Ninety-one years ago today, President Franklin D. Roosevelt executed what would be known as the greatest legal heist in American history. Unlike typical robberies, this one did not involve breaking into safes or wielding firearms. Instead, it was achieved through the stroke of a pen on White House letterhead.

Background of Executive Order 6102

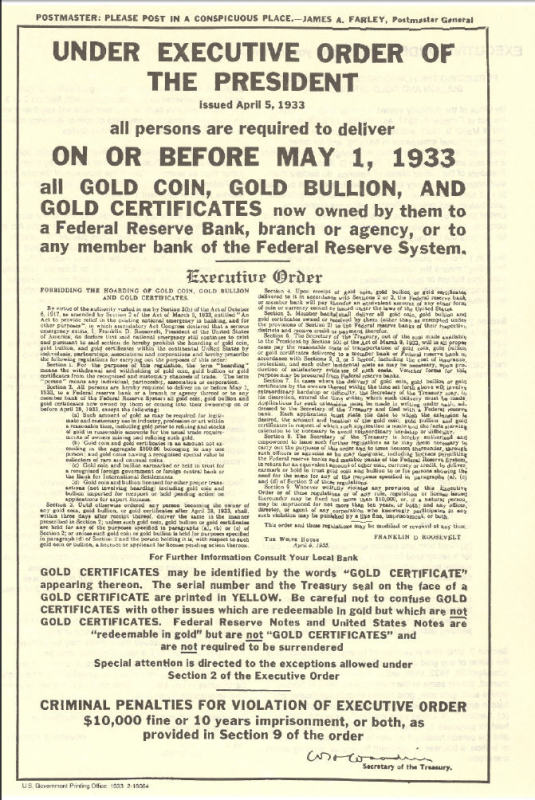

On April 5, 1933, FDR issued Executive Order 6102, which effectively made it illegal for any individual in the United States to possess gold. Citizens were mandated to surrender their gold to the government by the end of the month, facing a penalty of up to a $10,000 fine or 10 years in prison.

Significance of EO 6102

EO 6102 marked a significant milestone in the evolution of monetary history. It signaled the transition of the USA from a gold standard to a fiat standard, occurring between the establishment of the Federal Reserve in 1913 and the termination of the Bretton Woods system in 1971.

Lessons from History

While EO 6102 is often debated in the context of FDR's actions during the Great Depression, its true essence lies in how FDR navigated the legal landscape to enforce it. Despite the quasi-dictatorial nature of FDR's presidency, he leveraged specific legal mechanisms and executive powers to validate EO 6102.

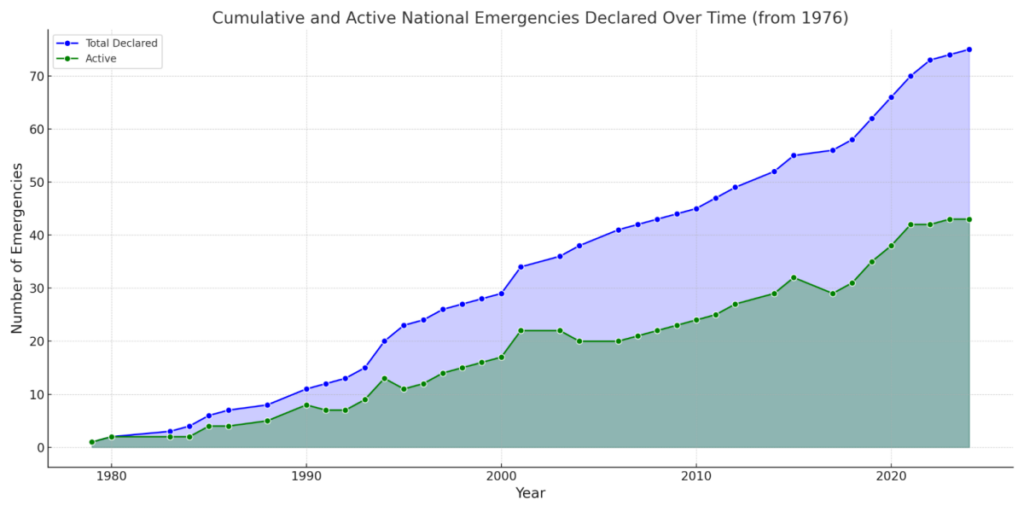

The Use of 'National Emergency'

The phrase 'national emergency' has been a potent tool for American Presidents to justify various actions since it was formally introduced in 1917. This term has been invoked over 80 times, with 42 declared emergencies still active today, showcasing the enduring nature of this concept.

The Evolution of Emergency Powers

The story of EO 6102 traces back to the Trading with the Enemy Act of 1917, a legislation that expanded the government's authority during wartime. Subsequent acts and amendments, including the Emergency Banking Act of 1933, further enhanced the President's control over financial matters during crises.

Could History Repeat Itself?

The crucial question arising from EO 6102 is whether a similar scenario could unfold in the future. With the ever-changing economic landscape and potential crises looming, the precedent set by FDR's order raises concerns about the government's authority to seize private assets under the guise of a national emergency.

Protecting Wealth in Uncertain Times

In today's digital era, the emergence of Bitcoin offers a new paradigm for safeguarding personal wealth against government overreach. With the ability to self-custody assets, individuals can potentially shield their finances from potential confiscation during turbulent times.

In conclusion, the legacy of Executive Order 6102 serves as a stark reminder of the power dynamics between the government and its citizens. As history unfolds, the need for financial autonomy and secure asset management remains a critical consideration in safeguarding personal wealth.

Frequently Asked Questions

What precious metal is best for investing?

This question is dependent on the amount of risk you are willing and able to accept as well as the type of return you desire. Gold has been traditionally considered a haven investment, but it's not always the most profitable choice. You might not want to invest in gold if you're looking for quick returns. If you have time and patience, you should consider investing in silver instead.

If you don’t want to be rich fast, gold might be the right choice. Silver might be a better investment option if steady returns are desired over a long period of time.

Should you open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. There is no way to recover money that you have invested in precious metals. This includes any loss of investments from theft, fire, flood or other circumstances.

Protect yourself against this type of loss by investing in physical gold or silver coins. These coins have been around for thousands and represent a real asset that can never be lost. These items are worth more today than they were when first produced.

Choose a reputable company with competitive rates and quality products if you are looking to open an IRA. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

If you decide to open an account, remember that you won't see any returns until after you retire. Keep your eyes open for the future.

Is buying gold a good retirement plan?

Buying gold as an investment may not seem very appealing at first glance, but when you consider how much people spend on average on gold per year worldwide, it becomes worth considering.

Physical bullion bar is the best way to invest in precious metals. You can also invest in gold in other ways. You should research all options thoroughly before making a decision on which option you prefer.

If you don’t have the funds to invest in safe places, such as a safe deposit box or mining equipment companies, buying shares of these companies might be a better investment. If you need cash flow from an investment, purchasing gold stocks is a good choice.

ETFs allow you to invest in exchange-traded funds. These funds give you exposure, but not actual gold, by investing in gold-related securities. These ETFs usually include stocks of precious metals refiners or gold miners.

Should You Invest Gold in Retirement?

It depends on how much you have saved and if gold was available at the time you started saving. If you're unsure about which option to choose then consider investing in both.

Gold offers potential returns and is therefore a safe investment. This makes it a worthwhile choice for retirees.

While most investments offer fixed rates of return, gold tends to fluctuate. As a result, its value changes over time.

But this doesn't mean you shouldn't invest in gold. It just means that you need to factor in fluctuations to your overall portfolio.

Another benefit to gold is its tangible value. Unlike stocks and bonds, gold is easier to store. It is also easily portable.

As long as you keep your gold in a secure location, you can always access it. Plus, there are no storage fees associated with holding physical gold.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

A portion of your savings can be invested in something that doesn't go down in value. Gold tends to rise when the stock markets fall.

Another advantage to investing in gold is the ability to sell it whenever you wish. Like stocks, you can sell your position anytime you need cash. You don't have to wait for retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't place all your eggs in the same basket.

You shouldn't buy too little at once. Begin by buying a few grams. Next, add more as required.

The goal is not to become rich quick. Instead, the goal is to accumulate enough wealth that you don't have to rely on Social Security.

While gold may not be the best investment, it can be a great addition to any retirement plan.

Who holds the gold in a gold IRA?

The IRS considers anyone who owns gold to be “a form money” and therefore subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

A financial planner or accountant should be consulted to discuss your options.

What tax is gold subject in an IRA

The fair market value at the time of sale is what determines how much tax you pay on gold sales. Gold is not subject to tax when it's purchased. It isn't considered income. If you sell it later you will have a taxable profit if the price goes down.

As collateral for loans, gold is possible. Lenders will seek the highest return on your assets when you borrow against them. In the case of gold, this usually means selling it. The lender might not do this. They might just hold onto it. They might decide that they want to resell it. Either way, you lose potential profit.

You should not lend against your gold if it is intended to be used as collateral. It is better to leave it alone.

What Precious Metals Can You Invest in for Retirement?

The best precious metal investments are gold and silver. They're both easy to buy and sell and have been around forever. If you want to diversify your portfolio, you should consider adding them to your list.

Gold: Gold is one the oldest forms currency known to man. It is also extremely safe and stable. Because of this, it's considered a good way to preserve wealth during times of uncertainty.

Silver: The popularity of silver has always been a concern for investors. It's a good choice for those who want to avoid volatility. Silver is more volatile than gold. It tends to rise rather than fall.

Platinum: A new form of precious metal, platinum is growing in popularity. It is very durable and resistant against corrosion, much like silver and gold. It's however much more costly than any of its counterparts.

Rhodium – Rhodium is used to make catalytic conversions. It's also used in jewelry making. It is also quite affordable compared with other types of precious metals.

Palladium: Palladium has a similarity to platinum but is more rare. It's also less expensive. This is why it has become a favourite among investors looking for precious metals.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

finance.yahoo.com

irs.gov

forbes.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

How To

The History of Gold as an Asset

From ancient times to the beginning of the 20th century, gold was used as a currency. It was accepted worldwide and became popular due to its durability, purity, divisibility, uniformity, scarcity, and beauty. Aside from its inherent value, it could be traded internationally. There was no international standard for measuring gold at that time, so different weights and measures were used around the world. For example, one pound sterling in England equals 24 carats; one livre tournois equals 25 carats; one mark equals 28 carats; and so on.

In the 1860s, the United States began to issue American coins made from 90% copper, 10% Zinc, and 0.942 Fine Gold. This led to a decrease of demand for foreign currencies which in turn caused their prices to rise. This was when the United States started minting large quantities of gold coins. The result? Gold prices began to fall. The U.S. government was unable to pay its debts due to too much money being in circulation. To do so, they decided to sell some of the excess gold back to Europe.

Most European countries distrusted the U.S. Dollar and began to accept gold as payment. Many European countries started to accept paper money as a substitute for gold after World War I. The price of gold has risen significantly since then. Even though the price of gold fluctuates, it remains one the best investments you can make.

—————————————————————————————————————————————————————————————-

By: Julian Fahrer

Title: National Emergency: Executive Order 6102 and the Heist of the Century

Sourced From: bitcoinmagazine.com/culture/national-emergency-executive-order-6102-and-the-heist-of-the-century-

Published Date: Fri, 05 Apr 2024 16:30:00 GMT