Bitcoin has been on a rollercoaster ride of price fluctuations, experiencing both highs and lows. Despite setting new all-time highs and maintaining a positive trajectory for two years, the surge in retail investors has been lacking. Many investors are eagerly awaiting the influx of retail participation, hoping it will drive the bitcoin price to unprecedented levels. This article delves into when we can expect retail investors to re-enter the bitcoin market and whether their return could push BTC to new heights.

Active Address Growth and its Influence

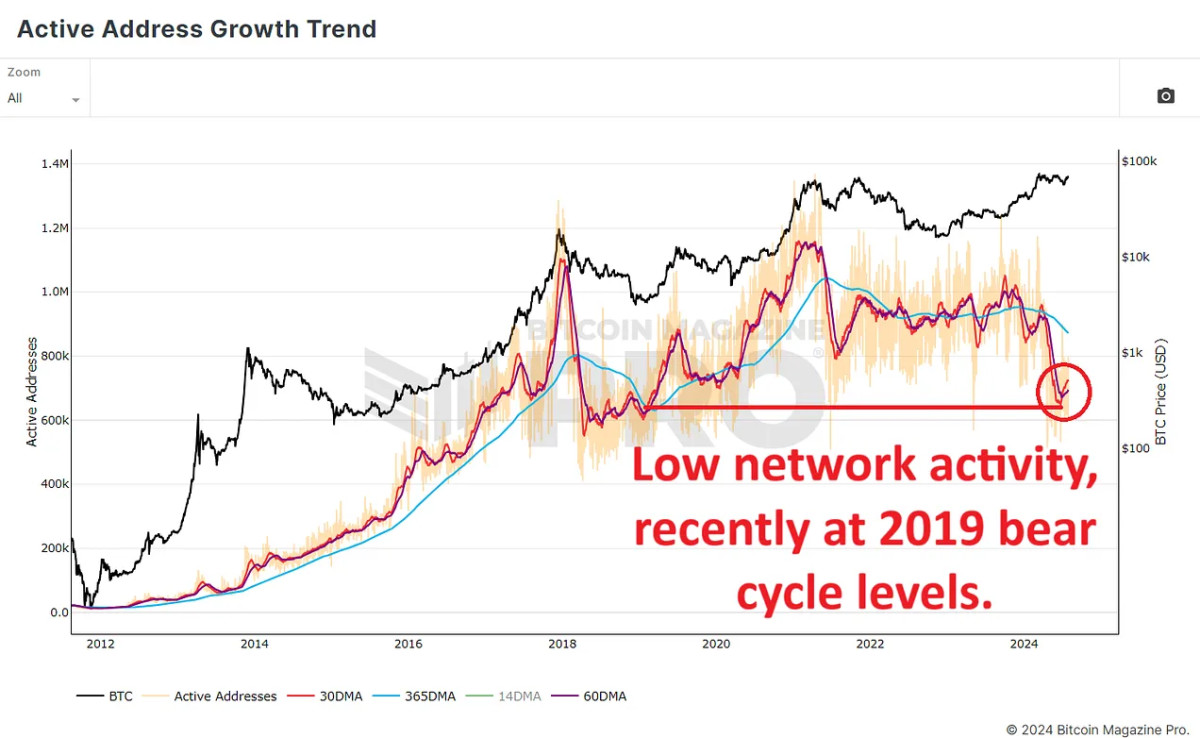

To predict the potential retail wave, analyzing the trend of active address growth is crucial. Data from Bitcoin Magazine Pro indicates a decline in the number of active network participants in recent months. The 365-day moving average, along with the 60-day and 30-day averages, shows a decrease in network activity, reminiscent of early 2019 levels after bitcoin's bear cycle. Despite bitcoin reaching a record high of around $74,000, there was no significant increase in network users, unlike previous cycles.

The Necessity of New Capital Inflow

This trend reflects Bitcoin's evolving role from a digital currency to a store of value. More users are investing in bitcoin as a long-term asset rather than using it for daily transactions. The Bitcoin HODL Waves & Realized Cap HODL Waves demonstrate this shift, with about 20% of bitcoin held for three months or less. Although new users are entering the market, they are not using bitcoin as frequently as before.

Understanding Market Forces and Retail Participation

Historically, a surge in retail activity precedes market peaks in Bitcoin's cycles. The current lack of significant retail interest, as shown by Google Trends, indicates a more sustainable and measured market growth. The Bitcoin Open Interest chart reveals a preference for trading actual bitcoin over futures contracts since late 2022. Investors are now more inclined to hold bitcoin long-term rather than engage in short-term speculative trading.

Final Thoughts

Despite the decline in Bitcoin's active user metrics, the market displays signs of stability and long-term investment potential. The absence of immediate retail interest may be perceived as bearish, but it signifies a more steady and sustainable growth path. Monitoring the entry of retail investors as bitcoin nears new highs is essential. Will retail investors succumb to FOMO buying, or will they continue with a long-term holding approach? The future trajectory of bitcoin's market hinges on these dynamics.

For a comprehensive analysis of this subject, watch a recent YouTube video for more insights.

Frequently Asked Questions

What type of IRA is used for precious metals?

Many financial institutions and employers offer an individual retirement account (IRA) as an investment option. Through an IRA, you may contribute money to an account that grows tax-deferred until withdrawn.

An IRA lets you save taxes and pay them off later. This allows for more money to be deposited in your retirement plan today than having to pay taxes tomorrow on it.

An IRA has the advantage of allowing contributions and earnings to grow tax-free until you withdraw your funds. When you do, there are penalties for early withdrawal.

Additional contributions can be made to your IRA even after you turn 50, without any penalty. If you choose to take withdrawals from your IRA during retirement, you'll owe income taxes and a 10% federal penalty.

Withdrawals made before age 59 1/2 are subject to a 5% IRS penalty. For withdrawals made between the age of 59 1/2 & 70 1/2, a 3.4% IRS penalty will apply.

There is a 6.2% penalty for withdrawals over $10,000 per calendar year.

What is a Precious Metal IRA, and how can you get one?

Precious metals can be a good investment for retirement accounts. They are a timeless investment that has held its value since the beginning of time. The best way to protect yourself from inflation is to invest in precious metallics such as platinum, silver and gold.

In addition, some countries allow citizens to store their money in foreign currencies. You can buy Canada gold bars and keep them home. Then, you can buy gold bars in Canada and sell them for Canadian dollars when your family is home.

This is a very easy way to invest in precious metals. It is particularly useful for those who live outside North America.

Which type of IRA works best?

The most important thing when choosing an IRA for you is to find one that fits within your goals and lifestyle. It is important to consider whether you want tax-deferred, maximized growth of your contributions, reduced taxes now and paid penalties later, or just avoid taxes.

The Roth option is a good choice if you have a lot of money saved for retirement, but not enough to invest. If you plan to continue working beyond age 59 1/2, and pay income taxes on any account withdrawals, the Roth option may be a good choice.

If you plan to retire early, the traditional IRA might make more sense because you'll likely owe taxes on the earnings of those funds. The Roth IRA is a better option if you plan to continue working well beyond age 65. It allows you to withdraw any or all of your earnings and not pay taxes.

How to Open a Precious Metal IRA

A self-directed Roth Individual Retirement Account is the best way to open a IRA for precious metals.

This account is more advantageous than other types of IRAs, because you don’t have to pay taxes on any interest earned from your investments until they are withdrawn.

This makes it appealing to those who want to both save money and get a tax cut.

You are not limited to investing in gold or silver. You can put your money in almost any item that meets the IRS guidelines.

People often think of silver and gold when they hear “precious metal” but there are many other precious metals.

You can find examples in palladium (platinum), rhodium (osmium), iridium and ruthenium.

There are many ways that you can invest precious metals. You can buy bullion coins or bars, or shares in mining businesses.

Bullion Coins, Bars

One of your easiest ways to get into precious metals is to purchase bullion coins. Bullion is a general term that describes physical ounces, or physical gold and silver.

When you buy bullion coins and bars, you receive actual pieces of the metal itself.

While you might not feel any change when you buy bullion coin bars or coins from a retailer, you will experience some benefits over time.

This is an example of a tangible piece in history. Each coin and bar has its own unique story behind it.

If you compare the nominal value to face value, you will often find that it is worth much less than its nominal. In 1986, the American Eagle Silver Coin was $1.00 per ounce. Today, however, the price of an American eagle is closer to $40.00 per ounce.

Bullion's price has risen dramatically since its inception, so many investors would rather invest in bullion coins than futures.

Mining Companies

A great way to get precious metals is by investing in shares in mining companies. When you invest in mining companies, you are investing in the company's ability to produce gold and silver.

You will be paid dividends that are based on the company’s profits. These dividends will then go towards paying out shareholders.

You will also benefit from the company's growth potential. The company's share prices should also increase as demand increases for the product.

You should diversify because these stocks have a tendency to fluctuate in their prices. This involves spreading your risk over multiple companies.

It's important to remember, however, that mining companies can still be subject to financial losses, just as any other stock market investment.

Your ownership stake could become worthless if the price of gold falls significantly.

The Bottom Line

Precious metals, such as silver and gold, can be a refuge during economic uncertainty.

Gold and silver can fluctuate in price. If you are interested in long-term investing in precious metals, open a precious Metals IRA account at a reputable firm.

This allows you to benefit from tax advantages and physical assets.

How do you choose an IRA.

Understanding your account type will help you find the right IRA. This includes whether your goal is to open a Roth IRA (or a traditional IRA). You will also need to know how much you can invest.

Next is deciding which provider best suits your needs. While some providers offer both accounts, others specialize in only one.

The fees associated with each option should be considered. There are many fees that vary between providers. They may include annual maintenance fees or other charges. Some providers charge a monthly fee depending on how many shares you have. Others may only charge one quarter.

Can I put gold in my IRA?

Yes! It is possible to add gold to your retirement plans. Because it doesn’t lose value over the years, gold makes a good investment. It is also resistant to inflation. It doesn't come with taxes.

Before you invest in gold, make sure to understand its differences from other investments. You cannot purchase shares of gold companies like bonds and stocks. They can't be sold.

Instead, convert your precious metals to cash. This means that you'll have to get rid of it. It's not enough to hold on to it.

This is what makes gold unique from other investments. As with other investments you can always make a profit and sell them later. But that's not the case with gold.

The worst part is that you cannot use your gold to secure loans. For example, if you take out a mortgage, you may give up some of your gold to cover the loan.

What does this all mean? You can't just keep your gold forever. You'll eventually need to convert it into cash.

There's no need to be concerned about this right now. All you have to do is open an IRA account. After that, you can start investing in gold.

What is the most valuable precious metal?

Investments in gold offer high returns on their capital. It protects against inflation, as well as other risks. As inflation worries increase, gold prices tend to rise.

It's a good idea for you to purchase futures gold. These contracts guarantee you will receive a certain amount of gold at a fixed price.

However, futures on gold aren't for everyone. Some prefer to have physical gold.

They can easily exchange their gold with other people. They can also sell it whenever they want.

Some people would rather not pay tax on their gold. They buy gold directly from government to do this.

This will require you to make multiple trips to your local postal office. First, convert any gold you have into coins or bars.

Finally, you'll need to get a stamp to put on the bars or coins. Finally, you send them to the US Mint. There they will melt the coins or bars into new ones.

The original stamps are used to stamp the new coins and bars. They are therefore legal tender.

However, if you purchase gold directly from the US Mint you won't be required to pay any taxes.

Decide what precious metal do you want to invest?

Statistics

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- Silver must be 99.9% pure • (forbes.com)

External Links

takemetothesite.com

en.wikipedia.org

wsj.com

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

How to Buy Gold for Your Gold IRA

Precious metal is used to describe precious metals such as gold, silver (excluding helium), palladium, palladium or osmium), ruthenium, rose, rhenium, ruthenium and others. It's any element naturally occurring with atomic numbers 79 to 110 (excluding helium), that is valued for its rarity or beauty. Precious metals that are most commonly used include silver and gold. Precious Metals are often used for money, jewelry and industrial goods.

Due to supply and demand, the price of gold fluctuates every day. Investors are looking for safe havens away from unstable countries and precious metals has seen a large demand over the past decade. Prices have increased significantly because of this demand. However, some are hesitant to invest in precious metals because of the rising costs of production.

Gold is a reliable investment due to its rarity and durability. Unlike many investments, gold never loses value. Gold can be bought and sold without tax. There are two ways to invest in gold. You can buy bars and gold coins, or invest into gold futures contracts.

The physical gold bars and coins provide immediate liquidity. They are easy and convenient to trade or store. They don't provide much protection against inflation. To protect yourself from rising gold prices, you can consider buying gold bullion. Bullion is physical gold that comes in different sizes and shapes. While some billions are sold in one-ounce portions, others come in larger pieces such as kilobars. Bullion is usually stored in vaults protected from theft and fire.

You might prefer to own shares of gold than actual gold. If so, then you should look into buying futures gold. Futures let you speculate about how gold's price might change. Buying gold futures exposes you to gold's price without owning the physical commodity itself.

If I wanted to speculate about whether gold's price would rise or fall, I could buy a gold contract. My position after the contract expires will be either “long” (or “short”) If I have a long contract, it means that I believe gold's price will rise. In exchange, I'll give money now and promise to get more when the contract ends. A shorter contract will mean that I expect the price to fall. I'm willing now to accept the money in exchange for the promise of making less later.

When the contract expires, I'll receive the amount of gold specified in the contract plus interest. I am now exposed to the price of gold, without actually holding it.

Precious metals are great investments because they're extremely hard to counterfeit. Precious metals are more difficult to counterfeit than paper currency. It is because precious metals are hardier than paper currencies that they can be counterfeited by printing new bills.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Bitcoin's Potential Retail Resurgence: A Deep Dive

Sourced From: bitcoinmagazine.com/markets/bitcoins-anticipated-retail-resurgence-

Published Date: Fri, 02 Aug 2024 16:34:26 GMT