Introduction

Renowned author Robert Kiyosaki, best known for his book Rich Dad Poor Dad, has recently recommended investing in bitcoin exchange-traded funds (ETFs). With concerns over the global economy slowing down and the possibility of a depression, Kiyosaki advises investors to take proactive measures and avoid being caught off guard.

Robert Kiyosaki and Spot Bitcoin ETFs

Robert Kiyosaki, co-author of the bestselling book Rich Dad Poor Dad, suggests that investors consider bitcoin ETFs as an alternative to direct investment in bitcoin. Rich Dad Poor Dad, published in 1997 and co-authored by Kiyosaki and Sharon Lechter, has been on the New York Times Best Seller List for over six years and has sold over 32 million copies worldwide.

Economic Concerns

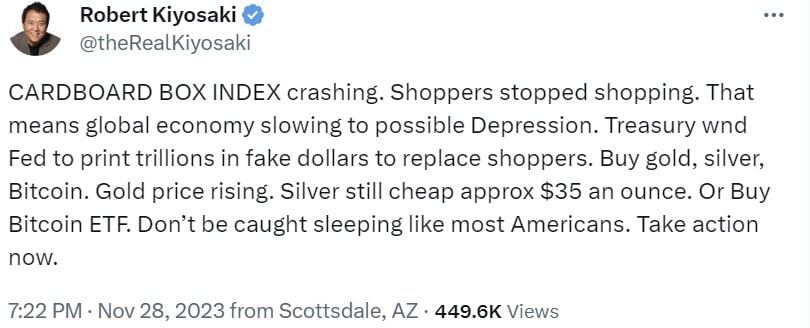

Expressing his concerns on social media platform X, Kiyosaki points to the Cardboard Box Index, an indicator used by some investors to gauge consumer goods production, which he claims is in decline. According to Kiyosaki, a decrease in shopping indicates a potential global economic downturn that could lead to a depression. He anticipates that the U.S. Treasury and Federal Reserve will respond by printing trillions of dollars, which he refers to as "fake dollars."

Investment Recommendations

In response to these concerns, Kiyosaki suggests his usual choices of gold, silver, and bitcoin. He highlights the rising price of gold and the relatively low cost of silver as attractive investment options. Additionally, he recommends considering a bitcoin ETF as an alternative investment avenue. He emphasizes the need for immediate action and proactive measures to avoid being caught off guard in the face of potential economic challenges.

Past Warnings and Predictions

This is not the first time that Kiyosaki has warned about a potential depression. In July, he predicted the coming of a depression, and in February, he cautioned about an impending crash that could lead to a depression. Kiyosaki's projections include gold being valued at $5,000, silver at $500, and bitcoin at $500,000 by 2025. He attributes these predictions to the expected loss of faith in the U.S. dollar, which he refers to as "fake money." In his view, gold and silver are considered "God's money," while bitcoin is seen as "people's money."

Bitcoin ETFs in the U.S.

Kiyosaki does not specify the type of bitcoin ETFs he recommends. In the U.S., there are currently futures bitcoin ETFs available, but the Securities and Exchange Commission (SEC) has yet to approve a spot bitcoin ETF. SEC Chairman Gary Gensler recently stated that the regulator is reviewing between eight and ten spot bitcoin ETF applications. Former NYSE president Thomas Farley expects a significant inflow of money into the crypto industry once spot bitcoin ETFs are approved. Microstrategy chairman Michael Saylor also predicts a doubling of demand for bitcoin following the halving and the approval of spot bitcoin ETFs.

Conclusion

Robert Kiyosaki's recommendation to invest in bitcoin ETFs comes in the wake of economic concerns and the potential for a global downturn. As an experienced author and investor, Kiyosaki suggests proactive measures such as investing in gold, silver, and bitcoin to safeguard against potential economic challenges. While the specific type of bitcoin ETFs is not mentioned, the approval of spot bitcoin ETFs in the U.S. is anticipated to bring significant changes to the crypto industry.

Your Thoughts

What are your thoughts on Robert Kiyosaki's advice? Do you agree with his investment recommendations? Share your opinions in the comments section below.

Frequently Asked Questions

What precious metals do you have that you can invest in for your retirement?

Gold and silver are the best precious metal investments. Both can be easily bought and sold, and have been around since forever. Consider adding them to the list if you're looking to diversify and expand your portfolio.

Gold: This is the oldest form of currency that man has ever known. It is stable and very secure. It's a great way to protect wealth in times of uncertainty.

Silver: Silver is a popular investment choice. It's a good choice for those who want to avoid volatility. Silver tends instead to go up than down, which is unlike gold.

Platinum: This precious metal is also becoming more popular. It's like silver or gold in that it is durable and resistant to corrosion. It's however much more costly than any of its counterparts.

Rhodium. Rhodium is used as a catalyst. It is also used in jewelry-making. It's also relatively inexpensive compared to other precious metals.

Palladium: Palladium is similar to platinum, but it's less rare. It's also less expensive. For these reasons, it's become a favorite among investors looking to add precious metals to their portfolios.

Can I have physical gold in my IRA

Gold is money. Not just paper currency. Gold is an asset people have used for thousands years as a place to store value and protect their wealth from economic uncertainty and inflation. Gold is a part of a diversified portfolio that investors can use to protect their wealth from financial uncertainty.

Many Americans are now more inclined to invest in precious metals like gold and silver than stocks or bonds. It is possible to make money by investing in gold. However, it doesn't guarantee that you'll make a lot of money.

One reason is that gold historically performs better than other assets during financial panics. Gold prices rose nearly 100 percent between August 2011 and early 2013, while the S&P 500 fell 21 percent over the same period. Gold was one asset that outperformed stocks in turbulent market conditions.

The best thing about gold investing is the fact that there's virtually no counterparty risk. You still have your shares even if your stock portfolio falls. If you have gold, it will still be worth your shares even if the company in which you invested defaults on its debt.

Finally, gold provides liquidity. This allows you to sell your gold whenever you want, unlike many other investments. It makes sense to buy small quantities of gold, as it is more liquid than other investments. This allows you take advantage of the short-term fluctuations that occur in the gold markets.

How can I withdraw from a Precious metal IRA?

First decide if your IRA account allows you to withdraw funds. Make sure you have enough cash in your account to cover any fees, penalties, or charges that may be associated with withdrawing money from an IRA.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. If you decide to go with this option, you will need to take into account the taxes due on the amount you withdraw.

Next, you'll need to figure out how much money you will take out of your IRA. This calculation is affected by many factors, such as the age at which you withdraw the money, the amount of time the account has been owned, and whether your plans to continue contributing to your retirement fund.

Once you have determined the percentage of your total savings that you would like to convert to cash, you can then decide which type of IRA to use. Traditional IRAs permit you to withdraw your funds tax-free once you turn 59 1/2. Roth IRAs have income taxes upfront, but you can access the earnings later on without paying additional taxes.

After these calculations have been completed, you will need to open a brokerage bank account. To encourage customers to open accounts, brokers often offer signup bonuses and promotions. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When it comes time to withdraw your precious metal IRA funds, you will need a safe location where you can keep your coins. While some storage facilities accept bullion bars and others require that you purchase individual coins, others will allow you to store your coins in their own safe. You'll have to weigh the pros of each option before you make a decision.

Bullion bars, for example, require less space as you're not dealing with individual coins. But, each coin must be counted separately. On the flip side, storing individual coins allows you to easily track their value.

Some people prefer to keep coins safe in a vault. Others prefer to store their coins in a vault. Regardless of the method you prefer, ensure that your bullion is safe so that you can continue to enjoy its benefits for many years.

What is the cost of gold IRA fees

The Individual Retirement Account (IRA), fee is $6 per monthly. This fee includes account maintenance fees as well as any investment costs related to your selected investments.

You may have to pay additional fees if you want to diversify your portfolio. These fees will vary depending upon the type of IRA chosen. Some companies offer checking accounts for free, while others charge monthly fees for IRA account.

Most providers also charge an annual management fee. These fees range between 0% and 1 percent. The average rate is.25% per year. These rates can be waived if the broker is TD Ameritrade.

Do you need to open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. You cannot recover any money you have invested. This includes all investments that are lost to theft, fire, flood, or other causes.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These coins have been around for thousands and represent a real asset that can never be lost. These items are worth more today than they were when first produced.

If you decide to open an IRA account, choose a reputable company that offers competitive rates and products. You should also consider using a third party custodian to protect your assets and give you access at any time.

If you decide to open an account, remember that you won't see any returns until after you retire. So, don't forget about the future!

Can I buy or sell gold from my self-directed IRA

While you can purchase gold from your self-directed IRA (or any other brokerage firm), you must first open a brokerage account such as TD Ameritrade. You can also transfer funds from another retirement account if you already have one.

Individuals can contribute as much as $5,500 per year ($6,500 if married filing jointly) to a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

You might want to purchase physical bullion, rather than futures contracts if you are going to invest in gold. Futures contract are financial instruments that depend on the gold price. These contracts allow you to speculate on future gold prices without actually owning it. But physical bullion refers to real gold and silver bars you can carry in your hand.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement funds

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- You want to keep gold in your IRA at home? It's Not Exactly Legal – WSJ

finance.yahoo.com

How To

The best place to buy silver or gold online

Before you can buy gold, it is important to understand its workings. Precious metals like gold are similar to platinum. It's very rare, and it is often used as money for its durability and resistance. It is hard to use, so most people prefer jewelry made of it to real bars of gold.

Two types of gold coins are available today: the legal tender type and the bullion type. Legal tender coins are minted for circulation in a country and usually include denominations like $1, $5, $10, etc.

Bullion coin are not intended for investment. However, their value will increase with inflation.

They aren't circulated in any currency exchange systems. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. Each dollar spent earns the buyer 1 gram gold.

Next, you need to find out where to buy gold. If you want to purchase gold directly from a dealer, then a few options are available. First off, you can go through your local coin shop. You can also go to a reputable website such as eBay. You can also look into buying gold online from private sellers.

Individuals who sell gold at wholesale and retail prices are called private sellers. Private sellers charge a 10% to 15% commission per transaction. Private sellers will typically get you less than a coin shop, eBay or other online retailers. This option can be a good choice for investing in gold because it allows you to control the price.

Another option for buying gold is to invest in physical gold. It is easier to store physical gold than paper certificates. But, you still have to take care of it. To ensure that your physical gold remains safe, you need to secure it in an impenetrable container such as a vault or safety deposit box.

To purchase gold by yourself, you can visit a bank and a pawnshop. A bank will be able to provide you with a loan for the amount of money you want to invest in gold. Pawnshops are small establishments allowing customers to borrow money against items they bring. Banks charge higher interest rates than those offered by pawn shops.

Another way to purchase gold is to ask another person to do it. Selling gold is also easy. Set up a simple account with GoldMoney.com and you will start receiving payments instantly.

—————————————————————————————————————————————————————————————-

By: Kevin Helms

Title: Robert Kiyosaki Recommends Buying Bitcoin ETFs Amid Economic Concerns

Sourced From: news.bitcoin.com/rich-dad-poor-dad-author-robert-kiyosaki-recommends-buying-bitcoin-etfs/

Published Date: Thu, 30 Nov 2023 02:30:00 +0000