Financial Firms Optimistic about SEC's Approval

Financial firms in the cryptocurrency industry are feeling confident that the Securities and Exchange Commission (SEC) will rule in favor of approving spot Bitcoin Exchange-Traded Funds (ETFs) after January 8, 2024. This development comes after discussions between spot Bitcoin ETF issuers, such as BlackRock, and the SEC to finalize the details of their proposed ETFs. The regulator, however, has expressed concerns about potential money laundering activities through in-kind creations, leading them to insist on cash-only purchases of shares.

ETF Issuers Comply with SEC's Requirements

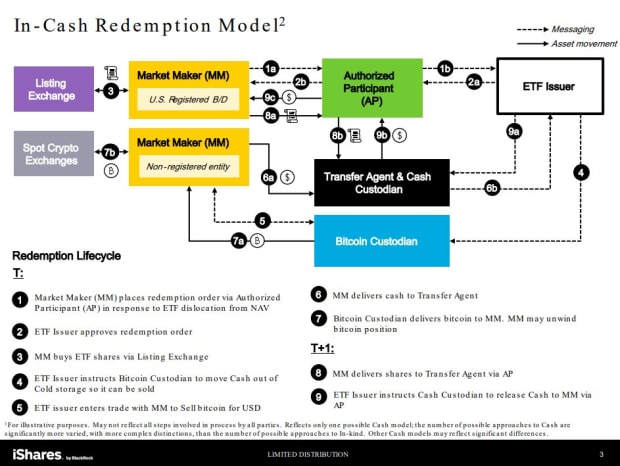

In response to the SEC's concerns, BlackRock and other ETF issuers have complied with the regulator's requirements and filed their ETFs to be in-cash for creations. Although the ETFs will hold spot bitcoin, investors will need to purchase shares using cash. This means that investors will provide cash to their chosen ETF issuer, who will then use the funds to acquire spot bitcoin for the ETF. Bloomberg senior ETF analyst Eric Balchunas believes that this move by BlackRock, one of the largest asset management firms, signifies the end of the debate regarding in-kind creations for Bitcoin ETFs.

Significant Milestone for Bitcoin's Integration

If the SEC approves these proposed Bitcoin ETFs, it will mark a significant milestone in the legitimization and integration of Bitcoin into traditional investment portfolios. The approval would also signal a shift in regulatory sentiment towards greater acceptance and regulation of Bitcoin. This move by the SEC holds the potential to boost the adoption of Bitcoin among institutional investors and pave the way for further regulatory advancements in the cryptocurrency industry.

Anticipation in the Financial Industry

While the SEC has not made any official statements regarding these discussions, Charles Gasparino's post on Fox Business has generated interest and optimism within the financial industry. Stakeholders are eagerly anticipating a potential approval around January 8, which could have a profound impact on the future of Bitcoin and its status as a mainstream investment asset.

CFTC

How To

Tips for Investing in Gold

Investing in Gold is a popular investment strategy. Because investing in gold has many benefits. There are several ways to invest in gold. There are many ways to invest in gold. Some prefer buying physical gold coins while others prefer gold ETFs (Exchange Traded Funds).

Before buying any kind of gold, you need to consider these things.

- First, verify that your country permits gold ownership. If you have permission to possess gold in your country, you can then proceed. You can also look at buying gold abroad.

- You should also know the type of gold coin that you desire. You have the option of choosing yellow, white, or rose gold.

- Third, consider the cost of gold. It is best to start small and work your way up. When purchasing gold, diversify your portfolio. Diversifying assets should include stocks, bonds real estate mutual funds and commodities.

- You should also remember that gold prices can change often. It is important to stay up-to-date with the latest trends.

—————————————————————————————————————————————————————————————-

By: Nik Hoffman

Title: SEC Expected to Approve Spot Bitcoin ETFs, Boosting Adoption and Regulation

Sourced From: bitcoinmagazine.com/markets/fox-business-firms-feel-confident-sec-will-approve-spot-bitcoin-etfs-after-january-8

Published Date: Wed, 20 Dec 2023 16:03:12 GMT