Are you ready to witness a groundbreaking shift in the real estate landscape? Grupo Murano, a leading $1 billion real estate giant from Mexico, is embarking on an innovative journey by embracing Bitcoin in its core operations. CEO Elías Sacal boldly claims that Bitcoin is reshaping the real estate industry by "demonetizing" it. Intrigued? Let's delve into how this strategic move is paving the way for a new era in real estate.

The Vision Behind Grupo Murano's Bitcoin Integration

Embracing Change: Bitcoin as the Game-Changer

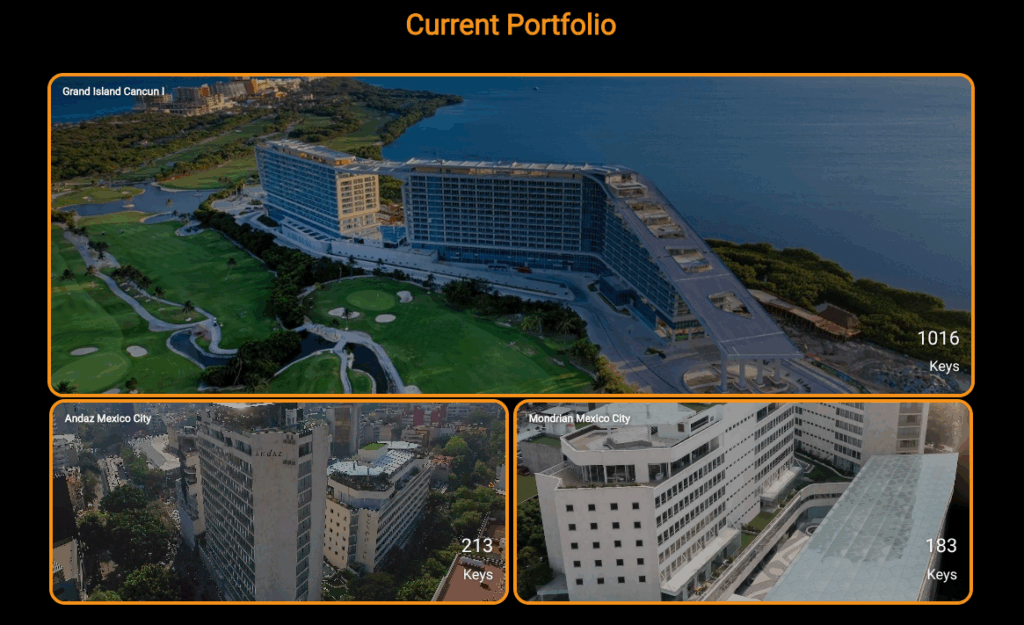

Picture this: Grupo Murano, known for managing prestigious hotels like Hyatt and Mondrian, along with residential and commercial properties in vibrant cities such as Cancun and Mexico City, is gearing up to convert its assets into Bitcoin. Through innovative approaches like refinancing and sale-leasebacks, the company aims to optimize its financial structure, reduce debt, and enhance operational efficiency.

Bitcoin: A Beacon of Stability in a Volatile Market

Steering Clear of Financial Turbulence

Let's face it: the real estate industry's reliance on conventional financing models is facing turbulence due to soaring interest rates. Grupo Murano's strategic shift towards Bitcoin is a game-changer. By embracing the stability of Bitcoin for transactions like global sourcing and customer payments, the company is cutting out intermediaries, reducing costs, and streamlining operations.

Empowering Stakeholders with Bitcoin Knowledge

Spreading the Bitcoin Revolution

Grupo Murano isn't just transforming its internal operations; it's on a mission to educate and empower its stakeholders about the benefits of Bitcoin. From deploying Bitcoin ATMs at its properties to forging partnerships with major payment platforms, the company is making Bitcoin transactions seamless and efficient. This strategic move aligns with its ambitious goal of building a $10 billion Bitcoin treasury within the next five years.

Bitcoin: Shaping the Future of Real Estate

A Visionary Outlook on Bitcoin's Role

Why stop at real estate? Grupo Murano envisions a future where Bitcoin dominates transactions globally. By focusing on high-margin projects and allocating a significant portion of its business to Bitcoin holdings, the company is setting a precedent for resilience and growth. Sacal's analogy of Bitcoin as the Formula One of cryptocurrencies resonates, highlighting the potential for Bitcoin to unify economies and reduce dependencies on traditional financial systems.

For readers of Bitcoin Magazine, Grupo Murano's strategic pivot serves as a testament to Bitcoin's transformative power in capital-intensive industries. By embracing change, prioritizing innovation, and leveraging Bitcoin's stability, Murano is leading the way towards a decentralized and robust future. As Sacal aptly puts it, "The future of real estate lies in Bitcoin transactions," signifying a paradigm shift towards a more secure and decentralized real estate ecosystem.

Frequently Asked Questions

Which is stronger? 14k Gold or Sterling Silver?

Both gold and silver make strong metals. Sterling silver is more affordable than sterling silver which has only 24% pure silver.

Sterling silver is sometimes called fine silver. This is because it is made with a mix of silver and different metals like copper or zinc.

Gold is usually considered to be extremely strong. It can only be broken apart by extreme pressure. If you were to drop an object on top of a piece of gold, it would shatter into thousands of pieces instead of breaking into two halves.

But silver isn’t nearly as sturdy as gold. A sheet of silver would likely bend and fold if you dropped an item on it.

Silver is usually used in jewelry and coins. Because of this, silver's value is subject to fluctuations based upon supply and demand.

Are gold and Silver IRAs a good idea or a bad idea?

This could be a great way to simultaneously invest in gold and silver. There are many other options. Please feel free to reach out to us with any questions. We are always happy to assist!

What are the three types of IRAs?

There are three basic types for IRAs. Each type has its advantages and limitations. Below, we'll discuss each one.

Traditional Individual Retirement Account (IRA).

A traditional IRA allows pre-tax money to be contributed to an account. This allows you to earn interest and defer taxes. Once you retire, withdrawals from the account are tax-free.

Roth IRA

Roth IRAs allow you to deposit after-tax dollars into an account. This allows earnings to grow tax-free. If you withdraw funds for retirement, your withdrawals from the account are exempted of tax.

SEP IRA

This is similar to a Roth IRA, except that it requires employees to make additional contributions. These additional contributions can be taxed. However, any earnings are now tax-deferred. When you leave the company the whole amount may be converted to a Roth IRA.

Statistics

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

takemetothesite.com

investopedia.com

regalassets.com

en.wikipedia.org

How To

How to determine if a Gold IRA works for you

Individual Retirement accounts (IRAs) are the most common type of retirement account. IRAs can also be purchased through banks, mutual funds, financial planners, and other institutions. The IRS allows individuals up to $5,000 in annual contributions without tax consequences. This amount is available to all IRAs, regardless of age. However, certain IRAs have limits on the amount you can deposit. For example, if your age is less than 591/2 years old, you can't contribute to a Roth IRA. Under 50-year-olds must wait until they reach 70 1/2 years of age before you can make contributions. Some employees may be eligible to match contributions from their employer.

There are two main types: Roth and traditional IRAs. Traditional IRAs can be used to invest in stocks or bonds, as well other investments. Roth IRAs are only available for after-tax dollars. Roth IRA contributions aren't subject to tax on the amount they are received, but Roth IRA withdrawals will be. Some people may choose to use both. Each type is different. There are pros and con's to each. Before you decide which type of IRA is right for you, what are the pros and cons? Keep these three things in mind:

Traditional IRA pros:

- Contribution options vary by company

- Employer match possible

- Save more than $5,000 per Person

- Tax-deferred growth up to withdrawal

- You may have income restrictions

- The maximum annual contribution limit is $5.500 (or $6.500 if married filing jointly).

- The minimum investment required is $1,000

- After age 70 1/2, you must begin taking mandatory distributions

- To open an IRA, you must be at least 5 years old

- Transfer assets between IRAs is not possible

Roth IRA pros:

- Contributions are free of taxes

- Earnings grow without paying taxes

- There are no minimum distribution requirements

- Investment options are limited to stocks, bonds, and mutual funds

- There is no maximum allowed contribution

- Transfer assets between IRAs is possible without restrictions

- Age 55 or older to open an IRA

You should be aware that not every company offers the same IRAs. For instance, some companies offer a choice between a traditional or a Roth IRA. Others offer the possibility to combine them. It's also worth noting that different types of IRAs have different requirements. For example, a Roth IRA has no minimum investment requirement, whereas a traditional IRA requires a minimum investment of just $1,000.

The Bottom Line

It is important to decide whether you want taxes now or later when you choose an IRA. If you're planning to retire in the next ten-years, a traditional IRA may be the best option. A Roth IRA might be better suited to you. In either case, it's a smart idea to speak with a professional about your retirement plans. An expert can advise you on the best options and how to navigate the market.

—————————————————————————————————————————————————————————————-

By: Juan Galt

Title: Grupo Murano’s Bold Move: How Bitcoin is Revolutionizing Real Estate

Sourced From: bitcoinmagazine.com/news/grupo-muranos-1b-bitcoin-bet-real-estate

Published Date: Tue, 22 Jul 2025 00:11:35 +0000