Financial Benchmarks Display Bullish Trend After FOMC Announcement

The most recent session of the Federal Open Market Committee (FOMC) concluded with the Federal Reserve maintaining current interest rates. The market, anticipating rate reductions in 2024 and influenced by Fed Chair Jerome Powell's dovish stance, responded positively. This positive sentiment was evident in the surge of U.S. stocks, the crypto economy, and precious metals such as gold and silver.

Following the FOMC's announcement, major U.S. stock indices experienced substantial growth, reflecting the market's optimistic mood after the meeting. The crypto sector also rallied, recording a significant 3.66% increase, with bitcoin (BTC) rising by 4%. Additionally, traditional safe-haven assets like gold and silver saw a respective increase of 2.41% and 4.48%, indicating a widespread positive response to the Fed's decision.

Powell Emphasizes Need for Careful Monetary Policy

In his comments after the meeting, Powell discussed the current economic situation. While stating that the economy is not currently in a recession, he did not dismiss the possibility of one occurring next year. Powell highlighted the importance of cautious monetary policy, stating, "We are very focused on avoiding the mistake of keeping rates too high for too long." He also acknowledged the progress made in core inflation and non-housing services inflation, indicating a cautious yet adaptable approach to future monetary policy adjustments.

Speculations on Future Rate Hikes and Cuts

Contrary to some market speculations, further rate hikes appear unlikely. Powell hinted at a shift in the central bank's policy, suggesting that the current policy rate is likely at or near its peak for this tightening cycle. This aligns with the belief among speculators that the Fed may have finished hiking rates and that rate cuts could be on the horizon in 2024. The FOMC's statement and Powell's remarks underscored the Fed's commitment to achieving its 2% inflation target, although the methods to achieve this target seem to be evolving.

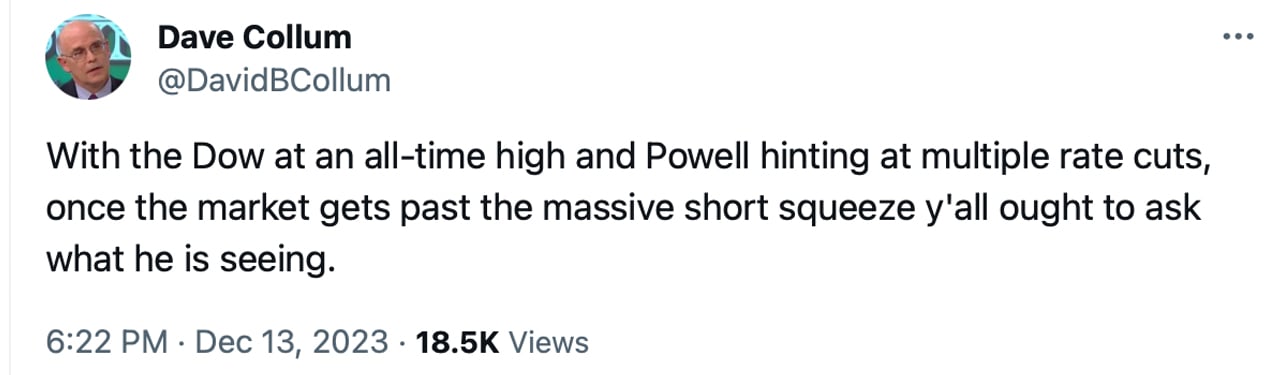

Various market experts have shared their insights following Powell's speech. Economist Peter Schiff commented on social media, stating that Powell's claim of winning the inflation war without causing harm to the economy or employment is because he didn't actually win but surrendered. Schiff added, "The only reason the phony economy and bull market are still alive is that inflation is not dead."

Sven Henrich of Northman Trader also weighed in, suggesting that Powell's actions have contradicted his previous tough rhetoric, which the market had already disregarded. Henrich criticized Powell's credibility, stating, "The credibility destruction is now complete." He further highlighted the discrepancy between Powell's claim of a restrictive policy level and the easing of financial conditions.

While Powell's address indicated that rate hikes are approaching their limit and cuts may occur in 2024, the CME Fedwatch tool predicts a rate increase at the next FOMC meeting in January. The market anticipates an 89.7% probability of a hike, while 10.3% expect no change.

What are your thoughts on the Federal Reserve's current stance? Do you anticipate more rate hikes or rate cuts in the future? Share your opinions in the comments section below.

Frequently Asked Questions

Can I purchase gold with my self directed IRA?

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. You can also transfer funds from an existing retirement fund.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

If you do decide that you want to invest, it is a good idea to buy physical bullion and not in futures. Futures contracts are financial instruments that are based on gold's price. They let you speculate on future price without having to own the metal. You can only hold physical bullion, which is real silver and gold bars.

What does a gold IRA look like?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

Physical gold bullion coin can be purchased at any time. To start investing in gold, it doesn't matter if you are retired.

An IRA allows you to keep your gold forever. You won't have to pay taxes on your gold investments when you die.

Your heirs can inherit your gold and avoid capital gains taxes. It is not required that you include your gold in the final estate report because it remains outside your estate.

To open a IRA for gold, you must first create an individual retirement plan (IRA). Once you've done that, you'll receive an IRA custody. This company acts as a middleman between you and the IRS.

Your gold IRA custodian is responsible for handling all paperwork and submitting the required forms to the IRS. This includes filing annual reports.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. The minimum deposit is $1,000. The minimum deposit is $1,000. However, you will receive a higher percentage of interest if your deposit is greater.

Taxes will apply to gold that you take out of an IRA. If you're withdrawing the entire balance, you'll owe income taxes plus a 10 percent penalty.

However, if you only take out a small percentage, you may not have to pay taxes. However, there are some exceptions. There are some exceptions. For instance, if you take out 30% or more from your total IRA assets, federal income taxes will apply plus a 20 percent penalty.

You should avoid taking out more than 50% of your total IRA assets yearly. Otherwise, you'll face steep financial consequences.

Should You Buy Gold?

Gold was once considered an investment safe haven during times of economic crisis. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

Experts think this could change quickly. Experts believe that gold prices could skyrocket in the face of another global financial crisis.

They also noted that gold is growing in popularity because of its perceived value as well as potential return.

These are some things you should consider when considering gold investing.

- Consider whether you will actually need the money that you are saving for retirement. You can save money for retirement even if you don't invest in gold. That said, gold does provide an additional layer of protection when you reach retirement age.

- Second, be sure to understand your obligations before you purchase gold. Each offer varying degrees of security and flexibility.

- Finally, remember that gold doesn't offer the same level of safety as a bank account. Losing your gold coins could result in you never being able to retrieve them.

You should do your research before buying gold. Protect your gold if you already have it.

How much of your portfolio should you hold in precious metals

To answer this question, we must first understand what precious metals are. Precious metals are those elements that have an extremely high value relative to other commodities. This makes them extremely valuable for trading and investing. The most traded precious metal is gold.

However, many other types of precious metals exist, including silver and platinum. While gold's price fluctuates during economic turmoil, it tends to remain relatively stable. It is also not affected by inflation and depression.

The general trend is for precious metals to increase in price with the overall market. They do not always move in the same direction. When the economy is in trouble, for example, gold prices tend to rise while other precious metals fall. Investors are more likely to expect lower interest rates making bonds less attractive investments.

Contrary to this, when the economy performs well, the opposite happens. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. They become less expensive and have a lower value because they are limited.

To maximize your profits when investing in precious metals, diversify across different precious metals. It is also a good idea to diversify your investments in precious metals, as prices tend to fluctuate.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads, Example, and Risk Metrics

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor