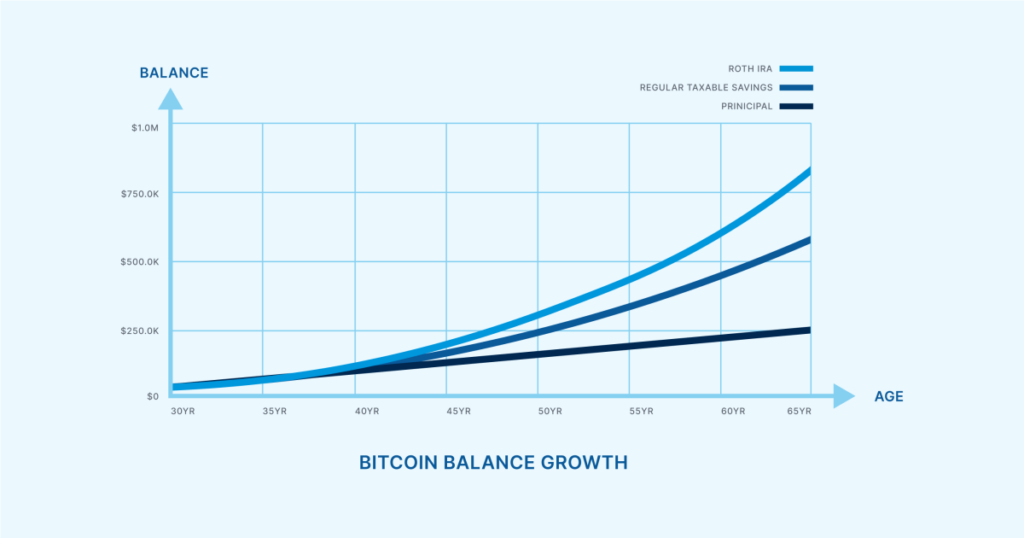

Considering adding bitcoin to your Roth IRA? Read on to explore four case studies that illustrate the benefits and considerations of holding bitcoin in a Roth IRA.

Case Study 1: Sally's Retirement Savings Strategy

Sally, in her early 30s, sees bitcoin as a long-term savings tool. By contributing to a bitcoin Roth IRA, Sally can benefit from tax-free growth, potentially saving over $117,000 in capital gains taxes by the time she retires. Additionally, she can withdraw contributions tax- and penalty-free for major life events like a vacation or a first-time home purchase.

Case Study 2: Rod's Retirement Planning

Rod, preparing for retirement, diversifies his portfolio with bitcoin through a Roth IRA. By strategically pulling from different "tax buckets" in retirement, Rod can optimize his tax situation and manage his income effectively. Adding a Roth IRA allows Rod to hold high-risk assets like bitcoin with the potential for tax-free growth.

Case Study 3: Larry's Inheritance Goals

Larry aims to leave a legacy for his loved ones by passing on bitcoin. With a Roth IRA, Larry can avoid Required Minimum Distributions and pass on assets tax-free to his beneficiaries. By converting pre-tax funds to a Roth, Larry can ensure tax-free growth for future generations.

Case Study 4: Wayne's Charitable Intent

Wayne, focused on leaving funds to charity, may not benefit from a Roth IRA due to his high current income and charitable intentions. Additionally, mining bitcoin within an IRA may not be advisable due to tax implications. Wayne's situation highlights the importance of considering individual factors when evaluating a Roth IRA.

Ultimately, the versatility of a Roth IRA combined with the potential of bitcoin can have a significant impact on your financial goals. Whether you're planning for retirement, considering inheritance, or looking to optimize tax efficiency, exploring a bitcoin Roth IRA could be a valuable strategy for your financial future.

CFTC

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- How do you keep your IRA Gold at Home? It's not exactly legal – WSJ

How To

Investing with gold or stocks

Gold investing as an investment vehicle can seem extremely risky these days. This is because many people believe that gold investment is no longer profitable. This belief arises because most people believe that the global economy is driving down gold prices. They feel that gold investment would cause them to lose money. There are many benefits to investing in gold. Below we'll look at some of them.

One of the oldest forms known of currency is gold. Its use can be traced back to thousands of years ago. It is a valuable store of value that has been used by many people throughout the world. As a means of payment, South Africa and many other countries still rely on it.

It is important to determine the price per Gram that you will pay for gold when making a decision about whether or not to invest. If you're interested in buying gold bullion, it is crucial that you decide how much per gram. You could contact a local jeweler to find out what their current market rate is.

It's worth noting, however, that while gold prices have fallen recently the cost of producing gold is on the rise. The price of gold may have fallen, but the production costs haven’t.

The amount of gold that you are planning to purchase is another important consideration when deciding whether or not gold should be bought. If you plan to buy enough gold to cover your wedding rings then it is probably a good idea to wait before buying any more. If you plan to do so as long-term investments, it is worth looking into. If you sell your gold for more than you paid, you can make a profit.

We hope this article helped you to gain a better appreciation of gold as a tool for investment. We recommend you do your research before making any final decisions. Only after you have done this can you make an informed choice.

—————————————————————————————————————————————————————————————-

By: Unchained

Title: Should You Include Bitcoin in Your Roth IRA? Four Case Studies

Sourced From: bitcoinmagazine.com/guides/four-case-studies-should-you-hold-bitcoin-in-a-roth-ira

Published Date: Sun, 17 Mar 2024 14:00:00 GMT