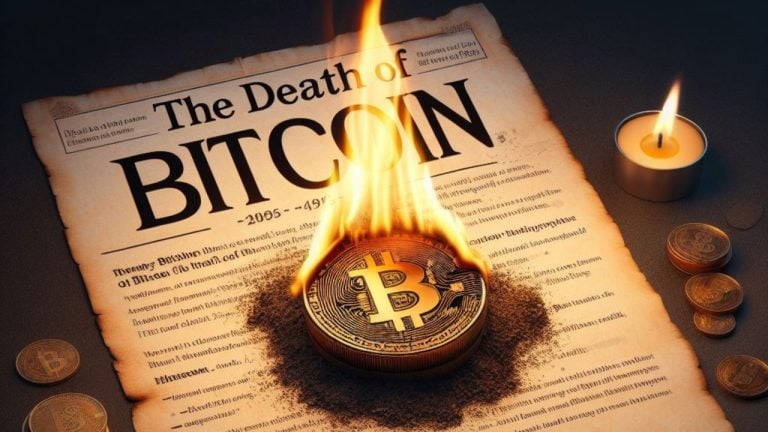

Arthur Hayes Speculates ETFs Could Threaten Bitcoin's Existence

Arthur Hayes, the former CEO of Bitmex and a prominent cryptocurrency market analyst, has raised concerns about the potential success of a spot bitcoin exchange-traded fund (ETF) and its impact on the future of bitcoin. Hayes suggests that the growing popularity of these ETF derivatives could lead to the consolidation of bitcoin custody in the hands of a few financial firms, ultimately immobilizing the cryptocurrency and causing miners to surrender due to a lack of blockchain activity.

Possible Demise of Bitcoin, According to Arthur Hayes

In a recent blog post titled "Expression," Arthur Hayes expresses his belief that the success of an upcoming spot bitcoin ETF could pose a significant threat to the existence of the Bitcoin network. He presents a hypothetical scenario where the majority of bitcoin is held by a small number of financial institutions, such as Blackrock.

Hayes argues that bitcoin's value as a store of wealth would be compromised if it becomes primarily viewed as a financial asset rather than a store of value, distinguishing it from other assets traded in traditional financial markets.

According to Hayes:

"Bitcoin is the first monetary asset in human history that only exists through movement. However, if there were no further bitcoin transactions between entities, miners would be unable to cover the energy costs required to secure the network."

The consequence of this scenario would be the complete shutdown of the Bitcoin network, as miners would be unable to sustain their operations once the subsidy ends around 2140 and they solely rely on transaction fees.

Hayes further posits that this outcome is more likely if users prioritize bitcoin as a financial asset rather than a store of value, opting for derivative products instead of the actual cryptocurrency. In the event of such a fate for bitcoin, Hayes predicts the emergence of a similar asset that would facilitate transactions within a non-state-owned financial system.

In conclusion, Hayes remarks:

"Hopefully, if such a scenario were to occur, we would learn from our mistakes and avoid entrusting our private keys to centralized entities."

What are your thoughts on Arthur Hayes' assessment of the potential impact of a spot bitcoin ETF on the future of bitcoin? Share your opinions in the comments below.

Frequently Asked Questions

How to Open a Precious Metal IRA

A self-directed Roth Individual Retirement Account is the best way to open a IRA for precious metals.

This account is more advantageous than other types of IRAs, because you don’t have to pay taxes on any interest earned from your investments until they are withdrawn.

It is attractive for people who want to save money, but need a tax break.

You do not have to only invest in gold and silver. You can invest anywhere you wish, as long as it is within the IRS guidelines.

While most people associate precious metals with silver and gold, there are many types of precious metals.

Some examples include palladium, platinum, rhodium, osmium, iridium, and ruthenium.

There are many ways that you can invest precious metals. There are two main options: buying bullion bars and coins, and purchasing shares in mining companies.

Bullion Coins and Bars

One of the most straightforward ways to invest is to buy bullion coin and bars. Bullion can be used to refer to the physical ounces or gold or silver.

Bullion bars and bullion coin are real pieces of metal.

Although you may not be able to see any change immediately after purchasing bullion bars and coins at a shop, you will soon notice some positive effects.

You'll be able to see a piece tangible of history. Each coin and each bar have a story.

If you compare the nominal value to face value, you will often find that it is worth much less than its nominal. The American Eagle Silver Coin cost $1.00 an ounce in 1986 when it was first introduced. Today, however the American Eagle's silver coin is worth closer to $40.00 an ounce.

Bullion has seen a dramatic rise in value since its introduction. Many investors would rather buy bullion coins or bullion bars than futures contracts.

Mining Companies

For those who want to purchase precious metals, another option is investing in shares of mining companies. When you invest in mining companies, you are investing in the company's ability to produce gold and silver.

You will get dividends based off the company's profits in return. These dividends will be used to pay shareholders.

The company's growth potential will also be of benefit to you. The demand for the product will also cause an increase in share prices.

Because these stocks fluctuate in price, it's important to diversify your portfolio. This allows you to spread your risk among multiple companies.

It's important to remember, however, that mining companies can still be subject to financial losses, just as any other stock market investment.

Your ownership stake could become worthless if the price of gold falls significantly.

The Bottom Line

Precious metals, such as silver and gold, can be a refuge during economic uncertainty.

Silver and gold, however, can experience wild swings in their prices. A precious metals IRA account is a good option for long-term investment.

This way, you can take advantage of tax advantages while benefiting from owning physical assets.

How much of your portfolio should you hold in precious metals

The best way to avoid inflation is to invest in physical gold. Because precious metals are a long-term investment, you can not only buy in to the current value but also the future potential of these assets. The value of your investment increases with rising prices.

Tax benefits will accrue if your investments are kept for at most five years. After that time, capital gains taxes will be due. If you want to learn more about how to buy gold coins, visit our website.

How much should your IRA include precious metals

Protecting yourself from inflation is best done by investing in precious metals such silver and gold. It's not just a way to save money for retirement.

Although silver and gold prices have increased in recent years, they can still be considered safe investments as they don't fluctuate nearly as much as stocks. These materials are in constant demand.

The prices of gold and silver are generally predictable and stable. They tend to increase when the economy is growing and decrease during recessions. This makes them very valuable money-savers and long term investments.

Your total portfolio should be 10 percent in precious metals. If you want to diversify even further your portfolio, that percentage could rise.

Do You Need to Open a Precious Metal IRA

It all depends on your investment goals and risk tolerance.

You should start an account if you intend to retire with the money.

The reason is that precious metals are likely to appreciate over time. They offer diversification advantages.

In addition, gold and silver prices tend to move together. This makes them better choices when you want to invest in both assets.

Do not invest in precious metals IRAs if your goal is to save money or take on any risk.

Is it possible to make money with a gold IRA.

Two things are necessary if you want to make a profit on your investment. First, you need to understand the market. Second, you need to know what type of products you have.

If you don't know, you shouldn't start trading until you are sure you have enough information to trade successfully.

A broker should offer the best service for each account type.

You can choose from a variety of accounts, including Roth IRAs or standard IRAs.

If you have other investments such as bonds or stocks, you might also consider a rollover.

Can I store my gold IRA account at home?

An online brokerage account is the best option to protect your investment funds. You'll have access to all the same investment options as if you were working with a traditional broker, but you don't need special licenses or qualifications. Plus, there are no fees for investing.

In addition, many online brokers offer free tools to help you manage your portfolio. Many online brokers allow you to download charts that will show how your investments are performing.

How can you withdraw from a Precious metal IRA?

If you have a precious metal IRA account such as Goldco International Inc., it may be worth considering withdrawing your funds. When you sell your metals, the value of those funds will be higher than if it was kept in the account.

If you are unsure how to withdraw money from your precious metal IRA, here is what you need to know.

First, check to see if your precious metal IRA provider permits withdrawals. Some companies permit this, while some don't.

Second, find out if you are eligible for tax-deferred gains from selling your metals. Many IRA providers provide this benefit. However, some don't.

Third, verify with your precious Metal IRA provider if you are charged any fees for taking these steps. The withdrawal may cost extra.

Fourth, keep track of your precious metal IRA investments for at least three years after you sell them. This means that you must wait until January 1st of each year to calculate capital gain on your investment portfolio. Follow the instructions on Form 8949 to calculate the gain.

In addition to filing Form 8949, you must also report the sale of your precious metals to the IRS. This is a step that ensures that all sales are taxed.

Finally, consult a trusted accountant or attorney before selling your precious metals. They can help ensure you follow all necessary procedures and avoid costly mistakes.

Statistics

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

External Links

takemetothesite.com

regalassets.com

en.wikipedia.org

kitco.com

How To

Things to Remember: Best Precious Metals Ira, 2022

Precious Metals Ira is one of the most popular investment options among investors. This article will help you understand what makes this asset class so attractive and how to make wise decisions when investing in precious metals.

Their long-term growth potential is the main draw of these assets. Looking back at historical data, we see that gold prices have shown incredible returns. Gold prices have increased by almost $1900 per troy ounce in the past 200 year, from $20 an ounce to nearly $1900 over that time. The S&P 500 Index, however, grew by only around half of that amount.

In times of economic uncertainty, gold is often considered a safe haven. When the stock market suffers bad days, people tend to sell stocks and move into the safety of gold. Gold is also seen as a hedge against inflation. Many economists believe that inflation will continue to exist. Physical gold is a way to protect your money from future price increases.

There are a few things you need to remember before purchasing precious metals like silver, gold or platinum. First, decide whether bullion bars are better than coins. Bullion bars can be bought in large quantities (like 100-ounces) and kept aside until required. Coins are smaller versions of bullion bars, which can then be used to buy small amounts of bullion.

The second is to think about where you intend to store precious metals. Some countries are safer then others. You might find it more sensible to store your precious materials overseas if you are a resident of the US. If you are thinking of storing your precious metals in Switzerland, however, you might be wondering why.

Finally, you need to decide whether you want precious metals investments directly or through “precious Metals Exchange-Traded Funds” (ETFs). ETFs, which track the performance different commodities like gold, are financial instruments. These instruments can be used to expose you to precious metals without needing to own them.

—————————————————————————————————————————————————————————————-

By: Sergio Goschenko

Title: Former Bitmex CEO Arthur Hayes: Potential Impact of ETFs on Bitcoin

Sourced From: news.bitcoin.com/former-bitmex-ceo-arthur-hayes-etf-success-might-destroy-bitcoin/

Published Date: Mon, 25 Dec 2023 04:30:14 +0000