and transport of a compound with a fatal human dose of a few milligrams. Incidents like the cyanide-contaminated water spill in Romania in 2000 caused mass die-offs of aquatic life and contaminated the drinking water of millions of people.

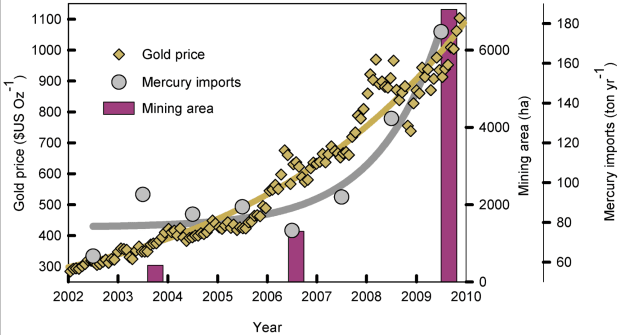

Mercury Emissions and Artisanal Mining

Gold production from artisanal and small-scale mines, predominantly in the global South, contributes to 38% of global mercury emissions. Mercury waste is a byproduct of the historic amalgamation method widely used in mines in Brazil and China. The release of mercury into the environment has severe consequences for both human populations and wildlife. Populations exposed to mercury vapor suffer from neurological issues, while downstream communities consuming mercury-contaminated fish face significant health risks.

The Role of Western Mining Companies and Gold Consumption

In response to stricter environmental and labor regulations in Western countries, mining companies have increasingly shifted their operations to developing countries. Surprisingly, only 7% of mined gold is used for industrial purposes, such as electronics. The majority is processed for jewelry or directly purchased as a store of value. This preference for gold as a store of value, particularly during periods of monetary debasement, drives up the demand and price of gold.

The Environmental Potential of Bitcoin

Bitcoin, often referred to as "digital gold," offers a potential alternative to traditional gold as a store of value. With its upcoming halving and lower inflation rate compared to gold, Bitcoin presents a unique opportunity for environmentally conscious investors. Research suggests that Bitcoin mining can support renewable energy expansion and incentivize methane emission reduction, while having a significantly lower carbon footprint compared to gold mining.

Conclusion

The environmental impact of gold mining cannot be ignored. From land coverage to water pollution, toxic chemicals, and mercury emissions, gold mining has far-reaching ecological and social consequences. As an alternative store of value, Bitcoin offers the potential for a more environmentally friendly solution. By shifting to a digital commodity with higher portability, divisibility, and scarcity, investors can support the expansion of renewable energy and contribute to a more sustainable future.

Disclaimer: This is a guest post by Weezel. The opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

How much money can a gold IRA earn?

Yes, but not as often as you think. It depends on what level of risk you are willing take. If you are comfortable investing $10,000 annually for 20 years, you could potentially have $1 million at retirement age. But if you put all your eggs in one basket, you'll lose everything.

Diversifying your investments is essential. When there is inflation, gold does well. You should invest in an asset that increases with inflation. Stocks do this well because they rise when companies increase profits. This is also true with bonds. They pay interest each and every year. They are great during economic growth.

But what happens if there's no inflation? In deflationary periods stocks and bonds both fall in value. Investors should not put all of their savings in one investment such as a stock mutual fund or bond.

Instead, they should invest in a mix of different funds. They could invest in stocks or bonds. They could also invest both in bonds and cash.

So they can see both sides of each coin. Inflation and depression. And they will still see a return over time.

Can you make money in a gold IRA

If you want to make money on an investment, you need to do two things firstly, understand how the market operates, and secondly, know what kind of products are available.

Trading is not a good idea if you don’t know what you need.

You should also find a broker who offers the best service for your account type.

There are many accounts available, including Roth IRAs and standard IRAs.

You may also wish to consider a rollover if you already have other investments, such as stocks and bonds.

Can I keep my gold IRA at work?

An online brokerage account will allow you to invest in the most secure way possible. You have all the investment options you'd get if you had a traditional broker. However, you don't require any licenses or qualifications. Plus, there are no fees for investing.

You can also use free tools offered by many online brokers to manage your portfolio. Online brokers will allow you to download charts so that you can see the performance of your investments.

Is it possible to hold precious metals in an IRA

The answer depends on whether or not the IRA owner is looking to diversify his holdings in gold and silver, or to keep them for safekeeping.

Two options are available for him if diversification is something he desires. He could either buy physical bars of silver and gold from a dealer, or he could sell the items to the dealer at year's end. Let's say he doesn’t want to sell back his precious metal investment. In such a case, he should not sell his precious metal investments. They would be perfect for storing in an IRA account.

Statistics

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

External Links

kitco.com

takemetothesite.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

How To

How To Buy Gold For Your Gold IRA

A term that describes precious metals is gold, silver and palladium. It's any element naturally occurring with atomic numbers 79 to 110 (excluding helium), that is valued for its rarity or beauty. Gold and silver are the most popular precious metals. Precious Metals are often used for money, jewelry and industrial goods.

Supply and demand affect the gold price daily. There has been a significant demand for precious metals over the past decade as investors look for safe havens in unstable economies. This has resulted in a substantial rise in the prices. But, investors in precious metals are becoming more cautious due to rising production costs.

Because gold is rare and durable, it makes a good investment. Gold never loses its value, unlike other investments. You can also sell or buy gold without paying any taxes. There are two ways you can invest in gold. You can purchase gold coins and bars or invest in gold futures contracts.

In-dispute liquidity can be achieved with physical gold bars or coins. They are easy to trade and keep. They don't provide much protection against inflation. Consider purchasing gold bullion if you want to be protected from rising prices. Bullion is physical gold, which comes in many sizes and shapes. One-ounce pieces are available for billions, while larger quantities such as kilobars and tens of thousands can be purchased. Bullion is typically stored in vaults to protect it from theft and fire.

Gold futures can be a great way to buy shares rather than actual gold. Futures let you speculate about how gold's price might change. Gold futures allow you to be exposed to its price without owning any physical commodity.

For instance, if I wanted speculation on whether gold prices would go up or lower, I could buy a contract for gold. My position at the expiration of the contract will be either “long-term” or “short-term.” If I have a long contract, it means that I believe gold's price will rise. In exchange, I'll give money now and promise to get more when the contract ends. A short contract, on the other hand, means I believe the price of gold is going to drop. I'm willing and able to take the money now, in return for the promise that I will make less money later.

I'll get the contract's specified amount of gold plus interest when it expires. This gives me exposure to the gold price, but I don't have to own it.

Precious metals are a great investment as they are hard to counterfeit. While paper currencies can be easily counterfeited by printing new bills, precious metals cannot. Because of this, precious metals have traditionally held their value well over time.

—————————————————————————————————————————————————————————————-

By: Weezel

Title: The Environmental Impact of Gold Mining: A Comparison with Bitcoin

Sourced From: bitcoinmagazine.com/markets/the-environmental-cost-of-gold-mining

Published Date: Wed, 17 Jan 2024 12:30:00 GMT