The U.S. Commodities Futures Trading Commission (CFTC) recently took legal action against Debiex, a fraudulent digital asset exchange platform that allegedly defrauded customers of $2.3 million. The CFTC claims that Debiex used romance scam tactics to deceive and steal from unsuspecting investors.

Debiex's Romance Scam Tactics

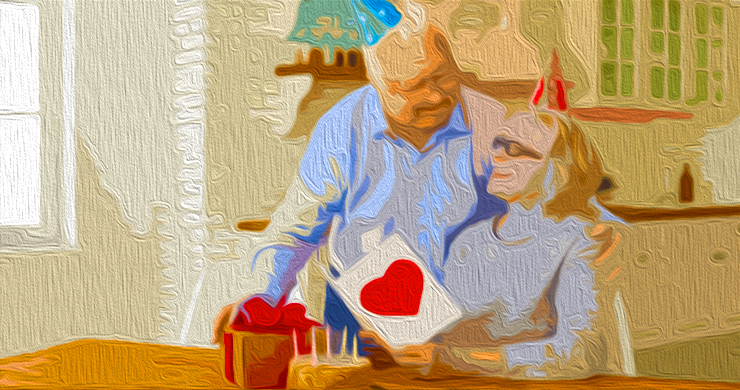

The CFTC alleges that Debiex employed romance scam tactics to carry out its fraudulent activities. By using these manipulative techniques, the exchange's representatives were able to swindle millions from five unnamed prospective investors. The CFTC has filed a civil suit against Debiex and identified Zhāng Chéng Yáng as a relief defendant for his suspected involvement in enabling the scam at least once.

The Director of Enforcement at the CFTC, Ian McGinley, commented on the civil enforcement action, stating, "This case exemplifies the Division of Enforcement's commitment to seeking justice for victims, combating misconduct, and holding accountable those who violate the anti-fraud provisions of the CEA."

The Elaborate Scam

The CFTC revealed that Debiex executed the scam from March 2022 until the present. The scheme involved various elements, including fake websites that closely resembled legitimate trading platforms, counterfeit customer service, and the use of money mules. Through these deceptive tools, the masterminds behind the scam convinced victims that Debiex was a legitimate crypto exchange.

Unfortunately, Debiex customers were unaware that the entire operation was an elaborate hoax designed to deceive potential investors.

The CFTC advises prospective investors to exercise caution and always verify a company's registration with the CFTC before investing any funds. By taking this precautionary step, individuals can protect themselves from falling victim to similar scams.

What are your thoughts on this story? Share your opinions in the comments section below.

CFTC

How To

Gold Roth IRA guidelines

You should start investing early to ensure you have enough money for retirement. As soon as you become eligible, which is usually around age 50, start saving and keep it up throughout your career. To ensure sufficient growth, it is vital that you contribute enough each year.

Also, you want to take advantage tax-free options such as a traditional 401k, SEP IRA or SIMPLE IRA. These savings vehicles enable you to make contributions while not paying any taxes on the earnings, until they are withdrawn. This makes them great options for people who don't have access to employer matching funds.

Savings should be done consistently and regularly over time. You may not be eligible for any tax benefits if your contribution is less than the maximum allowed.

—————————————————————————————————————————————————————————————-

By: Terence Zimwara

Title: The CFTC Files Civil Enforcement Action Against Bogus Crypto Exchange Debiex

Sourced From: news.bitcoin.com/cftc-files-civil-enforcement-action-against-bogus-crypto-exchange-debiex/

Published Date: Sun, 21 Jan 2024 09:00:12 +0000