If you have decided to invest in a gold IRA, then you'll want to know how this investment works. You can find out more about the tax implications and the costs involved by reading this article. You can also learn more about choosing the right company for your gold IRA. This article will help you understand the process and make an informed decision.

Investing in a gold IRA

Gold IRAs are a form of alternative investment, and are not traded on the public market. As such, they require special knowledge to evaluate. While gold offers a potential for high returns, it can also go down suddenly, requiring investors to make difficult decisions. In order to maximize the potential for return, investors should determine whether gold is rising or nearing its peak. In some cases, waiting until the market has stabilized is a better approach than investing now.

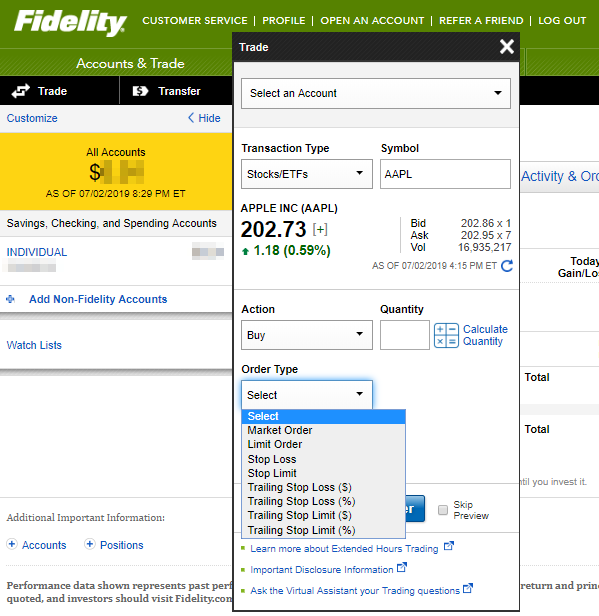

Fidelity is a well-known and reputable financial company that offers a full range of investment products and services. Investing in gold with Fidelity can provide tax advantages and help you build your retirement nest egg. Dedicated wealth managers will work with you to create a customized financial plan that will ensure your long-term financial security.

Tax implications of investing in a gold IRA

There are tax implications associated with investing in a gold IRA, but they are minimal. Typically, you will only be taxed on the amount you roll over. Still, you may want to consult a tax expert and financial advisor before making any decisions about your IRA.

Inheritance taxation is another tax that you need to consider. If you die and leave the gold to your heirs, you may owe inheritance taxes. The amount you owe will depend on how much gold is in your estate. If you held it for at least a year, however, you will only have to pay capital gains tax. Otherwise, you will have to pay income tax on the profits you earn on the sale.

Cost of investing in a gold IRA

Fidelity is a respected financial institution that offers a number of investment products and services. These include retirement planning and gold investing. It also offers dedicated wealth managers who create a customized financial plan for you. If you are interested in investing in gold, you may want to consider opening a gold IRA. This type of investment is tax-deferred and allows you to save for retirement.

A gold IRA allows investors to invest in gold without having to sell it. There are various gold IRA plans available with Fidelity, from paper gold to gold backed ETFs. It can be difficult to know which one is right for you.

Choosing a gold IRA company

When you choose a gold IRA fidelity company, you should choose a company that you can trust. Lear Investments has a proven track record of providing high quality service and has extensive knowledge of the bullion market. Its staff members are dedicated to helping you make informed decisions regarding your precious metal investment. It has an A+ rating with the Better Business Bureau and over 35 reviews on TrustLink.

While most IRAs allow you to keep gold in your home, this option is not approved by the IRS, and can incur tax penalties. It's important to choose a company that follows IRS regulations to ensure your retirement funds are protected.

Frequently Asked Questions

What is a Precious Metal IRA (IRA)?

Precious metals make a great investment in retirement accounts. They are a timeless investment that has held its value since the beginning of time. Investing in precious metals such as gold, silver, and platinum is also a great way to diversify your portfolio and protect against inflation.

Certain countries even allow their citizens to save money in foreign currencies. You can buy gold bars in Canada, and then keep them at the home. You can then sell the same gold bars to Canadian dollars when you return home to visit your family.

This is a simple way to make investments in precious metals. It's particularly helpful for people who don't reside in North America.

What is the best precious-metal to invest?

Investments in gold offer high returns on their capital. It protects against inflation as well as other risks. The price of gold tends to rise as people become concerned about inflation.

It's a good idea for you to purchase futures gold. These contracts guarantee that you will receive certain amounts of gold at a given price.

However, futures on gold aren't for everyone. Some people prefer physical gold.

They can trade their precious metals with others. They can also make a profit by selling their gold at any time they desire.

Some people choose to not pay taxes on gold. People buy gold directly from the government in order to avoid paying taxes.

This process requires you to make several trips to your local post office. You will first need to convert any existing gold in coins or bars.

Next, you will need to stamp the coins or bars. You then send them to US Mint. They melt the bars and coins into new coins.

The original stamps are used to stamp the new coins and bars. They are therefore legal tender.

However, if you purchase gold directly from the US Mint you won't be required to pay any taxes.

Decide which precious metal you would like to invest.

Which type of IRA can be used to store precious metals?

Employers and financial institutions often offer Individual Retirement Accounts (IRA) as an investment vehicle. An IRA allows you to contribute money that is tax-deferred until it is withdrawn.

An IRA lets you save taxes and pay them off later. This means that you can deposit more money into your retirement plan than have to pay taxes on it tomorrow.

An IRA has the advantage of allowing contributions and earnings to grow tax-free until you withdraw your funds. Early withdrawals are subject to penalties.

Additional contributions can be made to your IRA even after you turn 50, without any penalty. If you take out of your IRA during retirement you will owe income and a 10% federal penal.

Refunds received before the age of 591/2 are subject to a penalty of 5% from the IRS. Withdrawals between ages 59 1/2 and 70 1/2 are subject to a 3.4% IRS penalty.

A 6.2% IRS penalty applies to withdrawals exceeding $10,000 per annum.

Are precious metal IRAs a wise investment?

How much risk you are willing to take for an IRA account's value loss will determine the answer. These are good if you have $10,000 of cash and don't expect them grow quickly. These are not the best investments if there is a long-term plan for saving money (like gold) or if you want to invest more in assets that will rise in value over time. These fees can reduce any gains.

What are the best ways to choose an IRA.

The first step to finding an IRA for you is understanding your account type. This is regardless of whether you are looking to invest in a Roth IRA. You also want to know how much money you have available to invest.

Next is deciding which provider best suits your needs. Some providers offer both accounts and others only specialize in one.

Finally, you should consider the fees associated with each option. Fees can vary greatly between providers, and may include annual maintenance charges and other fees. One example is that some providers charge a monthly subscription based upon the number of shares you hold. Some providers charge only once a quarter.

Is gold IRAs a good way to invest?

An investment in gold can be made by buying shares of companies that mine it. These companies can make you money by investing in precious metals and gold.

There are however two problems with owning shares directly.

The first is that you could lose money if your stock is held on for too long. Stocks fall faster than their underlying assets (like gold) when they are declining. That means you could end up losing money instead of making it.

You may also miss potential profits if the market recovers before you sell. Be patient and wait for the market's recovery before you make any profits from your gold holdings.

However, if you want to separate your investments from your financial affairs, physical gold can still be a great investment option. An IRA in gold can diversify your portfolio and protect you against inflation.

Visit our website to find out more about investing in gold.

Statistics

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

External Links

takemetothesite.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

regalassets.com

investopedia.com

How To

How to Buy Silver With Your IRA

How to get started buying silver with your IRA – Owning physical bullion directly is the best way for you to invest in silver and gold. Bars and silver coins are the most common form of investment. They offer liquidity, diversification, and convenience.

There are several options to purchase precious metals, like gold or silver. You can purchase them directly through their producers, which include mining companies or refiners. You can buy them directly from the producer or a dealer who purchases and sells bullion.

This article will show you how to get started investing in silver using your IRA.

- Investing in Gold & Silver through Direct Ownership – The best way to purchase precious metals is to directly go to the source. This allows you to get the bullion directly and have it delivered directly to your home. While some investors prefer to keep their bullion inside their homes, others choose to store it in a storage facility that is insured and protected. You should ensure that your precious metal is properly stored when you are preserving it. Many storage facilities offer insurance that covers theft, fire, and damage. However, even with insurance you could lose your investments due to natural catastrophes or human error. For these reasons, storing your precious metals in a safe deposit box at a bank or credit union is always recommended.

- Online Precious Metals Shopping – Bullion online can be a great alternative to carrying around heavy boxes. Bullion dealers sell bullion in different forms, including coins and bars. There are many options for coins, including different shapes and sizes. Coins are generally more convenient to carry than bars. Bars come in different weights and sizes. Some bars weigh hundreds of pounds, while others only weigh a few ounces. When choosing which bar to buy, it is important to consider what you will use it for. If you plan on giving it as gifts, you might choose something smaller. If you are looking to add it as a gift, or to proudly display it, you may want to spend a bit more and buy something larger.

- Buy Precious Metals from Dealers – Another option is to purchase bullion directly from a dealer. Most dealers are experts in one part of the market: gold or silver. Some dealers specialize only in bullion of certain types, such as rounds or minted coin. Others are more skilled in certain regions. Others specialize in bulk sales. No matter what dealer you choose you will find that they offer great prices and flexible payment options.

- Buy Precious Metals Through Retirement Accounts. Although it is not considered an “investment”, investing in retirement accounts can provide exposure to precious metals. For Section 219 to receive tax benefits, you must have a qualified retirement fund that invests in precious metallics. These accounts include IRAs. These accounts are designed to help you save for retirement and often provide higher returns than other investment vehicles. These accounts also allow you to diversify across multiple metals. But what's the downside? Retirement accounts don't allow everyone to invest. Only employees who have been sponsored by an employer can invest in retirement accounts.