Bitcoin experienced a significant drop below $60,000 due to escalating tensions between Iran and Israel, raising concerns about potential Western involvement in a Middle East conflict. This scenario, common in the 21st century, could lead to higher inflation and disrupt global supply chains and commodity markets. Despite skeptics ridiculing Bitcoin's rapid sell-off in response to the news, it was one of the few assets available for trading over the weekend.

On-Chain Spending Behavior and Bitcoin Derivative Markets

Shifting focus from geopolitical issues, this article delves into the latest trends in on-chain spending behavior and Bitcoin derivative markets to assess whether the recent dip from $73,000 signifies a standard correction in a bull market or a cyclical peak.

Analysis of On-Chain Data

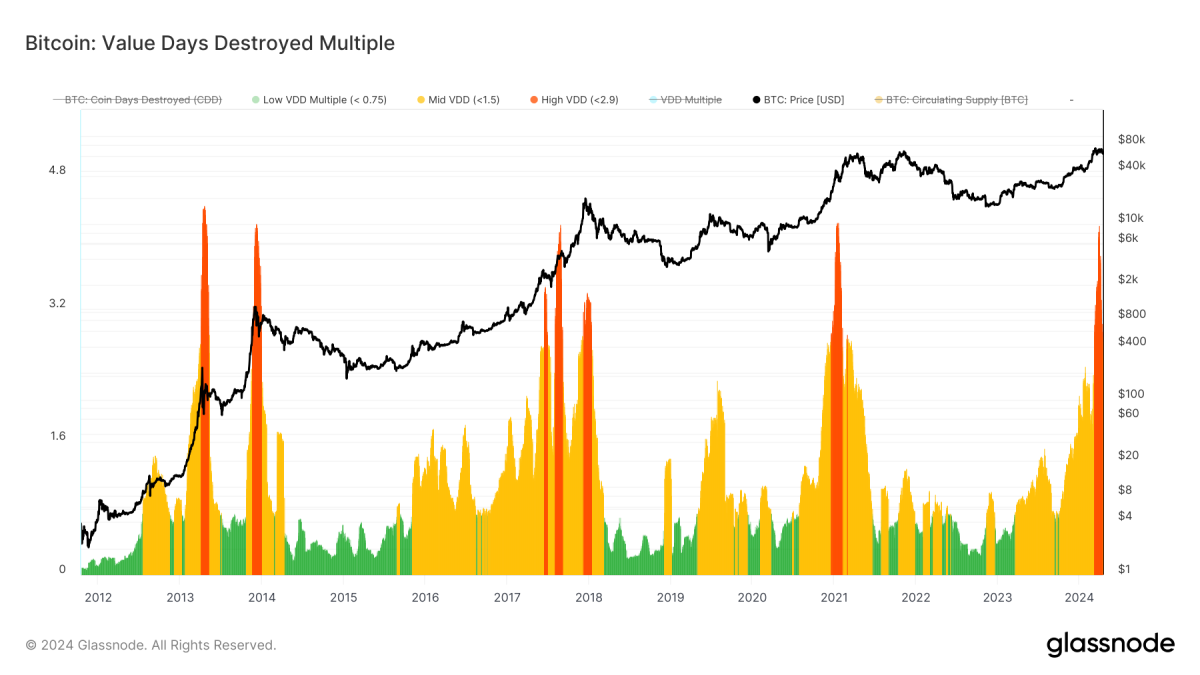

Examining the Value Days Destroyed Multiple, a metric created by TXMC, reveals near-term spending behavior compared to the yearly average. The data suggests that the bull market may have peaked, with approximately one-third of spending attributed to transfers from the Grayscale Bitcoin Trust to new ETF participants like BlackRock and Fidelity.

Interplay Between HODLers and New Entrants

Observing short-term and long-term holders during a typical bull market, revisits to the cost basis of short-term holders are considered healthy. The current psychological support level stands at around $58,500, indicating typical activity in a bull market.

Derivatives Market Analysis

The derivatives market reflects a flush of leverage and speculative activity, with futures trading at a slight discount to spot markets. While higher prices are not guaranteed, historical trends suggest potential for price appreciation. Notably, liquidatable leverage above $70,000 continues to increase, with shorts aiming to push prices below $60,000.

Despite a recent -33% pullback from all-time highs, strong spot demand is expected around $50,000. Any further dip may be short-lived, given the ongoing fiscal deficit spending pace. Overall, the current pullback and future fluctuations should be viewed positively by long-term investors, as Bitcoin's fundamentals remain strong.

In conclusion, this bull market shows resilience, and pullbacks play a crucial role in eliminating leverage and speculative activity during upward market trends. Investors are advised to "BTFD" – Buy The F***ing Dip.

Frequently Asked Questions

Can I buy Gold with my Self-Directed IRA?

Although you can buy gold using your self-directed IRA account, you will need to open an account at a brokerage like TD Ameritrade. You can also transfer funds from an existing retirement fund.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals can contribute up $1,000 per annum ($2,000 if they are married and jointly) directly to a Roth IRA.

You might want to purchase physical bullion, rather than futures contracts if you are going to invest in gold. Futures contracts are financial instruments based on the price of gold. They let you speculate on future price without having to own the metal. Physical bullion, however, is real gold and silver bars that you can hold in your hand.

Is gold a good choice for an investment IRA?

Any person looking to save money is well-served by gold. It can be used to diversify your portfolio. There's more to gold that meets the eye.

It's been used as a form of payment throughout history. It is often called “the most ancient currency in the universe.”

Gold is not created by governments, but it is extracted from the earth. It is very valuable, as it is rare and hard to create.

Gold prices fluctuate based on demand and supply. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. The value of gold rises as a consequence.

The flip side is that people tend to save money when the economy slows. This causes more gold to be produced, which lowers its value.

It is this reason that gold investing makes sense for businesses and individuals. You will benefit from economic growth if you invest in gold.

Also, your investments will earn you interest which can help increase your wealth. You won't lose your money if gold prices drop.

What is the tax on gold in Roth IRAs?

Investment accounts are subject to tax based only on their current value and not the amount you originally paid. So if you invest $1,000 in a mutual fund or stock and then sell it later, any gains are subject to taxes.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. Only earnings from capital gains and dividends are subject to tax. These taxes do not apply to investments that have been held for more than one year.

These accounts are subject to different rules depending on where you live. In Maryland, for example, withdrawals must be made within 60 days of reaching the age of 59 1/2 in order to qualify. Massachusetts allows you up to April 1st. And in New York, you have until age 70 1/2 . To avoid penalties, you should plan ahead and take distributions as soon as possible.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement funds

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- How do you keep your IRA Gold at Home? It's not legal – WSJ

How To

The growing trend of gold IRAs

Investors are increasingly turning to gold IRAs as a way to diversify and protect their portfolios from inflation.

Owners of the gold IRA can use it to invest in physical bars and bullion gold. It can be used as a tax-free way to grow and it is an alternative investment option for people who are not comfortable with stocks or bonds.

An investor can use a gold IRA to manage their assets and not worry about market volatility. The gold IRA can be used to protect against inflation or other potential problems.

Investors also enjoy the benefits of owning physical gold, which includes its unique properties such as durability, portability, and divisibility.

The gold IRA also offers many other benefits, such as the ability to quickly transfer the ownership of the gold to heirs, and the fact the IRS doesn't consider gold a currency.

This is why the gold IRA has become increasingly popular with investors looking to provide financial security during times of financial uncertainty.

—————————————————————————————————————————————————————————————-

By: Dylan LeClair

Title: The Current State of Bitcoin: Analyzing Market Trends and Investor Behavior

Sourced From: bitcoinmagazine.com/markets/dylan-leclair-bitcoin-bull-market-dip-or-cycle-regime-shift

Published Date: Wed, 17 Apr 2024 14:00:00 GMT