Introduction

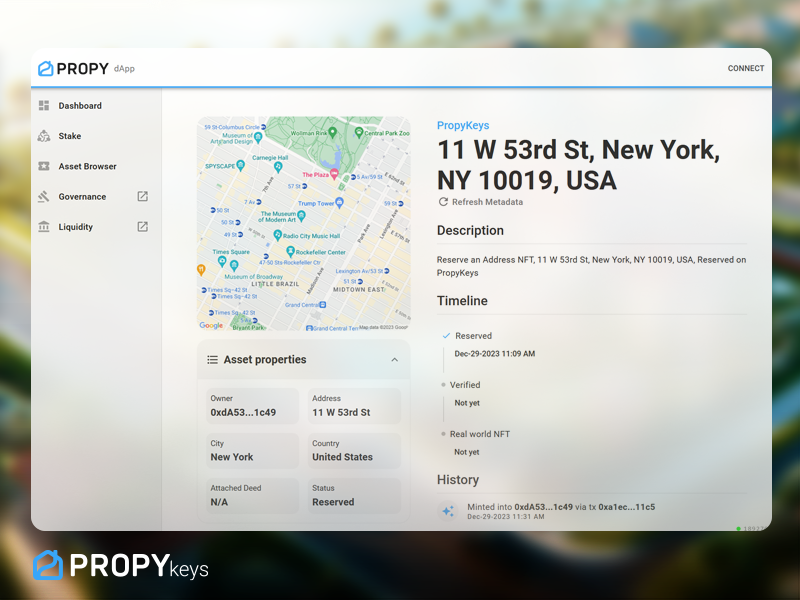

PropyKeys, a new gamified application, part of the Propy ecosystem, has launched a decentralized application (dApp) game that allows users to mint and trade real-world addresses onchain. Powered by the PRO token and launched on Base, a layer-2 network operating on top of Ethereum and part of the Coinbase ecosystem, PropyKeys is revolutionizing the home addresses market.

The Problem with Real Estate

Real estate has always been hindered by barriers to entry, such as high title fees and inefficiencies. However, blockchain technology has the potential to simplify these processes. Propy and its ecosystem companies are striving to make homeownership more affordable, user-friendly, and seizure-resistant. With a market value of $280 trillion, the real estate industry has been stuck in a "no trading zone," but PropyKeys aims to change that by providing a fun entry point to the Propy ecosystem and introducing onchain titles.

Unlocking Property Ownership

PropyKeys addresses critical pain points in the real estate market:

Democratized Minting and Trading

PropyKeys allows crypto natives to mint addresses, stake them, and facilitate seamless trades with property owners. Address NFTs can be minted for a PRO token fee. Home address holders and real property owners have advantages for the three tiers of NFTs. The fee structure for minting onchain addresses and property titles incentivizes community participation, with 100% of the collected fees being redirected to reward the network of address owners. Staking and governance participation also provide opportunities for token holders to contribute and earn rewards in PRO tokens.

Onchain Titles & RWA NFTs

Property owners can elevate their addresses to onchain titles, which can be staked or converted into Real World Asset (RWA) NFTs. These NFTs enable easy sales or micro mortgages, opening up new avenues for property transactions.

Trust & Security

PropyKeys champions an onchain, open-source, and community-governed title registry, leveraging user trust. By replacing paper deeds with algorithm-based systems, the platform ensures a trustworthy and secure environment for all users.

Get Your Real-World Address Minted Today

Visit PropyKeys.com today to mint your real-world address onchain and join the movement to empower accessible property transactions and ownership like never before. PropyKeys embodies trust and transparency, revolutionizing the real estate market by transitioning from conventional property registries to blockchain-based onchain titles. This shift instills trust in algorithms rather than centralized intermediaries and has the potential to transform not just the real estate sphere but also society as a whole.

About Propy

Propy is a pioneering platform that leverages blockchain technology to facilitate seamless transactions of real-world assets (RWA), with a focus on revolutionizing global real estate markets. As an industry leader, Propy specializes in providing secure and efficient solutions, ensuring an enhanced experience for buying and selling properties worldwide.

Contact Information

For media inquiries, please contact Andrew Zapo at andrew@propykeys.com.

Disclaimer: This press release contains forward-looking statements and should not be construed as investment advice. The actual results may differ materially from those projected in the forward-looking statements.

Note to editors: Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned in this press release.

Frequently Asked Questions

Which is more powerful: sterling silver or 14k gold?

Gold and silver are strong metals, but sterling silver is much less expensive because it contains 92% pure silver rather than just 24%.

Sterling silver is also called fine silver. It is made from a combination silver and other metals, such as zinc and copper.

Gold is considered very strong. It takes tremendous pressure to split it apart. If you drop something on top of a chunk of gold it will shatter into thousands of pieces rather than breaking into two halves.

On the other hand, silver is not nearly as strong as gold. If you dropped an item onto silver sheets, it would likely fold and bend without cracking.

Silver is often used to make jewelry and coins. Its value fluctuates based on demand and supply.

Are gold IRAs a good investment?

Purchase shares in mining companies to invest in precious metals like gold. You should buy shares in these companies to make money from investing in gold and other precious metals such as silver.

But, owning shares in direct form has two downsides:

First, you can lose money by holding onto your stock for too long. Stocks will fall faster than the underlying asset (like a gold mine) when they drop. This could mean that you lose money rather than making it.

Second, you could miss out on potential profit if you wait for the market to recover before you sell. So you may need to be patient and let the market recover before you profit from your gold holdings.

Physical gold can be beneficial if you prefer to keep investments separate from your finances. A gold IRA can help diversify your portfolio and protect against inflation.

You can find out more information about gold investing on our website.

Is it possible to hold precious metals in an IRA

This depends on the IRA's owner's desire to diversify or keep his holdings in silver and gold.

He has two options if he wishes to diversify. He could either buy bars of physical gold and/or sterling from a dealer or simply sell these items back at the end. Let's say he doesn’t want to sell back his precious metal investment. In that case, he should continue holding onto them as they would be perfectly suitable for storing within an IRA account.

Can I store my gold IRA at home?

An online brokerage account will allow you to invest in the most secure way possible. You will have the same investment options available as traditional brokers, but you won't need special licenses. There are no fees to invest.

A lot of online brokers offer tools for managing your portfolio. They will even let you download charts to see how your investments perform.

Statistics

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

External Links

takemetothesite.com

en.wikipedia.org

kitco.com

investopedia.com

How To

IRA-Approved Precious Metals

IRA-approved precious materials are excellent investments whether you're looking for ways to save money for retirement or to invest in your next business venture. Many options are available that can diversify your portfolio while protecting against inflation. These include silver coins, gold bars, and silver coins.

Precious metal investments products can be purchased in two forms. Bars and coins, which are physical bullion products, can be considered tangible assets as they are in tangible form. On the other hand, exchange-traded funds (ETFs) are financial instruments that track the price movements of an underlying asset, such as gold. ETFs can be purchased directly from the company issuing them, and trade in the same way as stocks on stock exchanges.

There are various types of precious metals available for purchase. Gold and silver are often used for jewelry making and decorating, while platinum and palladium are more commonly associated with luxury items. Palladium tends be more valuable than platinum which makes them ideal for industrial use. While silver can be used for industrial purposes, it is more commonly preferred for decorative purposes.

Physical bullion products tend to be more expensive due to the cost of mining and refining raw materials. These products are generally safer and more secure than paper currencies. For example, consumers may lose confidence in the currency and look for alternatives when the U.S. dollar loses purchasing power. Physical bullion products, on the other hand, do not depend on trust between companies or countries. Instead, they have the backing of central banks and governments. This gives customers confidence.

The supply and demand for gold affect the price of gold. If demand rises, the price will increase. Conversely, if supply exceeds demands, the price will drop. This dynamic creates opportunities for investors to profit from fluctuations in the price of gold. Physical bullion investors benefit because they have a greater return on their capital.

Contrary to traditional investments, precious metals can not be affected by economic recessions and interest rate changes. As long as demand remains strong, the price of gold will continue to rise. Precious metals, which are safe havens for times of uncertainty, are therefore considered to be safe havens.

The most widely used precious metals include:

- Gold – It is the oldest form of precious metallic and is sometimes called “yellow material”. Gold is a common name, but it's a rare element that can be found underground. The majority of the world's reserves of gold are located in South Africa, Australia and Peru.

- Silver – After gold, silver ranks second in precious metals. Silver, like gold, is extracted from natural deposits. Unlike gold, however, silver is typically extracted from ore rather than from rock formations. Because of its malleability and durability, as well resistance to tarnishing and conductivity, silver is widely used by industry and commerce. The United States makes more than 98% all of the global silver production.

- Platinum – Platinum is the third most valuable precious metal. It can be used to make high-end medical equipment, fuel cells, and catalytic converters. In dentistry, platinum is used to make bridges, crowns, and fillings.

- Palladium- Palladium, the fourth most precious precious metal, is Palladium. Due to its strength and stability, it is quickly gaining popularity among manufacturers. Palladium is also used for electronics, aerospace, military technology and automobiles.

- Rhodium – Rhodium is fifth most valuable precious metal. Rhodium is a rare metal, but it is highly sought-after because of its use as a catalyst for automobile engines.

- Ruthenium-Ruthenium is the sixth-most valuable precious metal. Although there is a limited supply of palladium and platinum, ruthenium can be found in abundance. It is used in steel making, aircraft engines, and chemical manufacturing.

- Iridium – Iridium is the seventh-most valuable precious metal. Iridium plays an important role in satellite technology. It is used in the construction of orbiting satellites that transmit TV signals and telephone calls.

- Osmium: Osmium is eighth most valuable precious metallic. Osmium can withstand extreme temperatures and is commonly used in nuclear reactors. It's also used in jewelry, medicine and cutting tools.

- Rhenium – Rhenium has been ranked as the ninth most valuable precious metallic. Rhenium is used for refining oil, gas, semiconductors, rocketry, and other purposes.

- Iodine: Iodine, the tenth highest-valued precious metal, is also known as Iodine. Iodine is used for photography, radiography and pharmaceuticals.

—————————————————————————————————————————————————————————————-

By: Media

Title: Mint and Trade Real-World Addresses Onchain With PropyKeys dApp, Part of Propy Ecosystem

Sourced From: news.bitcoin.com/mint-and-trade-real-world-addresses-onchain-with-propykeys-dapp-part-of-propy-ecosystem/

Published Date: Fri, 05 Jan 2024 08:15:37 +0000