The Bitcoin Fear and Greed Index serves as a sentiment analysis tool that gauges the overall mood of Bitcoin traders and investors. Ranging from 0 to 100, this index reflects market emotions from extreme fear to extreme greed. While widely used by analysts, some remain skeptical about its effectiveness. Let's delve into the data to determine if this index can truly enhance investment decisions.

Understanding Investor Emotion

The Fear and Greed Index consolidates various metrics to offer an insight into market sentiment. These metrics encompass:

- Price Volatility: Significant price fluctuations often trigger fear, particularly in bearish trends.

- Momentum and Volume: Increased buying activity typically indicates bullish sentiment.

- Social Media Sentiment: Public discussions about Bitcoin on various platforms mirror collective optimism or pessimism.

- Bitcoin Dominance: A higher Bitcoin dominance compared to altcoins usually suggests cautious market behavior.

- Google Trends: Interest in Bitcoin-related search terms correlates with public sentiment.

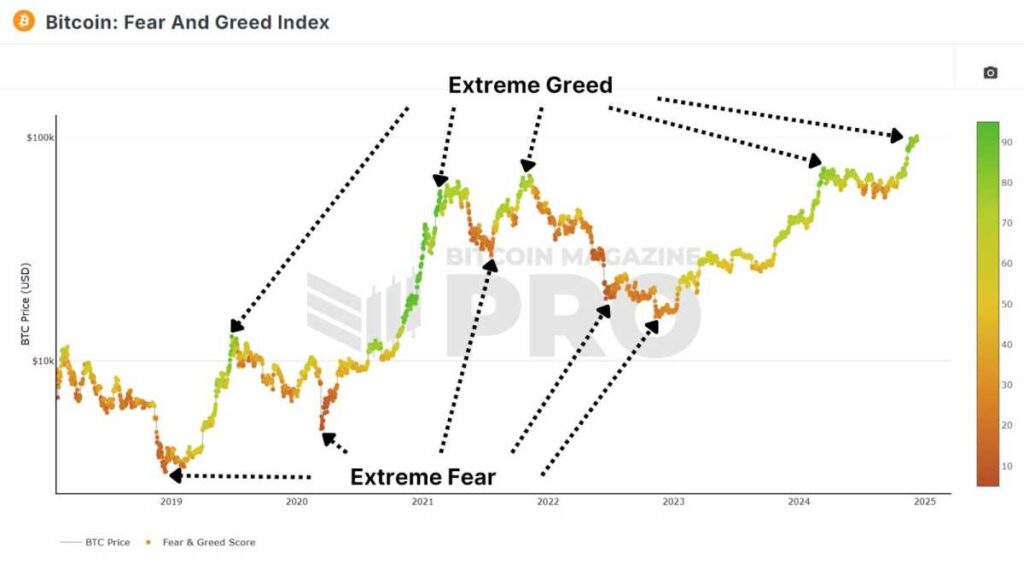

By amalgamating these metrics, the index presents a straightforward visual representation: red zones indicate fear (lower values), while green zones signify greed (higher values).

Contrarian Approach: Does it Work?

Observing the Fear and Greed Index reveals that mass psychology often presents opportunities for contrarian actions. In essence, when the majority is bearish, adopting a more bullish stance might be advantageous, and vice versa.

To validate the efficacy of the Fear and Greed Index beyond being a colorful chart, a test was conducted using data dating back to February 2018, the index's inception. The strategy employed was simple:

Allocate 1% of your capital to Bitcoin when the index reads 20 or below, and sell 1% of your Bitcoin holdings when the index hits 80 or above. If such a basic strategy yielded favorable results, it can be deemed a valuable tool for investors.

Results and Performance

The results showcased that this strategy notably outperformed a traditional buy-and-hold approach. The Fear and Greed Strategy generated a remarkable 1,145% return on investment, surpassing the 1,046% ROI achieved through a Buy & Hold Strategy during the same period. While the variance may not be substantial, it underscores the potential of scaling in and out of Bitcoin based on market sentiment for enhanced returns.

The Fear and Greed Index capitalizes on human psychology, leveraging market overreactions in both directions. By counteracting these extremes, the strategy effectively harnesses irrational and emotional market behaviors. Scaling in during fear and out during greed assists in managing risks and maximizing profits, surpassing the performance of one of the world's leading assets.

It's essential to note that successful execution of this strategy necessitates proper trade management, involving gradual scaling in and out over macrocycles. Additionally, it's crucial to consider fees and taxes that may apply. Market conditions can linger in states of irrational fear or greed for extended periods, and attempting to significantly increase exposure or secure profits solely based on this metric may not yield long-term success.

Final Thoughts

Despite its simplicity, the Fear and Greed Index has demonstrated its value when utilized thoughtfully. It aligns with the timeless principle of "buying when others are fearful and selling when others are greedy," a strategy followed by many successful investors.

While the Fear and Greed Index should complement other tools such as on-chain data and macroeconomic indicators for comprehensive analysis, the data unequivocally supports its relevance as a metric deserving consideration in your analytical arsenal.

For a deeper exploration of this subject, consider watching a recent YouTube video titled: Does The Bitcoin Fear & Greed Index ACTUALLY Work?

Disclaimer: This article is intended for informational purposes only and should not be construed as financial advice. Always conduct thorough research before making any investment decisions.

Frequently Asked Questions

Should You Invest in gold for Retirement?

The answer will depend on how many dollars you have saved so far and whether you had gold as an investment option at the time. If you are unsure of which option to invest in, consider both.

Not only is it a safe investment but gold can also provide potential returns. This makes it a worthwhile choice for retirees.

Most investments have fixed returns, but gold's volatility is what makes it unique. Its value fluctuates over time.

This does not mean you shouldn’t invest in gold. This just means you need to account for fluctuations in your overall portfolio.

Another advantage of gold is its tangible nature. Unlike stocks and bonds, gold is easier to store. It can be easily transported.

You can always access gold as long your place it safe. Physical gold is not subject to storage fees.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

Also, you'll reap the benefits of having some savings invested in something with a stable value. Gold rises in the face of a falling stock market.

Gold investment has another advantage: You can sell it anytime. You can easily liquidate your investment, just as with stocks. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all your eggs on one basket.

Don't buy too many at once. Start with just a few drops. You can add more as you need.

It's not about getting rich fast. Instead, the goal here is to build enough wealth to not need to rely upon Social Security benefits.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

Who is the owner of the gold in a gold IRA

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

If you plan on selling the gold someday, you'll need to report its value, which could affect how much capital gains taxes you owe when you cash in your investments.

It is a good idea to consult an accountant or financial planner to learn more about your options.

Can the government seize your gold?

Because you have it, the government can't take it. You worked hard to earn it. It belongs entirely to you. This rule could be broken by exceptions. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. You can also lose precious metals if you owe taxes. However, even if taxes are not paid, gold is still your property.

How much money should my Roth IRA be funded?

Roth IRAs can be used to save taxes on your retirement funds. You can't withdraw money from these accounts before you reach the age of 59 1/2. If you decide to withdraw some of your contributions, you will need to follow certain rules. First, you cannot touch your principal (the original amount deposited). You cannot withdraw more than the original amount you contributed. If you decide to withdraw more money than what you contributed initially, you will need to pay taxes.

The second rule is that your earnings cannot be withheld without income tax. Withdrawing your earnings will result in you paying taxes. Let's suppose that you contribute $5,000 annually to your Roth IRA. In addition, let's assume you earn $10,000 per year after contributing. On the earnings, you would be responsible for $3,500 federal income taxes. The remaining $6,500 is yours. Because you can only withdraw what you have initially contributed, this is all you can take out.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. On top of that, you'd lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). You only got back $4,000. Even though you were able to withdraw $7,000 from your Roth IRA,

There are two types if Roth IRAs, Roth and Traditional. A traditional IRA allows for you to deduct pretax contributions of your taxable income. Your traditional IRA can be used to withdraw your balance and interest when you are retired. You have the option to withdraw any amount from a traditional IRA.

Roth IRAs don't allow you deduct contributions. You can withdraw your entire contribution, plus accrued interests, after you retire. There is no minimum withdrawal required, unlike a traditional IRA. It doesn't matter if you are 70 1/2 or older before you withdraw your contribution.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)