Bitcoin as the Benchmark for Digital Asset Investors

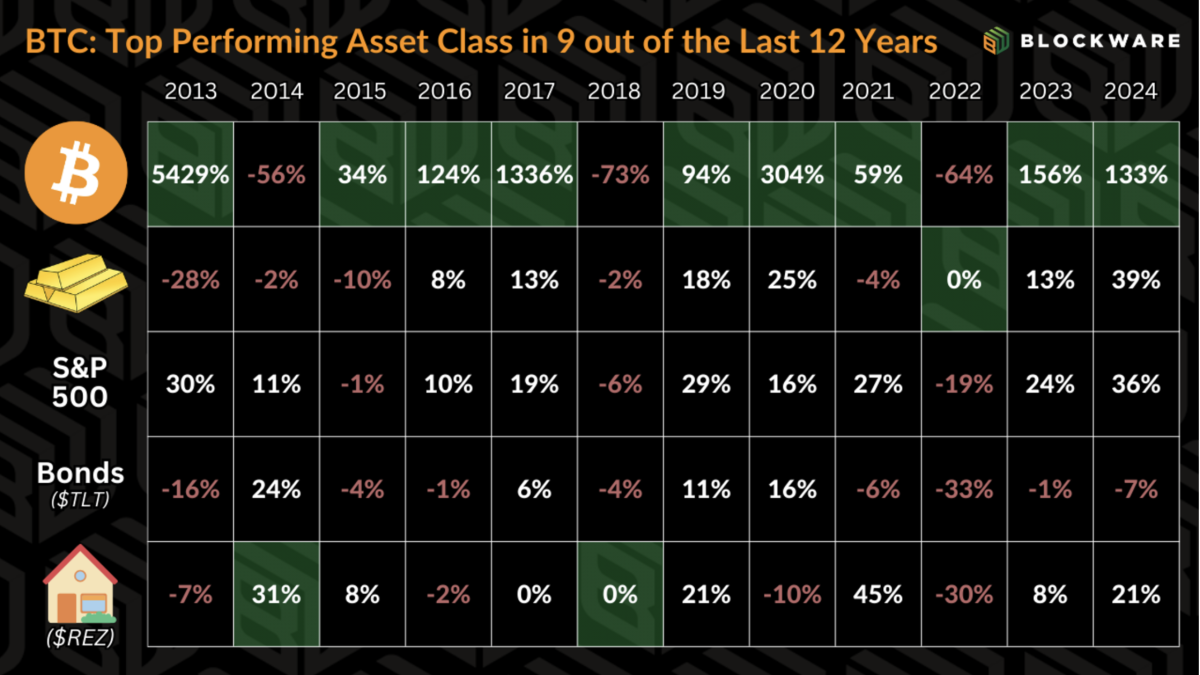

Bitcoin has consistently outperformed all major asset classes over the past decade, solidifying its role as the benchmark for digital asset investors. For those committed to Bitcoin’s long-term vision, the ultimate financial goal often shifts from acquiring more dollars to maximizing their Bitcoin holdings.

The Role of Bitcoin in Digital Assets

Bitcoin is to digital assets what treasury bonds are to the legacy finance system—a foundational benchmark. While no investment is without risk, Bitcoin held in self-custody eliminates counterparty risk, dilution risk, and other systemic risks common in traditional finance.

Bitcoin Yield: Acquiring More BTC

Another way to phrase this would be that the financial objective of digital asset investors is to acquire more BTC rather than acquire more dollars. All investments or spending are viewed through the lens of BTC being the opportunity cost.

Bitcoin Mining: A Strategy for Accumulating BTC

Bitcoin miners acquire BTC by contributing computational power to the Bitcoin network, and receiving a greater amount of BTC than what it costs in electricity to operate their machine(s). Now this is easier said than done. The Bitcoin protocol enforces a predetermined supply schedule using "difficulty adjustments" – meaning that more computational power dedicated towards Bitcoin mining results in the finite block rewards getting split up into smaller pieces.

Price Growth Outpacing Difficulty Growth

The price of a financial asset – specifically bitcoin – is set at the margin. This means that the asset’s price is determined by the most recent transactions between buyers and sellers. This dynamic creates opportunities for Bitcoin miners to accumulate vast amounts of bitcoin.

Price Volatility in Bitcoin Mining Hardware

In addition to wider profit margins during bull markets, Bitcoin miners have the simultaneous benefit of the fact that ASIC prices tend to move in tandem with the Bitcoin price. This gives miners a significant advantage when it comes to accumulating bitcoin.

Blockware Marketplace: Facilitating Bitcoin Mining

Blockware developed this platform to enable any investor – institutional or retail – the opportunity to gain direct exposure to Bitcoin mining. Users of the marketplace are able to purchase Bitcoin mining rigs that are hosted at one of Blockware’s tier 1 data centers and have access to industrial power prices. This innovation removes the obstacles that have historically made hosted mining difficult, enabling miners to concentrate on the mission: accumulating more Bitcoin.

For institutional investors looking for bulk pricing on mining hardware, contact the Blockware team directly.

Frequently Asked Questions

Can I store my gold IRA account at home?

Investing in an online brokerage account is the best way to keep your money safe. Online brokerage accounts offer all the same investment options and you do not need any special licenses. Additionally, investing is free.

You can also use free tools offered by many online brokers to manage your portfolio. To see the performance and trends of your investments, you can download charts from these brokers.

Can you keep precious metals inside an IRA

This question is dependent on whether an IRA owner wishes to diversify into gold or silver, or keep them safe.

If he does want to diversify, then there are two options available to him. He could buy physical bars of gold and/or silver from a dealer or sell these items back to the dealer at the end of the year. Let's say he doesn’t want to sell back his precious metal investment. He could keep the precious metals as long as he wants to.

What type of IRA is used for precious metals?

A Individual Retirement Account (IRA), is an investment vehicle offered by most financial institutions and employers. An IRA allows you to contribute money that is tax-deferred until it is withdrawn.

An IRA allows you to save taxes and pay them later when you retire. This allows you to save more money today and pay less taxes tomorrow.

An IRA's beauty is that earnings and contributions grow tax-free up to the time you withdraw them. When you do, there are penalties for early withdrawal.

Additional contributions can be made to your IRA even after you turn 50, without any penalty. If you decide to withdraw your IRA from retirement, you will owe income taxes as well as a 10% federal penalty.

A 5% IRS penalty is applicable to withdrawals made before the age of 59 1/2. For withdrawals made between the age of 59 1/2 & 70 1/2, a 3.4% IRS penalty will apply.

The IRS will penalize withdrawals of more than $10,000 annually.

What precious metals will be allowed in an IRA account?

The most common precious metallic used in IRA accounts, is gold. Investments in gold bullion coins or bars can be made as well.

Precious and precious metals are considered safe investments, as they don’t lose their value over the course of time. Precious metals are also great for diversifying an investment portfolio.

Precious metals are silver, palladium, and platinum. These three metals have similar properties. Each metal has its own unique uses.

In jewelry making, for instance, platinum is used. To create catalysts, palladium is used. Silver is used to producing coins.

Consider how much you plan to spend on gold when deciding on which precious metal to buy. A lower-cost ounce of gold might be a better option.

You should also think about whether you want to keep your investment private. If you have the desire to keep your investment private, palladium might be the best choice.

Palladium is more valuable than gold. It's also more rare than gold. You'll probably have to pay more.

When choosing between gold or silver, another important aspect is the storage fees. The weight of gold is what you store. For larger quantities of gold, you will be charged a higher storage fee.

Silver can be stored by volume. You'll pay less if you store smaller quantities of silver.

Keep in mind all IRS rules when you store precious metals inside an IRA. This includes keeping records of transactions and reporting them back to the IRS.

Can you make money in a gold IRA

Two things are necessary if you want to make a profit on your investment. First, you need to understand the market. Second, you need to know what type of products you have.

If you don't know, you shouldn't start trading until you are sure you have enough information to trade successfully.

A broker should offer the best service for each account type.

There are many account options available, including Roth IRAs (standard IRAs) and Roth IRAs (Roth IRAs).

You may also wish to consider a rollover if you already have other investments, such as stocks and bonds.

Statistics

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

External Links

regalassets.com

kitco.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

takemetothesite.com

How To

Things to Remember About the 2022 Best Precious Metals Ira

Precious Metals Ira ranks high among investors as one of their most popular investment options. This article will provide information on how to understand the appeal of precious metals ira and make sound investment decisions.

These assets' main appeal is their potential for long-term, sustainable growth. The historical data shows incredible returns for gold prices. Over the past 200+ years, gold prices rose from $20 to almost $1900 an ounce. In comparison, the S&P 500 Index only grew by around 50%.

In times of economic uncertainty, gold is often considered a safe haven. People will sell stocks to move to safety and security in gold when the stock exchange is experiencing a downturn. Inflation is also a hedge, so gold can be used as a security measure. Many economists believe that there will always be some degree of inflation. Accordingly, many economists believe that inflation will always be present. Therefore, physical gold can be considered a way for you to safeguard your savings from future price rises.

There are a few things you need to remember before purchasing precious metals like silver, gold or platinum. First, decide whether bullion bars are better than coins. Bullion bars usually come in large amounts (e.g 100 ounces), and are stored away until needed. Bullion bars are often replaced by coins, which can be used to buy smaller amounts of bullion.

Second, consider where you want to store your precious materials. Some countries are safer then others. If you are in the US, it might be a good idea to store your precious metals abroad. But if you're planning on storing them in Switzerland, you might want to ask yourself why.

Finally, you should decide whether you want to invest directly in precious metals or through “precious metals exchange-traded funds” (ETFs). ETFs, which track the performance different commodities like gold, are financial instruments. You can use these to get exposure to precious metals without having to own them.

—————————————————————————————————————————————————————————————-

By: Blockware

Title: Maximizing Bitcoin Holdings: A Guide to Accumulating More BTC

Sourced From: bitcoinmagazine.com/guides/maximizing-bitcoin-accumulation-beyond-the-benchmark-

Published Date: Tue, 26 Nov 2024 21:52:20 GMT