En ce moment, le prix du bitcoin semble sur le point d'entrer dans une phase euphorique d'action sur les prix après un marché haussier déjà solide. Cependant, ce cycle a-t-il vraiment été aussi impressionnant que le suggère le graphique des prix en USD, ou le Bitcoin pourrait-il en fait sous-performer par rapport à d'autres actifs et cycles historiques? Cette analyse plonge dans les chiffres, compare plusieurs cycles, et examine la performance du Bitcoin non seulement par rapport au dollar américain, mais aussi par rapport à des actifs comme l'or et les actions technologiques américaines, pour donner une image plus claire de notre situation actuelle.

Cycles de Prix Précédents du Bitcoin

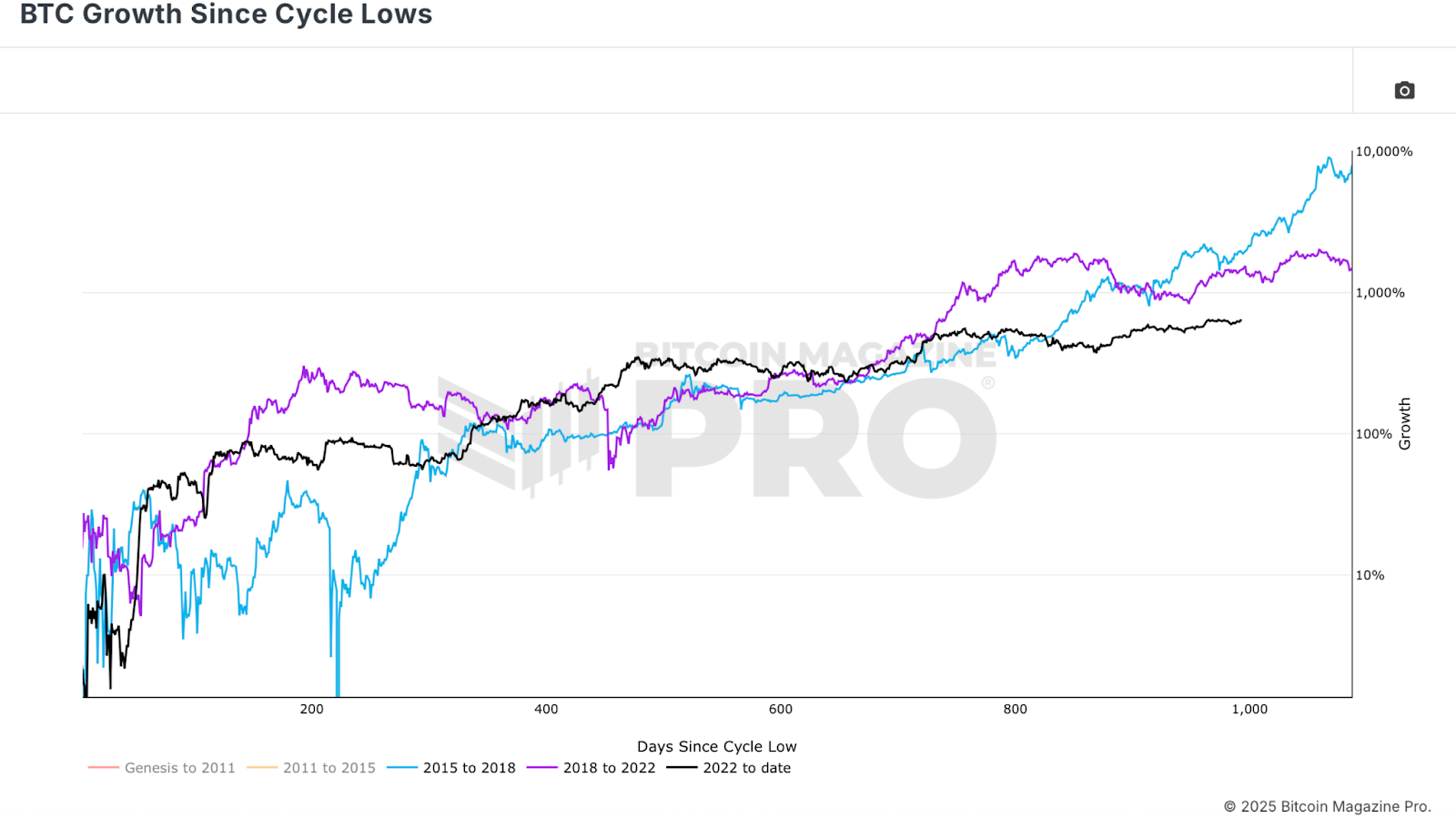

En regardant le graphique de la Croissance du Bitcoin Depuis les Creux des Cycles, les données semblent initialement prometteuses. Depuis les creux à la fin du dernier marché baissier, le Bitcoin a généré des rendements d'environ 634% au moment de l'écriture. Il s'agit de gains importants, soutenus non seulement par l'action sur les prix mais aussi par des fondamentaux solides. L'accumulation institutionnelle via les ETF et les réserves de trésorerie en Bitcoin a été robuste, et les données on-chain montrent qu'une grande proportion des détenteurs à long terme refusent de prendre des bénéfices. Historiquement, c'est le genre de toile de fond qui précède une phase de forte hausse en fin de cycle haussier, similaire à ce que nous avons vu dans les cycles précédents.

Performance Actuelle du Cycle de Prix du Bitcoin

En se tournant vers le graphique des prix en USD sur TradingView, le cycle de prix actuel du bitcoin ne semble pas si mal du tout, surtout en termes de stabilité. La plus forte correction de ce cycle a été d'environ 32%, ce qui s'est produit après avoir dépassé les 100 000 $ et être revenu à environ 74 000 $ – 75 000 $. Cela est bien plus doux que les replis de 50% ou plus observés dans les cycles passés. Une volatilité réduite pourrait signifier un potentiel de hausse réduit, mais rend également le marché moins périlleux pour les investisseurs. La structure des prix a suivi un schéma de "montée", des rallyes vifs suivis de consolidations agitées, puis un autre rallye, poussant à plusieurs reprises vers de nouveaux sommets historiques. Du point de vue fondamental, le marché reste solide.

Prix du Bitcoin vs Autres Actifs

En mesurant le Bitcoin par rapport à quelque chose de plus stable que le dollar américain, comme le NASDAQ ou d'autres actions technologiques américaines, une image différente émerge. Les actions technologiques américaines sont aussi des actifs spéculatifs à forte croissance, donc cette comparaison est plus directe que BTC vs USD. Ici, la performance du Bitcoin semble moins spectaculaire. Dans ce cycle actuel, la progression au-delà du sommet précédent a été minimale. Cependant, le graphique montre que le Bitcoin transforme actuellement les résistances précédentes en support, ce qui pourrait poser les bases pour une progression plus soutenue. Ce que l'on peut également voir, en regardant le cycle du double sommet précédent, c'est un deuxième sommet à un niveau considérablement plus bas, suggérant que le deuxième sommet du Bitcoin dans le dernier cycle a peut-être été davantage motivé par l'expansion de la liquidité mondiale et la dépréciation des devises fiduciaires que par une véritable surperformance.

Narratif de la "l'Or Numérique"

Le narratif de "l'or numérique" invite à une autre comparaison importante, en regardant le BTC vs l'Or. Le Bitcoin n'a toujours pas dépassé son précédent sommet historique de 2021 lorsqu'il est mesuré en Or. Cela signifie qu'un investisseur qui a acheté du BTC au pic de 2021 et a conservé jusqu'à présent aurait sous-performé par rapport à simplement détenir de l'Or. Depuis les creux du dernier cycle, le Bitcoin vs l'Or a généré plus de 300%, mais l'Or lui-même connaît une puissante tendance haussière. Mesurer en termes d'Or élimine les effets de la dépréciation des devises fiduciaires et montre le "vrai" pouvoir d'achat du BTC.

Vrai Pouvoir d'Achat

Pour pousser cela plus loin, ajuster le graphique Bitcoin vs Or pour l'expansion de la masse monétaire M2 mondiale peint un tableau encore plus alarmant. En tenant compte des énormes injections de liquidités dans l'économie mondiale ces dernières années, le prix de sommet de cycle du Bitcoin en termes d'Or "ajusté à la liquidité" est encore en dessous du sommet précédent. Cela aide à expliquer le manque d'enthousiasme des détaillants, car il n'y a pas de nouveaux sommets en termes de pouvoir d'achat réel.

Conclusion

Jusqu'à présent, le marché haussier du Bitcoin a été impressionnant en termes de dollars, avec plus de 600% de gains depuis les creux et une progression relativement peu volatile. Cependant, lorsqu'on le mesure par rapport à des actifs comme les actions technologiques américaines ou l'Or, et surtout lorsqu'on ajuste pour l'expansion de la liquidité mondiale, la performance est bien moins extraordinaire. Les données suggèrent que grande partie de la progression de ce cycle a pu être alimentée par la dépréciation des devises fiduciaires plutôt que par une surperformance pure. Bien qu'il reste encore une marge pour une hausse significative, surtout si le Bitcoin peut franchir la résistance ajustée à la liquidité et atteindre des sommets encore plus élevés, les investisseurs devraient également prêter une attention particulière à ces graphiques de ratio. Ils offrent une perspective plus claire sur la performance relative et pourraient fournir des indices précieux sur la direction probable du prix du Bitcoin à venir.

Frequently Asked Questions

Are gold IRAs a good investment?

You should buy shares in companies that produce gold. These companies can make you money by investing in precious metals and gold.

There are however two problems with owning shares directly.

Holding on to your stock for too many years can lead you to losing money. Stocks fall faster than their underlying assets (like gold) when they are declining. This means that you might end up losing more money than you make.

Second, you could miss out on potential profit if you wait for the market to recover before you sell. So you may need to be patient and let the market recover before you profit from your gold holdings.

But if you prefer to keep your investments separate from your finances, you can still benefit from owning physical gold. A gold IRA can help you diversify your portfolio, and protect against inflation.

Visit our website to learn more about gold investment.

How much money can a gold IRA earn?

Yes, but it's not as simple as you think. It all depends upon how much risk you are willing and able to take. If you can afford to invest $10,000 every year for 20-years, you could possibly have $1,000,000 by retirement age. However, if you have all your eggs in one place, you could lose everything.

Diversifying your investments is essential. Inflation makes gold a good investment. You should invest in an asset that increases with inflation. Stocks perform this well because they rise whenever companies increase their profits. This is also true with bonds. They pay interest each year. They are great during economic growth.

But what happens if there's no inflation? During deflationary periods, bonds fall in value while stocks fall further. This is why investors should avoid putting all their savings into one investment, such as a bond or stock mutual fund.

Instead, they should invest in a mix of different funds. They could, for example, invest in stocks and bonds. Or they could invest in both cash and bonds.

This gives them exposure to both sides. Both deflation and inflation. They will see a return over time.

What is the most valuable precious metal?

An investment in gold can yield high returns on its capital. It is also immune to inflation and other risk factors. The price of gold tends to rise as people become concerned about inflation.

It is a smart move to purchase gold futures. These contracts guarantee you will receive a certain amount of gold at a fixed price.

However, futures on gold aren't for everyone. Some prefer physical gold.

They can also trade their gold easily with others. They can also easily sell it whenever they like.

Some people want to avoid paying tax on their gold. They purchase gold directly from governments to achieve this.

This process requires you to make several trips to your local post office. First convert any gold that is already in circulation into coins or bars.

Then you will need a stamp to attach the coins or bars. Finally, send them off to the US Mint. They will then melt down the bars and coins to create new coins.

The original stamps are used to stamp the new coins and bars. That means that they're legal tender.

The US Mint will not tax gold purchased directly.

So, which precious metal would you like to invest in?

Are precious-metal IRAs a good option?

The answer depends on how much you are willing to risk an IRA account losing value. They make sense if you have $10,000 in cash as long as you don't expect them to grow very quickly. These are not the best investments if there is a long-term plan for saving money (like gold) or if you want to invest more in assets that will rise in value over time. You may also have to pay fees, which can reduce your gains.

Does a gold IRA earn interest?

It depends on how much money you put into it if you have $100,000, then yes. You will not be able to answer if your income is less than $100,000

The amount of money that you put into an IRA is what determines whether it earns or not interest.

You should consider opening a regular brokerage account instead if you put in more than $100,000 per year for retirement savings.

There you will earn more interest, but also be exposed to higher risk investments. It's not a good idea to lose all of the money you have invested in the stock exchange.

An IRA might be more advantageous if you are able to contribute only $100,000 per year. At least until there is a rebound in the market.

What precious metals can you invest in for retirement?

Understanding what you have now saved and where you are currently saving money is the first step in retirement planning. Take a look at everything you own to determine how much you have left. This should include any savings accounts, stocks, bonds, mutual funds, certificates of deposit (CDs), life insurance policies, annuities, 401(k) plans, real estate investments, and other assets such as precious metals. To determine how much money is available to invest, add all these items.

If you are between 59 and 59 1/2 years, you might consider opening a Roth IRA. While a Roth IRA does not allow you to deduct contributions from taxable income, a traditional IRA allows for that. You won't be allowed to deduct tax for future earnings.

You may need additional money if you decide you want more. Start with a regular broker account.

Statistics

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

External Links

takemetothesite.com

wsj.com

regalassets.com

investopedia.com

How To

How to Open a Precious Metal IRA

Precious metals are a highly sought-after investment vehicle. Because they offer higher returns than traditional investments such as stocks and bonds, they are very popular. But, it is important to do your research and plan carefully before investing in precious metals. Here are the basics to help you open your precious metal IRA account.

There are two types of precious metal accounts. They are paper gold and silver certificates (GSCs) and physical precious metals accounts. Each type has its pros and cons. GSCs, on the other hand, are more accessible and can be traded. To learn more about these options, keep reading below.

Physical precious metals accounts are comprised of bullion and bars as well as coins. Although this option can provide diversification benefits, there are some drawbacks. You will need to pay a lot of money for precious metals, whether you are buying, selling, or storing them. Due to their size, it can be difficult for them to be transported from one place to another.

However, silver and gold certificates made of paper are quite affordable. Additionally, they can be easily traded online and accessible. They are ideal for those who don't wish to invest in precious metals. But, they're not as well-diversified as physical counterparts. These assets are also supported by government agencies, such as the U.S. Mint. Inflation rates could cause their value to drop.

You should choose the account that best suits your financial needs before you open a precious-metal IRA. Before doing so, consider the following factors:

- Your tolerance level

- Your preferred asset-allocation strategy

- How much time do you have to invest

- No matter if you intend to use the funds in short-term trading.

- Which tax treatment would you prefer?

- What precious metal(s), would you like to invest?

- How liquid do you need your portfolio to be

- Your retirement date

- You'll need somewhere to keep your precious metals

- Your income level

- Your current savings rates

- Your future goals

- Your net worth

- Any special circumstances that may affect your decision

- Your financial overall situation

- Preference between paper and physical assets

- Your willingness to accept risks

- Your ability to handle losses

- Your budget constraints

- Your desire to be financially independent

- Your investment experience

- Your familiarity and knowledge of precious metals

- Your knowledge of precious metals

- Your confidence with the economy

- Your personal preferences

After you've decided on the best type of precious metal IRA for you, you can start to open an accounts with a reputable broker. These companies can be found through word of mouth, referrals and online research.

Once you've opened your precious metal IRA, you'll need to determine how much money you want to put into it. There are different minimum deposits for precious metal IRA accounts. Some accounts require $100 while others allow you to invest up $50,000.

As stated above, the amount of money invested in your precious metal IRA is completely up to you. A higher initial deposit will help you build wealth over a prolonged period. If you are planning to invest small amounts each month, a lower initial investment might be better.

There are many types of investments that can be purchased, as well as precious metals you can use in your IRA. Here are some of the most common:

- Bullion bars and rounds of gold, as well as coins

- Silver – Rounds and coins

- Platinum – Coins

- Palladium – Bar and round forms

- Mercury – Round and Bar Forms

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Est-ce que le Prix du Bitcoin Surpasse l'Or et le NASDAQ Durant ce Cycle?

Sourced From: bitcoinmagazine.com/markets/bitcoin-price-gold-and-nasdaq

Published Date: Fri, 15 Aug 2025 13:13:53 +0000