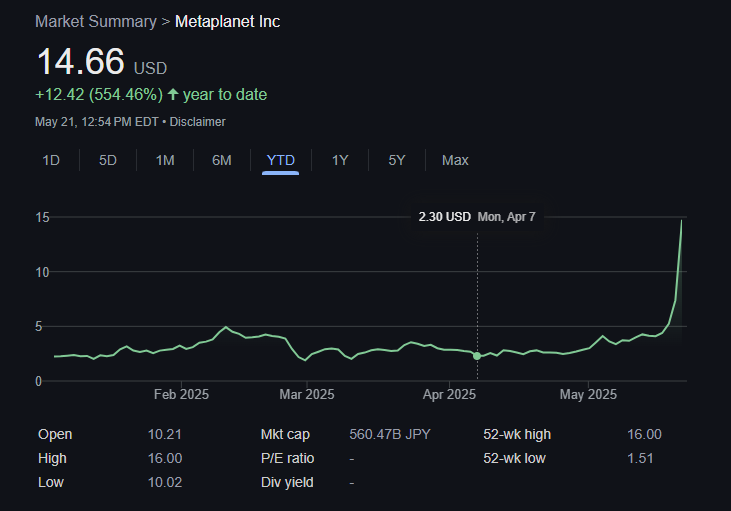

Hey there, crypto enthusiasts! Today, we're diving into the fascinating world of Metaplanet, Japan's premier Bitcoin treasury company, which has recently skyrocketed to a new all-time high in market capitalization. As Bitcoin smashes through its record price barriers, Metaplanet is riding the wave with unmatched enthusiasm and strategic moves.

The Meteoric Rise of Metaplanet

The Bitcoin Acquisition Strategy

Picture this: in just a bit over a year, Metaplanet has multiplied its Bitcoin holdings from a modest 98 BTC to a staggering 7,800 BTC as of May 19, 2025. That's like going from a tiny garden to a vast Bitcoin orchard, all harvested at an average price of $103,873 per coin. With Bitcoin's meteoric rise this year, that orchard is now a goldmine worth over $800 million!

The Innovative Financing Approach

Metaplanet's brilliance doesn't stop there. They recently completed a groundbreaking stock acquisition campaign, the "21 Million Plan," raising a whopping ¥93.3 billion in just 60 days. This innovative financing model allowed for additional Bitcoin purchases without diluting shareholder value. It's like doubling your dessert without compromising the main course!

The Strategic Moves

Alignment with Bitcoin's Trajectory

Metaplanet's success isn't luck; it's a well-thought-out strategy perfectly synced with Bitcoin's price movements. Since their pivot to a Bitcoin-centric approach in 2024, the company has seen remarkable quarterly BTC yields, driving their net asset value and market capitalization to dizzying heights alongside Bitcoin's rapid climb.

Financial Triumphs

In the first quarter of FY2025, Metaplanet reported its strongest financial results yet. With revenues and profits on the rise and substantial gains from Bitcoin holdings, the company's financial standing has never been more robust. It's like hitting a jackpot while riding a winning streak!

The Investor Magnet

Bitcoin Exposure on Tokyo Stock Exchange

Thanks to its strong correlation with Bitcoin's performance, many investors now view Metaplanet as a gateway to Bitcoin exposure on the Tokyo Stock Exchange. The company's growth story is not just about numbers; it's about being part of a thrilling journey towards financial innovation and success.

So, if you're looking to ride the Bitcoin wave with a strategic partner, keep your eyes on Metaplanet. It's not just about the numbers; it's about being part of a revolution in the making. Stay tuned for more updates on this exciting financial voyage!

Frequently Asked Questions

What precious metals do you have that you can invest in for your retirement?

Silver and gold are two of the most valuable precious metals. They are both easy to trade and have been around for years. These are great options to diversify your portfolio.

Gold: The oldest form of currency known to man is gold. It's also very safe and stable. This makes it a good option to preserve wealth in uncertain times.

Silver: Silver has been a favorite among investors for years. It is an excellent choice for investors who wish to avoid volatility. Silver tends instead to go up than down, which is unlike gold.

Platinum: A new form of precious metal, platinum is growing in popularity. It's resistant to corrosion and durable, similar to gold and silver. It is, however, more expensive than its competitors.

Rhodium: The catalytic converters use Rhodium. It is also used to make jewelry. It is also very affordable in comparison to other types.

Palladium: Palladium has a similarity to platinum but is more rare. It's also more affordable. It is a preferred choice among investors who are looking to add precious materials to their portfolios.

What is the best precious metal to invest in?

This question depends on how risky you are willing to take, and what return you want. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. You might not want to invest in gold if you're looking for quick returns. If you have the patience to wait, then you might consider investing in silver.

Gold is the best investment if you aren't looking to get rich quick. If you are looking for a long-term investment that will provide steady returns, silver may be a better choice.

How much do gold IRA fees cost?

The Individual Retirement Account (IRA), fee is $6 per monthly. This includes the account maintenance fees and any investment costs associated with your chosen investments.

To diversify your portfolio you might need to pay additional charges. These fees will vary depending upon the type of IRA chosen. Some companies offer free checking, but charge monthly fees for IRAs.

Most providers also charge annual management costs. These fees range from 0% to 1%. The average rate is.25% per year. These rates are usually waived if you use a broker such as TD Ameritrade.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

forbes.com

finance.yahoo.com

irs.gov

bbb.org

How To

Three ways to invest in gold for retirement

It is important to understand the role of gold in your retirement plan. You can invest in gold through your 401(k), if you have one at work. You may also be interested in investing in gold beyond your workplace. A custodial account can be opened by a brokerage firm like Fidelity Investments if you already have an IRA. If precious metals aren't your thing, you may be interested in buying them from a dealer.

If you do invest in gold, follow these three simple rules:

- Buy Gold With Your Cash – Do not use credit cards to purchase gold. Instead, deposit cash into your accounts. This will protect you from inflation and help keep your purchasing power high.

- Physical Gold Coins: You should own physical gold coins, not just a certificate. It's easier to sell physical gold coins rather than certificates. Physical gold coins don't require storage fees.

- Diversify Your Portfolio. Never place all your eggs in the same basket. By investing in multiple assets, you can spread your wealth. This helps to reduce risk and provides more flexibility when markets are volatile.

—————————————————————————————————————————————————————————————-

By: Oscar Zarraga Perez

Title: Metaplanet: Riding High Alongside Bitcoin's Soaring Prices

Sourced From: bitcoinmagazine.com/news/metaplanet-hits-new-all-time-high-as-bitcoin-hits-record-price

Published Date: Wed, 21 May 2025 17:33:11 +0000