Robert Kiyosaki, the author of Rich Dad Poor Dad, urges investors to closely monitor the upcoming Bitcoin halving. As the event draws near, Kiyosaki emphasizes the importance of paying attention to this significant occurrence. Despite revealing that he is $1 billion in debt, the famous author does not see it as a problem. Instead, he views debt as a means to acquire assets, including bitcoin, as he expresses his lack of trust in the U.S. dollar.

Robert Kiyosaki Highlights the Importance of Bitcoin Halving for Investors

Renowned for his book Rich Dad Poor Dad, which he co-authored with Sharon Lechter in 1997, Robert Kiyosaki brings attention to the upcoming Bitcoin halving in April as a key event for investors to keep an eye on. With over six years on the New York Times Best Seller List, Rich Dad Poor Dad has sold more than 32 million copies in over 51 languages across 109 countries.

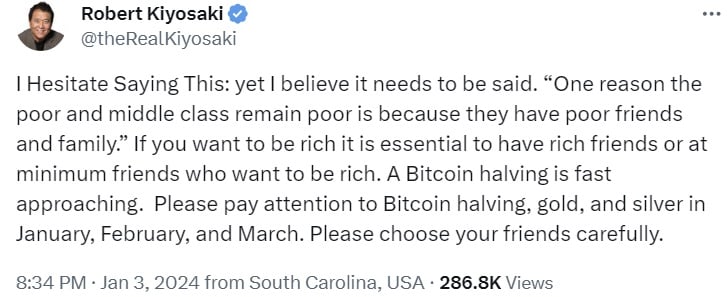

On the social media platform X, Kiyosaki shares his insights on the financial status of the poor and middle class. He suggests that one contributing factor is their social circle. According to him, having rich friends, or at the very least, friends who aspire to be rich, is essential for those who seek wealth. Kiyosaki concludes his post by emphasizing the significance of the upcoming Bitcoin halving and advises investors to also pay attention to gold and silver in January, February, and March.

Kiyosaki has long been an advocate for gold, silver, and bitcoin. In a recent Instagram reel, he discloses that he is more than $1 billion in debt, but he does not consider it his problem. He confidently states, "Not my problem," adding that if he goes bankrupt, the bank will face the same fate. The acclaimed author explains that while most people use debt to acquire liabilities, he uses it to acquire assets. He reveals that his Ferrari and Rolls-Royce are both fully paid off because they are considered liabilities. Kiyosaki further explains his approach, stating that he converts all the cash he earns into silver and gold. He also emphasizes his ownership of bitcoin, as he has lost trust in the U.S. dollar.

The upcoming Bitcoin halving, coupled with the potential approval of spot exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC), has heightened expectations of a significant surge in BTC price. Michael Saylor, the executive chairman of Microstrategy, predicts that demand will double following the halving. An analyst previously suggested that the bitcoin halving could push the price of BTC to $400,000. Other price forecasts include Pantera Capital's prediction of $148,000 and Fundstrat's projection of $180,000.

What are your thoughts on the advice given by Robert Kiyosaki, author of Rich Dad Poor Dad? Let us know in the comments section below.

Frequently Asked Questions

What are some of the advantages and disadvantages to a gold IRA

For those who don't have the ability to access traditional banking services but want to diversify their portfolios, a gold IRA can be a great investment option. It allows you to invest freely in precious metals, such as gold, silver and platinum until they are withdrawn.

There is a downside to this: if you withdraw your earnings early, you'll be subject to normal income tax. However, these funds are kept outside the country and cannot be seized by creditors if you default.

If you are looking to own gold without worrying about taxes, a golden IRA could be for you.

Does a gold IRA make money?

Yes, but not as often as you think. It all depends on how risky you are willing to take. If you can afford to invest $10,000 every year for 20-years, you could possibly have $1,000,000 by retirement age. However, if all your eggs are in one basket, then you will lose everything.

Diversifying investments is crucial. Gold does well when there is inflation. You want to make investments in an asset class that rises with inflation. Stocks perform this well because they rise whenever companies increase their profits. Bonds also do this well. They pay interest each year. They are great in times of economic growth.

But what happens if there's no inflation? During deflationary periods, bonds fall in value while stocks fall further. Investors should not put all of their savings in one investment such as a stock mutual fund or bond.

They should instead invest in a combination of different types of funds. They could invest in stocks or bonds. They could also invest both in bonds and cash.

This gives them exposure to both sides. Inflation and deflation. They will still experience a return with time.

How can I withdraw from an IRA with Precious Metals?

You may consider withdrawing your funds if you have an account with a precious metal IRA company such as Goldco International Inc. If you decide to sell your metals this way, they will be much more valuable than if they were inside the account.

Here is how to withdraw precious metal IRA funds.

First, find out whether your precious metal IRA provider allows withdrawals. This option is available from some companies, but not all.

Second, determine whether you can take advantage of tax-deferred gains by selling your metals. This benefit is provided by almost all IRA providers. Some IRA providers offer this benefit, but others don't.

Third, you should check with the provider of your precious metal IRA to determine if there are fees for these steps. There may be an additional charge for withdrawing.

Fourth, keep track of your precious metal IRA investments for at least three years after you sell them. To put it another way, you should wait until January 1st every year to calculate capital gains from your investment portfolio. Next, fill out Form 8949 to determine the amount you gained.

The IRS requires that you report your sale of precious metals. This will ensure you pay taxes on all the profits that your sales generate.

Consult a trusted attorney and accountant before selling your precious materials. They can help you avoid costly mistakes and ensure you comply with all regulations.

Which precious metals are best to invest in retirement?

Understanding what you have now saved and where you are currently saving money is the first step in retirement planning. Take a look at everything you own to determine how much you have left. This includes stocks, bonds and mutual funds, as well as certificates of deposit (CDs), life policies, annuities and 401(k), plans, real estate investments and other assets, such precious metals. Take all of these items and add them together to find how much you have left for investment.

If you haven't already done so, you may want to consider opening a Roth IRA account if you're younger than 59 1/2 years old. A Roth IRA, on the other hand, allows you to subtract contributions from your taxable revenue. But, future earnings won't allow you to take tax deductions.

You will need another investment account if you decide that you require more money. Start with a regular brokerage.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

External Links

investopedia.com

wsj.com

takemetothesite.com

forbes.com

How To

How to turn your IRA into a IRA with gold content

You want to convert your retirement savings from a traditional IRA to a gold IRA. Well, this article will help you do just that. Here are the steps to help you make the change.

“Rolling over” is the act of transferring money from one type (traditional) to another type (gold). Rolling an account over offers tax advantages. People may also prefer to invest physical assets, such precious metals.

There are two types IRAs – Traditional IRAs (or Roth IRAs). The main difference between the two types of IRAs is that Roth IRAs do not allow investors to deduct taxes from their earnings. This means that if you have $5,000 invested in a Traditional IRA, you will only be able take out $4850 after five years. However, if you put the same amount into a Roth IRA you would be able keep every penny.

This is what you need to know if you want to convert an IRA from a conventional to a IRA to a IRA with gold.

First, you must decide whether to move your balance into a new bank account or transfer funds from your existing account to the new one. Any earnings over $10,000 will be subject to income tax at the regular rate. You can rollover your IRA to avoid paying income tax until you are 59 1/2.

Once you have made up your mind, it is time to open a brand new account. It is likely that you will be asked to prove your identity by providing proof such as a Social Security card or passport. Next, you will need to complete paperwork proving your ownership of the IRA. Once you've filled out the forms you'll send them to your bank. They'll verify your identity and give instructions on where to send the checks and wire transfers.

This is the fun part. The fun part is when you deposit cash into the account, and then wait for the IRS approval. After you receive approval, you'll get a letter stating that you can now begin withdrawing funds.

That's it! Now, all you have left to do is relax and watch your wealth grow. If you decide to convert your IRA you can close it and transfer the remaining balance into a different IRA.

—————————————————————————————————————————————————————————————-

By: Kevin Helms

Title: Rich Dad Poor Dad Author Robert Kiyosaki Advises Investors to Pay Attention to Bitcoin Halving

Sourced From: news.bitcoin.com/rich-dad-poor-dad-author-robert-kiyosaki-advises-investors-to-pay-attention-to-bitcoin-halving/

Published Date: Fri, 05 Jan 2024 05:00:23 +0000